The Best AI Tools for Crypto SaaS Analytics that assist companies, investors, and developers in making more informed choices within the cryptocurrency ecosystem will be covered in this article.

These products offer market analysis, compliance solutions, on-chain data analytics, and real-time security monitoring. Crypto platforms may lower risks, improve performance, and obtain a competitive advantage in a rapidly expanding market by utilizing AI.

What is Crypto SaaS Analytics?

Crypto SaaS Analytics are cloud-based software solutions that monitor blockchain networks, cryptocurrencies, and decentralized apps using data analytics, AI, and machine learning. Real-time on-chain data, transaction activity, market trends, user behavior, and security signals are all gathered and processed by these technologies.

Crypto SaaS Analytics makes powerful blockchain intelligence accessible, scalable, and affordable by assisting companies, investors, and developers in gaining actionable insights, enhancing decision-making, monitoring risks, ensuring compliance, and optimizing performance without having to manage complicated infrastructure.

Benefits Of AI Tools for Crypto SaaS Analytics

Real-Time Data Assessment : AI tools assess large quantities of blockchain data and give record updates for all transactions and activities within the blockchain network.

Facilitation of Improved Business Processes: AI adaptive algorithms construct more rationale predictive analytics by removing guesswork on business actions at a particular point in time.

Advanced Fraud Detection and Risk Assessment: Risk analytics powered by AI assess smart contracts, gaps of potential fraudulent activities, and fraudulent behaviors, thereby minimizing the potential risks associated with hacks and fraud.

Marketing Strategy: These machine learning algorithms that assess data will help in identifying potential up-and-coming activities and also help in recognizing the shift in consumer behavior pertaining to price and activities of a business.

Streamlining Processes: The precision of automation will help in the optimization of data analysis and the elimination of repetitive data across the various activities of the cryptocurrency.

Unlimited Customization and Vertical and Lateral Growth : AI tools are SaaS-based, hence they can be applied to any blockchain technology.

Ease of Adjustments to Altering Regulations: A crypto company can legitimately conduct itself within the bounds of the law pertaining to cryptocurrency with the help of AI in monitoring transactions and in the various aspects of record-keeping.

Comprehension of Block and Non-Block User Activities: AI helps in the analysis of both the on-chain and off-chain data for understanding the activities of the users and the trends of their adoption and engagement.

AI That Does Not Break the Bank: With the advent of Cloud-based AI analytics, businesses of all sizes can afford sophisticated crypto insights since there’s no need for costly in-house systems.

Key Point & Best AI Tools for Crypto SaaS Analytics List

| AI Platform | Key Point / Focus |

|---|---|

| Halborn AI Security | Provides advanced blockchain security auditing and real-time threat detection using AI. |

| CertiK Skynet AI | Monitors smart contracts and blockchain activity for vulnerabilities and potential exploits. |

| Santiment AI | Offers on-chain, social, and market data analytics for crypto trend insights. |

| PeckShield AI | Delivers blockchain security monitoring, alerts, and risk analysis for DeFi projects. |

| Glassnode AI Metrics | Provides on-chain metrics and behavioral analytics for informed crypto market decisions. |

| Token Terminal AI | Evaluates crypto projects’ financial performance and revenue metrics using AI analytics. |

| Gauntlet AI Simulation | Simulates economic scenarios and stress-tests blockchain protocols to predict risks. |

| TRM Labs SaaS Intelligence | Detects fraud, compliance risks, and illicit transactions across crypto networks. |

| Elliptic Navigator | Tracks crypto transactions for compliance and anti-money laundering (AML) purposes. |

| Chainalysis Market Intel | Provides market intelligence and blockchain transaction insights for investors and institutions. |

1. Halborn AI Security

Halborn AI Security has been listed as one of the Best AI Tools for Crypto SaaS Analytics for its state-of-the-art blockchain security services. Using AI, Halborn tackles vulnerabilities and potential user exploits by automating smart contract audits.

Halborn’s blockchain network monitoring keeps fraud at bay and allows it to provide actionable insights to developers and firms. With the fusion of AI-powered threat detection and human expertise, Halborn offers comprehensive protection from cyber threats. Halborn is a valuable tool for crypto projects that need strong security, trust, and compliance for their decentralized applications.

Halborn AI Security Features, Pros & Cons

Features:

- Auditing smart contracts in real time.

- Recognition of threats in blockchain.

- Risk scoring using AI.

- Alerts and dashboards.

- Support for response and remediation.

Pros:

- Identifying threats and removing them.

- Protecting the company and, reducing the risk.

- Compatible with many blockchain technologies.

- Useful for big as well as small prospects.

- Providing effective defensive strategies.

Cons:

- May be costly with small prospects.

- Some dashboards are complex.

- Limited to the protection of blockchain (No market analytics).

- Prompt verification of alerts are needed.

- Risk scoring is not dependent on data inputs.

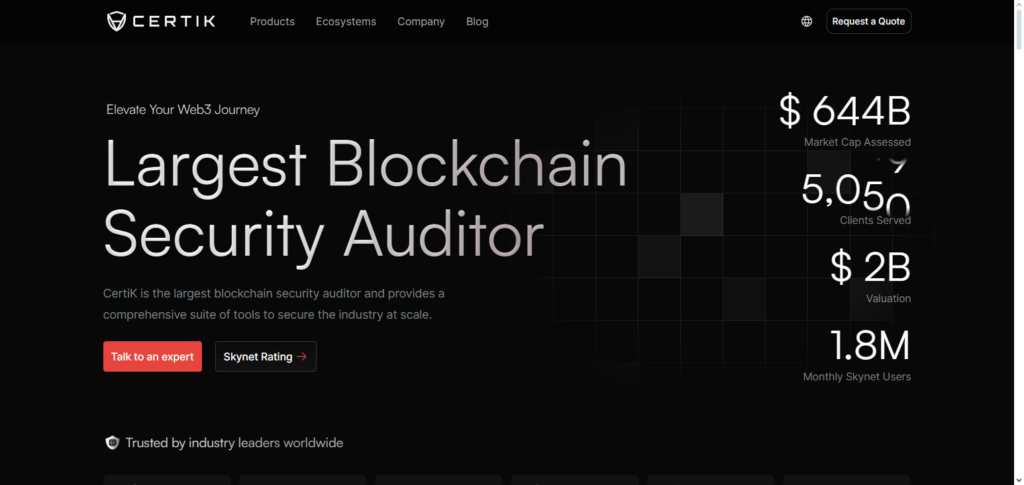

2. CertiK Skynet AI

Recognized as the Best AI Tool for Crypto SaaS Analytics, CertiK Skynet AI offers a unique blend of blockchain vulnerability and exploit monitoring on Skynet. Certik Analytics uses AI and machine learning technologies to examine smart contracts, DeFi systems, and various blockchain ecosystems, while understanding their ecosystems and offering the best possible solutions.

With the help of AI, Skynet offers analytics to its developers and investors for tracking their dashboards on trends and historical data of risks, alerts, and project security scores. CertiK empowers crypto businesses to preserve integrity, reduce the likelihood of a financial hit, and keep the audits automated and compliant with regulations.

CertiK Skynet AI Features, Pros & Cons

Features:

- Monitoring blockchain in real time.

- Analysis of potentials in contracts.

- Exploiting alerts.

- Intelligence for predicting threats.

- Security score analytics.

Pros:

- Risk evaluation in real time.

- DeFi, NFT, and crypto support large.

- Analytics are predictive.

- Verified by many blockchain companies.

- Simplified scoring is a risk.

Cons:

- Features are complex for many.

- Alerts can be false.

- Requires knowledge of smart contracts

- Higher rates for smaller teams

- Less customizable reporting

3. Santiment AI

Santiment AI is also among the Best AI Applications for Analytics in SaaS for Crypto. Santiment AI provides analytics for social data, on-chain data, and market data. It uses AI to analyze social and market data, along with blockchain data, to understand investor sentiment, track tokens, and analyze trading strategies.

Traders can chart their trading strategies based on Santiment’s recommendations. Santiment uses historical data and predictive analytics to determine and highlight potential market anomalies, trends, and spikes.

With the combination of social sentiment analytics and blockchain analytics, Santiment provides its users with a comprehensive view of market sentiment and project performance. Santiment AI is one of the most valuable tools for crypto institutional investors and analysts to improve their strategies, manage risk, and better their investment decisions.

Santiment AI Features, Pros & Cons

Features:

- On-chain metrics analytics

- Social media sentiment monitoring

- Market trend prediction

- Investor behavior analytics

- Dashboards and alerts customization

Pros:

- Provides insights using on-chain and social data

- Helps traders find new opportunities

- Aids in strategy formation using predictive modeling

- Data visualization dashboards

- Analytics from past trends for improved evaluation

Cons:

- Data from social sentiment can be inaccurate

- There may be some delay in real-time metrics

- More advanced analytics are difficult to interpret

- Some platforms have restricted analytics integration

- Additional fees for full access

4. PeckShield AI

PeckShield AI has won the award for the Best AI Tool for Crypto SaaS Analytics at PeckShield for its analytics and blockchain security and risk prevention.

PeckShield’s artificial intelligence detects every possible risk and security issue in smart contracts, tracks suspicious activities and generates alerts for every possible risk, and keeps an eye on the evolving DeFi ecosystem.

It also provides in-depth analytics regarding transaction flows and the possible occurrence of malware, hacks, rug pulls, and fraud. PeckShield provides risk assessment and historical analytics to make the best possible informed decisions. The tool focuses on security and analytics, making it a dual-role tool.

PeckShield AI Features, Pros & Cons

Features:

- Smart contract risk assessment

- Tracking activities in DeFi

- Fraud alerts in real-time

- Risk assessment reports

- Blockchain analytics for Investors and projects

Pros:

- Early detection of scams and fraud

- More than one blockchain in focus

- Detailed analyses for informed decision making

- Useful for both developers and investors

Cons:

- Less focus on analytics of market trends

- Can be difficult for beginners

- Alerts may require additional manual monitoring4. Alert fatigue if numerous notifications

- Not fully transparent pricing

5. Glassnode AI Metrics

Glassnode AI Metrics is known as the Leading Best AI Tool for Crypto SaaS Analytics. It emphasizes predictive on-chain analytics in the cryptocurrency space. It provides actionable analytics for network activity, liquidity, supply, and investor behavioral trends.

It leverages AI for the visualization of complex blockchain data and the accessibility of the data for traders, analysts, and institutions. Glassnode combines data from history and reinforcement learning to trace market cycles, phases of accumulation, and likely price changes.

Insights from Glassnode are relied on for investors and analysts to create plans, minimize risk, and assess the state of the market. Glassnode is an analytics tool for crypto stakeholders focused on data accuracy and interpretability.

Glassnode AI Metrics Features, Pros & Cons

Features:

- Analyze the blockchain transactions for crypto assets.

- Keep track of network activity and liquidity.

- Monitor aimless investments.

- Examine previous patterns.

- Predictive market signals.

Pros:

- Accurate and reliable information for trading.

- Useful for institutional analyses.

- Graphs and dashboards for clarity, information, and presentation.

- Helps strategies with prior pattern and data reviews.

- Enhances risk management and investment planning.

Cons:

- Certain metrics require premium subscriptions.

- May be overwhelming for novices.

- Lacks internal security.

- Can be ineffective without trading extra instruments.

- Primarily based on blockchain information.

6. Token Terminal AI

One of the Token Terminal AI is one of the Best AI Tools for Crypto SaaS Analytics. Token Terminal AI is one of the best tools for analyzing the financial success of different blockchain projects.

Like other tools we’ve discussed, Token Terminal uses AI to evaluate revenue, users, and other critical performance indicators for various DeFi and NFT platforms. The tool translates blockchain revenue and users into more recognizable financial metrics, which helps investors do comparative analyses between different projects. In addition to revenue and user comparisons, the system also provides other services, such as trends, project comparisons, and revenue forecasts.

For institutional investors/portfolio managers/analysts, Token Terminal AI provides reliable and advanced analytics. The platform combines blockchain data with financial data and revenue metrics to provide answers, which is what makes it so valuable to SaaS crypto analytics firms.

Token Terminal AI Features, Pros & Cons

Features:

- Monitoring of revenue and financial KPIs.

- Assessment of token supply and demand.

- Comparative analysis of competing projects.

- Predictive analytics.

- Insights for crypto projects from an investment standpoint.

Pros:

- Transforms blockchain information into financial metrics.

- Comparative analysis of projects.

- Aiding decision making on portfolio and investment.

- Strategic planning through forecasting of trends.

- Reporting dashboards.

Cons:

- Financial metrics are the primary focus.

- Alerts are not very frequent.

- There is a lack of emphasis on security and compliance.

- It requires financial KPIs knowledge.

- A paid subscription is necessary to access the complete features.

7. Gauntlet AI Simulation

Gauntlet AI Simulation is recognized as one of the Best AI Tools for Crypto SaaS Analytics. It offers simulated risk assessment for various blockchain networks.

Its AI models stress-test different protocols, simulate various economic models, and forecast network’s responses to various levels of market volatility and attacks. Gauntlet assists developers in optimizing the safety and operational efficiency of their networks by predicting and modeling user behaviors, liquidity shifts, and various protocol parameters.

Investors may assess the protocol’s resilience and financial risk exposure through Gauntlet’s insights. Among many other things, Gauntlet helps ensure that the DeFi and NFT ecosystems are fully operational by employing predictive simulations to allow proactive economic model adjustments.

Gauntlet is unique for crypto projects in the areas of operational security and strategic optimization, with its unparalleled combination of AI simulations and actionable analytics.

Gauntlet AI Simulation Features, Pros & Cons

Features:

- Simulation and testing of stress protocols.

- Modeling of economic scenarios.

- Assessment and prediction of risks.

- Optimization of network resilience.

- Suggestions of strategies using AI.

Pros:

- Systemic failures in protocols are avoided.

- DeFi parameters are adjusted for safety.

- Developers make decisions based on data.

- Developers run simulations for complex scenarios.

- Increased confidence in protocols for investors.

Cons:

- Requires a high level of expertise.

- Small projects are not served well.

- Simulations are not always accurate to the real-world.

- Resource and expensive to set up.

- Results are difficult to interpret.

8. TRM Labs SaaS Intelligence

TRM Labs SaaS Intelligence is a Best AI Tool for Crypto SaaS Analytics recognized for improving fraud management, AML compliance, and other aspects of risk management. Utilizing AI driven algorithms, the platform scans and evaluates blockchain transactions in real-time, capturing and reporting questionable transactions and tracing suspicious transaction streams.

The platform adds analytics, reporting tools, and other compliance features for regulatory waivers in financial institutions, crypto wallets, and exchanges. Through the use of operational analytics, dashboards, and AI, TRM Labs provides a means through which organizations can capture, visualize, and manage operational analytics.

By fostering the integration of compliance, analytics, and security, TRM Labs provides a protective and insightful solution to crypto businesses for their digital financial processes.

TRM Labs SaaS Intelligence Features, Pros & Cons

Features:

- Fraud detection in real time.

- Reporting and Compliance of AML.

- Monitoring of transactions.

- Risk assessment of blockchain entities.

- Analytic institutions dashboards.

Pros:

- Compliance mandates are strengthened.

- Identification of transactions is suspicious and deals.

- Lots of blockchain protocols are supported.

- Monitoring is made easier with visual dashboards.

- Exchanges, wallets, and businesses find this useful.

Cons:

- It is focused on compliance above all.

- For small users the subscription cost is high.

- Analytics of the industry are lacking.

- Technical difficulties come with the integration and setup.

- Additional tools for full coverage might be needed.

9. Elliptic Navigator

Named a Best AI Tool for Crypto SaaS Analytics for compliance, transaction monitoring, and risk analytics, Navigator is an AI-based analytics tool. Its proprietary algorithms carry out blockchain analysis and fraud, money laundering, and suspicious activity detection analytics. Navigator enables crypto clients to reduce risk and stay compliant with regulations by offering a variety of proactive possible actions.

It clarifies transaction origin analysis by mapping out intricate transaction pathways. Elliptic Navigator helps financial institutions, exchanges, and investors operate efficiently by enhancing raw forensic blockchain analysis with AI. It is a critical resource for transparent and responsible risk management in crypto-related processes.

Elliptic Navigator Features, Pros & Cons

Features:

- Tracing of transactions that are related to cryptocurrency.

- Assessment of the cryptocurrency counterparties.

- Monitoring of fraud and AML.

- Compliance Reporting

- Forensic Blockchain Analytics

Pros:

- Strong focus on regulations and compliance

- Money laundering and fraud detection

- Serves institutional investors and exchanges

- Illustrates intricate transaction patterns

- Offers dependable risk assessment

Cons:

- Compliance-oriented analytics is scarce

- Specialized expert knowledge is often needed

- Pricing is prohibitive for smaller users

- More attention is placed on institutional demands

- Less ideal for individual retail investors

10. Chainalysis Market Intel

Chainalysis Market Intel is recognized as one of the leading AI Tools for Crypto SaaS Analytics. It analyzes blockchain markets and transactions. Its AI-based Market Intel inspects token migration, shifts, network activities, and provides investors and financial institutions with actionable insights.

Chainalysis analyzes liquidity, identifies irregular activities, and provides insights for understanding behaviors of investors.

Customers can make informed investment choices, lessen risk, and recognize investment possibilities by merging historical data with advanced predictive analytics. Chainalysis includes risk and compliance intelligence, which is useful for customers who need an analytics solution and require guidance on compliance within the cryptocurrency market.

Chainalysis Market Intel Features, Pros & Cons

Features:

- Token tracking and market intelligence

- Analysis of blockchain transactions

- Insights for predictive trends

- Tracking of liquidity and network activity

- Intelligence for compliance and risk

Pros:

- Merges compliance with market analytics

- Facilitates institutional investment and strategy

- Predictive analytics enhance quality of choices

- Effectively monitors liquidity and flow of tokens

- Offers stakeholders actionable intelligence

Cons:

- Subscription costs are steep

- Beginners find it complex

- Real-time security alerts are limited

- Focus is mainly on institutions

- Simulations may require extra tools

Conclusion

In conclusion, the field of Best AI Tools for Crypto SaaS Analytics is changing quickly and has unmatched capabilities for financial analysis, market insights, security, and compliance.

While CertiK Skynet AI guarantees smart contract security, platforms like Halborn AI Security and PeckShield AI place a higher priority on real-time threat detection.

Simulation systems like Gauntlet AI maximize protocol robustness, while analytics-focused technologies like Santiment AI, Glassnode AI Metrics, and Token Terminal AI offer practical on-chain and financial insights.

In the meanwhile, Chainalysis Market Intel, Elliptic Navigator, and TRM Labs integrate intelligence and compliance. In an increasingly complicated blockchain industry, using these AI technologies helps investors and cryptocurrency companies make data-driven decisions, reduce risks, and maximize growth.

FAQ

AI tools for Crypto SaaS Analytics are software platforms that leverage artificial intelligence and machine learning to analyze blockchain data, smart contracts, market trends, and security risks. They help investors, developers, and businesses make informed decisions, monitor protocols, detect fraud, and optimize performance.

These tools provide critical insights into network activity, user behavior, market trends, and protocol risks. They enhance security, improve compliance, reduce financial exposure, and enable data-driven decision-making in the fast-paced crypto ecosystem.

Top platforms include Halborn AI Security, CertiK Skynet AI, Santiment AI, PeckShield AI, Glassnode AI Metrics, Token Terminal AI, Gauntlet AI Simulation, TRM Labs SaaS Intelligence, Elliptic Navigator, and Chainalysis Market Intel. Each specializes in areas like security, analytics, simulation, or compliance.

Yes. Tools like Halborn AI Security, PeckShield AI, TRM Labs, and Elliptic Navigator provide real-time monitoring and AI-driven alerts to detect suspicious transactions, smart contract vulnerabilities, and potential cyberattacks.

Absolutely. Investors can use them for market analysis, trend prediction, and portfolio management, while developers benefit from smart contract audits, risk assessment, and protocol simulations to optimize security and efficiency.