About Convex FXS Coin

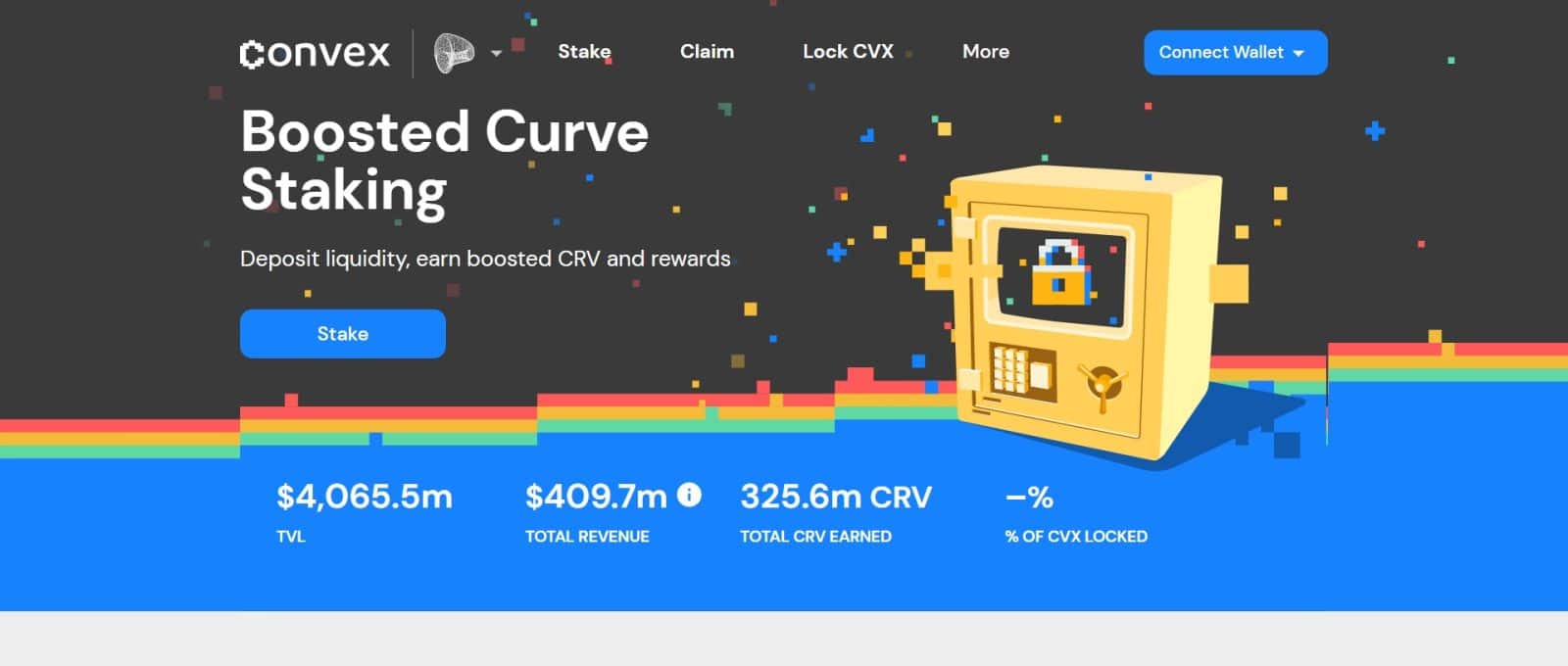

Convex FXS Coin allows Curve.fi liquidity providers to earn trading fees and claim boosted CRV without locking CRV themselves. Liquidity providers can receive boosted CRV and liquidity mining rewards with minimal effort. If you would like to stake CRV, Convex lets users receive trading fees as well as a share of boosted CRV received by liquidity providers. This allows for a better balance between liquidity providers and CRV stakers as well as better capital efficiency. Convex has no withdrawal fees and minimal performance fees which is used to pay for gas and distributed to CVX stakers.

Convex FXS Coin Point Table

| Coin Basic | Information |

|---|---|

| Coin Name | Convex FXS Coin |

| Short Name | CVXFXS |

| Circulating Supply | N/A |

| Max Supply | 6,677,337 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

Convex for CRV Stakers

Convex rewards CRV stakers with a share of the boosted CRV on the Convex platform making it an ideal destination for those who wish to stake CRV whilst remaining liquid:

- Earn a share of the Convex platform fees in CRV

- Earn trading fees from the Curve platform (3CRV)

- Receive liquid cvxCRV allowing anyone to exit their staked CRV position

- Receive CVX rewards

- Claim veCRV aidrops such as EPS (airdrop distribution will be done to the best of your abilities. Will require cooperation from the other platforms)

Convex for Curve Liquidity Providers

Convex allows liquidity providers to earn trading fees and claim boosted CRV without locking CRV themselves. Liquidity providers can receive boosted CRV and liquidity mining rewards with minimal effort:

- Earn claimable CRV with a high boost without locking any CRV

- Earn CVX rewards

- Zero deposit and withdraw fees

- Zero fees on extra incentive tokens (SNX, etc)

Voting and Gauge Weights

The Curve system allows veCRV holders to vote how CRV inflation is distributed by assigning weights to each pool’s “gauge”. As a holder of veCRV, Convex Finance can participate in these voting procedures, and these voting rights are passed to vote locked CVX holders.

Convex for Frax Finance

Convex Finance originally started out with the goal of optimizing and expanding opportunities for users of Curve.fi. Going forward, expansion into other protocols will allow further growth and opportunities for the protocol and CVX holders. Frax Finance has adopted a similar token-locking model for it’s governance token, FXS. Convex Finance has expanded to optimize opportunities for liquidity providers on Frax the same way it has done so for Curve.fi LPs.

Why Choose Convex FXS Coin?

Voting and Gauge Weights

vlCVX holders will collect 7% of all FXS emissions from pools staked on Convex, paid out as cvxFXS. Frax governance proposals are available for vlCVX holders to vote on. Voting will take place on Snapshot. Convex will allocate 20% the protocol’s veFXS to optimize liquidity and FXS rewards for vlCVX holders and LPs during gauge-weight votes. The remaining 80% of veFXS weight will be distributed proportionally according to the bi-weekly vlCVX gauge votes on pools that are on both Curve and Frax eg. Frax metapools.

Vote Locking

In order to vote on any proposal on Convex, you must lock your CVX tokens for a fixed time period(a minimum of 16 weeks). Locked tokens will be inaccessible until 16 full epochs have passed.

- If you lock immediately before a new epoch starts, your CVX will be locked approximately 16 weeks.

- If you lock in the middle of an existing epoch, your CVX will be locked for 16 weeks + the time between your lock and the next epoch start.

Vote Delegation

Voting rights from held CVX tokens may be delegated to another address/entity. This function is ideal for those who hold CVX tokens but are unsure/uninterested in how they would vote on proposals or gauge weight votes. You can also delegate vote weight directly to the Convex Finance core team.

Delegating is a separate action from locking: you don’t need to delegate if you lock, nor do you need to lock if you delegate. You delegate your voting power by delegating, and you increase your voting power by locking. If you delegate without locking, you delegate 0 voting power at the current time, but if you lock in the future, this voting power will be delegated automatically.

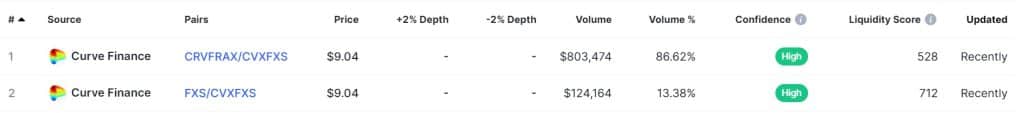

Where Can You Buy Convex FXS Coin?

Tokens Can Be Purchased On Most Exchanges. One Choice To Trade Is On Curve Finance, As It Has The Highest CRVFRAX/CVXFXS. e Trading Volume, $8,947 As Of February 2021. Next is OKEx, With A Trading Volume Of $6,180,82. Other option To Trade Include CRVFRAX/CVXFXS And Huobi Global. Of Course, It Is Important To Note That Investing In Cryptocurrency Comes With A Risk, Just Like Any Other Investment Opportunity.

Market Screenshot

Convex FXS Coin Supported Wallet

Several Browser And Mobile App Based Wallets Support Convex FXS Coin. Here Is Example Of Wallet Which Convex FXS Coin – Trust Wallet For Hardware Ledger Nano.

Leave a Reply