About Liquid CRO Coin

Liquid CRO Coin staking allows users to stake and earn yields without locking their assets into a protocol. To achieve that, users will have to deposit staking tokens into staking pools and will receive a token receipt of the corresponding liquid staked token. With that, users can use the token within the ecosystems for various yield strategies to maximize their earnings without the need of unstaking.

LCRO is the token receipt of liquid staked CRO that users will receive after staking CRO with Veno. LCRO is an auto-compounding yield-bearing token, where its internal exchange rate on Veno will increase over time when compared to CRO based on CRO staking yield on Crypto.org.

As users automatically accrue the CRO staking yield value in their LCRO token; LCRO can thus be used freely across the Cronos DeFi ecosystem. LCRO holders will: (1) be able to utilize them as collateral while earning staking yield, (2) be able to find immediate CRO liquidity with low fees, and many more.

Liquid CRO Coin Point Table

| Coin Basic | Information |

|---|---|

| Coin Name | Liquid CRO Coin |

| Short Name | LCRO |

| Circulating Supply | 15,893,117 LCRO |

| Max Supply | 15,893,117 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

Veno Finance

Staking is a common mechanism to secure Layer 1 Blockchains; for CRO, users can stake CRO on the Crypto.org chain to receive CRO staking rewards. However, with an increase in adoption of Web 3, staking may be unfriendly to users who prefer immediate liquidity on their CRO holdings. In the case of CRO, the unstaking period is an exceptionally long 28 days.

Staking may also be quite a hassle as it requires users to select and frequently monitor their delegated validator status. Worst yet, many users are also unfamiliar with the risks and inner workings of staking. This is where your one-stop liquid staking solution comes in.

Get Started with Veno

Veno is a liquid staking protocol where you can stake your CRO and receive the auto-compounding, yield-bearing receipt token LCRO. The LCRO token is designed to maximize composability. Just by owning LCRO, you automatically accrue the CRO staking yield value in your LCRO token; LCRO can thus be used freely across the Cronos DeFi ecosystem. Veno’s liquid staking token LCRO offers the most extensive, lowest cost, and most reliable method of utilizing your staked CRO.

Tokenomics

VNO is Veno’s native token which can be utilized across the Cronos Ecosystem. VNO has several use cases, including rewards participation and boost farming. For example, users can deposit VNO into different vaults in Reservoir or Fountain to earn additional yields.

How to Unstake CRO

Input the desired LCRO amount for unstaking. Note that your CRO will undergo at least a 28 days unbonding period upon unstaking. The unstaking requests are being processed in 4 day batches. Resulting in the total unstaking time might go up to 32 days. Review the amount to unstake, the withdrawal fee and the expected unlock date. Click Confirm unstaking to submit the request.

Why Choose Liquid CRO Coin?

Claim CRO from NFT

Once you have unstaked, you will receive an NFT that represents your share of CRO to be received. The NFT is redeemable when it completes the unstaking cycle. You may refer to the unlock date on the NFT to determine when you can redeem the CRO.

Reservoir

The Reservoir carries dual functionality and is both Veno’s reward participation and insurance module. Users can lock VNO to receive CRO rewards here. Users can choose between lock durations of 3-months, 12-months, 48-months, and 96-months to lock their VNO. The longer the lock duration and/or larger the quantity locked, the larger proportion of rewards will be shared to the users.

Veno aims to provide a sustainable 50% share of validator rewards (in CRO) to VNO stakers in the Reservoir. The validator commission on CRO staking yield is 10%, and Veno does not take any additional commission on the staking yield.

Fountain

The Fountain is where users can lock VNO to receive VNO incentives. Users can choose between lock durations of 3-months, 12-months, 48-months, and 96-months to lock their VNO. The longer the lock duration, the larger the proportion of VNO emissions for the users.

Staking Dashboard

Staking Dashboard allows you to view your lifetime earnings, pending earnings, transaction history as well as the historial staking APY. Check out the graphs and FAQ sections below to learn more about this feature.

Staking APY

The Staking APY displayed on Veno is calculated based on the increase of the exchange rate from CRO to LCRO in the last 24 hours compounded daily. Using the change in the LCRO exchange rate as the base for the Staking APY means that it reflects the real earnings from holding LCRO and that users do not have to think about validator commission or protocol fees.

At launch, Veno will be using the change in the LCRO exchange rate over the last 24 hours. When more data is available, this will be switched to the last 7 days instead. This aims to provide a more consistent APY estimate.

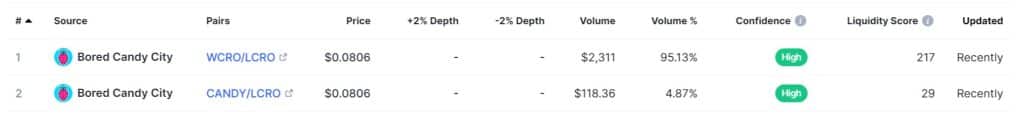

Where Can You Buy Liquid CRO Coin?

Tokens Can Be Purchased On Most Exchanges. One Choice To Trade Is On Bored Candy City, As It Has The Highest WCRO/LCRO. e Trading Volume, $8,947 As Of February 2021. Next is OKEx, With A Trading Volume Of $6,180,82. Other option To Trade Include WCRO/LCRO And Huobi Global. Of Course, It Is Important To Note That Investing In Cryptocurrency Comes With A Risk, Just Like Any Other Investment Opportunity.

Market Screenshot

Liquid CRO Coin Supported Wallet

Several Browser And Mobile App Based Wallets Support Liquid CRO Coin. Here Is Example Of Wallet Which Liquid CRO Coin – Trust Wallet For Hardware Ledger Nano.

Liquid CRO Roadmap

Leave a Reply