About Hades Coin

Hades Coin aims at incentivizing each market participant to the best of its ability to ensure healthy market dynamics. As it is now and for the foreseeable future, the protocol fees are and will be of 0%. This can be subject to change through a governance vote. 2 year vesting with incremental monthly release that is fully executed if no tokens are sold during the period. If tokens are sold during the vesting period, the emission of the following month will go back to where it would be without the funds that were just withdrawn/sold.

Hades Coin Point Table

| Coin Basic | Information |

|---|---|

| Coin Name | Hades Coin |

| Short Name | HADES |

| Circulating Supply | N/A |

| Max Supply | N/A |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

DCA in and out of collections

Imagine now if the floor price of that collection drops, you would now have to adjust your entire system, NFT per NFT. Cumbersome at 5 NFTs, annoying at 10 NFTs and an absolute nightmare if you have to deal with more. However, with hadeswap, you can create a selling pool with those 5 NFTs and have it set so that the price increases automatically by y% or +x SOL each time an NFT is bought from your pool. If the floor price drops, you would only have to adjust just one parameter, which is the floor price of your pool. Neat, right? Well, it doesn’t stop there.

Now let’s have a look at the latest hype collection that you’ve missed, the price has mooned and you’d like to get in on the action but you’d rather wait for the price to drop first. Instead of putting up bids on NFTs that you see on a market place, you can actually set up a buying pool with the prices you’d like to get in at, which is the same as laying buy orders at certain price points.

Two-sided liquidity pools

This is where things get interesting for people willing to earn from using hadeswap. Let’s get into it – this is a combination of setting up a buying pool and a selling pool simultaneously for the same NFT collection: buying more NFTs if the price drops to a certain level and selling those NFTs if the price increases. By doing so, you’re effectively providing liquidity on both sides to the hade swap Automated Market Maker (AMM).

To incentivize the creation of such pools, you get the ability to collect fees on the spread as people swap in and out of your pool. As complex as this may sound, the principle is simple in itself: just like on any market, there is always a slight difference in price while selling an asset or buying one – it’s exactly off that difference that you can earn! This tried-and-proven DeFi mechanism is now available for you to leverage your precious NFT collections.

Liquidity will eventually spread beyond floor NFTs

In the future, as the liquidity for floor NFTs will become more robust and the spread reduces, there will be more liquidity available for mid-rares. Currently one would argue it’s more interesting to buy 2 floor NFTs vs. buying a more rare one simply because the liquidity is heavily concentrated around the floor of a collection, but it’s only a matter of time before they could have trait-based pools on hadeswap, which means more liquidity for those rarer NFTs.

is it risky?

As is the case with liquidity providing in a standard liquidity pool, there is only one main risk implied with the use of liquidity pools. In essence, IL is a temporary loss of funds occurring when providing liquidity and it’s often explained as the difference between holding an asset versus providing liquidity in that asset. In a perfect world with no impermanent loss, the liquidity providers (LPs) would just be collecting money from the entirety of the trading fees. LPs can of course still be profitable even in case of impermanent loss (IL), as long as [impermanent loss < collected fees] is true.

Why Choose Hades Coin?

Rogue-like gameplay

A players must navigate through randomly generated dungeons, fighting through hordes of enemies to reach the end.

Immersive storyline

A players take on the role of Zagreus, the prince of the Underworld, as he tries to escape and find his way to the surface.

Stylish graphics and art style

The game features hand-drawn art, animations and vibrant visual effects, accompanied by a haunting musical score.

Wide range of weapons and abilities

A players can acquire and upgrade various weapons, each with its own unique abilities and playstyle.

An ever-changing dungeon

The game features procedurally generated environments, ensuring each playthrough is a new experience.

Character interactions

A players encounter a cast of colorful characters, including the gods and inhabitants of the Underworld, who offer quests, provide information and engage in meaningful conversations.

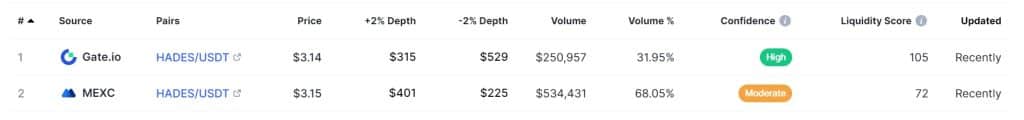

Where Can You Buy Hades Coin?

Tokens Can Be Purchased On Most Exchanges. One Choice To Trade Is On MEXC, As It Has The Highest HADES/USDT. e Trading Volume, $8,947 As Of February 2021. Next is OKEx, With A Trading Volume Of $6,180,82. Other option To Trade Include HADES/USDT And Huobi Global. Of Course, It Is Important To Note That Investing In Cryptocurrency Comes With A Risk, Just Like Any Other Investment Opportunity.

Market Screenshot

Hades Coin Supported Wallet

Several Browser And Mobile App Based Wallets Support Hades Coin. Here Is Example Of Wallet Which Hades Coin – Trust Wallet For Hardware Ledger Nano.

Leave a Reply