In this article, I will discuss the Best Ethereum Staking Platforms focuses on the top services that enable users to earn rewards by staking Ethereum.

These platforms offer users easy, advanced, and secure ways to earn passive income while Ethereum network.

This guide focuses on the Best Ethereum Staking Platforms Staking Ethereum for passive income has become increasingly popular over the years and I will show you the most secure and trusted platforms that guarantee maximum profitability.

What is Ethereum Staking Platforms?

Ethereum staking platforms are online services or protocols that grant access to Ethereum’s proof-of-stake (PoS) network by letting users lock their ETH tokens to validate transactions and secure the blockchain.

Ethereum networks reward users by giving additional ETH, often relative to the amount and duration of staking. These platforms can be as simple as centralized exchanges providing staking services, or as complex as decentralized protocols that allow users total fund control.

Ethereum staking platforms simplify passive income generation for novice and seasoned investors and same time improving network’s security.

Why use Ethereum Staking Platforms

Earn Passive Income: By staking their tokens, users receive ETH rewards, which provides a stable form of passive income.

Support Network Security: Staking confirms transactions which helps secure the Ethereum blockchain and maintains the integrity of the network.

Lower Technical Barriers: Staking on Ethereum is simplified on these platforms for users who do not wish to operate their own validator nodes.

Flexible Options: Numerous platforms provide a variety of lock-up periods and changing reward mechanisms to suit various investment philosophies.

Liquidity Opportunities: Certain platforms offer liquid tokens which allows users to participate in DeFi and earn additional yield, which is advantageous.

Key Point & Best Ethereum Staking Platforms List

| Platform | Key Point |

|---|---|

| Lido | Liquid staking with easy ETH staking and ERC-20 stETH token rewards. |

| Aave | Earn staking rewards while lending or borrowing assets on its DeFi protocol. |

| Curve Finance | Integrates staked ETH into liquidity pools for additional yield. |

| Yearn Finance | Optimizes staked ETH returns via automated yield strategies. |

| Rocket Pool | Decentralized ETH staking with node operators, flexible staking amounts. |

| Frax Finance | Enables staking of Frax-related assets alongside ETH for yield. |

| Pendle Finance | Allows trading of future yield from staked ETH for flexible earnings. |

| EigenLayer | Restaking ETH to secure multiple protocols, enhancing network utility. |

| EtherFi | Non-custodial ETH staking with liquid tokens and DeFi integrations. |

| StakeWise | Split staking rewards and ETH into liquid tokens for more flexibility. |

1. Lido

Lido is regarded as one of the best Ethereum staking platforms due to its unmatched ease of use when staking ETH, without the need to set up a validator node.

The platform’s proprietary liquid staking feature is a game-changer, allowing users to stake ETH and receive stETH tokens, which facilitates participation in various DeFi activities, thus retaining liquidity and earning DeFi rewards.

The professional node operators across Lido’s decentralized network ensures top tier security and reliability, catering to both novice and seasoned investors.

The platform’s low rewards, competitiveness, and seamless integration across several DeFi protocols make Lido one of the frontrunners in staking and passive income monetization.

Lido Features

- Liquid Staking: The staking of ETH and earning stETH tokens simultaneously.

- High Security: Works with decentralized validators to reduce risks.

- Easy To Use: Staking users do not need to operate a validator node to stake.

2. Aave

Aave has become one of the best platforms for staking Ethereum because of its innovative strategy of funneling staking within an extensive DeFi lending framework. Aave’s staking feature is unlike any other platform.

Users can earn ETH rewards while lending or borrowing assets, therefore creating dual earning possibilities.

Aave has a unique safety module which secures the protocol and provides additional incentives to stakers. Stakers earn passive income while gaining protection for the network.

Aave offers a staker friendly Defi infrastructure with a simple interface, effective and flexible risk limits, and staker returns that are free of yield sacrifice. Aave is a leader in Ethereum staking due to the combination of protection, yield optimization and multifunctional utility.

Aave Features

- DeFi Integration: Collateralized borrowing and lending is possible with staked ETH.

- Liquidity Mining: Additional AAVE token rewards are given as liquidity mining incentives.

- Smart Contract Security: All funds are protected with smart contracts that have been properly audited.

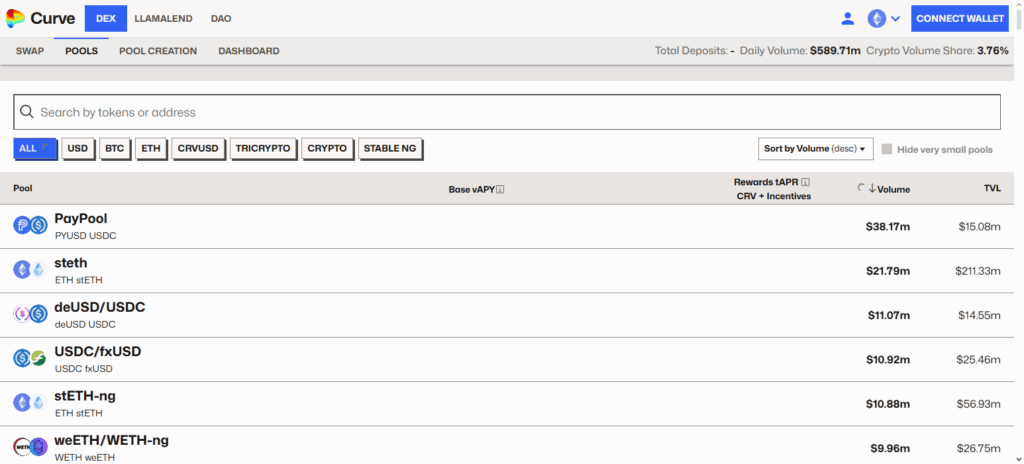

3. Curve Finance

Curve Finance is among the most proficient Ethereum staking platforms due to the ability to stake ETH while also providing liquidity to earn optimal rewards.

Its unique ability to place staked ETH in tailored liquidity pools reduces slippage while maximizing yield for the slippage participants. Users earn staking rewards and generate passive income through Curve’s stablecoin-centric pools.

The low fee, high capital efficient, and deep liquidity features on the platform serve the needs of retail and institutional investors. The innovative Blend of Liquidity and staking Incentives strategy further cements Curve Finance’s reputation as the most ETH holder friendly platform.

Curve Finance Features

- Stablecoin Staking: Staking Token stETH, and other tokens in liquidity pools.

- Yield Farming: Users receive fees from liquidity provision as well as from other incentives of the protocol.

- Low Slippage Trading: Designed to exchange stablecoins and staked ETH derivatives.

4. Yearn Finance

One of the best Ethereum staking platform is Yearn Finance and this is because of its automated yield optimizing system which gives users the ability to not keep checking their staked ETH.

The platform’s distinctive characteristic is the intelligent vault strategies which uses automation to shift staked assets across DeFi protocols to secure rewards.

Since users of all experience levels can make money without using DeFi services themselves, the system automation reduces risk and saves time.

Moreover, the Yearn Finance platform’s ability to integrate with multiple DeFi platforms and the diverse yield sources provide stakers the added advantage of liquidity.

The platform’s effectiveness and strategic integration with DeFi services has made it automation finance stand out from the rest of the Ethereum staking platforms.

Yearn Finance Features

- Yield Optimization: ETH in staked positions is automatically moved to the highest yield vaults.

- Gas Optimization: Users have their fees reduced due to less complex transactions.

- DeFi Aggregation: Combines staking from different protocols for users to maximize returns.

5. Rocket Pool

Rocket Pool stands out as one of the best Ethereum staking platforms because of its decentralized and trustless staking solution as it prioritizes the security and digital flexibility needed by its users.

Another unique feature of Rocket Pool is its ability to accept as low as 0.01 ETH, a stark contrast to traditional staking which requests 32 ETH to become a validator node.

Staked ETH is distributed to a wide range of professional node operators which guarantees both decentralization and reliability.

Users receive rETH tokens which is a representation of their staked assets. rETH can be deployed in other DeFi ventures to gain further yield. With its unmatched accessibility, decentralization, and liquidity Rocket Pool stands out as one of the best options to stake Ethereum.

Rocket Pool Features

- Decentralized Staking: ETH can be staked by users with a decentralized network of node operators.

- rETH Token: Stakers get rETH which is their staked ETH with the rewards.

- Low Entry Barrier: Stake with as low as 0.01 ETH.

6. Frax Finance

Frax Finance integrates Ethereum staking with a unique stablecoin and DeFi earning model for flexible crypto earning opportunities.

Frax Finance differentiates itself by enabling stakers to earn ETH rewards, disentangled with the additional yield opportunities from Frax’s fractional-algorithmic stablecoin ecosystem.

The unique integration has the potential for both stability and growth, along with diversified returns, which makes the whole Ethereum blockchain ecosystem more attractive to investors.

Frax Finance has low fees and transparent operations, which guarantees protocol security and a safe staking environment.

This seamless combination of staking with dynamic DeFi poises Frax Finance users to enjoy crypto ETH rewards while reserving liquidity and strategic leeway.

Frax Finance Features

- Flexible Staking: Staking is unlocked using tokenized derivatives.

- Maximizing Rewards: Algorithmically strategized yield bonus rewards.

- Liquidity Farming Pools: Staked collateral assets can be farmed.

7. Pendle Finance

Pendle Finance has one of the best Ethereum staking platforms out there today because it tackles one of the most complex issues in Ethereum staking by allowing the trading and management of future yield on staked ETH .

Unable to unstake ETH but can trade the staking position Hedging ore yield trading position on simplified using fractalized Pendle Finance tokenized staking rewards system.

Pendle Finance unique innovation gives users unprecedented yield farming flexibilities on Ethereum. Pendle Finance is compatible with other DeFi protocols enabling users to obtain extra liquidity and yield opportunities on Ethereum.

Pendle Finance’s synthesis of yield farming with staked ETH tokens and Pendle Finance yield tokens proves that staked ETH is Pendle Finance adds unrivaled yield and risk usage. Pendle Finance is one of the best Ethereum staking platforms.

Pendle Finance Features

- Staked ETH Tradeable Futures: Users can trade staked ETH’s future yield.

- Yield Management: Strategies such as selling or yield locking are available.

- Advanced Financial Products: DeFi merges with staked yield with Pendle’s innovative offerings.

8. EigenLayer

Eigenlayer is one of the best Ethereum staking platforms due to the innovative idea of “restaking”.

This new idea gives users the ability to use ETH restaked to secure multiple protocols at the same time. Because they do not need to add more collateral, restakers can earn more rewards from other platforms.

This is the full potential of their assets. By restaking, it adds even more value to Ethereum because it helps secure new sDecentralized networks with even more earning potential.

Eigenlayer is focused on risk transparency, risk management, and protocol flexibility, making it suitable for all investors from conservative to expert.

Its multi-layered staking model, gives Eigenlayer a cutting-edge advantage over other Ethereum staking platforms.

EigenLayer Features

- ETH Restaking: ETH stakers can restake and secure more protocols.

- Staking ETH Incentives: Additional rewards earned for securing protocols beyond ETH staking.

- Multi-layered: Ethereum’s ecosystem is secured while the yield is compounded.

9. EtherFi

Etherfi is considered a pioneer in Ethereum staking for its non-custodial staking experience. Users retain full control of their ETH while earning staking rewards.

Its main differentiator is its incorporation of liquid staking into foundational DeFi. EtherFi users can maintain their yield-earning staked ETH on other protocols.

EtherFi offers safety through a broad decentralized validator network. EtherFi also emphasizes their safety record through public smart contracts.

Having relatively low staking thresholds and competitive returns also improves EtherFi’s market reach. With the combination of liquidity and safety from DeFi, Etherfi is a premier Ethereum staking service.

EtherFi Features

- Staking ETH: Users have full control of their staked ETH.

- Liquid Staked ETH: Staked ETH is represented by derivatives that can be traded.

- where most users are: EtherFi offers improved security for mass staking.

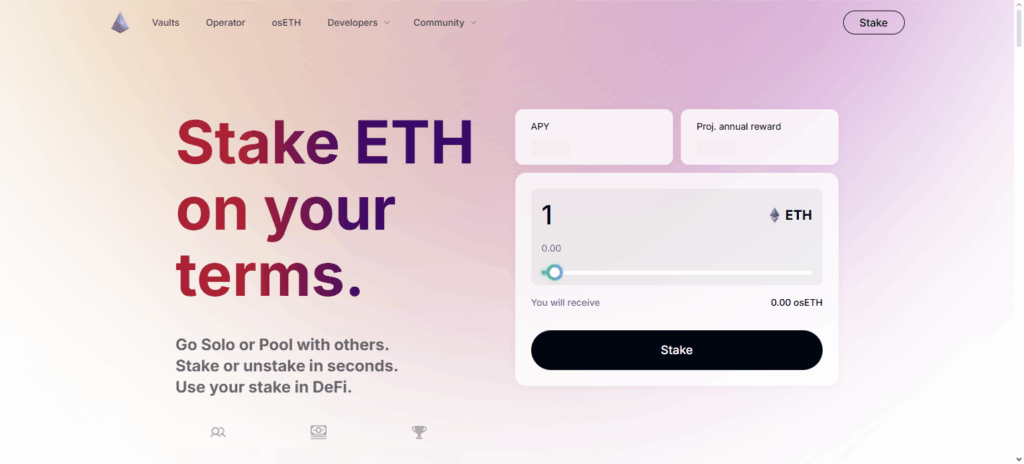

10. StakeWise

StakeWise is one of the best staking platforms for Ethereum because of its unique flexible and efficient staking experience with a unique reward-splitting system.

StakeWise is unlike the traditional platforms that offer staked Ethereum and earned rewards in separate and distinct tokens that users can reinvest, trade or manage, thus optimizing the liquidity and control staked outcomes.

StakeWise uses decentralized validator networks for security and reliability, which also results in low fees and transparent operations.

StakeWise is best for investors looking for reward flexibility, liquidity, and strong network security, because it allows them to optimize their ETH staking strategy. This makes it one of the very best platforms in the industry.

StakeWise Features

- Higher Yield Staking: Staking rewards are reinvested automatically.

- Split Rewards & Principal Tokens: sETH2 and rETH2 are better flexible rewards for principal and restaked tokens.

- Transparent Dashboard: Visualizes staking performance & rewards seamlessly.

How Does Ethereum Staking Work?

Locking ETH – Users wishing to take part in Ethereum’s Proof-of-Stake (PoS) network have to first deposit ETH to a staking platform or validator node.

Validator Selection – All validators are selected randomly from stakers on the network to propose and confirm new blocks.

Earning Rewards – Validators are rewarded in ETH relative to the amount staked and the duration of staking.

Security Contribution – Staked ETH are used to help defend the Ethereum blockchain by confirming transactions and stopping malicious network behavior.

Penalties for Misbehavior – Validators have the incentive to correctly participate in the network by offline losing a portion of staked ETH for dishonest behavior.

Withdrawal Flexibility – Users on many platforms have the option of unstaking ETH, or utilizing liquid staking for liquidity in DeFi systems.

Conclusion

In summary, the leading ETH staking platforms strike a balance between security, flexibility, and reasonable returns while facilitating passive revenue for users, and supporting the network.

Lido, Aave, Rocket Pool, and StakeWise excel on the Ethereum network due to their unique attributes, ranging from liquid staking and DeFi integration to reward-splitting.

As a novice who wants to start easy, or an advanced investor optimizing your yield, you can rely on these platforms for ETH staking. Finding a good platform means you’ll have safety and the most ETH earning potential as the Ethereum network develops.

FAQ

Rewards vary by platform, the amount staked, and network conditions, typically ranging from 4% to 8% APY.

Yes, but safety depends on the platform. Reputable platforms use decentralized validators and smart contract audits to minimize risks.

Liquid staking tokens (e.g., stETH, rETH) represent your staked ETH and can be used in DeFi while still earning staking rewards.

Not always. Platforms like Lido, Rocket Pool, and StakeWise allow staking with smaller amounts through pooled or liquid staking solutions.

An Ethereum staking platform allows users to lock their ETH to help validate transactions on the Ethereum network and earn rewards in return.