I’ll go over the Top AI Tools for Forecasting Crypto Revenue in this post. Predicting revenue streams and token performance has become essential due to the increasing complexity of cryptocurrency marketplaces.

Traders, investors, and institutions can evaluate on-chain data, predict market trends, and make well-informed decisions to optimize profits while successfully managing risks by utilizing AI-powered platforms.

What is AI Tools for Crypto Revenue Forecasting?

AI Tools for Crypto Revenue Forecasting are sophisticated software systems that forecast revenue streams, token performance, and market trends in the cryptocurrency ecosystem using blockchain analytics, machine learning, and artificial intelligence.

To produce useful insights, these tools examine on-chain data, transaction patterns, investor activity, and liquidity fluctuations.

They assist traders, investors, and institutions in forecasting profits, managing risks, and making well-informed financial decisions by utilizing predictive algorithms and real-time monitoring. AI capabilities are now crucial for precisely estimating revenue and optimizing investment strategies in today’s fast-paced cryptocurrency marketplaces.

How To Choose AI Tools for Crypto Revenue Forecasting

Identify the End Goal

Make sure to identify if you need the AI tool for trading, investing, analysis of DeFi protocols, or regulatory compliance. Your mission directs which tool features like revenue forecasting, predictive analytics, or risk monitoring are valuable to you.

Supported Blockchains & Assets

Make sure the inclusion of the tool covers the blockchains and coins you are actively working on. There are providers where the focus is just on Bitcoin and Ethereum, others are broader covering DeFi tokens and protocols across multiple blockchains.

Assess Predictive Features

Useful features to look for are smart money tracking, token flow analytics, and prediction of revenue and other relevant historical datasets. Revenue forecasting to trend analysis is a critical dimension for most value-based decisions.

Usability & Interface

Consider using platforms with simple dashboards, good visual analytics, and concise reports. Some complex platforms may need you to have subject matter expertise, but others may be used with just basic analytics skills.

Pricing & Subscription Model

Check the price points and tiers of the subscriptions across platforms. For instance, Chainalysis or TRM Labs are enterprise grade and may come at a hefty price while individuals trading can have more affordable choices with Glassnode or Token Terminal.

Explore Integration and Accessible APIs

Tools that easily integrate with your trading systems, portfolio trackers, and analytics software are invaluable. API access allows for optimized automated workflows and better utilization of your data.

Evaluate Community and Support

Active forums, community documentation, and responsive customer support can help you make the most of the tool and resolve problems more efficiently.

Experiment with Free Demos and Trials

When available, utilize free trials and demo options. This allows you to evaluate the tool and how well it meets your revenue forecasting objectives.

Key Point & Best AI Tools for Crypto Revenue Forecasting List

| Platform | Key Intelligence Focus | Core Strengths | Best Use Case |

|---|---|---|---|

| Chainalysis Market Intel | Blockchain transaction & market intelligence | Deep on-chain attribution, risk scoring, institutional-grade data | Compliance teams, exchanges, market surveillance |

| Elliptic Discovery | Crypto risk analytics & entity tracking | Advanced wallet clustering, AML monitoring, cross-chain analysis | Financial institutions & regulators |

| TRM Labs Revenue Intelligence | Revenue flow & illicit finance tracking | Real-time monitoring, sanctions exposure, behavioral analytics | Exchanges, law enforcement, fintechs |

| Nansen AI Revenue Analytics | Smart money & revenue movement analysis | Labelled wallets, investor behavior insights, token flow tracking | Crypto investors, hedge funds |

| AnChain.AI Predictive Suite | Predictive blockchain security & risk | AI-driven anomaly detection, threat forecasting | Web3 security, fraud prevention |

| Gauntlet AI Simulation | Protocol risk & economic simulations | Stress testing, parameter optimization, DeFi modeling | DeFi protocols, DAO risk management |

| Token Terminal AI | Protocol financial & revenue analytics | Standardized financial metrics, valuation models | Fundamental crypto analysis |

| Messari AI Forecasts | Market research & trend forecasting | AI-enhanced research, sector outlooks, token intelligence | Institutional investors, analysts |

| Glassnode AI Metrics | On-chain behavioral & liquidity metrics | Long-term holder data, supply dynamics, sentiment signals | Macro crypto market analysis |

| IntoTheBlock Predictive AI | Price movement & on-chain signals | Machine learning indicators, probability-based forecasts | Active traders, quantitative analysts |

1. Chainalysis Market Intel

To monitor cryptocurrency flows and market trends, Chainalysis Market Intel offers comprehensive blockchain transaction and market intelligence. It provides institutional-grade insights for trading, investment analysis, and compliance by aggregating on-chain data. Users may spot high-risk addresses, track wallet activity, and spot market trends.

Chainalysis Market Intel stands out as one of the best AI tools for crypto revenue forecasting in the middle of the process, allowing businesses to use real-time and historical blockchain data to manage market exposure, estimate revenue potential, and predict liquidity movements—all of which are crucial for strategic decision-making.

Chainalysis Market Intel Features, Pros & Cons

Features:

- Analysis of on-chain transactions

- Identification of market shifts

- Labeling and clustering of wallets

- Risk and compliance assessments

- Alerts and notifications in real-time

Pros:

- Analytics for multiple institutions

- Solid risk and compliance management

- Transactions in real-time

- Multiple blockchain support

- Forecasting with historical data

Cons:

- Overpriced for low-spenders

- Newcomers find it difficult to use

- Unremarkable predictive AI modeling

- Compliance is the main focus

- Full use requires expertise in the field

2. Elliptic Discovery

Elliptic Discovery focuses on crypto risk analytics and entity tracking and offers wallet and transaction history analytics. Discovery’s tools use AI to detect nefarious users, analyze cross-chain activity, and pattern detection on big-ticket transactions. Analysts use Elliptic Discovery data to content model their revenue and improve forecast accuracy.

Elliptic Discovery is among the top AI tools to forecast revenue in crypto. Elliptic Discovery helps investors and institutions analyze the revenue streams, assess risk-adjusted returns, comply with the regulations, and provides actionable insights using on-chain clustering and advanced predictive analytics.

Elliptic Discovery Features, Pros & Cons

Features:

- Tracking of wallets and entities

- Monitoring of Anti-Money Laundering (AML)

- Analytics concerning multiple chains

- Detection of suspicious behavior

- Visualization of the flow of transactions

Pros:

- Detection of risk and fraud is superb

- Alerts for suspicious behavior in real-time

- Supports multiple chains

- Compliance with the laws

- Coupling of wallets is accurate

Cons:

- Focus less on revenue projection and more on compliance

- Expensive to subscribe

- Learning is difficult

- Predictive modeling is insufficient

- User experience is poor

3. TRM Labs Revenue Intelligence

TRM Labs Revenue Intelligence tracks crypto movements to analyze revenue, detect the financing of illicit trade, and improve revenue streams. This platform provides AI-based alerts in real-time, activity tracking, and exposure assessment across blockchains.

This platform helps clients analyze and forecast revenue streams, assess the legality of transactions, and analyze revenue trends. One of the best AI tools for revenue forecasting in cryptocurrencies is TRM Revenue Intelligence.

It offers revenue predictive analytics to exchange operators, fintech, and regulators, helping them to analyze and model revenues, identify revenue streams, and assist in strategic digital asset markets planning, and financial risk management.

TRM Labs Revenue Intelligence Features, Pros & Cons

Features:

- Tracking of real-time revenue flow

- Analytics concerning behaviors

- Monitoring exposure to sanctions

- Support for multiple chains

- Alerts for automated suspicious transactions

Pros:

- Great risk and fraud detection

- Designed for large businesses

- Alerts customization in real-time

- Capability to analyze multiple chains

- Fintech and exchange support

Cons:

- High pricing for small teams

- Novice users may find it confusing

- Focused on compliance

- Few options on data visualization

- Integrations can be complicated

4. Nansen AI Revenue Analytics

The Nansen AI Revenue Analytics provides investors behavioral insights by tracking smart money movements, on-chain revenue, and token analytics. Even though Nansen employs different labeled wallets, tracking revenue analytics is possible with lion_wallets, which Nansen labels as whales, institutional liquidity providers, and investors.

This enables the precise tracking of revenue analytics and estimations. Nansen AI Revenue Analytics allows most traders and fund managers a clear prediction of earnings along with the trends of the market.

Nansen is recognized as one of the top tools in predicting revenue in the crypto space, as it allows its’ users to forecast revenue, analize cash flow, and improve investment plans by providing analytic frameworks and visual dashboards to direct strategies in diverse DeFi and Crypto accounts.

Nansen AI Revenue Analytics Features, Pros & Cons

Features:

- Monitoring smart money

- Analysis of labeled wallets

- Visualization of token flow

- Insights on investor behavior

- Tracking of DeFi protocols

Pros:

- Analytics for traders and investors

- Insights on predicted revenue trends

- Support for DeFi

- Dashboards that are interactive

- Monitoring in real-time

Cons:

- Cost of premium subscriptions

- Limited to a small number of supportive chains

- May be too much for novices

- Data lag can happen

- Requirement of advanced features

5. AnChain.AI Predictive Suite

AnChain.AI Predictive Suite is one of the top blockchain technology security tools. It’s AI tech, om top of risk assessment, analyzes breaches, predicts pending attacks, and oversees and audits breach behaviors in a transactional manner.

With hisory repetition technology, AnChain can identify events that can negatively influence revenue and in turn, the targeted market or fraudulent behavior.

AnChain.AI Predictive Suite is one of the best AI tools for predicting revenue in the crypto market since it provides the ability to forecasting revenue decrease, how to minimize a revenue decrease, the potential risk, and how the process will improve the operational behavior of the firm.

AnChain provides the contradictory the revenue and compliance objectives, thus bridging security and financial intelligence.

AnChain.AI Predictive Suite Features, Pros & Cons

Features:

- Anomaly detection using AI

- Risk analytics that are predictive

- Monitoring of transactions

- Detection of fraud

- Alerts and security notifications

Pros:

- A strong predictive capability in AI

- Alerts for real-time threats

- Helps forecast revenue risks

- Designed for the enterprise scale

- Improved security and compliance

Cons:

- More security focused than revenue focused

- Small businesses find it expensive

- The user interface is too complicated for newcomers.

- Users have to learn in order to use advanced features.

- The analysis of DeFi is quite basic.

6. Gauntlet AI Simulation

Gauntlet AI Simulation focuses on risk assessment and economic modeling of DeFi protocols and platforms. Using simulation algorithms, it forecasts profit changes from liquidity and other market shifts. Stakeholders can assess performances through different stress tests.

Gauntlet AI Simulation is among the top-rated tools for crypto revenue forecasting, providing insights on profit and loss potentials and other liquidity factors.

By modeling the revenue response to different market conditions, it enables participants in the ecosystem, such as investors, DAOs, and protocol developers, to enhance financial gains and loss mitigation through adjusted return pathways in the complex DeFi ecosystem.

Gauntlet AI Simulation Features, Pros & Cons

Features:

- Testing the limits of protocols

- Making models of the economy

- Simulating liquidity

- Revenue projection adjusted for risks

- The optimization of DeFi protocols

Pros:

- Simulation of risk and revenue on the basis of facts

- Optimized the protocols of DeFi

- Sophisticated tools for modeling

- Planning the scenario

- Useful for protocols and DAOs

Cons:

- Knowledge that is advanced is needed.

- Only the platforms of DeFi

- Complicated for small traders

- Costs a lot

- The cost of configuration is high, and it may take a long time.

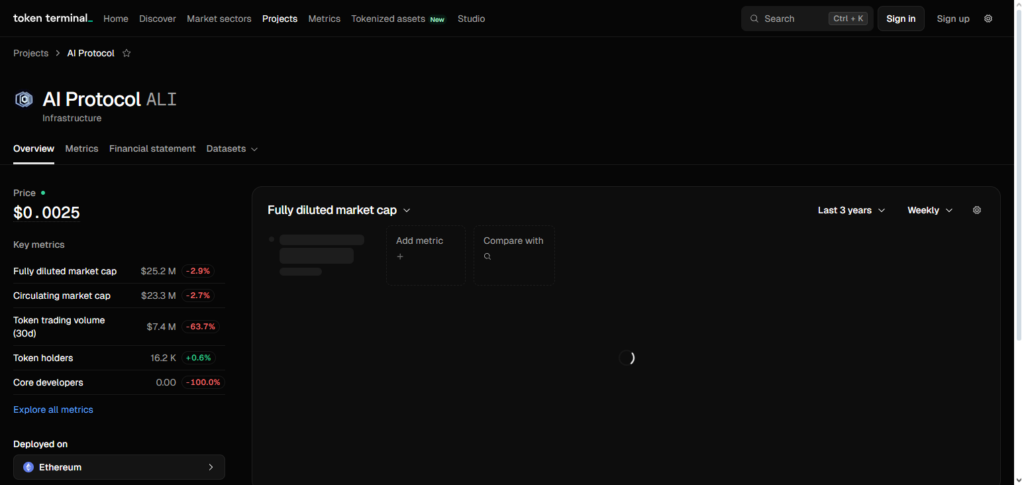

7. Token Terminal AI

Token Terminal AI analyzes the financial aspects and revenue generation of crypto protocols using on-chain data and creating customing KPIs. Users can analyze and track the revenue, performance of the protocol, and market cap.

Its AI models analyze and predict profit, token velocity, and trends of profitability across several blockchain systems. Token Terminal AI is among the top-rated tools for crypto revenue forecasting, for protocol teams, analysts, and investors to contribute to data-backed financial decisions.

Navigating through complex on-chain data to analyze revenue becomes less complex, facilitating crypto forecasting, investment assessment, and strategic planning for the future.

Token Terminal AI Features, Pros & Cons

Features:

- Protocol KPIs that are standardized

- Tracking of revenue

- Analyzing of profits

- Monitoring the flow of tokens

- Modeling of finances

Pros:

- Metrics that are standardized and clear

- Insights that are accurate regarding revenue

- User-friendly dashboards

- Help with investment strategies

- Reliable predictions

Cons:

- Predictive AI is deficient

- Only the protocols of cryptocurrency are covered

- There is less compliance, and features are less

- The subscription that is paid is required

- The coverage on the multi-chain is less

8. Messari AI Forecasts

Messari AI Forecasts integrates the most recent market research and AI-powered forecasting tools. It provides forecasted analytics and reports on trends, potential performance for the token, and insights for the sector.

Their algorithms utilize and combine historical price data, trade volumes, and on-chain activities for more accurate revenue forecasts. Messari AI Forecasts offers one of the finest AI tools for predicting revenue in the crypto sphere.

The research helps in comprehending the earnings of protocols and the patterns for potential growth, hence becomes a vital tool for progressively better enhanced strategies and forecasting revenue models for the investors and types of institutions when predicting the movements of the crypto market and revenue streams.

Messari AI Forecasts Features, Pros & Cons

Features:

- Enhanced research in the market using AI

- Predicting trends

- Analyzing the performance of tokens

- Insights of the sector

- Analyzing data with prediction and history

Pros:

- Forecasting that is certain

- Dashboards that are easy to use

- Analyzing the whole market

- Insights that are based on data

- Great for both investors and analysts

Cons:

- Non secured

- Might need third-party data integration

- On-chain depth is shallow

- Costs money

- Limited to no real-time notifications

9. Glassnode AI Metrics

As the name, Glassnode AI Metrics, implies the information it provides is of a multitude of metrics regarding the behavior of the chain, its liquidity, and the long-term holders of the chains’ currency. There are metrics for the supply and demand as well as for the accumulation of tokens and the revenue potential.

Predictive modeling can be used for network activity and tokens to measure revenue potential as a function of the tokens’ activity.

Glassnode AI Metrics is one of the best invoicing tools and provides crypto revenue forecasting for traders, and investors, and offers protocol revenue, investor insights, and cycle analytics. It offers metrics that capture revenue and make crypto and DeFi financial planning granular.

Glassnode AI Metrics Features, Pros & Cons

Features:

- On-chain behavior analysis

- Liquidity and supply analysis

- Holder segmentation

- Sentiment analysis

- Predictive modeling

Pros:

- Comprehensive on-chain analytics

- Robust macro analytics

- Dashboards with real-time data

- Revenue prediction analytics

- Valuable for traders and investors

Cons:

- Steeper learning curve for novices

- Expensive

- Lacks real-time analytics

- Predictive alerts are sparse

- Advanced analytics requires data literacy

10. IntoTheBlock Predictive AI

IntoTheBlock Predictive AI uses machine learning to generate heuristic price predictions and analytics through the chain. Predictive models are used to measure liquidity, the actors of the chain, and the function of the transactions to measure potential revenue and behavior of markets.

IntoTheBlock Predictive AI has earned the right to be called one of the top crypto revenue forecasting AI tools because of its accurate, data-based forecasting of crypto digital assets. It offers a revenue prediction model that enables users to streamline their trading arrangements, predict revenue pliability, and determine the effect of market shifts on a protocol’s revenue.

IntoTheBlock Predictive AI Features, Pros & Cons

Features:

- Price prediction with machine learning

- Revenue risk analytics with machine learning

- Holder analysis and liquidity analysis

- On-chain signal generation

- Market trend analysis

Pros:

- Predictive analytics are accurate

- Real-time data

- Visuals are easy to interpret

- Supports investment strategy

- Combined approach with multiple metrics

Cons:

- Limited supported tokens

- Subscription is premium priced

- Advanced learning curve

- Not compliance focused

- Data lags during volatile market cycles

Conclusion

In conclusion, AI tools are essential for revenue forecasting since the changing cryptocurrency ecosystem necessitates accurate insights and predictive intelligence.

By merging on-chain data, predictive modeling, and market intelligence, platforms such as Chainalysis Market Intel, Elliptic Discovery, TRM Labs, Nansen AI, AnChain.AI, Gauntlet AI, Token Terminal, Messari AI, Glassnode, and IntoTheBlock offer unmatched insights. These technologies enable traders, investors, and institutions to accurately optimize financial strategies, predict revenue trends, and evaluate risk.

In the quick-paced world of cryptocurrency, users may maximize revenue potential and make wiser, data-driven decisions by utilizing AI to translate raw blockchain data into actionable insights.

FAQ

AI tools for crypto revenue forecasting are software platforms that use artificial intelligence, machine learning, and blockchain analytics to predict revenue streams, token performance, and market trends. They analyze on-chain data, transaction patterns, liquidity, and investor behavior to provide actionable insights for traders, investors, and institutions.

These tools help in accurate revenue predictions, risk assessment, and strategic planning. They reduce manual analysis, provide real-time insights, and allow users to anticipate market changes, optimize trading strategies, and make data-driven investment decisions.

Some of the top AI tools include Chainalysis Market Intel, Elliptic Discovery, TRM Labs Revenue Intelligence, Nansen AI Revenue Analytics, AnChain.AI Predictive Suite, Gauntlet AI Simulation, Token Terminal AI, Messari AI Forecasts, Glassnode AI Metrics, and IntoTheBlock Predictive AI. Each offers unique analytics, predictive modeling, and revenue tracking capabilities.

Most platforms support major blockchains and top cryptocurrencies, with some specializing in DeFi tokens or smart money analytics. The accuracy depends on data availability, market liquidity, and the tool’s predictive algorithms.

While some platforms are beginner-friendly with dashboards and visual analytics, others like Gauntlet AI or AnChain.AI require advanced knowledge in blockchain and finance. Beginners can start with Token Terminal, Messari AI, or Glassnode for simpler insights.