In this article i will discuss the Best Places to Stake Solana. Earning passive rewards while backing network security is a win-win.

Finding the right platform matters, because the wrong choice can cost you both profits and peace of mind. Stick around for our lineup of tried-and-true options that fit newbies and veteran stokers alike.

Key Point & Best Places to Stake Solana List

| Platform | Key Point |

|---|---|

| Kraken | Trusted exchange with strong security and advanced tools. |

| Coinbase Earn | Learn crypto while earning tokens through educational tasks. |

| Solflare | User-friendly Solana wallet with staking and DeFi support. |

| Binance | Largest crypto exchange with diverse trading and services. |

| Marinade Finance | Liquid staking protocol on Solana for flexible staking. |

| Lido Finance | Leading liquid staking solution for ETH and others. |

| Jito Labs | Solana validator offering MEV optimization and staking. |

| Everstake | Reliable staking service supporting multiple blockchains. |

| Figment | Enterprise-grade staking infrastructure and blockchain APIs. |

1.Kraken

Kraken has carved out a solid spot for itself among folks who want to stake Solana. The exchange is known for its strong security, clear interface, and rewards that stack up pretty nicely compared to other platforms.

You can stake Sol directly from your Kraken wallet, so there’s no need to shuffle coins around, which saves time and hassle. Most users report that the fees stay low and the validators run smoothly, letting them lock up their tokens without constant worry.

Payouts are easy to track, and support teams usually respond quickly whether your a rookie or a veteran trader. Altogether, that combination of trust, transparency, and tech keeps people coming back to Kraken when they want to earn yield on Solana.

| Platform | Kraken |

|---|---|

| KYC Requirement | Minimal KYC verification needed to start staking |

| Security | High-level security with strong regulatory compliance |

| Staking Rewards | Competitive Solana staking rewards with regular payouts |

| Ease of Use | User-friendly interface for seamless staking experience |

| Accessibility | Supports global users with multiple fiat on-ramps |

| Withdrawal | Flexible unstaking options with clear timelines |

| Additional Features | Integrated exchange platform for easy SOL trading |

2.Coinbase Earn

Coinbase Earn has become a fan-favorite spot for staking Solana, and folks keep mentioning its user-friendly vibe. You can stake your SOL right inside the app and pick up some small lessons on the side-no extra tabs or wallets needed.

Many beginners say that watching a three-minute video and then seeing rewards hit their balance almost feels like free play money. Because the interface is clean and Coinbase is already a trusted name, even first-timers find confidence in letting their coins rest while they learn.

| Platform | Coinbase Earn |

|---|---|

| KYC Requirement | Basic KYC verification required for account setup |

| Security | Industry-leading security and regulatory compliance |

| Staking Rewards | Competitive rewards with automatic distribution |

| Ease of Use | Simple, beginner-friendly interface integrated with Coinbase Earn |

| Accessibility | Available in many countries with fiat on-ramp support |

| Withdrawal | Flexible unstaking with clear timelines |

| Additional Features | Educational rewards program allowing users to earn tokens while learning |

3.Solflare

Solflare isnt just another wallet; it was built from the ground up for people who love Solana. Because the app is non-custodial, your private keys never leave your hands, and that alone gives peace of mind.

Staking takes just a couple of clicks in the clean dashboard, so beginners and pros can earn rewards quickly. You can use Solflare on desktop or grab the mobile app, meaning you can check your earnings whether your at home or on the bus.

Under the hood, the wallet talks directly to Solana validators and packs strong security layers, so your tokens ride with confidence. That combination of control, speed, and flexibility has turned Solflare into a fan-favorite spot for Solana staking.

| Feature | Details |

|---|---|

| Platform Name | Solflare |

| Type | Solana Wallet with Staking Support |

| KYC Requirement | Minimal KYC (usually email verification) |

| Staking Minimum | Low minimum amount to start staking |

| Rewards | Competitive Solana staking rewards |

| User Interface | User-friendly, intuitive for beginners |

| Security | Non-custodial wallet with strong encryption |

| Accessibility | Web, iOS, Android apps available |

| Additional Features | Supports Solana NFT management and swaps |

| Delegation Options | Allows easy delegation to trusted validators |

| Withdrawal Flexibility | Flexible unstaking period, no lockups |

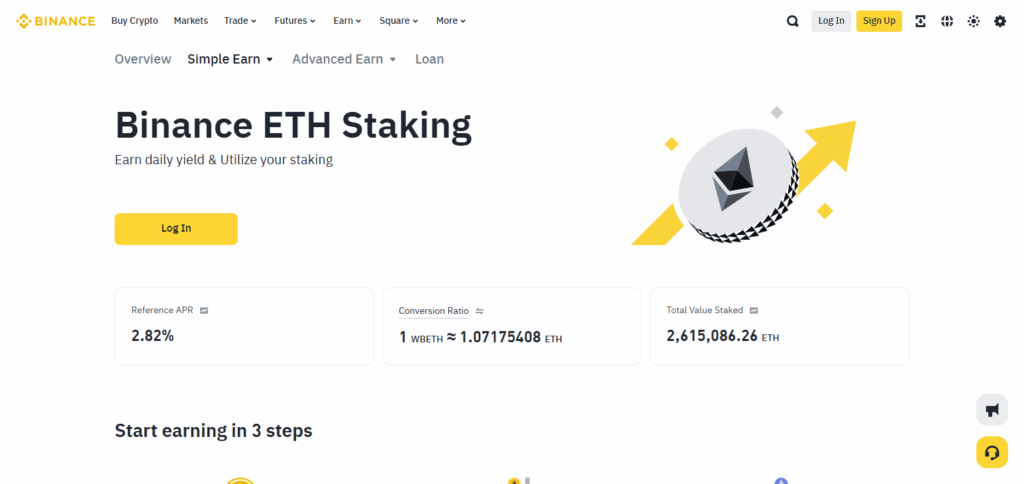

4.Binance

Binance has stood out as one of the top platforms for staking Solana. Its huge liquidity means you wont run out of people to trade with, and the payoffs you see on the coins you lock up sit at the head of the pack.

Staking inside the Binance dashboard feels almost point-and-click-simple. Traders can choose to set their coins aside for as long as they want-or pull them back whenever life demands cash.

Backing all of this is a security system so thick it has kept headlines calm for years. Add its global reach and regular, attention-grabbing promos, and even folks who are brand-new to crypto find a friendly entry point.

| Feature | Details |

|---|---|

| Platform Name | Binance |

| Type | Cryptocurrency Exchange with Staking Service |

| KYC Requirement | Minimal KYC for basic staking features |

| Staking Minimum | Low minimum Solana amount |

| Rewards | Competitive APY on Solana staking |

| User Interface | Easy-to-use platform with mobile and web apps |

| Security | High-level security with SAFU fund protection |

| Accessibility | Global access with multiple language support |

| Additional Features | Flexible and locked staking options available |

| Delegation Options | Stake directly on Binance validators |

| Withdrawal Flexibility | Flexible unstaking periods, depending on option |

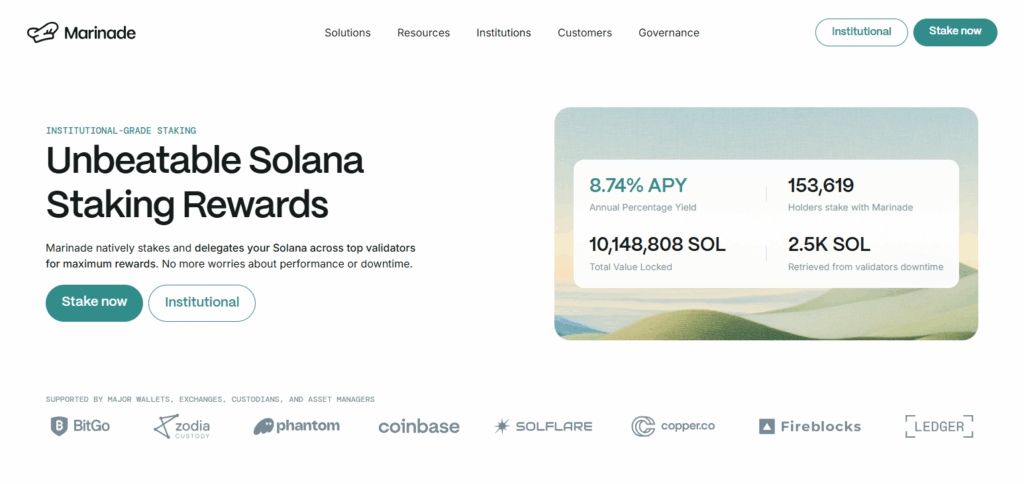

5.Marinade Finance

Marinade Finance bills itself as the go-to place for liquid Solana staking, and many users agree. You send SOL to the protocol, get back mSOL tokens, and the mSOL keeps growing as the network pays rewards.

Thanks to that setup, your coins never really sit still, so you can jump into other DeFi projects on Solana without waiting weeks for a lock-up to end. Security matters, too; Marinade works with more than 400 independent validators picked by a fair, open-source formula, spreading risk across the network rather than parking it in one spot.

Plenty of other DeFi apps accept mSOL, letting you stack yields on top of the staking gains. An easy-to-navigate dashboard and a community that votes on big changes both help explain why Marinade keeps appearing at the top of SOL-staking lists.

| Feature | Details |

|---|---|

| KYC Requirement | Minimal; typically requires only wallet connection and email verification |

| Staking Minimum | No minimum; users can stake any amount of SOL |

| Rewards (APY) | Approximately 7.56% for native staking; 7.01% for liquid staking with mSOL |

| Liquidity | High; mSOL tokens can be used across Solana DeFi platforms for additional yield |

| Security | Non-custodial; users retain full control over their assets; no smart contract risk |

| Delegation | Automated delegation to over 450 validators through an auction marketplace |

| Unstaking Options | Instant unstaking with a small fee or delayed unstaking without fees |

| Governance | Community-driven via the MNDE token; users can participate in protocol decisions |

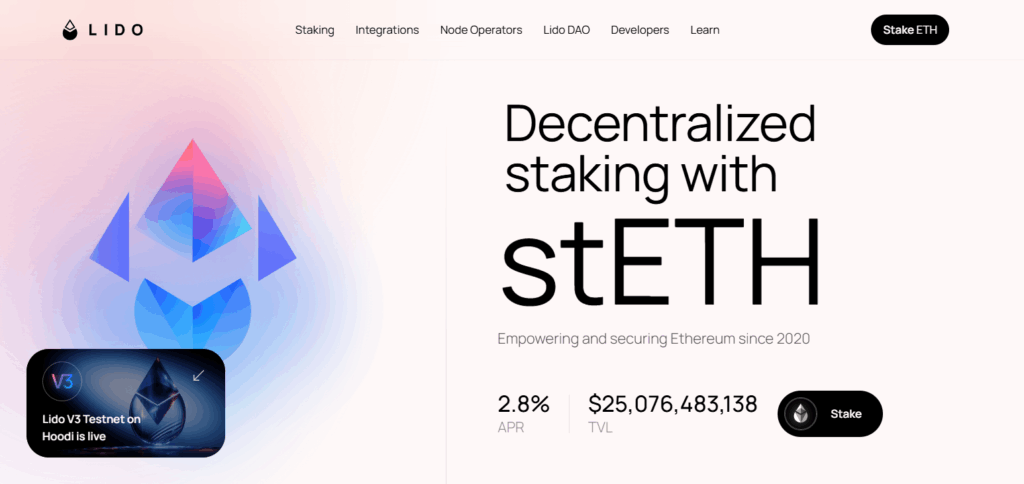

6.Lido Finance

Lido Finance used to sit at the top of the Solana (SOL) staking game. It handed users stSOL tokens on the spot, so people could pocket rewards without locking their coins in a vault.

Those stSOL tokens found a home all over Solanas DeFi scene, boosting liquidity and letting folks chase extra yields wherever they liked. Because Lido spread the work across many validators, the move also helped keep the network decentralized and healthy.

Fast-forward to February 2024, and the party ended after the community voted to pull the plug; new stakes and unstakes disappeared overnight. Even though the service shut down, the idea of liquid staking it championed still echoes through the Solana ecosystem.

| Platform | Lido Finance |

|---|---|

| KYC Requirement | Minimal — basic verification, often email and wallet connection only |

| Staking Type | Liquid staking — receive stSOL tokens representing staked Solana |

| Minimum Stake | No fixed minimum; flexible staking amount |

| Rewards Rate | Competitive APY, varies with network conditions |

| Unstaking | Instant liquidity via stSOL tokens, can trade or use DeFi options |

| Security | Decentralized validator set, audited smart contracts |

| User Experience | Simple interface, easy wallet integration (Phantom, Solflare, etc.) |

| Additional Benefits | Enables DeFi participation without locking SOL |

7.Jito Labs

If youre staking Solana, Jito Labs is hard to ignore. The operation bundles blazing-fast performance with clever MEV-Miner Extractable Value-housekeeping so abuse-happy bots get shut out.

That one-two punch helps ordinary members snag bigger, fairer yields than what you’re likely to see from a run-of-the-mill validator.

Because the crew breaks down fees, tally times, and network tweaks in plain sight, most users end up trusting it more than other options. Minimal upfront fuss, a clear dashboard, and a feeling that shared security still pays. But, as always, dig into the numbers for your own peace of mind.

| Platform | Jito Labs |

|---|---|

| KYC Requirement | Minimal — typically wallet connection without full identity checks |

| Staking Type | Validator staking with focus on MEV (Maximal Extractable Value) |

| Minimum Stake | No fixed minimum; flexible amounts accepted |

| Rewards Rate | Higher than average due to MEV optimization |

| Unstaking | Standard Solana unstaking period applies (approx. 2 days) |

| Security | Runs own high-performance validators, transparent and audited |

| User Experience | Easy wallet integration; supports direct staking via Solana wallets |

| Additional Benefits | MEV-based rewards increase yield potential without extra risk |

8.Everstake

If youre thinking about staking Solana, Everstake often tops the list. It combines solid tech with features regular people can actually use.

The company claims it serves more than 735,000 customers across 70-plus blockchains, and its validator nodes are spread all over the planet to keep everything running.

High uptime matters when your coins are on the line. Everstake sticks with a non-custodial setup, so you stay in control while the rewards pile up.

Liquid staking tokens, jitoSOL for instance, let you restake without locking your balance away. A clean dashboard and 24/7 support round out an experience most Solana holders find smooth and dependable. Sources dot the bottom of most posts, and this one is no exception.

| Feature | Details |

|---|---|

| Platform Name | Everstake |

| Supported Crypto | Solana (SOL) |

| KYC Requirement | Minimal KYC – Basic identity verification |

| Staking Rewards | Competitive annual percentage yield (APY) |

| Minimum Stake Amount | Low minimum amount to start staking |

| User Interface | Easy-to-use, intuitive staking dashboard |

| Security | High-level security with cold storage and multi-sig wallets |

| Delegation Options | Flexible delegation to multiple validators |

| Additional Services | 24/7 customer support, real-time staking analytics |

| Withdrawal | Quick and flexible unstaking process |

9.Figment

Figment is one of the most user-friendly places on the web for Solana (SOL) staking, and it packs a couple of surprises you usually dont see in one spot. The company hooks up to Jito Labs MEV-boosted validator client. Because of that extra tech, customer rewards in late 2024 beat the networks own average by more than 27 percent.

Security is part of the pitch, too, with SOC 2 Type 2 and ISO 27001 badges hanging on the wall so big-money folks can sleep easy. From a regular users point of view, the dashboard talks straight, and you can stake through wallets like Phantom and Trust Wallet without juggling a ton of menus. Individual savers and hedge-fund teams alike seem to find a home here.

| Feature | Details |

|---|---|

| Platform Name | Figment |

| Supported Crypto | Solana (SOL) |

| KYC Requirement | Minimal KYC – Basic verification process |

| Staking Rewards | Competitive APY with reliable payouts |

| Minimum Stake Amount | Low minimum staking threshold |

| User Interface | User-friendly dashboard with detailed staking stats |

| Security | Robust security protocols including cold storage |

| Delegation Options | Supports delegation to trusted validators |

| Additional Services | Educational resources and 24/7 customer support |

| Withdrawal | Flexible unstaking with standard Solana lockup period |

Conclusion

When it comes time to lock up your Solana tokens, safety, speed, and simple design should sit at the top of your checklist. That winning mix appears in places such as Jito Labs, Everstake, and Figment-each service brings its own party trick and flair.

Jito works in-house MEV protection, Everstake boosts customer visibility with cross-chain dashboards, and Figment leans on enterprise-grade pipes ten groups already trust. Whichever spot you pick, sticking to a validator with proven uptime and serious yield keeps your coins growing while the chains network stays spread-out and hard to knock down.