This article will cover the How to Buy Crypto with HDFC Bank in India. As HDFC is one of the trusted banks in India, the buying of cryptocurrency through HDFC Bank will ensure the safe and hassle-free transaction.

I will walk you through the step-by-step process for depositing INR, selecting the most appropriate exchange, buying cryptocurrency, and doing all of this in the most safe and risk-free manner.

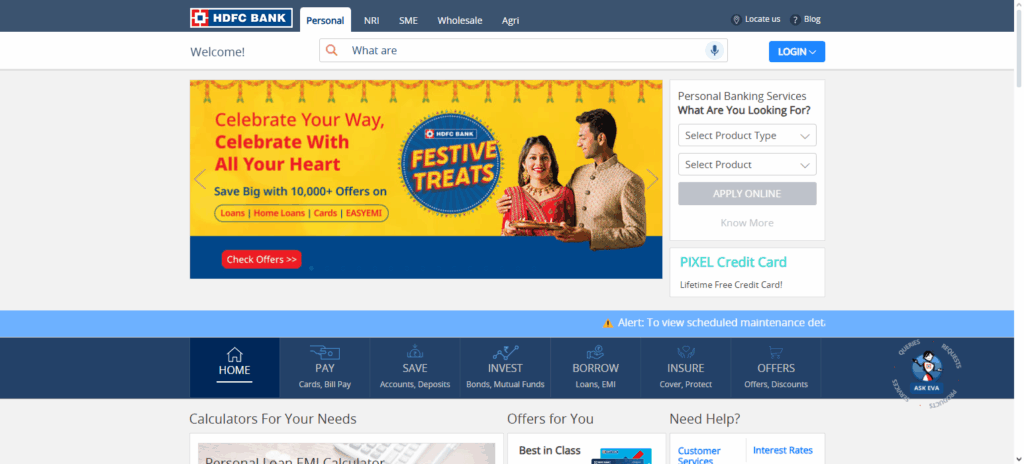

What is HDFC Bank?

HDFC Bank started in 1994 as one of the first, is one of the first private sector banks in Mumbai, India.

Since its inception, it has been focused in the areas of traditional and digital retail and corporate banking, issuance of debit and credit cards, loans, and other investments.

HDFC Bank has designed and embraced several technological advancements, which makes seamless online banking possible through various secured payment gateways.

HDFC Bank is designed to serve millions of customers, because it has placed branches and ATMs across the whole nation. The emphasis of the HDFCBank is customer centric and on customers and innovative solutions.

HDFC Bank has facilitated secure and trusted ecosystem for banking and blockchain-enabled cryptographic transactions.

How to Buy Crypto with HDFC Bank in India

Here’s a step-by-step example of how to buy cryptocurrency with HDFC Bank in India:

Step 1: Select a Trustworthy Crypto Exchange

You can choose trusted Indian crypto exchanges like or CoinDCX, with HDFC Bank for INR deposits

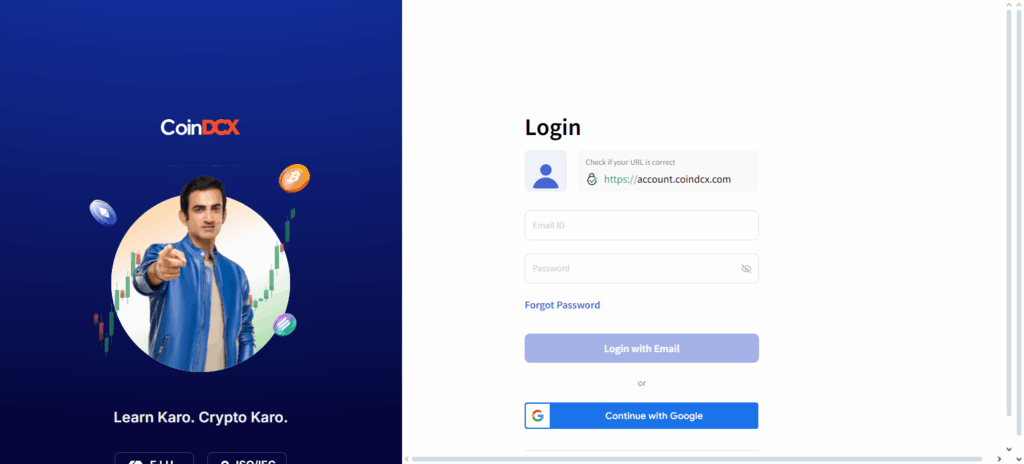

Step 2: Register and Finish KYC

- Make an account on the exchanges

- Finish KYC verification by sending your PAN card, Aadhaar, and selfie

Step 3: Connect Your HDFC Bank Account

- Connect HDFC Bank account on the exchange for deposits and withdrawals

- Select NEFT, IMPS, or UPI as the payment method

Step 4: Deposit INR from HDFC Bank

- Fund transfer from your HDFC account(deposited account) to the exchange should be initiated

- You will receive a confirmation after a few minutes or a few hours (UPI, NEFT/IMPS) respectively

Step 5: Purchase Cryptocurrency

- Select the desired cryptocurrency (e.g. Bitcoin, Ethereum, USDT)

- Place a buy order by entering the desired amount in INR

Step 6: Protect Your Cryptocurrency

- After buying crypto, move it to a safe wallet, away from the exchange.

- Make sure to activate 2FA and keep an eye on wallet activity.

Other Places to Buy Crypto with HDFC Bank in India

ZebPay

ZebPay is a very popular cryptocurrency exchange site in India and has a solid reputation for keeping its site easy to use and safe. When people buy crypto through HDFC Bank on ZebPay, they seem to benefit from the bank’s stellar digital infrastructure and rapid transaction turnover.

Users can also send funds instantly using the bank’s IMPS, NEFT, and RTGS services which means reliable and rapid deposits.

HDFC Bank’s very advanced security, ZebPay’s compliance, and transaction volume also means lower risk of transaction failures and delays.

This means that the process is seamless for both new and seasoned investors. Using ZebPay in conjunction with HDFC Bank, crypto investors in India can easily buy and manage cryptocurrencies from a single safe and reliable access point.

CoinSwitch Kuber

CoinSwitch Kuber is one of India’s most popular crypto exchanges for buying cryptocurrency and holding an HDFC Bank account. You can make HDFC fast and easy transactions since CoinSwitch Kuber allows you to deposit INR instantly via UPI, NEFT, and IMPS.

CoinSwitch Kuber is popular among customers for its easy-to-use, straightforward interface and hassle-free access to multiple cryptocurrencies.

The platform’s robust encryption and compliance with regulations make it one of the safest trading environments for HDFC Bank customers.

The platform enables users to compare real-time values for different cryptocurrencies which makes trading and investing in cryptocurrency simple, helping users get the best rate in the market.

The platform’s security and comprehensive features make it an excellent platform for crypto trading and investing.

Is Buying Crypto with HDFC Bank Safe?

Visit NowPurchasing crypto with HDFC Bank is usually safe, especially when using trustworthy, regulated crypto exchanges. HDFC Bank employs comprehensive security protocols for online transactions—two-factor authentication, transaction alerts, secure UPI, NEFT, and IMPS payments, among other measures.

However, the safety of the exchange is still a factor, given that unregulated ones can be risky. Verify that the exchange conducts KYC and anti-money laundering checks, regulatory compliance, and provides secure wallet options.

Using personal devices, steering clear of public Wi-Fi, and frequent monitoring of your accounts will secure your funds. All this makes crypto purchases via HDFC Bank safe and hassle-free.

Tips for Safe Crypto Transactions with HDFC Bank

Use Only Reputable Exchanges– Only utilize regulated and trusted platforms, particularly WazirX, CoinDCX and CoinSwitch.

Utilize 2-Step Verification– 2-Step verification can provide an additional layer of safety on your bank and exchange accounts.

Use a Wallet– After closing a trade on an exchange, avoid leaving crypto on an exchange for a long time.

Avoid Public Networks– Ensure you have a secure, private connection for transactions.

Check Your Accounts for Unauthorised Transactions– Check your HDFC bank account regularly and your account on the exchange for any suspicious transactions.

Use Strong and Different Passwords– Passwords on different platforms should be different.

Start with Low Amounts– To begin with, use low amounts that you can afford to lose.

Common Challenges & How to Avoid Them

Failure to Complete Transactions – Payments may sometimes fail due to bank or exchange issues.

How to Avoid: Ensure account details are correct, pick reliable UPI/NEFT methods, and check if account balance is enough.

Unreasonably High Fees – There are exchanges with heavily priced deposit, withdrawal, and trading fees.

How to Avoid: Search through different exchanges and pick the cheapest one when doing HDFC Bank transactions.

Limits Imposed by the Exchange – There are daily or monthly limits that restrict buying more.

How to Avoid: Check your exchange limits and plan to take your transactions in smaller batches.

Uncertain Regulations – Crypto transactions in India may be poorly regulated.

How to Avoid: Follow monthly updates from the RBI and government, and only use compliant exchanges.

Lack of Security – There are hacks against bank accounts and phishing attacks against exchanges.

How to Avoid: Activate 2FA, use difficult passwords, and do not forget to transfer crypto to cold wallets.

Risk & Considerations

Market Volatility – The principal value of crypto assets is subject to fluctuation and will continue to fluctuate in response to changes in market conditions.

Consideration: Place an order only for the amount you are willing to lose, and avoid selling in a hurry.

Regulatory Issues – In India, government-issued regulations regarding cryptocurrency are a work in progress, meaning that this in-progress legislation will directly affect trading and/or withdrawals.

Consideration: Transact with only compliant exchanges. Keep an eye on any new posts regarding the RBI’s and the Government’s new regulations.

Transaction Issues – Payments not delivered in the specified time via NEFT, IMPS, or UPI is an occurrence that some individuals will face.

Consideration: Check the account and transaction limits assigned to the account to try and minimize failed transactions.

Security Issues – The risk of hacks, phishing, or fraudulent attacks.

Consideration: Combining various security measures, including both weak and strong ones, with an active and robust unique crypto wallet, will significantly reduce the threat of loss.

Liquidity Issue – The sale and/or purchase of specific crypto assets can have a narrower trading gap and/or lower trading volumes.

Consideration: Transact with well-known crypto and exchanges that are highly liquid.

Expenses – Deposit and or transaction fees issued by a bank or an exchange will cut into the gains.

Consideration: Banking methods and fees should be compared and the most financially beneficial should be used for the transaction and trade, in order to cut down expenses.

Pros & Cons

| Pros | Cons |

|---|---|

| High security with HDFC Bank’s robust transaction protection | Crypto market is highly volatile, risk of losing money |

| Easy and quick fund transfer via NEFT, IMPS, or UPI | Some exchanges charge high deposit, withdrawal, or trading fees |

| Trusted and regulated bank ensures safer transactions | Regulatory uncertainty in India may affect crypto trading |

| Compatible with major Indian crypto exchanges | Daily or monthly transaction limits can restrict large purchases |

| Ability to track transactions through banking app and alerts | Requires digital literacy to navigate exchanges and wallets |

| Supports both small and large transactions | Potential risk of phishing or hacking if security measures aren’t followed |

Conclusion

Purchasing crypto using an HDFC Bank account in India is always safe, convenient, and efficient, especially when using trusted and regulated exchanges.

After linking your HDFC Bank account and completing the mandatory KYC process, secure payment options (NEFT, IMPS, UPI) can be used to buy some of the most popular cryptocurrencies, Bitcoin, Ethereum, and USDT.

Reduce your risk by investing small amounts, and avoid issues by staying within the latest guidelines. HDFC Bank can be used to execute legal and crypto transactions without hassles.

FAQ

No, HDFC Bank does not sell cryptocurrencies directly. You need to use trusted crypto exchanges that support INR deposits via HDFC Bank.

Yes, it is safe when using regulated exchanges, enabling 2FA, and following secure transaction practices. HDFC Bank provides strong security for online payments.

You can use NEFT, IMPS, or UPI to deposit INR into crypto exchanges.