About Deribit

Launched in Jun 2016, Deribit describes itself as a futures and options trading platform for cryptocurrencies. The team is based in Amsterdam. Deribit is an answer to those searching for a professional grade cryptocurrency derivatives platform. Your goal was to create an efficient and fair marketplace that could connect traders of all backgrounds and trading styles. High matching engine capacity, low latency, advanced risk management, and high liquidity makes Deribit a unique player in the market.

Deribit Cryptocurrency started with the ambition of creating the first cryptocurrency options exchange in the world. Even though it was a highly challenging task, in slightly more than two years, the team finished working on system development. In June of 2016, Deribit was officially launched. Deribit is a cryptocurrency futures and options exchange, with its headquarters located in Panama City, Panama.

Currently, your customers can trade perpetual, futures, and options contracts. Deribit is growing rapidly and is among the top exchanges providing crypto futures and perpetual contract trading. Furthermore, Deribit remains the leading exchange offering European style cash-settled crypto options and continues to set the standard for the industry.

Information Table

| Exchange Name | Deribit |

| Exchange Service | Spot and futures trading |

| Exchange Launch Year | 2016 |

| Made In | Amsterdam |

| Mobile App | Android & IOS |

| Fiat Option | Available |

| KYC | Required |

| 2FA Security | Available |

| Maker Fees | 0.75% |

| Taker Fees | 0.70% |

| Referral Program | N/A |

| Support | Email & Live Chat Option Available |

| Official Website | Click Here To Visit |

How To Register At Deribit Exchange?

To register on Deribit, click Register Now button at the top of the page. You can also start creating an account directly through the form on the main page.

You only need to enter your e-mail and come up with a password. If there is a referral code, it is also entered at this stage. Password requirements: at least 8 characters, numbers, upper and lower case.

Click ” Create Account ” then go to your email to verify it. Enter the code you received and registration is complete. You can start replenishing your account.

How To Verify Your Deribit Cryptocurrency Account ?

There is no mandatory verification at Deribit, but you can pass it if you wish. At the moment, the only restriction imposed on unverified users is the withdrawal limit of 30,000 yen. In the future, depending on the actions of regulatory authorities, conditions may change.

For verification, you can use one of four documents to choose from: passport, driver’s license, identity card or residence permit. Artificial intelligence is used to evaluate the authenticity of documents. This service is provided by the Onfido online identification service, already used by the Deribit, Revolut platforms.

How To Buy Crypto Or Deposit Crypto At Deribit Crypto Exchange?

There are two main options for topping up your balance on Kraken. Firstly, you can buy cryptocurrency with a bank card – it’s fast and convenient. Go to the ” Buy crypto ” -> ” Buy crypto with a credit card ” section.

Choose a cryptocurrency (currently there are 13 coins available for purchase in this way). Enter the amount and select the fiat currency to be used for payment.

After that, you will need to select a payment channel: each of them has conditions. You can choose between Simplex, Mercuryo, Banxa and Moonpay. Click ” Buy ” next to the appropriate option.

Agree to the terms and confirm the transition to the site of the payment provider. Enter information about the card and its owner, confirm the transaction. Cryptocurrency will be credited to the exchange account within a few minutes.

Second Method

You can transfer digital assets to the balance of the exchange from any external crypto wallet. For this:

- Go to the “Deposit” section from the “Assets” menu.

- From the drop-down list, you can select the cryptocurrency you want to deposit into your account.

- The wallet address will appear. You need to copy it and send funds to it from another wallet or exchange. Please note that only bitcoin can be sent to bitcoin addresses, similarly with other coins.

- You can also click “Show QR code” – for transfers from a mobile wallet, this is a more convenient option.

How To Withdraw Crypto Asset From Deribit Exchange ?

Having completed all the necessary trading operations, it’s time to withdraw the received assets to an external wallet. Go to ” Assets ” -> ” Withdraw “. Please note that the operation is only available after enabling two-factor authentication in the settings. This is for added security and requires less than a minute, so don’t neglect this measure.

Select a cryptocurrency and enter the withdrawal amount. Each coin has its own withdrawal fee, for example, for BTC it is 0.00057 BTC. Click ” Output “. By default, the exchange processes applications three times a day, however, hourly withdrawals are available for Premium users. Also, the time of receipt of the cryptocurrency is affected by the workload of the blockchain network.

How To Secure Your Deribit Account ?

Also remember to go to the Security tab and activate two-factor authentication using the Google Authenticator app – this is the most reliable way to prevent unauthorized access to your account.

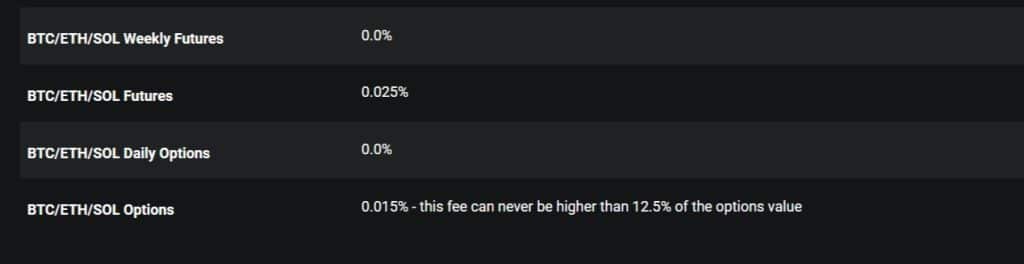

Deribit Fees

Deribit has a maker-taker fee model. This means that orders providing liquidity could have different fees versus orders that take liquidity. Fees vary per product and are calculated as a percentage of the underlying asset of the contract.

Trading Fees

Option Combo fees

The second option leg(s) fee is reduced by 100% (=FREE!!) as follows:

Only discount for combos with a combination of buy and sell trade like for example a call spread and no discount for two legs in the same direction like straddles

- They group the Buy trades (group A) and the Sell trades (group B). The fees for the group with the lowest fees will be waived.

- If the fee for buy trade (Group A) would be 10 and sell trade (Group B) 8 they would apply the 100% discount percentage on the cheapest group in this case the total fee for the combo would be 10 instead of 18

- Butterfly example Buy Call1, Buy Call2, (Group A) and sell 2 x Call3 (Group B), they would waive fees for Group A or B pending which group has lowest fees

- The same discount method will be applied to options combos executed as a block trade.

Futures spreads / Futures combos

Due to the maker / taker structure for futures and perps this model works differently for futures and they will apply a 50% discount on the cheapest taker leg. Example: client A is maker for futures spread and receives -1 bps rebate for both legs (=> 2 x -1 = -2 bps), Client B is taker for the spread and has regular fee of 3 bps. Client B will pay 3 + 50% x 3 = 4.5 bps for the spread instead of 6.

For futures spreads executed as a block trade, the model works differently. Deribit charges a fixed fee of 0.025% for BTC, ETH and SOL futures and perpetual, regardless of whether acting as a maker or taker. Should you have a volume discount your actual fees would be visible in the account menu. The Block Fee is expressed as a percentage of the base fee that can be found on the fee page. For example, if the base fee is 0.025% and the percentage shown is 80% it would imply your Block Fees for this instrument are 80% of 0.025% = 0.02%.

Delivery (Settlement at Expiry)

Futures and options deliveries are charged an additional fee. The daily options and weekly futures are exempt from delivery fees.

Deposits and Withdrawals

Bitcoin deposits are credited after 1 confirmation on the network. They do not charge fees for deposits. Withdrawals are processed instantly if the balance in your hot wallet permits so. They keep only a small percentage of coins in hot storage, therefore there is a chance that your withdrawal cannot be processed immediately. If needed, once a day they will replenish the balance of the hot wallet from the cold storage.

Features Of Deribit Crypto Exchange

Available At Android & IOS Store

Deribit Cryptocurrency Exchange exchange application available on both world famous mobile store google play store and iOS store . You Can download App and start trading.

Global Partner Network

They work with partners from various sectors and regions to provide unlimited trading possibilities and eliminate any hurdles traders might face. Enhance your trading with:

- Automated Trading

- Software Solutions

- Portfolio Management

- Data Analysis

- Custody

Advanced Multilevel Security

Safeguard your assets on Deribit with 99% of all funds stored in cold storage with a multi-sig, MPC and split private key structure. Or choose the best match for your security requirements from your third-party custody network.

Superior System Architecture

Your proprietary technology and global server infrastructure ensure an unmatched system performance making Deribit the first choice for algorithmic and high-frequency traders.

Trade Orders

Your order will be matched at the best possible price. The only price limit attached to this order is the allowed trading bandwidth of the instrument as imposed by the Deribit Risk Management System. The order will be matched up to the permitted bandwidth price limit and enter the order book at the highest possible price (buy order) or lowest possible price (sell order) if not immediately filled.

24/7 Live Chat

If you’re awake, they are too. When you need help, your team of experts will work with you via 24/7 live chat to reach a quick and efficient resolution.

Deribit Conclusion

Deribit is a centralized cryptocurrency exchange that specializes in offering futures and options trading for cryptocurrencies. The exchange is particularly popular among advanced traders and those who are looking to trade derivatives. Deribit offers a user-friendly platform with advanced trading features, such as stop-loss orders and margin trading. The exchange also has high liquidity, which allows users to quickly execute trades at the best available prices. However, as with any centralized exchange, there are potential drawbacks, including the centralized nature of the platform, vulnerability to hacking, and limited customer support.

Additionally, Deribit’s focus on derivatives trading may not be suitable for all traders, particularly those who prefer to trade spot markets. Ultimately, whether or not Deribit is the right exchange for an individual will depend on their specific needs and priorities. It is important for individuals to carefully consider the Pros and Cons of the exchange before making a decision to trade on Deribit.

Leave a Review