What Is KarmaDao? (KDAO)

KarmaDao is a decentralized reserve currency protocol built on Avalanche Network. Originally was an OHM fork, which was then migrated to an auto staking protocol. Each KDAO token is backed by a basket of assets (e.g. MIM,AVAX) in the KARMA treasury and collateral pool, giving it an intrinsic value that it cannot fall below. Also, protocol introduces unique economic and game-theoretic dynamics into the market through staking and bonding as well as a Lotto inspired Game UI that will bring DAO closer to the metaverse.

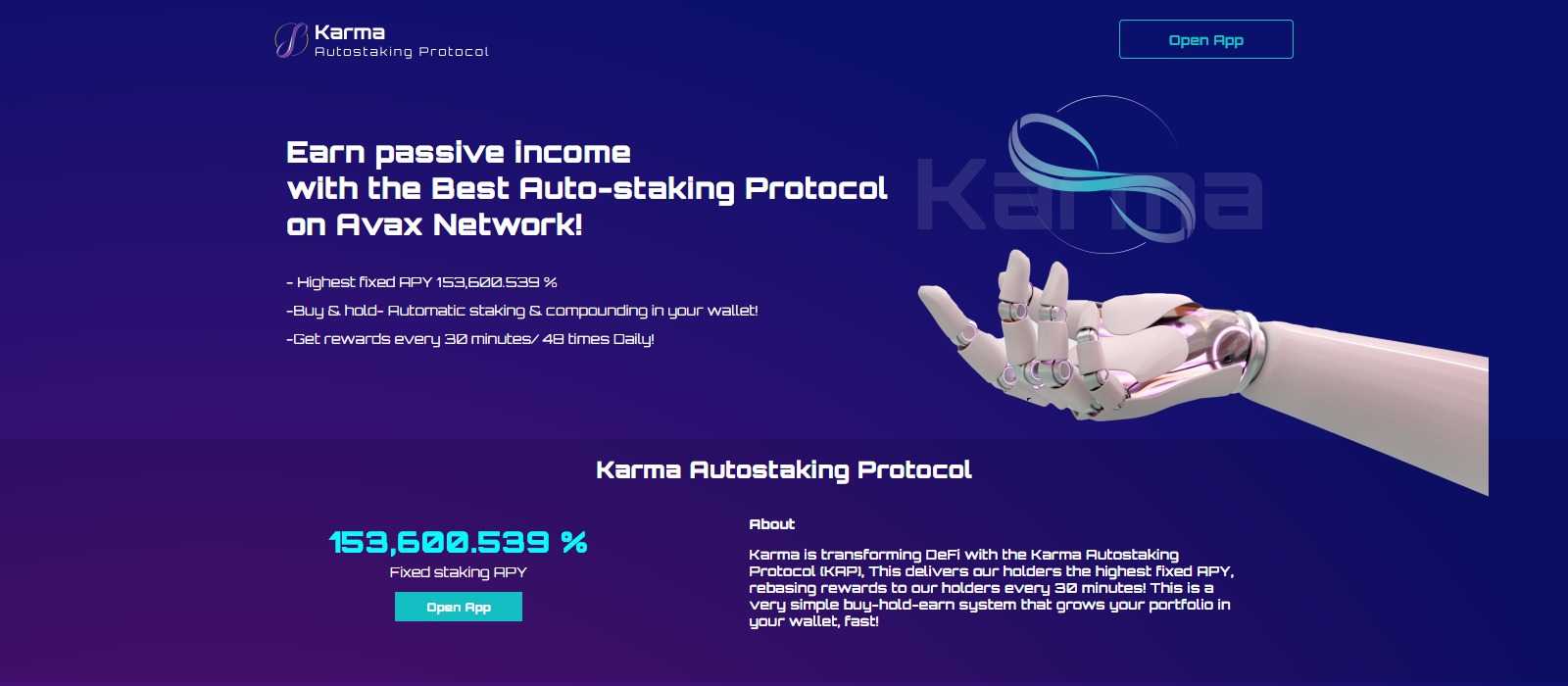

Karma is transforming DeFi with the Karma Autostaking Protocol (KAP), This delivers our holders the highest fixed APY, rebasing rewards to the holders every 30 minutes! This is a very simple buy-hold-earn system that grows your portfolio in your wallet, fast!

| Coin Basic | Information |

|---|---|

| Coin Name | KarmaDao |

| Short Name | KDAO |

| Circulating Supply | N/A |

| Total Supply | 225,178 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

Karma rewards the holders with automatic compounding interest, increasing their $karma Holdings overtime.

Treasury Revenue

A portion of the buy and sell fees help sustain the Karma Treasury revenue 5% of the trading volume will be redirected the the RFV, Thus helping control the Karma staking protocol disticutions.

Treasury Growth

Treasury inflow increases the Karma treasury balance and backs outstanding $karma Tokens.

Staking rewards

Karma Tokens Compounded automatically, The treasury is backed with intrinsic value.

Karma Tokenomics explained

Automatic LP

5% of the trading dees return to the liquidity ensuring $karma increasing collateral Value.

Risk free Value

5% of the trading fees are redirected to the RFV which helps sustain and back the staking rewards and provide a positive rebase to holders.

Treasury

3% of the purchases and 8% of the sales go directly to the treasury which supports the RFV.

What makes Karma different?

COMMUNITY:

KarmaDao team is aware that strong community offers a strong opportunity for its members. They aim to bring users together for a truly remarkable crypto experience for the long – term.

UNIQUE TOKEOMICS

Protocol utilizes unique Game Theory in Tokenomics to bring about the best yields while maintaining attractive marketability, value proposition and market dynamics for sustainable growth with three innovations Lotto inspired Game UI, currently developing. It is a random system where community will benefit ourselves by just holding.

Auto stake protocol, the participants don’t need to stake their KarmaDao ,it’s automatically giving more facilities for obtaining yield rebases. Rebases’ amount, increased to 48 epochs per day. The fact of distributing better yields afford to holders an exhaustive control from their rewards as well as better distribution of supply.

Built BY USERS for USERS After witnessing many projects fail, they have learned alot and wanted to implicate these features to the community., team has put heads together to bring you a project everyone can get behind. With innovative ideas and extensive collaboration, they are working to bring you what they believe is truly the pinnacle of what a true DAO should be.

What is the point of Karma?

The goal is to build a policy-controlled currency system, in which the behavior of the KDAO token is controlled at a high level by the DAO. In the long-term, they believe this system can be used to optimize for stability and consistency so that KARMA can function as a global unit-of-account and medium-of-exchange currency. In the short term, they intend to optimize the system for growth and wealth creation.

Also, the new added feature of “lotto” system, will give investors an active incentive to hold and auto-stake their KarmaDao Coin, as well as buy more. This will not only increase their odds of winning, but increase their yearly compound. They believe in creating a true DAO, and they will actively create this by using the snapshot feature, and steering community in the right direction.

How do I participate in KARMA?

There are four main strategies for market participants: Buying KDAO and auto staking it with a highest fixed annual 153,600,539 % APY. Participating in quizzes as well as raffles made for the community, as well as Lotteries system that will be developing. Governance participants can get involved on forum and through discussions in community discord and DAO discord servers respectively.

How can benefit from KARMA?

The main benefit for stakers comes from supply growth. The protocol mints new KARMA tokens from the treasury, the majority of which are distributed to the stakers. Thus, the gain for stakers will come from their auto-compounding balances, though price exposure remains an important consideration. That is, if the increase in token balance outpaces the potential drop in price (due to inflation), stakers would make a profit.

Who created KARMA?

KARMA was developed and built by a distributed doxxed team, and is contributed by the Karma DAO community.

Who runs KARMA?

KARMA is governed by the community. That’s the main point of our dao, all decisions and changes are voted by holders.

Leave a Reply