About DeFiPie Planet Coin

DeFiPie Planet Coin Current lending platforms such as Compound and Aave have algorithmically determined interest rates based on demand and supply. Users do not have the option to create their own pool with customised terms and rates. Users have no choice but to lend at the rates determined by the algorithm. DeFiPie allows users to set up lending pools where they regain control over interest rates and collateralization terms. Lending pools are distinct from liquidity pools in the manner that it requires its members to vote on matters such as rates and governance

DeFiPie Planet Basic Point Table

| Coin Basic | Information |

|---|---|

| Coin Name | DeFiPie Planet |

| Short Name | PIE |

| Circulating Supply | N/A |

| Max Supply | 220,000,000 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

DeFiPie Team

PIE – The Native Token of DeFiPie

Compound (COMP), Aave (LEND), and Synthetix (SNX) are among the most successful DeFi platforms. Each has provided valuable features to their users and attracted liquidity into their protocols. The native tokens of DeFi protocols have shown tremendous potential for upside price appreciation. LEND has appreciated almost 1500% YTD while SNX has increased by roughly 150%

DeFiPie Yield farming – Earn PIE Tokens From Participating

DeFiPie Planet Coin Anyone who participates in the DeFiPie ecosystem will receive a small amount of PIE every day. Users will be rewarded PIE for staking, issuing loans, depositing, collateral, and participating in liquidity pools. Yield farming incentives users to both borrow and provide liquidity. By incentivizing both borrowers and lenders, it facilitates healthy demand and supply dynamics for DeFiPie. This will allow the app to thrive by attracting a strong user base both to borrow and to issue loans.

DeFiPie Collateralization Options – Allowing Users to Earn Returns on Their Stand-In Tokens

DeFiPie Planet Coin Several DeFi protocols issue stand-in assets such as p-tokens for the assets a user deposits. However, these assets remain idle and sit on the user’s balance sheet as dead weight. With DeFiPie, users will be able to deposit their p-tokens as collateral to loan different assets. The value of the stand-in token will be tied to the underlying assets. Oracles will be used to determine and update the value of such hybrid collaterals

DeFiPie Custom Lending Pools –Giving Users

Power Over Interest Rates Current lending platforms such as Compound and Aave have algorithmically determined interest rates based on demand and supply. Users do not have the option to create their own pool with customised terms and rates. Users have no choice but to lend at the rates determined by the algorithm.

DeFiPie allows users to set up lending pools where they regain control over interest rates and collateralization terms. Lending pools are distinct from liquidity pools in the manner that it requires its members to vote on matters such as rates and governance

Video Of DeFiPie Planet Coin

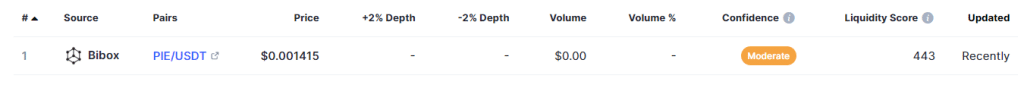

Where Can You Buy DeFiPie Planet ?

Tokens Can Be Purchased On Most Exchanges. One Choice To Trade Is On PancakeSwap (V2), As It Has The Highest WBNB/WAIFU. e Trading Volume, $8,947 As Of February 2021. Next is OKEx, With A Trading Volume Of $6,180,82. Other option To Trade Include WBNB/WAIFU And Huobi Global. Of Course, It Is Important To Note That Investing In Cryptocurrency Comes With A Risk, Just Like Any Other Investment Opportunity.

Market Screenshot

Leave a Reply