In this piece, I will talk about How to Store Stablecoins Securely and the ways to store them securely.

As the adoption of cryptocurrency increases, the need to secure stablecoins like USDT and USDC becomes more imminent.

I will cover the different wallets available, safety measures, and the usual blunders to steer clear of so that you can expertly manage your stablecoin investments.

Understanding Stablecoins

Stablecoins are a category of cryptocurrencies designed to hold a fixed value by being pegged to a reserve asset like the U.S. dollar, euro, or gold. Stablecoins are more useful than volatile cryptocurrencies like Bitcoin or Ethereum as they offer price stability.

Unlike unfriendly crypto assets, stablecoins are good for trading, saving, and daily transactions. They offer the positives of digital currency—swift, cross-country, and decentralized, alongside the security of traditional fiat currencies—which makes them useful for users wanting less exposure to risk within the crypto market.

How to Store Stablecoins Securely Step-by-Step Process

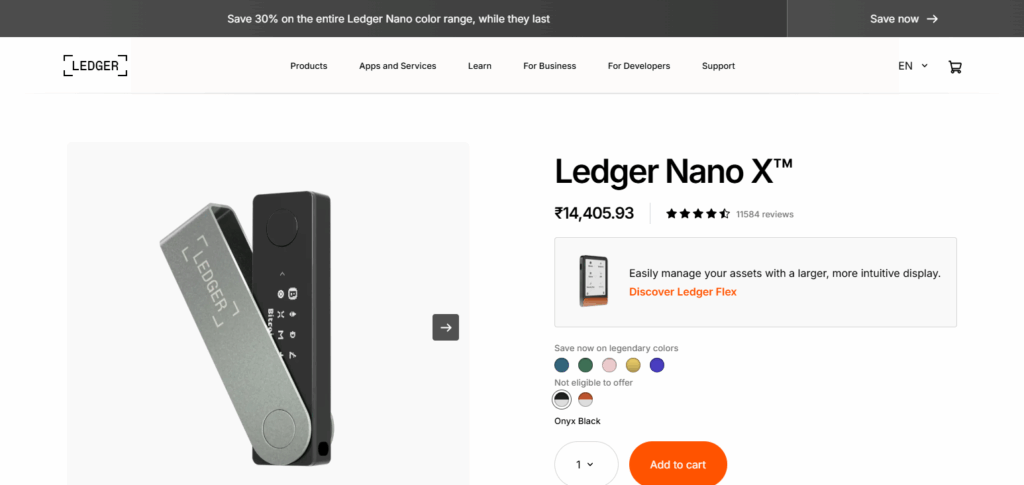

Example: Keeping $5,000 of USDC in Ledger Nano X

Buy a hardware wallet

- Trusted brands are Ledger Nano X and Trezor Model T.

- Avoid tampered devices by purchasing directly from the manufacturer.

Set up the wallet

- Connect to computer or phone.

- Install Ledger Live, and create a new wallet. 24-word recovery phrase should be kept offline.

Install the USDC-compatible app

- Install Ethereum app from Ledger Live since USDC runs on ERC-20.

- Make sure you have an Ethereum account to receive USDC.

Transfer USDC to your wallet

- Go to Ledger Live and copy your Ethereum address.

- From your exchange or hot wallet, send USDC to this address.

- Confirm transaction on your device.

Verify and disconnect

- Ensure that the USDC balance shows in Ledger Live.

- Turn off the internet connection to your wallet, your funds are now in cold storage.

Best Practices for Wallet Security

Two-Factor Authentication (2FA): Introduces an additional access barrier to your wallet.

Use Strong, Unique Passwords: Maintain security by not sharing access codes on different sites.

Backup Seed Phrases with increased Security Measures: Write phrases then store them in a secure offline location.

Keep all Programs and Devices Current: Consistent improvement on devices and wallets enhances security features.

Steer Clear of Public Wifi: Utilize private and trusted wifi for accessing your wallet.

Use Hardware Wallets for Large Amounts: Maintain these significant staple coins stored offline.

Stay Vigilant with Phishing Attacks: Don’t provide any wallet details or a click to strange links.

Check Wallet Service Providers: Only utilize wallet software from verified and trusted sourced sites.

Multi-Sig Wallets and Smart Contract Vaults

Multi-Signature (Multi-Sig) Wallets

Multi-sig wallets allow for an authorization structure with several keys granting access to a specific action unlike traditional wallets which only need one. For example, a 2-of-3 multi-sig setup permits two out of three key holders to transact. This setup boosts protection against attacks, thus ideal for businesses, teams, or high-value accounts. It reduces single points of failure.

Smart Contract Vaults

Smart contract vaults are automated systems designed on blockchain technology that enhance security to programmable logic. They may include features such as time locks, spending limits, and multi-party approval rules. In 2025, Gnosis Safe and Argent Vault are expected to enable users to safely store and manage stablecoins without using centralized platforms through advanced smart contracts.

Storing for Different Use Cases

Long-Term Holding

Use hardware wallets or cold storage for long term holding. Over time, these methods will keep large amounts of stablecoins securely stored offline, as they are nearly impossible to hack.

Daily Spending

Mobile and desktop hot wallets can be used for daily spending. For security, your wallet should offer 2FA and biometric login, in addition to being easy and quick to use.

Business Treasury

Shared control is best achieved using multi-sig wallets or smart contract vaults. These offer ease of access and shared control which is great for budgeting and compliance while running a business.

Common Mistakes to Avoid

Keeping Significant Holdings on Exchanges: Funds may be locked or stolen during a hack.

Neglecting to Storing Seed Phrases Securely: Missing one means goodbye to your digital assets.

Phishing Scams: Do not post passwords or keys for any web services you use publicly or click on strange URLs.

Outdated Wallet Software: Prior versions might be exploited by out of date cyber defense systems.

Not Strengthening Device Security: Weak safeguards on your mobile device or computer can expose your wallet to unwelcome apps.

Not Unique Passwords: Increases the risk of being exposed cost significantly when one account is hacked into.

Pros & cons

| Pros | Cons |

|---|---|

| Protects against hacks and theft | Some secure methods (like hardware wallets) can be expensive |

| Enables full control over your assets (with non-custodial wallets) | Losing private keys or seed phrases can result in permanent loss |

| Reduces reliance on centralized exchanges | More complex setup and maintenance for advanced security options |

| Flexible options for daily use, long-term storage, and business use | Risk of phishing scams and malware if best practices aren’t followed |

| Smart contracts and multi-sig wallets offer programmable security | Requires technical knowledge to use advanced wallets securely |

Conclusion

Choosing the appropriate wallet for your stablecoins in 2025—whether it be for long-term keeping, daily transactions, or managing business dealings—will determine how secure your stablecoins are.

Maximum safety may include using hardware wallets, enforcing two-factor authentication, and securely storing your seed phrase backups.

Don’t fall for phishing scams, and make sure not to commit the mistake of leaving large sums on exchanges. Your stablecoins, along with any other digital assets, can be kept protected and in your full control with the right tools and practices.