In this article, I will discuss the Best Money Exchange Companies and their highlight features, rates, as well as how friendly they are to customers.

If you are sending money overseas or simply exchanging currency, whichever the case may be, the provider selected must be convenient, fast, and economical.

I will analyze the best companies that enable easier and cheaper international transactions for the people all over the world.

Key Point & Best Money Exchange Companies List

| Service | Key Point |

|---|---|

| Wise | Offers mid-market exchange rates with low, transparent fees. |

| MoneyGram | Provides widespread cash pickup locations in over 200 countries. |

| Paysend | Fixed low fee with card-to-card transfers to over 100 countries. |

| Ria Money Transfer | Competitive rates and large global network with many cash pickup options. |

| Western Union | Extensive global reach with options for bank, mobile, and cash transfers. |

| Remitly | Fast transfers with express and economy options, especially for remittances. |

| Xe | Strong in currency exchange and international bank transfers. |

| Revolut | App-based service offering transfers at interbank rates with extra features. |

| Instarem | Low-cost transfers with rewards and business-friendly solutions. |

| WorldRemit | Mobile-friendly platform with quick transfers and multiple payout methods. |

1.Wise

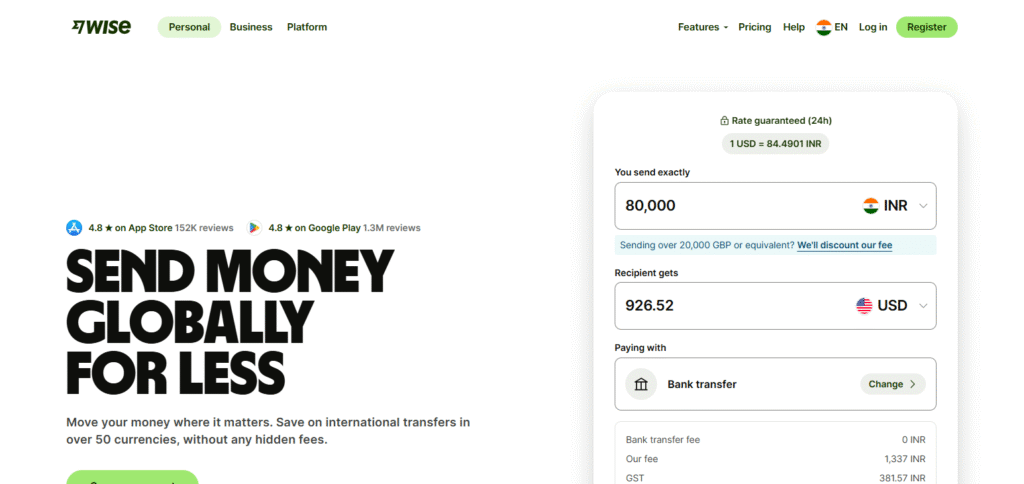

Wise is one of the best money exchange services these days, owing to their policies of fairness and transparency. Unlike conventional services, Wise employs the real mid-market exchange rate without any concealed fees, ensuring that customers receive optimum value for their finances.

Its differentiating factor is in its website which is purely online and assists customers instantly while offering low costs and instantaneous visibility of the rates. Wise is best for people and corporations who require simple and inexpensive solutions for international transfers free of complex fee structures.

Wise Features

- Mid-Market Exchange Rates: Wise does not add any margins on the real mid exchange rates, and ensures you make the most value out of your money.

- Low, Transparent Fees: Wise, unlike other services, charges low fees in advance for services rendered, meaning you know precisely what the cost will be.

- Global Reach: Wise supports over 80 countries which ensures fast and safe transfers to a lot of other countries.

2.MoneyGram

MoneyGram is one of the most prominent money exchange companies in the world because of its reach and ease of use. Grams of money which can be exchanged in excess of two hundred countries are able to be sent or received via its many kiosks at various birth destinations, without the need for a bank account.

However, its greatest advantage is in the strong cash pickup network which many remote or underserved areas rely on. This along with the ability to transact face to face makes it popular across the globe.

MoneyGram Features

- Wide Network of Locations: MoneyGram has a huge network with over 400,000 agent locations, so you can always send or receive money physically.

- Multiple Payout Options: Customers can choose to receive the funds via cash, bank, or mobile wallet which gives flexibility to receivers.

- Quick Transfers: Transfers are done very quickly, with some of them being done in a couple of minutes.

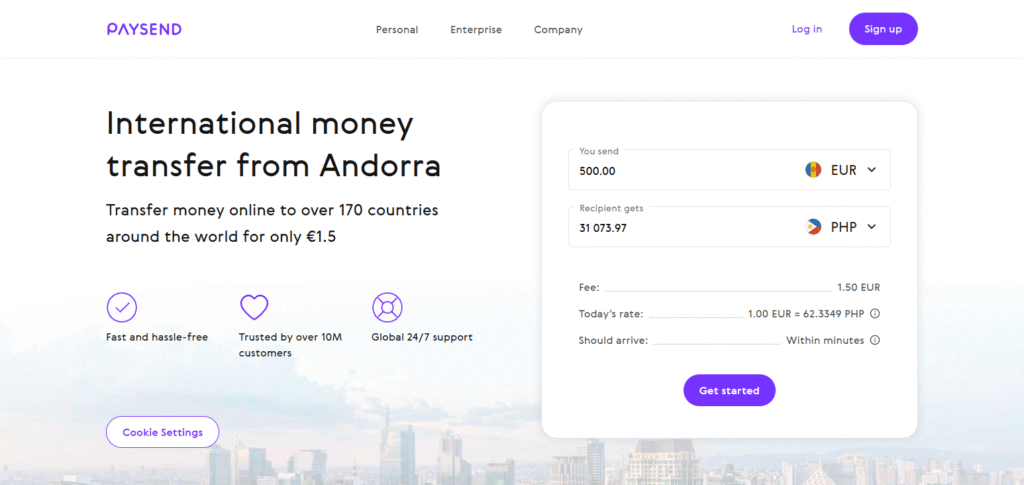

3.Paysend

Paysend is one of the most favored money exchange services due to its unique card-to-card transfer system. Users can send funds directly to the recipient’s card in more than 100 countries, often within a matter of minutes.

Its distinctive advantage is being a flat fee service devoid of exchange rate mark ups, meaning the pricetag will always be low and consistent. The straightforward nature of Paysend, especially in avoiding traditional banking systems, makes it a swift solution for global transfers.

Paysend Features

- Fixed Low Fees: Paysend has no hidden payments and gives a fixed low cost which financially helps a lot of people.

- Card to Card Transfers: Funds can be moved directly from one bank card to another in over a hundred countries which is really convenient.

- Instant Transfers: Most transfers are completed in a few minutes which ensures instant access to funds.

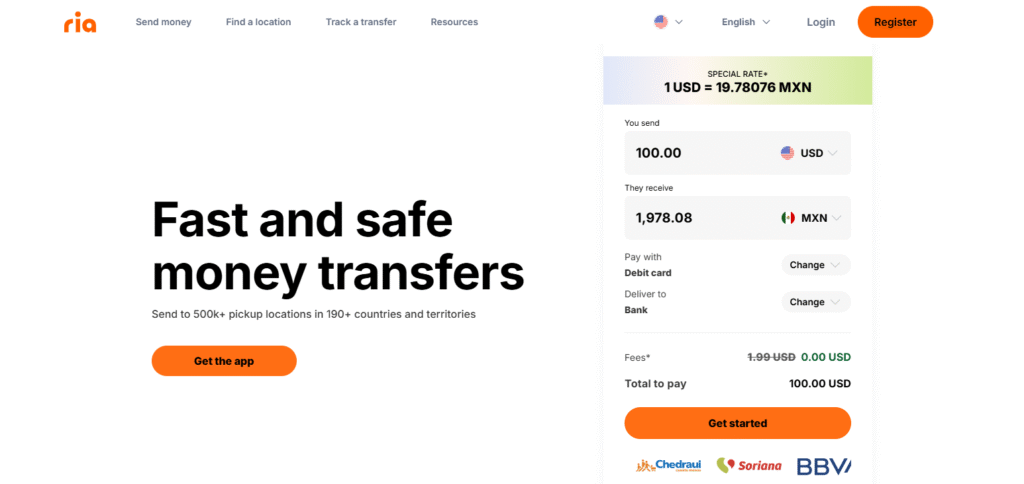

4.Ria Money Transfer

Ria Money Transfer has developed a strong global infrastructure which has led them to become one of the best customer-focused services.

They also take the lead due to the mobile deposits and cash pick-up, along with other forms of payment. Ria is able to deliver fast and secure transfers to remote areas through local partnerships which is why they lead the competition.

Ria is known for the ease and reliability customers can access while sending money across borders with their competitive rates, especially when they expand Ria’s growing digital platform.

Ria Money Transfer Features

- Global Reach: Ria works in more than 160 countries and they have more than 450,000 agents (locations).

- Low-Cost Payment Transfers: Provides low-cost international payment transfers with reasonable exchange rates, as well as low fees.

- Reliable Payment Methods: Provide multiple payment options that include cash pickup, bank transfer, and money delivered to the recipient’s home.

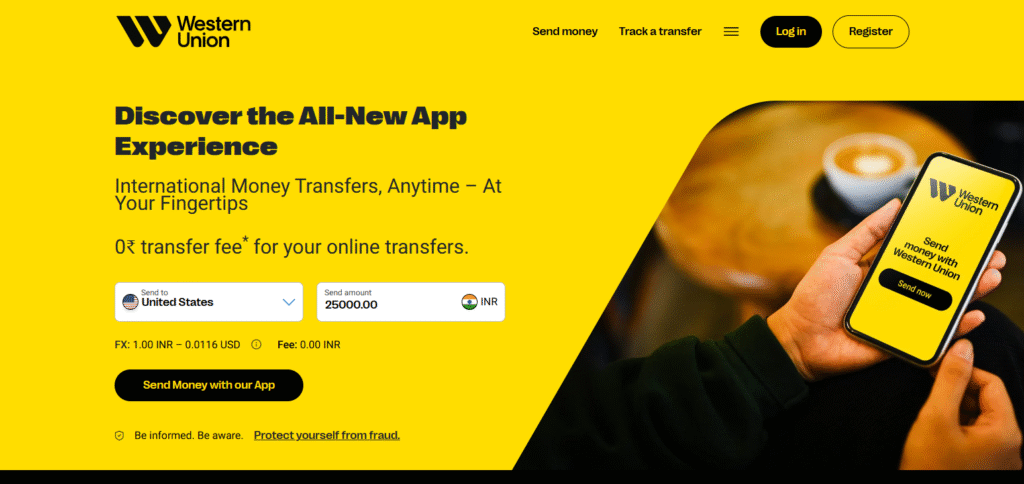

5.Western Union

Western Union is considered one of the leading international money transfer services due to its exceptional worldwide coverage and flexibility.

It functions in over 200 countries and territories, providing numerous transfer options such as cash pickup, bank deposits, and mobile wallet transfers. What differentiates Western Union is how effectively it caters to both modern users and individuals without bank accounts via its comprehensive agent network.

This blend of analog presence and digital advancement guarantees swift, dependable transfers for a broad spectrum of clients.

Western Union Features

- Extensive Global Network: It is available in over 200 countries and territories; Western Union is one of the most accessible services across the globe.

- Multiple Transfer Methods: Remitly offers services ranging from cash pickup, mobile wallet transfers, and bank transactions.

- Fast Transfers: Some transfers can be accessed within a few minutes, hence enabling many users to receive their money almost instantly.

6.Remitly

Remitly is one of the best companies in the world of money exchange due to their focus on speed and flexibility for workers and families living abroad.

There are two delivery options: Express with immediate transfers and Economy which is suited for budget transfers. Users can now manage their timing as well as expenditure. What sets Remitly apart is how it supports local customers in a given country, including using their languages and enabling certain functionalities specific to the country.

This level of care has made it a go-to, reliable, and effective provider for overseas transactions.

Remitly Features

- Dual Delivery Options: They include Express with Instant Payment Transfer and Economy which are cost-efficient transactions.

- Mobile-Friendly: Users can send money from wherever they are using different mobile devices and the app-based platform is easy to navigate.

- Localized Service: Offers features of the country that customers are interacting with including the corresponding language for every customer.

7.Xe

Xe is regarded as one of the best money exchange companies because of their outstanding knowledge on currencies and their exemplary collection of exchange rate data. They provide international money transfer services at very low rates and absolutely no secret charges.

What makes Xe differ from the rest is the fact that it combines a reliable currency conversion system with secure international money transfers which enables users to track rates, and transfer funds all on one platform. The combination of such information with services provides users with the confidence and control over their overseas transactions.

Xe Features

- Real-Time Exchange Rates: With Xe, you can always be sure that the rates claimed are true for the transfers made as they provide active check/monitoring rates.

- No Hidden Fees: Xe always provides reasonable pricing and no other charges are added for transfers made.

- Global Coverage: Supports transfers from countries above 130, as well provides numerous payment and receipt methods.

8.Revolut

Revolut is one of the best money exchange companies because its app integrates banking, budgeting, and international transfers. For most users, it provides currency exchange at interbank rates with no markup, maximizing its value.

What differentiates Revolut is the multi currency account feature which enables users to hold, convert and spend in several currencies instantly. All these factors, together with immediat full alerts and security options, make Revolut an agile solution for managing money from all around the globe.

Revolut Features

- Revolut Accounts: Users can hold, convert and spend currencies instantly in a single platform.

- Cost Savings: Provides transfers at interbank rates with no markup for most users, reducing costs.

- Comprehensive Mobile App: Provides a mobile app for transfers, budgeting, and managing finances.

9.Instarem

Instarem is regarded as one of the best money exchange companies because it values fast transfer and pricing transparency. With minimal costs, it provides exchange rates that are updated in real time, enabling users to make cheaper international payments.

The reward model sets Instarem apart from its competitors—clients are given points for every transaction which can be used to get discounts. The customer focus combined with an extensive transfer network and business-oriented functionalities makes Instarem ideal for individuals and corporations dealing with cross-border payments.

Instarem Features

- Affordable Global Transfers: Provides competitive exchange rates and low fees for global transfers.

- Rewards Program: Users earn loyalty points on every transaction which can be redeemed for discounts.

- Transparency and Efficiency: Focus on fast and secure processes with transparency throughout.

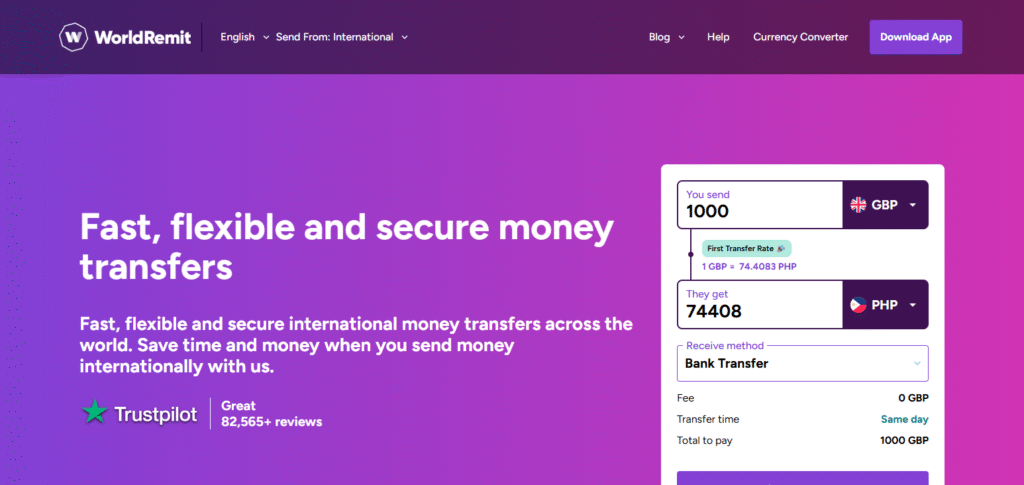

10.WorldRemit

WorldRemit is one of the best money exchange companies because of its easy-to-use interface and secure, rapid transfers to over 130 countries. It provides numerous payout methods like bank deposit, mobile money accounts, and cash collection places to meet a variety of customers’ preferences.

Its distinction lies in the mobile-centric approach, allowing users to send money through WorldRemit on-the-go from their smartphones. Such ease, immediacy, and widespread availability make WorldRemit popular for international remittances.

WorldRemit Features

- Multiple Payouts: Supports bank transfers, mobile payments, airtime topups, and cash pickups.

- Mobile First: Optimized to allow users to send money through their smartphones with ease.

- Cost Effective Transfers: Affordable exchange rates and low fees for international transfers.

Conclusion

To sum up what has been said, leading currency exchange companies utilize a combination of speed, reliability, and low-cost prices to satisfy the varying needs of clients.

Be it Wise with their clear fee policies, or MoneyGram with their international services, or even Revolut with their app-based services – all companies have distinguishing traits that set them apart from their competitors.

These companies, with a focus on the convenience of the customers, competitive rate and numerous transfer options promote confidence when transferring money internationally, thus securing their position as frontrunners in the industry.