In this article, I will highlight the Best Crypto Aggregator Apps for Yield Farming which allow for effortless maximum return on investments.

These apps automate strategy selection, yield comparison, and profit optimization across several protocols, thereby making DeFi investments truly effortless.

These aggregator applications improve yield farming for novices and veterans alike, making it simpler, safer, and more productive.

What is Crypto Aggregator Apps?

A Crypto Aggregator App is a real time digital platform that collects data from a variety of cryptocurrency exchanges. A Crypto Aggregator App enables users to comparе and analysе different exchangеs on a single platform saving time.

An Aggregator App simplifies trading via analytics and trading signals. In a highly volatile and dynamic cryptocurrency market, usеrs can find the Instrument of thеir choicе at thе bеst rеtеs. Crypto Aggregator Apps bеcausе thеy provide timе savеing rеporting, and data comparе.

Why Use Crypto Aggregator Apps for Yield Farming

Yield Comparison Made Easier – Aggregator apps allow users to compare yield rates from different DeFi platforms, guaranteeing users optimal and profitable returns.

Saving Time – Users save time because instead of going to different protocols to check rates, they see all the relevant farming opportunities from different protocols all in one dashboard.

Managing Risks – Users are able to make safer investments because many aggregators provide information pertaining to a protocol’s trustworthiness, audits, and liquidity risks.

No Manual Optimization Required – Certain apps will move liquidity in and out of certain pools in an automated fashion to get an optimized return based on interest rates and rewards.

All-In-One Portfolio Tracking – Users receive aggregators to achieve real-time monitoring of all their DeFi assets and farming rewards throughout several platforms.

Gas Fees Optimization – Some aggregators optimize smart contracts to manage transactions in a way that gas fees or transaction costs are lowered.

Access to More Protocols – Users are able to access a large number of DeFi platforms and tokens from a single interface which broadens their range of potential investments.

Easy Navigation – The complex yield farming process is made simple with aggregators which provide clear dashboards and easy to interpret metrics.

Key Point & Best Crypto Aggregator Apps for Yield Farming

| Platform | Key Point |

|---|---|

| Beefy Finance | A multi-chain yield optimizer that automatically compounds users’ crypto holdings to maximize returns across various DeFi protocols. |

| Yearn Finance | One of the earliest DeFi aggregators that automates yield farming by shifting funds between platforms offering the best interest rates. |

| DeFi Llama | A powerful analytics and data aggregator that tracks total value locked (TVL) across multiple DeFi protocols, helping users identify top yield platforms. |

| Instadapp | A DeFi management platform that lets users automate complex strategies like leverage, yield farming, and lending using a single smart wallet. |

| Harvest Finance | Aggregates and optimizes yield farming strategies by automatically collecting and reinvesting rewards into high-yield pools. |

| Idle Finance | Focuses on smart yield optimization by balancing risk and returns, allowing users to choose between “Best Yield” and “Risk Adjusted” strategies. |

| Reaper Farm | A yield aggregator on the Fantom network that maximizes compounding efficiency and minimizes fees for farmers through automated strategies. |

| Aperture Finance | A DeFi strategy automation platform offering “smart vaults” that adjust user positions dynamically for optimal yield and minimal risk. |

| OpenOcean | A cross-chain aggregator that combines both DeFi and CeFi liquidity, allowing users to get the best swap rates and farming opportunities in one place. |

| 1inch Earn |

1. Beefy Finance

Beefy Finance stands out as one of the top crypto aggregator apps for yield farming. It delivers automated yield farming across multiple chains while employing sophisticated strategies for yield optimization and compounding.

Users can earn the highest yield across different chains without any hassle since Beefy Finance spans across the Binance Smart Chain, Avalanche, and Polygon chains. The platform’s unique selling point is the time-efficient and hassle-free vaults that auto-reinvest earnings.

The platform’s seriousness towards users is evident in the transparency of security with multiple contract audits, community governance, and user interface. The sophisticated optimization of the platform across chains, as well as the user-friendly interface, grants reliability for any first or advanced defi user.

Pros & Cons Beefy Finance

Pros:

- Automated compounding of yields occurs.

- You can access yield farming on multiple blockchains.

- Regular audits build trust and transparency.

Cons:

- Complex strategies may confuse the user.

- Some chains may charge exorbitant gas fees.

- Returns on the pool may be volatile and depend on other market factors.

2. Yearn Finance

Yearn Finance stands out as one of the leading crypto aggregator applications for yield farming due to its ability to simplify complex DeFi strategies for users. Operating on the Ethereum blockchain, it leverages smart contracts to automatically transfer users’ assets to the most lucrative protocols.

What makes Yearn Finance special is the “Vault” system which automates the continuous rebalancing of assets to optimize yield. It saves users the manual effort of tracking assets and switching platforms, and also helps them avoid gas fees.

With active community governance, transparent operations, and a strong track record on security, Yearn Finance is a powerful automated tool for achieving continuous passive income and presents users with no major drawbacks.

Pros & Cons Yearn Finance

Pros:

- Yield optimization is fully automated with “Vault” strategies.

- The community is strong and governance proven.

- Automated moving of funds saves gas and time, re-allocating to top high yield pools.

Cons:

- Mostly expect to use Yern Finance with Ethereum-based protocols.

- Fees charged to the vault for use can lower returns.

- The site is less user-friendly and designed mostly for experienced users.

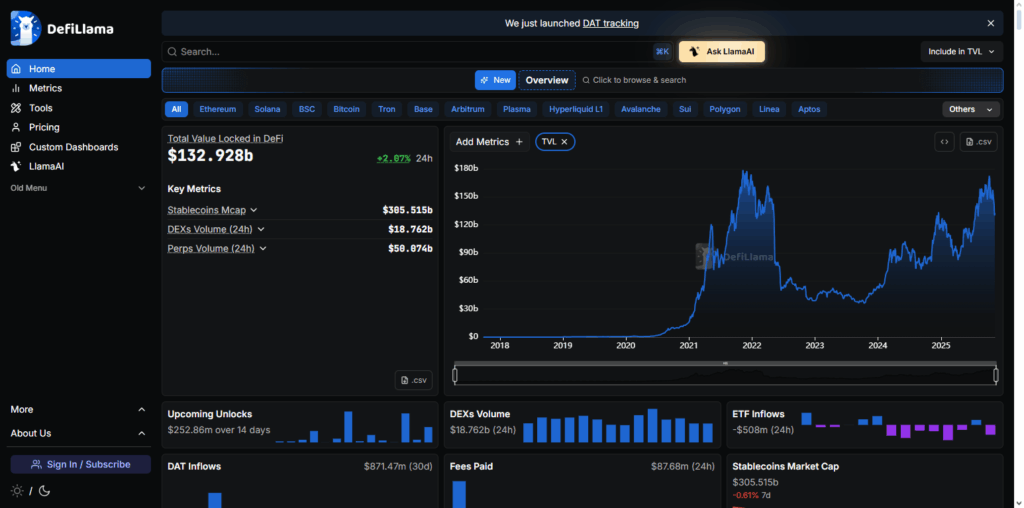

3. DeFi Llama

DeFi Llama stands as one of the premier crypto aggregator apps for yield farming due to its coverage of the whole DeFi ecosystem with detailed, up-to-the-minute analytics. It measures and reports the Total Value Locked (TVL) yield rates and other performance analytics over different chains and protocols.

What differentiates DeFi Llama from other aggregators is its data transparency and multi-chain coverage, making it easy for users to spot yield opportunities.

It uniquely doesn’t demand a linked wallet or permits trading, unlike other aggregators, concentrating instead on precise, neutral analytics. The open-source, dependable, and thoroughly analyzed project comparisons are other attributes that solidify DeFi Llama as an important resource for users to base yield farming strategies on.

Pros & Cons DeFi Llama

Pros:

- Excellent analytics for observing the DeFi TVL and yield.

- Data is presented openly and is fully transparent.

- You can view multiple chains to identify the best farming opportunities.

Cons:

- You may not yield farm directly from the site.

- You have to manually implement any strategies.

- The interface is rather dry and not user-friendly.

4. Instadapp

One of the best crypto aggregator apps for yield farming is Instadapp, since it automates and consolidates sophisticated DeFi strategies via smart automation and a unified smart wallet.

This lets users oversee and administer resources within the Aave, Maker, and Compound ecosystems and protocols from a single interface. Unlike other platforms, there is a smart layer of automation, allowing users to execute complex tasks in a matter of clicks, such as refinancing, leverage adjust, and liquidity shift.

With the integrated automation dashboards, cutting-edge yield farming techniques may be used. Such transparent DeFi investments, automation, and self-custodial control, as well as multi-protocol integration and self-custodial control, attest to the professionalism of the automation tools, enabling users to maximize yield safely.

Pros & Cons Instadapp

Pros:

- Unified dashboard for managing multiple DeFi protocols.

- Smart automation alleviates friction points within operations of leveraging and refinancing.

- Non-custodial design ensures full user control.

Cons:

- Best suited for advanced DeFi users.

- Limited supported protocols compared to broader aggregators.

- Occasional gas-heavy transactions.

5. Harvest Finance

Harvest Finance is among the top crypto aggregator applications for yield farming since it allows users to automate the collection and reinvestment of rewards across different DeFi protocols. It employs automated optimizing compounding strategies to maximize profit by returns reinvestment.

Harvest Finance’s auto-harvesting feature is particularly novel. It combines users’ funds to minimize gas expenses and improve operational efficacy. It employs gas-efficient strategies across several blockchains.

It is also transparent about its reward scheme using the FARM token and incentive design. Harvest Finance’s reputation as an easy and efficient DeFi passive income application is driven by its emphasis on sophisticated automation and computation cost reductions.

Pros & Cons Harvest Finance

Pros:

- Auto-harvesting mechanism compounding returns automatically.

- Gas costs reduction through aggregated transactions.

- Multi-chain yield farming opportunities.

Cons:

- FARM token rewards are subject to high volatility.

- Some strategies have moderate entry barriers.

- Past security incidents raised user caution.

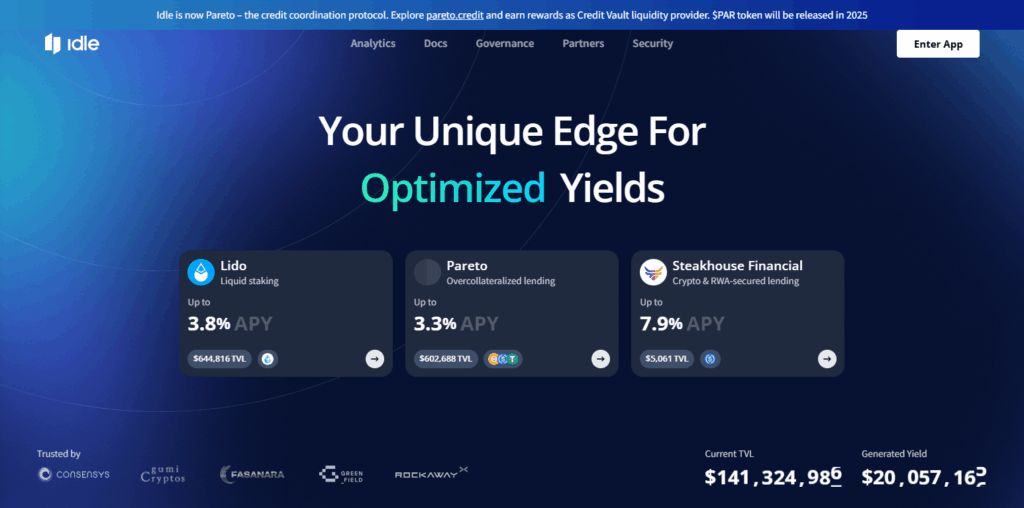

6. Idle Finance

Idle Finance stands out as one of the premier yield farming crypto aggregator applications because of its automated portfolio balancing which manages size and scope of risks and profits effectively.

Users can select an approach from the Best Yield or Risk-Adjusted options based on their individual comfort for volatility. Idle Finance is differentiated through the proprietary Smart Allocation Algorithm, which assesses and reallocates assets across various DeFi protocols, optimizing for performance and consolidation of risk.

The Idle Finance ecosystem is complemented with community governance via the IDLE token. The combination of automation with configurability and risk control gives users an exceptional yield farming experience.

Pros & Cons Idle Finance

Pros:

- “Best Yield” and “Risk-Adjusted” strategies are offered for added flexibility.

- Smart Allocation Algorithm optimizes returns strategically.

- Community driven governance via IDLE token is active.

Cons:

- Selection of supported assets is limited.

- Low market activity results in stagnant yields.

- Heavy reliance on Ethereum as a blockchain increases gas costs.

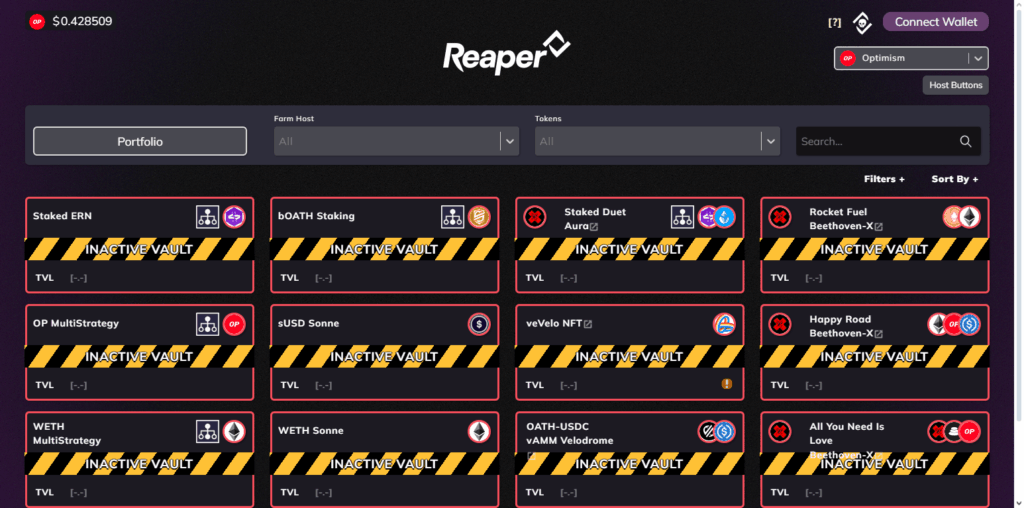

7. Reaper Farm

Of all the crypto aggregator apps for yield farming, Reaper Farm is the most effective due to its focus on auto-compounding strategy efficiency.

Mainly operating on the Fantom network, Reaper Farm yields optimization by automatically harvesting rewards from different liquidity pools, reinvesting them, and harvesting rewards again.

Reaper Farm’s high-efficiency vaults stand out since they use compounding to recoup transaction costs and perform up to four reinvestments each day.

Reaper Farm is also optimally transparent, secure and community driven, and focused on reliable and sustainable growth. Automated yield farming across different networks with minimized transaction costs provides effortless yield farming optimization for users with Reaper Farm’s low fee yield farming.

Pros & Cons Reaper Farm

Pros:

- Vaults of high efficiency offer frequent auto-compounding.

- Operates largely on the low-fee Fantom network.

- Community-centric and open development.

Cons:

- Beyond Fantom, very restricted chain support.

- Compared to bigger ecosystems, liquidity pools are smaller.

- Complex design makes it unsuitable for beginners.

8. Aperture Finance

Aperture Finance is highly regarded when it comes to crypto aggregator apps for advanced and automated yield farming. It improves market yield farming using smart vaults, which alters user positions to suit prevailing market conditions.

The aperture finance difference is the intent-based automation engine. Users specify goals, and the system effortlessly trails the most suitable strategies, taking the manual work out of investing.

It operates across multiple chains with compatibility to principal consortia, thereby, providing freedom and variety. With concentration on automation, control, and accuracy, Aperture Finance manages efficient yield farming like no other.

Pros & Cons Aperture Finance

Pros:

- Smart vaults increase yields while requiring no manual action.

- Smart automation that intends to stream lines actions and adapt to change in market.

- Multi-chain integration provides different avenues for asset diversification.

Cons:

- The supported protocols are still growing.

- For high-value portfolios, there might be a need for trust in automation.

- For new DeFi users, there is a lack of educational material.

9. OpenOcean

OpenOcean is arguably the best crypto aggregator app for yield farming. This is because it integrates both DeFi and CeFi liquidity sources to provide the most efficient trading and yield farming opportunities.

OpenOcean provides real time updates across various networks and protocols to get the best swap rates and the most rewarding farming opportunities. OpenOcean’s cross-chain aggregation engine is perhaps the most distinctive element of the platform.

Users get the best possible value across various blockchains without the inconvenience of changing applications. OpenOcean’s sophisticated smart routing technology also reduces slippage and gas costs.

Users can execute complex strategies thanks to the platform’s user friendly interface, which saves them a lot of time. OpenOcean is unrivaled because of the speed, transparency, and ease of use in yield farming.

Pros & Cons OpenOcean

Pros:

- Combines liquidity from DeFi as well as CeFi systems.

- The cross-chain engine is capable of providing the best rates for swaps and yields.

- Smart routing results in lower slippage and gas fees.

Cons:

- For new users, the interface might be complicated.

- For best results, there should be dependability on network liquidity.

- Advanced options could be seen as complex and might need special knowledge.

10. 1inch Earn

Because it cleverly analyzes several DeFi platforms to discover the highest yields for your assets while avoiding fees and slippage, 1inch Earn is regarded as one of the best crypto aggregator apps for yield farming.

1inch Earn effectively and efficiently directs funds into top-performing yield opportunities by pooling liquidity across decentralized exchanges. When compared to manually searching methods, its algorithmic approach saves consumers time and effort.

The platform is perfect for both novice and seasoned yield farmers looking for higher, automatic returns because of its integration with top DeFi chains, which supports a variety of techniques and aids in risk management.

Pros & Cons 1inch Earn

Pros

- Efficient Yield Optimization: They determine the highest yields available for farming on multiple DeFi platforms and route there.

- Better Slippage & Fees: They’re able to execute trades more efficiently and route to exchanges with lower fees.

- Broad Protocol Scope: They are able to tap into a vast array of DEXs and liquidity pools.

- Intuitive Design: For both novices and experts alike, complex yield farming strategies are distilled down to an easily manipulable product.

- Cross-Chain: Their protocol spans multiple chains, increasing your asset’s usefulness and your farming opportunities.

Cons

- Smart Contract Approval: The DeFi protocols smart contracts also require trust.

- Illiquid Markets: The farming opportunities that are available are sometimes shallow.

- Volatile Markets: The farming yields can decrease dramatically when the price of the underlying volatile asset drops.

- Non-Transparent Fees: A complex framework of fees can sometimes be encountered.

- Liquidity Issues: The available farming opportunities can be shallow.

Conclusion

To sum up, the most effective crypto aggregator apps for yield farming in DeFi provide passive income with the aid of automated toolset strategies, yield optimizers, and reduction of manual labor.

While Beefy Finance, Yearn Finance, and Harvest Finance perform most automated compounding, DeFi Llama and Instadapp provide strong analytics and management systems. Others such as Idle Finance, Reaper Farm, Aperture Finance, and OpenOcean prioritize efficiency and flexibility, cross-chain access, and collapsing the borders of crypto yield farming.

All of these aggregators enable users to optimize return and reduce risk, and implement an investment strategy based on real analytics, empowering them to achieve maximum potential which makes them the most effective and necessary DeFi tools for passive income.

FAQ

They simplify the process by automatically moving funds between the most profitable pools, reducing manual effort, and saving on gas fees while maximizing returns.

Most leading aggregators like Beefy Finance, Yearn Finance, and Instadapp undergo regular audits. However, users should always research and understand smart contract risks before investing.

Yes, many platforms offer intuitive dashboards and automated strategies, making yield farming accessible even for beginners without deep DeFi knowledge.

Some of the best include Beefy Finance, Yearn Finance, DeFi Llama, Instadapp, Harvest Finance, Idle Finance, Reaper Farm, Aperture Finance, and OpenOcean.