In this article, my focus will be on Best Crypto Aggregator Tools for Cross-Chain Swaps. With the growth of the crypto ecosystem over several blockchains, the use of dependable swap aggregators for seamless asset transfers, quick execution, and optimal price determination is a must.

These tools greatly ease the multi-chain trading process by merging liquidity from numerous exchanges and bridges, thereby providing a unified and streamlined interface for the user.

What is Crypto Aggregator Tools for Cross-Chain Swaps?

Crypto Aggregator Tools for Cross-Chain Swaps provide the ability to swap tokens across different blockchains without jumping multiple exchanges and bridges.

They combine liquidity pools to offer one unified platform. Aggregators provide a seamless experience by replacing the need for users to spend time on price comparisons and route searches on decentralized exchanges. Apart from being time-saving, aggregators help minimize slippage, ease gas fees, and accelerate the transaction process.

They ease the complexity of multi-chain manipulations with a single click. DeFi users, newcomers and experienced alike, appreciate the security and convenience these crypto aggregator tools provide.

Benefits Of Crypto Aggregator Tools for Cross-Chain Swaps

Best Pricing & Lowest Slippage: Aggregators provide the most cost-efficient pricing options by scanning numerous DEXs and bridges.

Access to More Liquidity: Users can execute larger swaps seamlessly as price impact is reduced owing to the aggregation of numerous liquidity pools.

Seamless Cross-Chain Experience: Users can perform cross-chain swaps without switching networks manually or hopping between different applications.

Reduced Gas & Transaction Fees: Smart routing reduces the fees on the path taken to complete a swap.

Faster Transactions: Swaps are fast due to the automated routing that minimizes delays as compared to manually bridging and trading.

Enhanced Security: Integrated audited bridges and DEXs of trusted protocols limit the problem of engaging with unreliable systems.

Better User Experience (UX): Multi-chain swaps are easy to execute for complete novices. Customization is available for advanced traders.

Key Point & Best Crypto Aggregator Tools for Cross-Chain Swaps List

| Aggregator | Key Points |

|---|---|

| Rango Exchange | Multi-chain swap aggregator combining bridges + DEX liquidity; supports 60+ blockchains; advanced routing for optimal pricing. |

| 1inch | Leading DEX aggregator; finds best swap rates across 100+ liquidity sources; focuses on low slippage and gas optimization. |

| OpenOcean | Aggregates both DEXs and CEXs; supports cross-chain swaps with smart routing; offers arbitrage-friendly features. |

| Jupiter Exchange | Solana ecosystem aggregator; discovers best swap routes via multiple DEXs; minimizes price impact and fees. |

| LlamaSwap | Powered by DefiLlama; transparent pricing with no added fees; compares best rates across multiple chains. |

| CoWSwap | Uses batch auctions to reduce MEV attacks; peer-to-peer price matching for better execution; gasless order signing. |

| Squid Router (Axelar) | Cross-chain router using secure Axelar messaging; enables swapping, bridging, and contract calls across chains. |

| Li.Fi Protocol | Universal bridge and DEX aggregator; offers best routes for bridging + swapping; SDK widely used by DeFi apps. |

| XY Finance | Fast cross-chain swapping with a unified interface; supports bridging, lending assets; attractive for multichain DeFi users. |

| Symbiosis Finance | Streamlined cross-chain liquidity protocol; single-click swaps across EVM & non-EVM chains |

1. Rango Exchange

Among the various crypto aggregator tools available for cross-chain swaps, Rango Exchange is exceptional due to the integration of simplified bridges, and decentralized exchanges, and routing into one system.

Users can conduct cross-ecosystem asset transfers without changing interface, and the system supports EVM, Cosmos, Solana, and additional networks. Rango’s system for cross-ecosystem asset transfers identifies and selects the optimal and least expensive exchange route to eliminate slippage and the probability of a failed transaction.

Users can trace all steps in a transaction to understand it before confirming it, and most platforms do not offer such complete and open visibility. Thanks to Rango’s extensive multi-chain liquidity and interoperability, multichain traders can enjoy the experience.

Rango Exchange Features

- Universal Aggregation — Accesses DeFi, DEXs, and bridging services across 60+ blockchains.

- Cross-Chain Routing Intelligence — Identifies and executes the swap route in the most cost-effective and safe route available.

- NFT & Wallet Support — Interoperates with various wallets and NFT assets across several blockchains.

2. 1inch

1inch is among the first suggested crypto aggregator platforms for cross-chain swaps. When it comes to PathFinder’s algorithm, the variety of methods to optimize a trade per user and minimize slippage by splitting an order over several sources of liquidity is unmatched in the field.

After all, 1inch connects users to hundreds of DEXs on multiple chains, and highly competitive pricing and liquidity. Most importantly, though, is 1inch’s routing technology, which ingeniously saves users gas fees on the transactions, especially during periods of over-congestion. Users of the 1inch platform also enjoy Fusion Mode.

This innovation allows users to execute secure swaps and gasless MEV-distributed swaps. The cross-chain trading offers users unparalleled efficiency, security, and low costs.

1inch Features

- DEX Aggregator Efficiency — Enhances transaction value and minimizes slippage by distributing trades across various liquidity pools.

- Limit Orders & DeFi Tools — Offers advanced order types and gasless swaps on selected networks.

- Extensive Ecosystem Support — Integrates a wide range of EVM networks and a large number of tokens.

3. OpenOcean

OpenOcean stands out as a top choice for cross-chain swap crypto aggregators since it seamlessly integrates both decentralized and centralized exchanges to provide the most exceptional liquidity access.

OpenOcean assists users outside the scope of merely DeFi liquidity pools as it also considers pricing from centralized exchanges (CEXs), anticipating best execution for traders. OpenOcean offers efficient multi-chain swap execution due to the platform’s intelligent routing algorithm capturing and computing slippage, gas fees, and bridge routes.

Advanced trading functionalities like limit orders and arbitrage make the platform appealing to novices and sophisticated traders alike. OpenOcean’s cross-ecosystem liquidity bridging provides traders with the desired flexibility and the most favorable pricing for a wide array of trading strategies.

OpenOcean Features

- CeFi + DeFi Aggregation — Enhances pricing competitiveness by incorporating both centralized and decentralized liquidity.

- Cross-Chain Swaps — Offers a unified interface for swapping tokens on several blockchains.

- Analytics & Pro Tools — Contains advanced features like slippage control, price charts, and arbitrage.

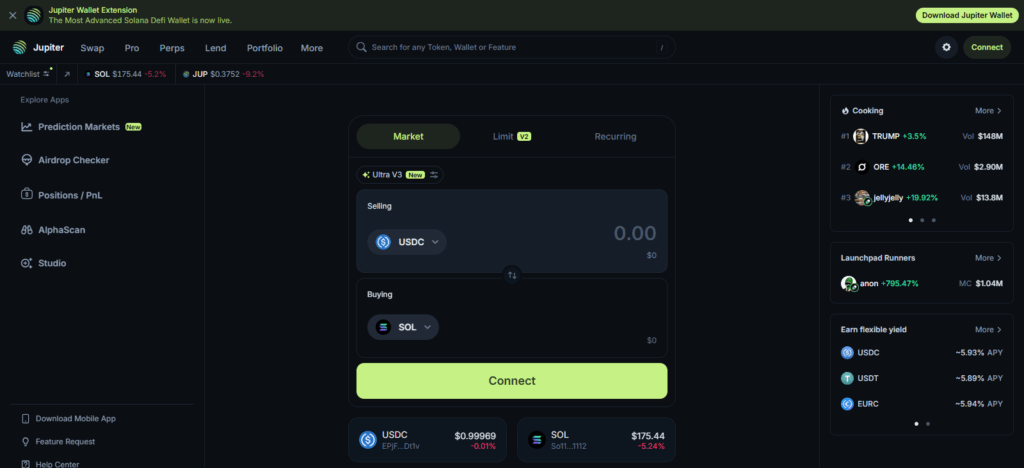

4. Jupiter Exchange

Jupiter is recognized as one of the most efficient crypto aggregator tools for cross-chain swaps. This is particularly true for the Solana ecosystem. Its routing engine is highly optimized and focuses on the most efficient execution of trades.

Minimizing slippage, price impact, and transaction friction is made possible due to its constant evaluation of Solana DEXs and their respective liquidity. Integrating with Solana’s secure and affordable infrastructure is one of Jupiter’s key differentiators, allowing customers to do multi-hop swaps within a single transaction.

Furthermore, customers looking for assets outside Solana ecosystem can use Jupiter’s secure bridging routes. The transparency of Jupiter’s pricing and the liquidity it offers further solidifies its position as the most reliable and effective tool for cross-chain trading.

Jupiter Exchange Features

- Solana Liquidity Hub — Bundles top Solana DEXs for the most competitive pricing on SPL tokens.

- Stable & Fast Settlement — Unmatched fast & low-cost liquidity routing optimized for slippage.

- Bridging Support — Moving cross-chain assets into the Solana ecosystem.

5. LlamaSwap

LlamaSwap is one of the best crypto aggregator tools for cross-chain swaps focused on complete transparency and cost-effective trading using trusted DefiLlama data.

Unlike other platforms, which hide extra fees and manipulate quotes, LlamaSwap analyzes rates on all DEXs and cross-chain bridges in real-time without any surcharge, so users always see the absolute best price.

It eases cross-chain execution through support of main-chain networks and optimal route suggestions with minimized slippage and gas costs.

Combining ease of use, transparency, and unbiased price aggregation, LlamaSwap is the trusted choice for users who value simplicity and cost in each swap.

LlamaSwap Features

- DAO-Driven Aggregator — Built using on-chain governance. The DeFi transparency is also a feature.

- Multi-Chain Support — The liquidity is interconnected through various major blockchains.

- Gas-Optimized Execution — Specializes in gas cost minimization during token swaps.

6. CoWSwap

CoWSwap has some of the best crypto aggregator tools for cross-chain swaps because of the mechanism for batch auctions which defends users against MEV-attacks and price manipulation.

As compared to the DEXs performing trades and fulfilling orders in the book, CoWSwap orders peer to peer transactions and gives users improved prices compared to traditional routing.

Its solvers gas auctions, which compete on the gas and the route, solve the most efficient routing problem across and along chains to minimize gas, slippage, and cross chain swaps, etc. CoWSwap has gasless order signing and trustless contract-settlement which allows users to swap in a gasless order environment with gas contract-for swaps.

The smooth UX, MEV protections, and price-optimizations makes CoWSwap most preferred for efficient and safe cross-chain swaps.

CoWSwap Features

- MEV-Protection — Batch auctions prevent front-running and sandwich attacks.

- No Traditional AMM Fees — When matching orders are available, trades are settled peer-to-peer.

- Solver Network Routing — Sophisticated solvers compete for the best price on behalf of the user.

7. Squid Router (Axelar)

Squid Router built on Axelar secure cross-chain infrastructure is one of the best crypto aggregator tools for cross-chain swaps because it allows for blockchain contract calls and transfers in one.

Instead of making users swap and bridge separately, Squid performs both functions in a single unified route. The automatic bridge Squid performs has low risks, with failed transactions being unlikely due to Axelar decentralized validation.

Squid offers a simplified on-chain user experience while supporting fast execution across major EVM and non-EVM ecosystems. By providing advanced capabilities to dApps and users, Squid Router allows effortless interoperability, superior to any other solution in the market.

Squid Router (Axelar) Features

- Cross-Chain Messaging Power — Leverages the Axelar network for seamless and secure cross-chain swaps and interactions.

- Composable Asset Transfers — Move tokens and execute smart contract calls on different chains simultaneously.

- User-Friendly Widget — Provides cross-chain functionality for dApps.

8. Li.Fi Protocol

Li.Fi Protocol is seen as one of the best crypto aggregator tools for cross-chain swaps because of the universal routing engine it provides that integrates bridges and DEXs into one smart system. Li.Fi does not stick to a single bridge route.

It analyzes many for safety, speed, cost, and success, then automatically chooses the best execution. Most notably, Li.Fi is a developer-focused SDK that enables cross-chain swaps to seamlessly integrate in wallets, dApps, and exchanges throughout the crypto ecosystem.

With extensive blockchain coverage, meticulous security reviews, and active liquidity management, Li.Fi ensures safe and seamless multi-chain trading for builders focused on interoperability as well.

Li.Fi Protocol Features

- Bridge + DEX Aggregation — Merges the liquidity of top bridges and DEXs to create safe routing options.

- Risk-Scoring Engine — Evaluates bridge risk and fee, and calculates the likelihood of success for a transaction.

- SDK for Developers — Provides seamless multi-chain integration for wallets and DeFi applications.

9. XY Finance

XY Finance is one of the fastest and most flexible cross-verse aggregators. The execution is fast and adaptable to the vast and numerous ecosystems.

It combines DEXs and cross-verse liquidity bridges to provide optimal real-time pricing and the lowest slippage even during highly volatile conditions.

The unified liquidity feature is exceptional as it allows users to pass EVM and non EVM chains including the BNB Chain, Polygon, and Avalanche, directly and seamlessly as opposed to using multiple disparate systems.

It offers a simple interface in which sophisticated cross-verse routes are simplified. Best suited for users who require operational efficiency, liquidity depth, and easy multichain accessibility.

XY Finance Features

- Omnichain Routing — Efficient and secure swaps over EVM and non-EVM chains.

- NFT Bridge Support — Cross-chain NFT transfers are supported.

- Low-Fee Execution — Every swap path is optimized for lower gas and transaction costs.

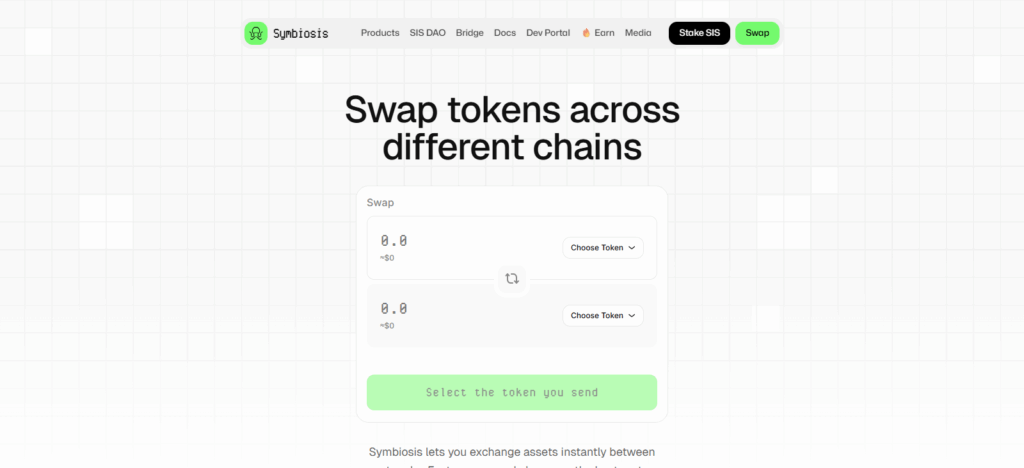

10. Symbiosis Finance

Symbiosis Finance is known as one of the top crypto aggregator tools for cross-chain swaps due to the ability to transact seamlessly between EVM and non-EVM networks in one unified transaction.

Reducing failed swaps and extraneous steps, the platform automatically connects to the most dependable liquidity pools and bridges. One of the most unique features is the decentralized liquidity model which guarantees optimal and liquid pricing, even during periods of intense system congestion.

Symbiosis streamlines the user experience by eliminating the requirement for manual network switching, ensuring that the process of switching and using multiple chains is as effortless as standard swaps.

With decentralized security infrastructure and extensive network interconnection, it guarantees the speed, ease of use, and multichain access that all multichain DeFi users require.

Symbiosis Finance Features

- Cross-Chain Liquidity Layer — Liquidity from multiple chains is pooled for effortless swaps.

- Gas Fee Abstraction — Swap gas fees are incorporated in the token used for the swap.

- Non-Custodial Security — The swaps are executed in a fully non-custodial manner.

Risk & Consider

Bridge Security Risks: Since aggregators depend on third-party bridges, which can be poorly designed and lead to hacks or exploits and loss of assets.

Transaction Failure on Complex Routes: Swaps that require manual transactions consist of multiple different parts that can lead to a sudden loss of the transaction if the liquidity changes, and if the bridge does not respond, the process is time-consuming and costly.

High Volatility & Slippage: Users might not get the expected outcome because of the sudden changes in the market that leads to people being on the losing end of a trade.

Gas Fees Can Spike Unexpectedly: Users will always expec gas prices to be predictable, however, sudden congestion in the network will lead to unprecedented changes.

Smart Contract Vulnerabilities: Any DEX, bridge or aggregator contract is interconnected and poorly built systems will ultimately lead to the failure of the entire network.

Limited Customer Support in DeFi: There is a lack of oversight on the automated systems which leads to great recovery difficulties when addressing system issues.

Regulatory Uncertainty: There is a great lack of compliance with automated systems especially in relation to centralised exchanges in different countries.

Conclusion

As users continue to interchange assets between various blockchain environments, cross-chain swap Crypto aggregator tools become indispensable.

These platforms merge bridge functions with access to deep liquidity, thereby simplifying complex DeFi activities, ensuring better pricing, quick execution, and broader support for assets. Each aggregator showcases specific advantages, whether a low-slippage environment, protection from MEV, and easy-to-use workflows.

Traders working with cross-chain diversifying liquidity tools from Rango, 1inch, OpenOcean, Jupiter, LlamaSwap, CoWSwap, Squid Router, Li.Fi Protocol, XY Finance, or Symbiosis Finance enjoy better flexibility and improved safety across various chains. A confident multichain experience is what an aggregator provides for customers.

FAQ

A cross-chain swap aggregator is a tool that combines liquidity from various DEXs and bridges to let users exchange tokens across multiple blockchains in one interface with the best pricing.

Aggregators save time, reduce slippage, lower gas fees, and improve swap success rates by automatically choosing the most efficient route.

They are generally secure if using reputable protocols, but risks still exist due to smart contract vulnerabilities or bridge failures. Always verify platforms before large transfers.