This article covers the Best Crypto DeFi Platforms for Flash Loan Strategies detailing how innovative protocols allow users to borrow funds for opportunities like arbitrage and liquidation with no collateral. Flash loans are executed in seconds.

They combine deep liquidity and safe smart contracts. Knowing which platforms are the best enables traders to work with increased efficiency, minimized risks, and enhanced earnings in DeFi.

What is Crypto DeFi Platforms?

DeFi, or Decentralized Finance, refers to an entire ecosystem of crypto blockchain systems designed to provide financial services without the need for an intermediary, such as a bank or a stockbroker.

Orchestrated primarily via smart contracts built on the Ethereum framework, these systems provide services such as crypto lending and borrowing and automated crypto trading.

Transactions of assets and funds to and from a bank, compliance with KYC and account approval processes, and transaction security are replaced through cryptographic systems and open decentralized networks.

The absence of gatekeepers means that people can access these services with an internet connection and a crypto wallet.

The DeFi systems provide services no other financial systems can, such as cost reduction, accessibility, and automated trading and lending services, thus promoting financial inclusion and the digital economy in unprecedented ways.

Why Use Crypto DeFi Platforms for Flash Loan Strategies

No Collateral Needed – With flash loans, potential borrowers gain instant access to any number of crypto assets without the risk of any secure collateral.

Automated Smart Contracts – Smart Contracts guarantee that any loans which are borrowed are guaranteed to be paid back at the instant in the same block.

High Liquidity Access – One of the major DeFi platforms is accessible to all, and is leveraged to gain access to any number of xen trading and arbitrage opportunities.

Fast Execution – The flash loan and transaction crypto system is built for time profit and can be implemented in arbitrage and liquidation.

Global Availability – Unlike traditional finance, DeFi is accessible to anyone with a crypto wallet, eliminating the need for approvals, paperwork, or intermediaries.

Potential for High Profits – Flash loans taken on arbitraging assets with different market prices can guarantee profit.

Transparent and Open-Source Systems – Users can audit any and all proprietary systems which increases the overall safety.

Automation and Bot Integration – Traders can set scripts to automatically perform flash loans on system.

Benefits Of Crypto DeFi Platforms for Flash Loan Strategies

Instant Borrowing Power – Positive cash flow through flash loans without collateral requirements is available for near immediate withdrawal.

Low Entry Barrier – The only requirement is a crypto wallet and a basic understanding of crypto and DeFi tools to implement complicated financial strategies.

Higher Profit Opportunities – The ability to perform arbitrage and liquidation within seconds open up opportunities of drastically profiting and executing multiple strategies in a short time.

Time Efficiency – Smart contracts speed up and automate the entire process. There is no more the need to rely on people where errors most commonly occur.

Global Access – There is no need to go through the traditional banking system and all associated paperwork. It is available to anyone in the world at any time.

No Trust Issues – Every transaction is recorded on the blockchain and can be audited for accuracy.

Programmability – Custom bots can be programmed to implement and carry out new and adaptive strategies to automate profit making.

Loans Immediate Repayment – Repayment within the same block is a requirement which drastically reduces risk of default.

Funds Optimization – DeFi platforms large liquidity pools can be optimized to integrate the most profitable trades.

Tooling and Expansion – The available tools within DeFi are constantly expanding which allows new strategies concerning the use of flash loans to open up.

Key Point & Best Crypto DeFi Platforms for Flash Loan Strategies List

| DeFi Platform | Key Strength / Highlight |

|---|---|

| Aave V3 | High liquidity, cross-chain functionality, advanced risk management tools |

| Compound V3 | Capital-efficient borrowing with improved collateral & liquidation efficiency |

| Balancer V2 | Flexible multi-token pools good for arbitrage-based flash loan strategies |

| dYdX (Layer-2) | High-speed Layer-2 order book trading with low fees |

| MakerDAO | Trusted decentralized stablecoin backed by crypto collateral |

| Curve Finance | Highly efficient stablecoin swaps ideal for price arbitrage strategies |

| Instadapp | Simple UI for executing flash loan strategies across multiple protocols |

| Yearn Finance | Auto-compounding vault strategies for passive income |

| Beefy Finance | Multi-chain vaults with automated yield maximization |

| Solend | Fast transactions with low fees on Solana ecosystem |

1. Aave V3

Aave V3 is among the best Crypto DeFi platforms for flash loan strategies due to its unrivaled speed and execution risk management for advanced flash loan strategies.

There are no limits to the amounts of crypto that is uncollateralized for the user to borrow, which means it can be used for refinancing, arbitrage and liquidation opportunit Aave V3 also cross chain lends and efficiently designed pools.

Highly vetted, Aave V3 smart contracts are guaranteed to automate processes. There are also the best community tools designed and automated processes to powerful integrations for the community developed tools. Aave V3 is guaranteed to be the best for flash loan development.

Aave V3 – Key Features

- Flash Loans Support with high liquidity for large and fast trades.

- Cross-Chain Lending to maximize opportunities across multiple networks.

- Advanced Risk Tools like isolation mode and efficiency mode for safer execution.

2. Compound v3

Compound V3 is not regarded in flash loan strategies for providing native flash loans, but for offering a profitable lending environment and efficient DeFi operations that can be paired with flash loans from other protocols.

Its architectural redesign around a single borrowable asset model improves capital efficiency, reduces liquidation risks, and lowers costs. This simplifies and better positions traders executing flash loans for optimized control over arbitrage, collateral adjustments, debt refinancing, and debt market cross over.

Driven by security excellence, predictable governance, and firm liquidity, Compound V3 positions itself as a performance and returns enhancement strategic center for flash loan actors.

Compound V3 – Key Features

- Capital-Efficient Design with improved collateral usage.

- Low Liquidation Risk through simplified asset structures.

- Reliable Liquidity for refinancing and debt optimization.

3. Balancer V2

One of the best options for flash loan strategies is Balancer V2. This is due to the unique structure of its liquidity pools, which accommodate multiple tokens and allow for more price discrepancies.

This position is further enhanced by Balancer V2’s customizable Automated Market Maker (AMM) architecture, which facilitates more sophisticated arbitrage opportunities and more effective liquidity utilization.

The Balancer V2 smart contracts feature a unique separation of the asset management and pool logic components, which streamlines the execution of flash loan transactions by significantly reducing the gas costs associated with multiple rapid transactions.

Coupled with high liquidity and configurability of pools, and frictionless integration with dominant DeFi primitives, Balancer V2 creates an ecosystem in which users of flash loans can identify and execute high-precision low risk and low operational risk strategies.

Balancer V2 – Key Features

- Multi-Token Pools increase arbitrage possibilities.

- Low Slippage Swaps ideal for flash loan strategies.

- Flexible AMM Logic for custom liquidity configurations.

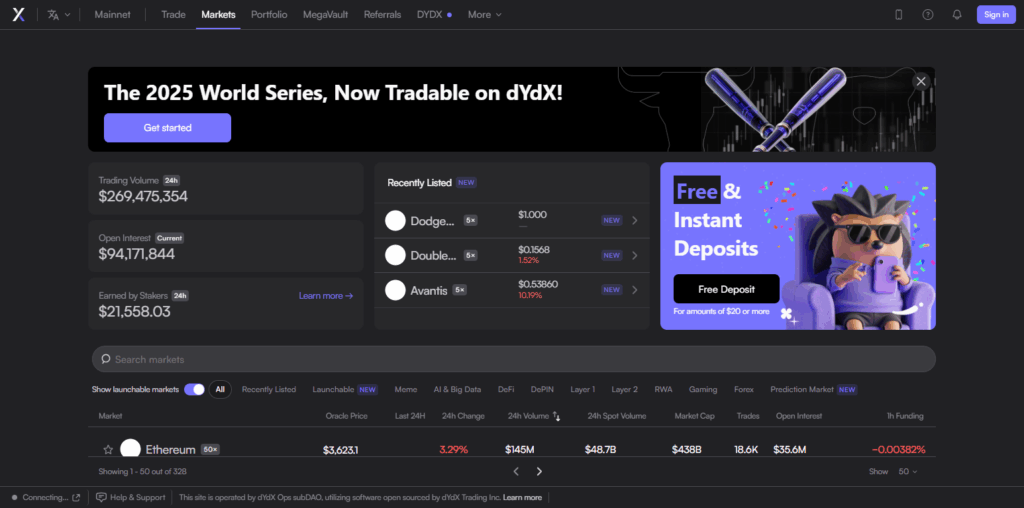

4. dYdX (Layer-2)

dYdX (Layer-2) is a highly valuable platform for traders who engage in flash-loan arbitrage and liquidation strategies.

This is due to the platform’s efficient order books and inexpensive Layer-2 setting which enables the execution of sophisticated trading operations intertwining flash loans with arbitrage and liquidation trading.

Even though dYdX doesn’t offer flash loans, it is an a vital execution venue, where traders are capable of opening, closing, and hedging highly leveraged positions in real time through funds available for borrowing in other DeFi protocols.

Flash loan traders value dYdX for its non custodial derivatives and perpetual contracts with rapid settlement, as they need to respond quickly to market trends and price changes. The ability to execute strategies profitably is fueled by rapid execution, deep liquidity, and dYdX’s analytic, institutional-level capabilities.

dYdX (Layer-2) – Key Features

- High-Speed Trading Execution on a Layer-2 order book.

- Derivatives & Perpetual Markets for leveraged positions.

- Low Transaction Costs enabling profitable flash trade execution.

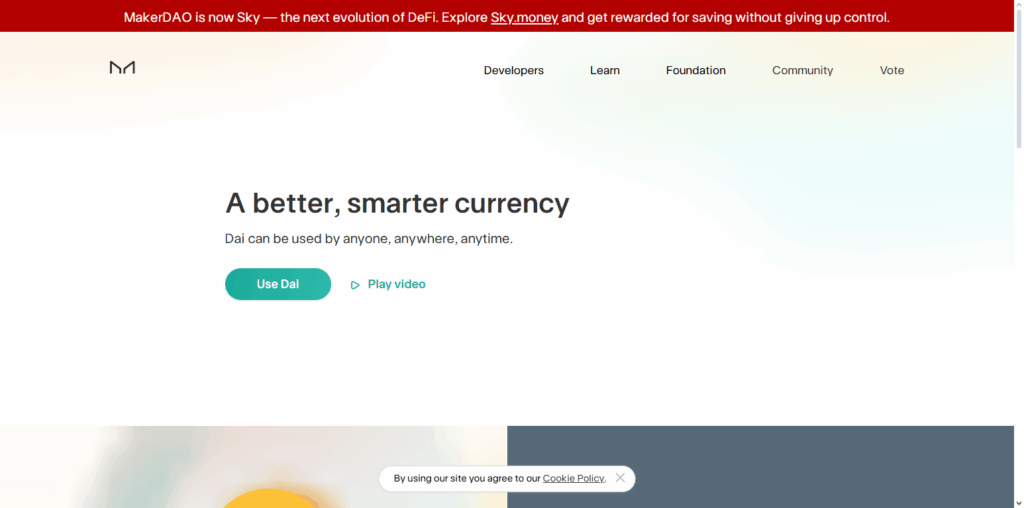

5. MakerDAO

MakerDAO is essential in flash loan strategies since it is the primary generator of DAI, one of the most popular stablecoins in DeFi.

Although MakerDAO does not offer flash loans, it does provide access to the vault system which allows operators in flash-loan environments to rebalance collateral, pay down debt, or liquefy trapped assets to collateral substitute.

This is directly related to the Maker ecosystem’s governance, over-collateralization, and DAI’s stabilizing liquidity and price dynamics.

These features provide the DAI liquidity and stability needed to implement refinancings and arbitrage strategies. Paying down collateral and over-issuing liquidity makes MakerDAO a powerful source of collateral flexibility for stabilizing the profitability of flash loan strategies.

MakerDAO – Key Features

- DAI Stablecoin Issuance for currency-stable strategies.

- Secure Collateral Vaults supporting quick liquidity unlocks.

- Strong Governance & Stability Mechanisms trusted across DeFi.

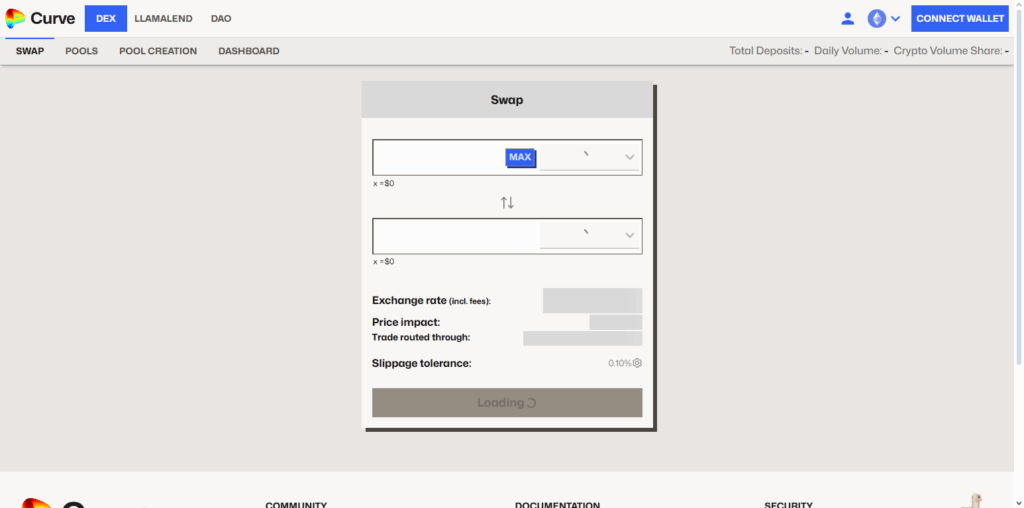

6. Curve Finance

Curve Finance ranks among the top DeFi platforms for flash loan execution due to its stablecoin and correlated-asset AMM pools which often create micro price discrepancies. Skilled traders can exploit these price differences.

Curve’s deep liquidity environment means that large flash loan facility trades are executed with little slippage, which makes arbitrage opportunities far more reliable and easier to predict.

Curve’s enhanced optimized swap algorithm guarantees precision and speed in the high-velocity trades that are characteristic of flash loan execution.

Following security audits, with several stablecoin pairs, and with flash loan dealers like Aave, Curve Finance delivers a superb environment for liquidity optimization and stablecoin arbitrage.

Curve Finance – Key Features

- Efficient Stablecoin Swaps ideal for arbitrage.

- Deep Liquidity Pools reducing risk of failed execution.

- Optimized AMM Algorithms ensuring minimal price impact

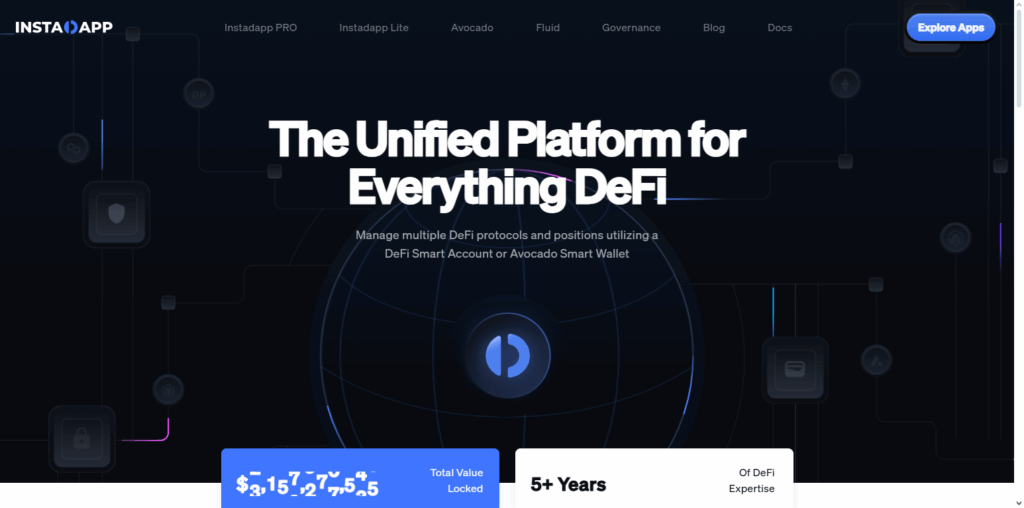

7. Instadapp

Instadapp is one of the best DeFi platforms for flash loan strategies as it is a powerful automation layer that connects Aave, Compound, MakerDAO, and Curve.

It acts as a one-stop interface. Their smart DeFi management tools let users perform advanced flash loan sequences—debt refinancing, collateral swapping, multiprotocol arbitrage—without needing extensive programming knowledge.

The ‘Account Extension’ system provides trusted contract-based control over assets, enhancing speed and capital efficiency for processes that need it.

Their dashboard and automation tools simplify otherwise complicated strategies for advanced users and beginners alike, making the interface for executing flash loans streamlined, powerful, and as optimized as possible.

Instadapp – Key Features

- Unified DeFi Interface to manage multiple protocols

- One-Click Automation of complex flash loan strategies

- Smart Account System improving execution security

8. Yearn Finance

Yearn Finance supports flash loan strategies as a powerful yield-optimization hub, where loaned amounts can be used immediately for high-rate returns across a myriad of liquidity pools and other protocols.

Although it does not issue proprietary flash loans, its automated vault strategies empower traders to exploit market inefficiencies and maximize earnings on flash-loan-powered liquidity boosts.

The smart contract design of Yearn optimally and intelligently reallocates assets to the most profitable and lucrative opportunities, thereby saving time and effort in strategy execution.

Advanced yield harvesting finely tuned automated profit generation with respect to flash loans, high liquidity strategies, and advanced DeFi integrations confirms security practices and yield generating optimizations to sustain profit potential for users.

Yearn Finance – Key Features

- Automated Yield Boosting for borrowed assets

- Strategic Vaults that constantly optimize returns

- Seamless DeFi Integrations to expand opportunity sources

9. Beefy Finance

Beefy Finance stands out as a viable option for flash loan strategies since it offers yield optimization that is automated and flash loan compatible on multiple chains.

Beefy Finance does not provide native flash loans, but it’s flash loan compatible auto-compounding vaults assist in maximizing returns on short-term liquidity that’s gained through flash borrowing.

For traders, Beefy Finance allows effortless manual alterations to be skipped when they wish to reconfigure yield stacking, liquidity positions, or liquidity tooling in a variety of chains.

Beefy Finance reduced execution time in strategy automation, which is essential to flash loan loans as they move in cycles. Beefy Finance boosts profitability and flash-loan yield strategy efficiency from the robust smart contract and diverse protocol integrations.

Beefy Finance – Key Features

- Cross-Chain Auto-Compounding for maximized profits

- Multiple Strategy Vaults for flexibility in deployment

- Low Fees & High Efficiency for rapid yield cycles

10. Solend

Solend is a standout DeFi platform for executing flash loan strategies on Solana blockchain. This is primarily due to Solend’s low costs and quick transactions.

Solend is geared to handle rapid arbitrage and liquidation situations. It also deep provides liquidity for the key assets on the Solana blockchain ecosystem.

This allows traders to borrow and return large amounts on the same transaction. Solend’s active risk management and oracle-efficient pricing systems capture most market activity on flash-loan driven activities.

Smart contract systems on Solend as well as the other integrated Solana DeFi systems provide ease and automation to the process. This inherent Solana blockchain feature enhances the operational dependability and economic viability of flash loan strategies.

Solend – Key Features

- Ultra-Low-Cost Transactions on Solana

- Fast Borrow & Repay Cycles required for flash loans

- Real-Time Risk Management to support liquidation strategies

Risk & Considerations

High Technical Complexity – A deep understanding of smart contracts and the relevant market is a must, as one wrong set of automated instructions can lead to a costly error.

Smart Contract Vulnerabilities – Losing money and funds becoming liquid is sudden with bugs and unexplored exploits.

Market Volatility – Expected returns can dwindle or get wiped out completely when prices move in and out quickly during execution.

High Gas/Transaction Fees – Strategies becoming unprofitable because of loss are frustrating, especially when it is due to the network congestion and automated instructions being executed.

Execution Failure Risk – Time and fees get wasted and nothing to show for it when the automated instructions fail to execute any part of the transaction.

Front-Running Attacks (MEV) – Bots are programmed to identify and intercept other automated instructions, taking profits for themselves.

Liquidity Limitations – A not insignificant number of money pools are unable to be sufficiently liquid for large automated loan trades and set the profit.

Regulatory Uncertainty – DeFi regulations are not carved in stone when it comes to control, and the compliance burden is likely to be only passed down.

Protocol Dependency – A strategy is worthless if the one functional part integrated with another fails, especially as most will rely on it as a crutch.

Potential for Illegal Misuse – The reverse is true with attacks using automated loans, and that loophole has only made flash loans even more secure.

Conclusion

Each platform considered the best in crypto DeFi for flash loan strategies has distinct advantages that enable traders to engage in advanced financial activities rapidly, automatically, and efficiently.

Aave V3 and Curve Finance are still in the top tier because of their highly liquid markets and efficient transaction surrounding. Automation and smart yield management to profit maximization are provided by apps like Instadapp, Yearn Finance, and Beefy Finance.

Moreover, blockchain ecosystem specific alternatives like Solend and trade oriented systems like dYdX offer rapid transactional pathways designed for highly accurate and low latency trade execution.

Although risks such as smart contract risk, volatility, and complicated execution tend to draw the attention of users, the reward potential is designed to capture the attention of users.

Using the platforms in advanced and real-time trading of profit within the risk parameters and in the structured DeFi systems is something that the net of traditional finance does not cover.

FAQ

A platform must offer high liquidity, fast smart contract execution, low costs, and seamless protocol integrations to support collateral-free borrowing within a single transaction.

Aave V3 is widely regarded as the best due to its large liquidity pools, strong security, and advanced risk controls specifically designed for flash loan operations.

Yes. Platforms like Instadapp simplify flash loan workflows, letting users execute complex strategies through user-friendly interfaces.

Yes. While they require no collateral, they involve technical risk, smart contract vulnerabilities, market volatility, and potential transaction failures.

No. Protocols like Aave, Curve Finance, and Balancer enable flash loans directly, while others like Compound and MakerDAO support them indirectly through integrations.