In this article, I will discuss the Binance Earn vs Staking comparison so that you know how each method works for earning passive income with crypto.

This guide will be helpful for any investor since knowing the differences between these two options can help make the right decision based on your risk appetite, objectives, and understanding of the subject matter.

Overview

In the realm of cryptocurrency, generating passive income has gained significant traction. Two popular ways of earning are Binance Earn and Staking. Users can earn rewards from their crypto holdings with both methods, however, they differ in approach and are tailored to distinct investor objectives.

This article highlights the main differences between Binance Earn and traditional staking to aid your decision on which method would be more beneficial for you.

Binance Earn vs Staking

What is Binance Earn?

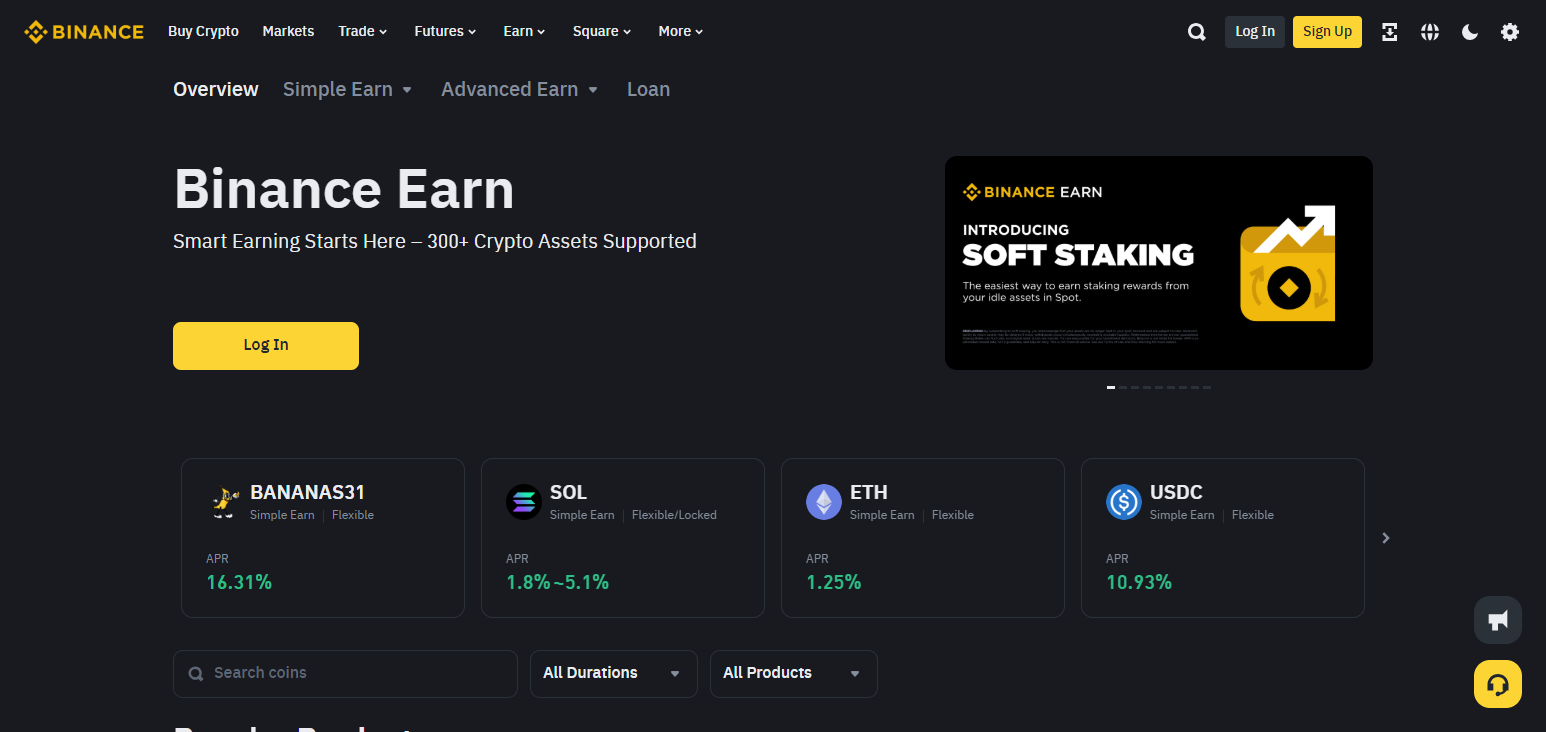

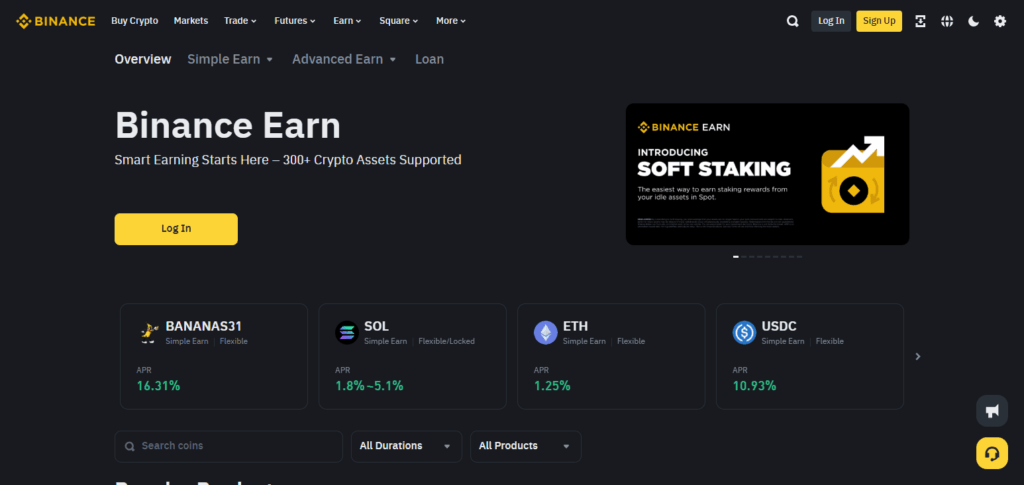

Binance Earn is a set of features offered on the Binance exchange which allows users to earn passively on their idle cryptocurrencies. Binance Earn further offers a variety of investment options like Flexible and Locked Savings, Launchpool, Auto-Invest, and Dual Investment, catering to varying levels of risk appetite and investment objectives.

Participants are able to earn rewards via interest, staking, or farming depending on the selected product. Binance Earn simplifies the process of growing assets for crypto enthusiasts with little to no technical background and seeks to balance short- and long-term investment needs. It offers simple yet effective options with both lower and higher yields.

What is Staking?

Staking refers to the process of locking-up cryptocurrency in the blockchain network to aid in validating transactions for the Proof of Stake (PoS) systems or any similar systems. Participants who partake in the rewards are referred to as stakers and validators.

Staking, therefore, earns rewards in the form of extra tokens. Staking aids in the maintenance of the network’s operations and grants voting or governance rights. It usually requires a commitment of tokens for a certain timeframe which makes them inaccessible.

Staking can be done directly on-chain (non-custodial) or through centralized platforms like exchanges. Investments that raise Passive income while aiding in the decentralization of blockchains are ideal for long term holders.

Key Differences Between Binance Earn and Staking

| Feature | Binance Earn | Staking |

|---|---|---|

| Platform Type | Centralized (Binance) | Decentralized or Centralized |

| Product Diversity | Multiple earning options (savings, dual, launchpool) | Only Proof-of-Stake token-based |

| Accessibility | Beginner-friendly, plug-and-play | May require technical knowledge |

| Flexibility | Offers both flexible and locked products | Usually has fixed lock-up durations |

| Rewards | Vary by product, not always staking-based | Purely staking rewards |

| Risk | Risk varies by product (some are low-risk, others high-risk) | Risk depends on validator slashing and token volatility |

| Control | Binance holds your funds | More control in on-chain staking |

| Custody | Custodial (Binance controls keys) | Non-custodial if self-staked |

Earning Mechanism

Rewards can be generated differently across platforms. Binance Earn has multiple options as it encompasses more than just staking, including savings products that function similarly to a bank’s interest-earning deposits. Dual Investment earns from price speculation. In contrast, staking rewards derive exclusively from PoS network transaction validations.

Control and Custody

Use of funds on Binance Earn means your assets are entrusted to the platform. This puts you at the mercy of the platform’s security and honesty. Staking on-chain with a personal wallet, like Ledger or MetaMask, lets one retain control of the private keys. This comes with greater responsibility, but also far less risk of third parties.

Flexibility and Liquidity

Binance Earn features flexible savings with no withdrawal limitations which appeals to short-term holders. Certain products also allow early redemption with partial rewards. Staking is usually associated with a lock-up period, during which no access to funds is permitted. Ethereum staking, for example, had a lengthy removal delay until the most recent updates.

Risk Levels

Products from Binance Earn come with different risk levels. The risks associated with flexible savings are low, whereas DeFi staking and Dual Investment carry volatile risks. While staking is associated with lower risk, it is not risk-free. Slashing can occur from validator penalties and token prices can diminish.

Reward Potential

Adjusted inflation and validator fees create a more reliable ecosystem for predicting staking rewards. With Binance Earn, it is possible to get higher and more frequent returns through multiple product options; however, the method of generating returns may be less clear.

Ease of Use

Designed for beginners, Binance Earn features a simple layout that allows automatic reward collection and one-click subscriptions, making processes effortless. In contrast, staking can be intricate due to the need to understand a myriad of factors starting from staking pools to validators’ gas fees as well as network risks, especially when done through DeFi platforms or node operation.

Which One Should You Choose?

Your decision will depend on your investment strategy, understanding of technology, and risk appetite.

Choose Binance Earn if:

- You appreciate a straightforward and passive approach.

- You wish to earn income through various other means besides staking.

- You don’t mind Binance having custody of your funds.

- You want convenient earning opportunities with a lot of freedom.

Choose Staking if:

- You would like to support decentralization.

- You possess non-custodial control and have some technical expertise.

- You plan on holding PoS tokens for the long haul.

- You prefer active participation in the reward system.

Pros & Cons

Binance Earn – Pros

- Ease of Use: Helps novice users to begin earning instantly.

- Variety: Encompasses savings, dual investment, launchpool, auto-invest, etc.

- Terms of Service: Offers both flexible and locked products.

- Self-Reinvestment: Certain products reinvest by themselves.

- No Blockchain Understanding Needed: Perfect for alienated persons from the ecosystem’s nitty-gritty.

Binance Earn – Cons

- Custody: User with no access to his funds and Binance has complete authority.

- Centrally Controlled: Vulnerable to exchange downtimes or legal enforcement.

- Inconsistent Earnings: Earnings for some products might be ambiguous.

- Capital Risks: Higher risk Dual Investment feature.

- Limited Token Availability: Not every coin/token is available in every product.

Staking – Pros

- Participation in DeFi: Effectively takes part in reinforcing the different blockchain networks.

- Native Rewards: Earn rewards from the protocol in a more transparent manner.

- Non-Custodial: You have access to your funds and private keys.

- APR: Provides much greater APR for those who choose to hold for longer.

- Active Participation: Entitles holders to participate in governance votes in some protocols.

Staking – Cons

- Technical Complexity: Understanding wallets, validators, and lock-up terms is a requirement.

- Lock-Up Periods: There may be delays in releasing staked funds.

- Slashing Risks: Your staking balance may be subject to penalties due to validator slashing.

- Limited Liquidity: Tokens that are staked are not accessible for swift trading activities or emergencies.

- Token Volatility: Drastic decreases in the price of cryptocurrency can diminish the actual value of the rewards claimed.

Conclusion

Both Binance Earn and staking provide great opportunities to passively earn income from your crypto holdings, albeit with distinct differences. Binance Earn works best for users looking for effortless work, a variety of options, and convenience and flexibility.

Earning is suitable for users who are new in the field or prefer a hands-off style. On the other hand, staking benefits users who prefer holding onto their assets, desire greater control, appreciate the blockchain’s underlying infrastructure, and value decentralization more.

In the end, one’s preferred method will still largely depend on one’s investment technique, knowledge in technology, and appetite for risk. A considerable number of investors appreciate both methods finding it useful to diversify their earnings crypto assets.