What Is Crypto Airdrop?

A crypto airdrop is a marketing strategy employed by cryptocurrency projects to distribute free tokens or coins to a targeted audience. During an airdrop, these digital assets are often distributed to existing holders of a specific cryptocurrency or individuals who meet certain criteria, such as participating in social media campaigns, holding a minimum amount of a particular token, or being part of a specific community.

Airdrops are conducted to generate awareness, attract new users, and foster community engagement for a particular project. Participants typically receive the airdropped tokens directly into their cryptocurrency wallets, providing them with an initial stake in the project.

While some airdrops aim to reward loyal users and build a supportive community, others may serve as a means to distribute tokens before or during an initial coin offering (ICO) or token sale. Participants should exercise caution, conduct due diligence, and verify the legitimacy of the airdrop and the project behind it to avoid potential scams.

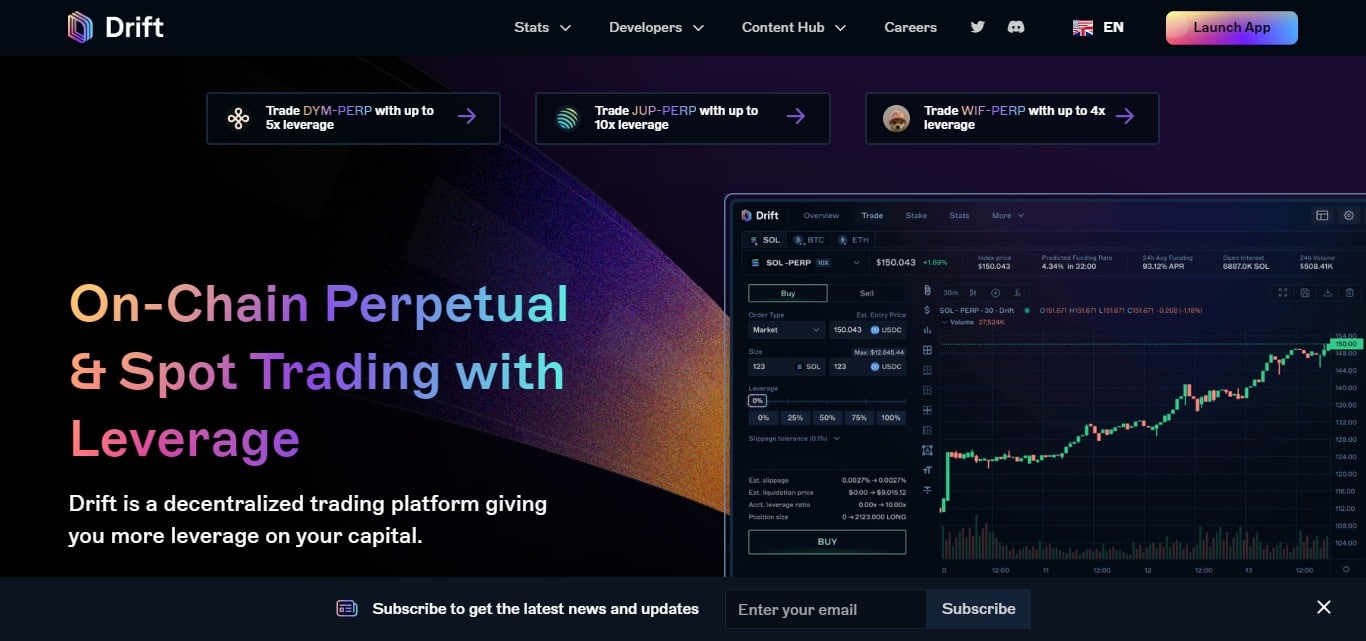

What Is Drift Protocol Airdrop?

Drift Protocol is a decentralized, fully on-chain perpetual swap exchange built on Solana. Drift Protocol is the first perpetual swap exchange to leverage a Dynamic AMM. A Dynamic AMM is based on a virtual AMM (vAMM), but it’s key innovation is that it introduces repegging and adjustable k mechanisms to recalibrate liquidity in a trading pool based on participant demand.

Drift Protocol has raised $27.3M in funding from investors like Multicoin Capital and Jump Capital. They don’t have their own token yet but have launched a points system. Users who make trades and provide liquidity on the platform will get points. Users who collect points may get an airdrop based on their points if they launch their token.

Basic Drift Protocol Airdrop Points

| Basic | Details |

|---|---|

| Token Name | Drift Protocol |

| Platform | Solana |

| Support | 24/7 |

| Total value | n/a |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

How To Claim Drift Protocol Airdrop Step-by-Step Guide:

- Visit the Drift Protocol dashboard.

- Connect your Solana wallet.

- Now, make trades on the platform.

- Users can do Perpetual and Spot trading.

- Go to “Earn”, click on DLP and provide liquidity to the available pools.

- Users who make spots and perpetual trades and provide liquidity on the platform will get points.

- They don’t have their token yet but users who collect points may get an airdrop based on their points if they launch their token.

- Please note that there is no guarantee that they will do an airdrop to the early users of the platform. It’s only speculation.

How To Check Drift Protocol Airdrop Is Real Or Fake

Checking the legitimacy of a crypto airdrop can be a bit tricky, as scammers often use sophisticated techniques to create fraudulent airdrop campaigns that appear to be legitimate. Here are some steps you can take to verify the authenticity of a crypto airdrop:

- Official internet page: Check out Drift Protocol’s official website. Reputable projects typically have a well-designed, educational website with information about the team, the project, the whitepaper, and other pertinent material.

- Official Social Media Accounts: Check the airdrop details on Drift Protocol’s official social media accounts on Twitter, Telegram, and Discord. On these platforms, legitimate projects formally declare themselves.

- Roadmap and Whitepaper: Find a whitepaper that describes the objectives, aims, and technologies of Drift Protocol. Reputable initiatives frequently offer comprehensive details regarding their goals and methods of operation.

- Details about the team: A transparent team with profiles and backgrounds available on their website or LinkedIn is typically associated with legitimate initiatives. Check the team members’ credentials.

- Comments from the Community: Look for Drift Protocol debates and comments from the community. Interact with the community to pose queries and obtain data from individuals who have taken part.

- In summary, it’s important to conduct thorough research, verify the source and instructions, look for feedback from other users, and trust your instincts when evaluating the legitimacy of a crypto airdrop. By taking these steps, you can minimize the risk of falling for a fraudulent airdrop and protect your assets and personal information.

What are the risks of participating in an airdrop?

Participating in a cryptocurrency airdrop carries several risks that individuals should be mindful of. Firstly, the most common risk is the potential for encountering scams. Malicious actors often exploit the popularity of airdrops to create fake projects, leading participants to disclose private keys, personal information, or even transfer funds, resulting in financial losses and security breaches. Additionally, the value of airdropped tokens can be highly volatile, subjecting participants to the inherent risks of cryptocurrency price fluctuations.

There is also the possibility of participating in a project with questionable legitimacy, where the airdrop may be a tactic to attract users before engaging in fraudulent activities. Moreover, the sheer number of airdrop offerings can make it challenging to differentiate between genuine projects and scams. It is crucial for participants to exercise due diligence, verify the legitimacy of the airdrop and the underlying project, and be cautious about sharing sensitive information or making financial transactions to mitigate these potential risks.

Drift Protocol Airdrop Pros Or Cons

Pros of participating in an airdrop:

- Innovative Technology: Drift Protocol introduces an innovative approach to perpetual swap exchanges by utilizing a Dynamic Automated Market Maker (AMM). The incorporation of repegging and adjustable k mechanisms aims to enhance liquidity by adapting to participant demand, potentially providing a more efficient and responsive trading experience.

- Built on Solana: Being built on the Solana blockchain can offer advantages such as high throughput and low transaction costs. Solana’s design supports fast and cost-effective transactions, potentially providing users with a seamless and economical trading environment.

- Significant Funding: Drift Protocol has successfully raised $27.3 million in funding from reputable investors like Multicoin Capital and Jump Capital. This substantial financial backing can contribute to the development and sustainability of the project, fostering confidence among users and stakeholders.

Cons of participating in an airdrop:

- Limited Token Information: Drift Protocol, at the time of information availability, does not have its own native token. While they have launched a points system, the absence of a dedicated token may limit certain functionalities and benefits that token holders typically enjoy, such as governance rights or staking rewards.

- Airdrop Dependency: The points system and the potential for future airdrops are tied to the launch of Drift Protocol’s native token. Users may be dependent on the successful launch of the token to fully realize the benefits associated with their accumulated points, introducing an element of uncertainty.

- Dynamic AMM Complexity: While the Dynamic AMM introduces innovative features, the complexity of repegging and adjustable k mechanisms may pose a challenge for users unfamiliar with these concepts. This complexity could potentially hinder the adoption of the platform by more casual or novice traders.

Drift Protocol Airdrop Final Verdicts

In conclusion, Drift Protocol emerges as an intriguing player in the decentralized finance (DeFi) space, presenting a fully on-chain perpetual swap exchange built on the Solana blockchain. The platform distinguishes itself by pioneering the use of a Dynamic Automated Market Maker (AMM), incorporating innovative features like repegging and adjustable k mechanisms to adapt liquidity dynamically based on participant demand. Backed by a substantial $27.3 million funding from prominent investors such as Multicoin Capital and Jump Capital, Drift Protocol demonstrates strong financial support, instilling confidence in its potential for growth and development.

While the absence of a native token raises certain questions about additional functionalities typically associated with token ecosystems, Drift Protocol introduces a points system. This gamified approach encourages user engagement, as participants who trade and provide liquidity accrue points, potentially qualifying for airdrops in the future when the platform launches its native token. The strategic integration of a points-based incentive system aligns with the broader trend of fostering user loyalty and participation within decentralized exchanges.