What Is Crypto Airdrop?

A crypto airdrop is a marketing tactic used by blockchain projects and cryptocurrency organisations to give away free coins or tokens to a targeted audience. Typically, the distribution is directed towards individuals who fulfil specific requirements, including performing tasks or engaging in promotional activities, or towards current cryptocurrency holders. “Airdropping” digital materials to a specific audience is the idea behind the phrase “airdrop”. A few of the goals of airdrops are to reward current users, raise awareness of new projects, and foster community involvement.

To be eligible for the airdrop, participants typically need to meet certain requirements, such as having a minimum quantity of a certain token or completing activities like social media interactions or referrals. In order to prevent potential frauds in the cryptocurrency arena, participants should exercise caution and confirm the legitimacy of the airdrop, even if real airdrops can be an effective way for projects to distribute tokens and promote community growth.

What Is Ethena Airdrop?

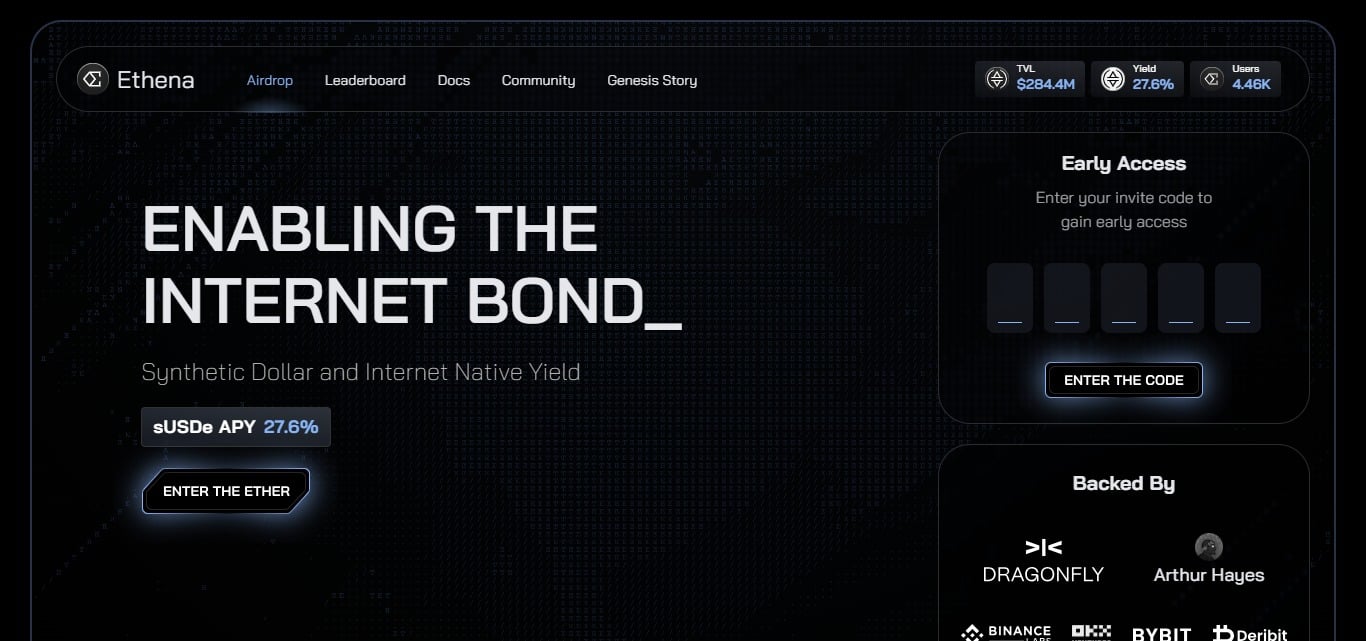

Ethena Airdrop is a synthetic dollar protocol built on Ethereum that will provide a crypto-native solution for money not reliant on traditional banking system infrastructure, alongside a globally accessible dollar denominated savings instrument – the ‘Internet Bond’. Ethena’s synthetic dollar, USDe, will provide the first censorship resistant, scalable and stable crypto-native solution for money achieved by delta-hedging staked Ethereum collateral. USDe will be fully backed transparently onchain and free to compose throughout DeFi.

Ethena Airdrop has raised $14M in funding with backing from investors like Binance, Dragonfly, and Wintermute. They don’t have their own token except their own stablecoin USDe. They’ve launched a points system in the form of shards. Users who mint, provide liquidity and stake USDe will earn shards. Also, earn more shards for each referral. Users who collect shards may get an airdrop if they plan to launch their own governance token.

Basic Ethena Airdrop Points

| Basic | Details |

|---|---|

| Token Name | Ethena Airdrop |

| Platform | ETH |

| Support | 24/7 |

| Total value | n/a |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

How To Claim Ethena Airdrop Step-by-Step Guide:

- Visit the Ethena app page.

- Connect your Ethereum wallet.

- Accept the terms and continue to the dashboard.

- You will need any one of the stablecoins like USDT, USDC, DAI, FRAX, etc. You can get it from Binance.

- Now go back to Ethena and click on “Buy”.

- Swap your stablecoins for USDe (Ethena’s synthetic dollar).

- Go to “Stake” and stake some USDe.

- Also, provide some liquidity to some of the available pools.

- You will earn points in the form of shards for doing the above tasks.

- Also, earn 10% of the shards from each referral.

- They don’t have their own governance token yet but are very likely to launch one in the future, as it is backed by industry leaders such as Binance, Dragonfly, Wintermuter and more.

- For more information regarding the campaign, read this article.

- Please note that there is no guarantee that they will launch their own token or do an airdrop to early users. It’s only speculation.

How To Check Ethena Airdrop Is Real Or Fake

Checking the legitimacy of a crypto airdrop can be a bit tricky, as scammers often use sophisticated techniques to create fraudulent airdrop campaigns that appear to be legitimate. Here are some steps you can take to verify the authenticity of a crypto airdrop:

- Official Website: Go to Ethena’s official website to see if there are any updates about the airdrop. On their official venues, legitimate projects will offer information on airdrops.

- Social Media Accounts: Check the details on Ethena’s official accounts on Telegram, Twitter, and Discord. These channels are often used for official airdrop announcements.

- Community Forums: Look for conversations regarding the Ethena airdrop on respectable cryptocurrency forums and communities. Get opinions from seasoned community members to ensure its validity.

- Whitepaper and Project Details: Ethena’s whitepaper and project specifics should be reviewed in order to determine whether any current or planned airdrops have been mentioned. Genuine projects typically offer a wealth of details regarding their distribution plans.

- Collaborations and Endorsements: Check to see if Ethena has declared collaborations with respectable groups or initiatives. Reputable airdrops frequently work with well-known companies in the cryptocurrency industry.

- In summary, it’s important to conduct thorough research, verify the source and instructions, look for feedback from other users, and trust your instincts when evaluating the legitimacy of a crypto airdrop. By taking these steps, you can minimize the risk of falling for a fraudulent airdrop and protect your assets and personal information.

What are the risks of participating in an airdrop?

Before partaking in such actions, people should be aware of the risks associated with crypto airdrops. The possibility of fraud and frauds is one of the main worries. The popularity of airdrops is frequently used by dishonest actors to launch phoney campaigns that trick users into divulging private keys or other sensitive information. Engaging in fraudulent airdrops can also expose participants to phishing attempts, which are attempts by attackers to deceive users into disclosing sensitive information.

Additionally, there’s the chance of viewing phoney websites linked to airdrop advertisements or downloading malware. Moreover, participants can receive tokens with little to no market value, which could result in financial losses. The value of the airdropped tokens is therefore not guaranteed. People should be sceptical, confirm the validity of the airdrop through official means, and avoid disclosing important information in order to reduce these hazards. To properly navigate the sometimes unregulated and decentralised bitcoin ecosystem, knowledge and awareness are essential.

Ethena Airdrop Pros Or Cons

Pros of participating in an airdrop:

- Creative Solution: Ethereum offers a creative crypto-native substitute for the existing banking infrastructure in the form of the USDe, a synthetic dollar. The ‘Internet Bond’ expands financial possibilities in the cryptocurrency realm by providing a dollar-denominated savings vehicle that is available globally.

- Stability and Resistance to Censorship: USDe seeks to be the first cryptocurrency that is stable, scalable, and resistant to censorship. Staked Ethereum collateral that has been delta-hed to achieve stability raises expectations for the stability of the synthetic dollar.

- Transparent On-Chain Backing: By guaranteeing complete on-chain transparency, USDe is completely backed and users can see how the stablecoin is collateralized. In the context of cryptocurrency, this openness is consistent with the ideas of decentralisation and trustlessness.

Cons of participating in an airdrop:

- Dependency on Ethereum: Due to Ethereum’s dependency on the Ethereum blockchain, there may be issues with scalability and cost, particularly when there is high gas pricing and network congestion. The present scalability problems with the Ethereum network may impose restrictions on users.

- Restricted Token Variety: Ethena’s lack of a native governance token may make it harder for users to take part in governance and decision-making processes on the network. Extra incentives for involvement and engagement in the community could be offered by a dedicated coin.

- Uncertainty Regarding the Launch of the Governance Token: Although the possibility of an airdrop of a governance token is stated, the absence of specifics and a well-defined launch plan may cause users’ confidence, which could affect their motivation to actively gather and interact with shards.

Ethena Airdrop Final Verdicts

Finally, Ethena shows promise as a synthetic dollar protocol running on the Ethereum network, providing a novel crypto-native alternative for a stable and decentralised medium of exchange. Through the novel technique of delta-hedging staked Ethereum collateral, Ethena hopes to produce a censorship-resistant, scalable, and stable synthetic dollar, USDe, by utilising Ethereum’s infrastructure. This strategy allows for transparency and composability across the whole decentralised finance (DeFi) ecosystem in addition to guaranteeing the stability of USDe.

Among Ethena’s noteworthy contributions is the launch of the “Internet Bond,” a worldwide available savings vehicle denominated in dollars. By doing this, Ethena’s synthetic dollar becomes even more useful and offers customers a distinctive and alluring financial tool in the decentralised market.

Reputable investors including Binance, Dragonfly, and Wintermute have backed Ethena after it completed a $14 million investment round. Their stablecoin USDe serves as their native token, however the lack of a native token emphasises the need of building a strong and stable synthetic dollar above the pursuit of a convoluted token ecosystem.