In this post, I’ll talk about MasterFunders, a prop trading company that helps traders develop through skill-based challenges instead than putting their own money at risk.

Both novice and seasoned traders can benefit from MasterFunders’ streamlined structure, funded account chances, and demo-based evaluations. It is a well-liked option in the prop trading sector due to its simple methodology, clear regulations, and affordable prices.

What is MasterFunders?

MasterFunders is a cutting-edge financial platform that links companies with investors and provides a variety of funding options made to satisfy contemporary entrepreneurial demands.

It offers a variety of services, including as loans, crowdsourcing, and equity investment, making it possible for startups and SMEs to effectively access cash.

In order to ensure that businesses and investors can interact with confidence, the platform places a strong emphasis on security, transparency, and ease of use.

Personalized support helps organizations maximize finance plans, while advanced data and user-friendly dashboards enable informed decision-making.

MasterFunders promotes growth, innovation, and mutually beneficial financial opportunities by bridging the gap between investors and expanding businesses.

Key Point

| Key Point | Details |

|---|---|

| Platform Name | MasterFunders |

| Category | Financial Technology (FinTech) / Funding Platform |

| Services Offered | Equity Funding, Business Loans, Crowdfunding, Investment Opportunities |

| Target Users | Startups, SMEs, Entrepreneurs, Investors |

| Key Features | Secure transactions, User-friendly interface, Real-time analytics, Flexible funding options |

| Mission | To bridge the gap between businesses seeking capital and investors seeking opportunities |

| Benefits for Businesses | Quick access to capital, Networking with investors, Growth support |

| Benefits for Investors | Diverse investment options, Transparent processes, Potential high returns |

| Platform Accessibility | Web-based platform (and possibly mobile app if available) |

| Security Measures | Data encryption, Investor protection, Compliance with regulations |

| Website | [Insert official website URL] |

Trading

How To Set Up MasterFunders

Step 1: Visit the Official Website

- Enter the official MasterFunders website URL into your browser.

- Make sure you verify that the website is secure by checking to see if the website begins with HTTPS.

Step 2: Sign Up / Create an Account

- Hit the “Sign Up” or “Register” if you wish to start the registration process.

- Select Business if you wish to obtain funds or Investor if you wish to offer funding.

- Provide the site with the necessary information: name, email, phone, and password.

Step 3: Verify Your Account

- You should receive an email from MasterFunders that contains a verification link.

- Once you have this link, by clicking on it, your account will become active.

Step 4: Complete Your Profile

- Businesses: Enter the business name, business industry, funding requirements, and financial docs.

- Investors: Provide your investment criteria, your risk profile, and the verification documents required.

Step 5: Explore Funding or Investment Options

- For businesses: Available funding offers, loans, or equity investors should be reviewed.

- For investors: Available investment opportunities are available by the business or project.

Step 6: Submit a Funding Request / Investment Proposal

- As a business, you will detailed information about your project when you complete the funding application.

- As an investor, you will be able to submit your investment proposal to fund your chosen business.

Step 7: Reach Out and Make Deals

- Use messaging functions on our platforms to talk to investors and companies about any potential deals.

- Make counter offers about their offers.

Step 8: Complete the Agreement

- Complete the agreed amounts using the appropriate secure transfer.

- Make sure you have the correct documentation for the agreements or understandings from the platform.

Step 9: Manage Responsibly

- For companies: Keep an eye on the available funds, any interest repayments, and the current engagement with your investors.

- For investors: Monitor your payouts with returns, the current projects for your investments, and any analytics for your overall portfolio.

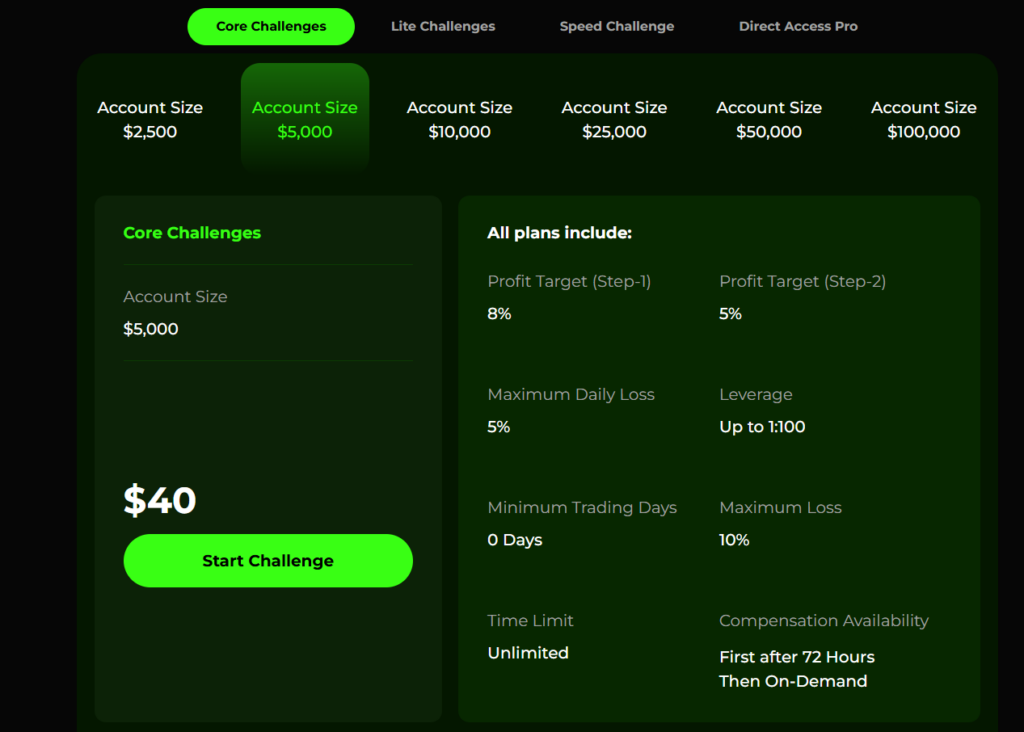

MasterFunders Challenges

MasterFunders Account Comparison

Account Types

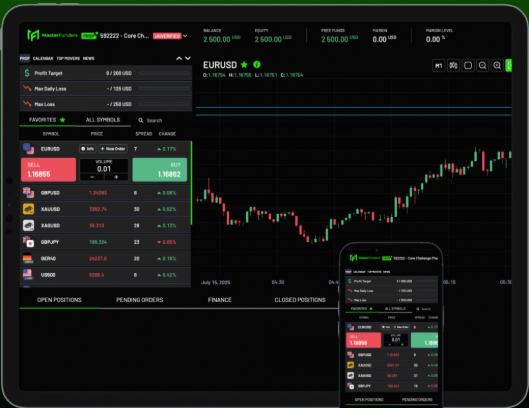

MasterFunders provides each trader with demo accounts in order to promote a stress-free and risk-free environment while undergoing the trading process. These demo accounts are used during the challenge phase to allow traders to refine their skills and perfect their strategies.

With the demo accounts used during the challenge phase, traders are able to gain the competency and skills required to enter real accounts. The demo accounts are able to replicate the actual trading environment closely and allow the traders to gain valuable experience.

MasterFunders offers funded accounts from as little as $2,500 to $200,000, and this range, whether you are a beginner trader in the system, or a more advanced trader, you are able to be catered to.

This design means you are able to gain more confidence with each challenge you complete before you enter the funded account phase. Low and affordable fees to enter the trading system as well as gaining a funded account means more people can participate in the trading system as well.

The system is designed to ensure everyone has the same opportunities, and receives the same treatment in the system, to allow everyone to be fairly incorporated in the system, and so everyone can be included.

| Account Type | Available |

|---|---|

| Demo Account | Yes |

| Islamic Account | No |

| Segregated Account | No |

| Managed Account | No |

| Suitable for Beginners | Yes |

| Suitable for Professionals | Yes |

| US Traders Allowed | No |

Commission and Fees

| Fee Type | Description |

|---|---|

| Challenge/Account Fee | Traders pay a fee to enter evaluation challenges (varies by account size and challenge type; e.g., Core and Lite challenge fees). |

| Profit Split | Default profit share is 80% for the trader, and can increase up to 90% under certain conditions. |

| Payout / Withdrawal Fee | No fees charged by MasterFunders for payouts; withdrawal costs depend only on the payment provider used. |

| Trading Commission | Forex, commodities & indices typically have $1 per lot commission; stocks have 0.10% per lot; cryptocurrencies are commission-free. |

| Account Maintenance Fee | No ongoing account maintenance fees are charged. |

| Inactivity Fee | No inactivity penalties for traders who aren’t actively trading. |

| Overnight / CFD Fees | Overnight holding fees may apply for CFD positions, depending on the instrument and direction. |

| Currency Conversion Fee | No currency conversion fees charged by the platform itself. |

Deposit and Withdrawals

| Category | Details |

|---|---|

| Deposit Methods | Credit/debit cards, bank transfers, local/online payments, mobile money, e-wallets (Skrill, Neteller), and cryptocurrencies. |

| Deposit Fees | No fees charged by MasterFunders; any charges are from the payment provider. |

| Withdrawal Methods | Bank wire transfer, Revolut, Skrill, PayPal, and cryptocurrencies. |

| Withdrawal Fees | No withdrawal fees from MasterFunders; fees depend on the provider used. |

| Processing Time | Typically processed within 1–2 business days (varies by method and provider). |

| Minimum Withdrawal | Depends on payment method; payout eligibility starts after profit threshold is met. |

| Currency Support | Multiple currencies via payment providers, but the primary internal account is usually in USD. |

| Special Notes | MasterFunders does not handle client deposits directly as funds; traders pay challenge fees but do not “deposit” into trading accounts in the usual broker sense. |

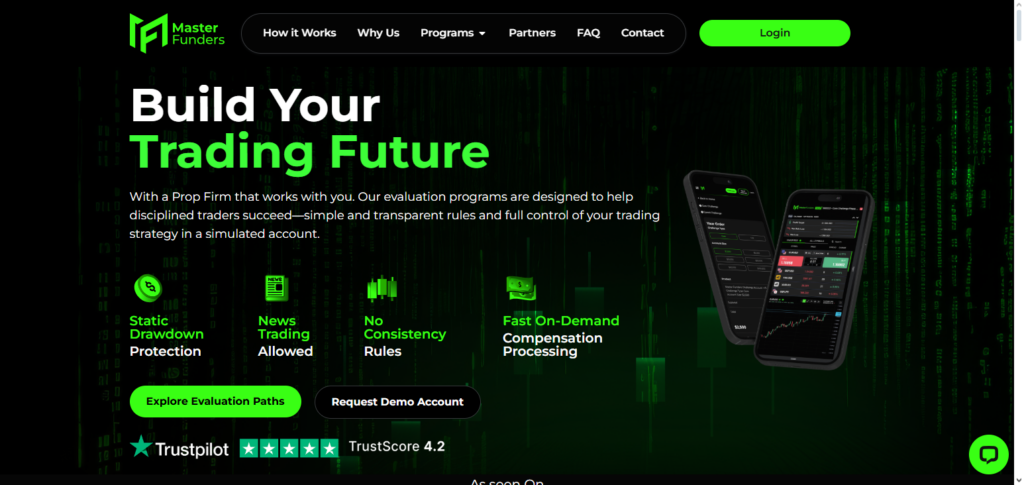

Trading Platform

| Trading Platform Feature | Availability at MasterFunders |

|---|---|

| Proprietary Trading Platform | Yes — MasterFunders’ in-house platform for all users |

| MetaTrader 4 (MT4) | No — not supported |

| MetaTrader 5 (MT5) | No — not supported |

| cTrader | No — not supported |

| Browser-Based Platform | Yes — accessible via web browser |

| Desktop Application (Windows & Mac) | Yes — available |

| Mobile App (Android & iOS) | Yes — via mobile apps |

| Demo / Simulated Trading Environment | Yes — all evaluation trading is simulated |

| Real-Time Performance Dashboard | Yes — included on platform |

How MasterFunders Works

Account Creation

- For verification purposes, businesses and investors input information needed for account creation.

Profile Completion

- Businesses fill in information regarding their companies, funding needs, and financials.

- Investors define the types of investments they are interested in and the level of risk they are willing to take.

Evaluate Options

- Investors are able to assess the investment opportunities of businesses and their projects.

- Users are able to assess funding opportunities such as debt, equity, or other types of entrepreneurial funding.

Proposals & Applications

- Investors are able to assist businesses by funding their projects with investment proposals and venture capital.

- Businesses are able to apply for funding and submit project details to lenders or investors.

Terms Negotiation

- Participants are able to negotiate on the equity, interest rates and other terms of funding.

Documented Transactions

- Users are able to obtain streamlined transactional funding through the platform with legal documentation and funds securely.

Reporting

- Investors receive updates about the project to assess their returns on capital and performance of their equity.

- Investors and businesses are able to monitor funding status and repayments.

Assistance

- Users of the services are able to obtain customer support regarding accounts, troubleshooting, or any other questions related to the service.

Benefits Of MasterFunders

Fast Funding

- Businesses have the ability to access loans, crowdfunding, or equity in a matter of minutes without going through the lengthy processes of traditional banks.

Variety of Funding

- The service is able to finance through different means of loans for businesses, equity funding, or Crowdfunding.

Ease of Use

- The sight and app are easy to use and navigate no matter your tech skills.

Safe and Secure

- Both businesses and investors are kept safe with encrypted transactions.

Meeting New People

- Master Funders connects businesses with possible investors and financiers.

No Hidden Prices

- The service offers no hidden prices and provides real-time analytics.

Assistance in Advancing

- The customized funding solutions are able to assist a startup or an SME to grow or scale.

Return on Investments

- Investors are able to gain access to investments with a probable financial return, and gain risk management tools.

Tracking Your Money

- Master Funders allows both the business and the investors to track funding and repayments.

Guidance

- Master Funders offers customer support which provides assistance throughout the process.

Key Features of MasterFunders

Varied Funding Options

- Business loans, equity funding, and crowdfunding.

Seamless User Experience

- Streamlined onboarding, intuitive UI, and simple navigation.

Secure Transactions

- Transactions protected by encryption and regulatory compliance.

Real-Time Funding Analytics

- Analytics of the funding situation, repayment, and return of the investment.

Customized Solutions for Companies

- Funding options tailored for entrepreneurs, small and mid-sized companies, and businesses.

Investor Interface

- Portfolio management, investment and return tracking.

Processes with complete Disclosure

- Documentation and communication are openly provided and routinely maintained.

Access to Adjacent Resources

- Businesses are able to access and communicate with practitioners of financial management, and potential backers.

Assistance and Support

- Customer service is available for inquiries, assistance to complete the registration process, or to advise on funding.

Varied funding Conditions

- The terms of funding including, interest rates, repayment duration, and structure of the investment are adjustable.

Success Stories / Case Studies

Funded Accounts Post Evaluation

- Users have mentioned how they had been getting accounts post evaluation, and users pleasantly appreciated the seamless and smooth experience.

Support Experiences

- Users appreciated the support responsiveness and especially the support during evaluation and payout processes so users felt support along the whole way.

Payout Speed

- Users have shared experiences were they have received much expedited profit withdrawal and were even received their money in less than 19 minutes.

Challenge Cost Accessibility

- Users mentioned how the low cost starting challenges (e.g. the $5 challenge) created accessible opportunities for users to attempt challenges and even get funded.

Platform Credibility

- Users have independently mentioned MasterFunders to be a credible and easy to use prop trading platform and have thus recommended MasterFunders to users on a quest to get funded.

Comparison with Other Funding Platforms

| Feature | MasterFunders | FundedNext | Instant Funding IO | Typical Prop Firm (General) |

|---|---|---|---|---|

| Funding Model | Instant funding & evaluation challenges | Instant + challenge plans | Instant access after purchase | Mostly evaluation challenges |

| Profit Split | Up to ~90% | Up to ~95% (varies) | 80–90% | ~70–90% depending on firm |

| Payout Speed | Fast payouts (often 3 days after funding + on-demand) | Generally daily/on-demand | Immediate after setup | Often delayed or periodic |

| Account Size Options | Up to ~$400K scalable | Up to ~$300K | Up to ~$1.28M depending on plan | Varies widely (often up to high levels) |

| Drawdown Rules | Static risk limits; clear rules | Typically fixed static drawdown | Trailing/static depending on plan | Depends on firm (static or trailing) |

| Platform Support | Match-Trader (web/mobile) | MT4/MT5/cTrader/Match-Trader | Usually MT5 | Varies (MT4/MT5/cTrader) |

| Local Payment Options | Strong support (cards, wallets, local) | Moderate (cards & wallets) | Limited (card & crypto) | Varies by provider |

| Scaling Potential | Up to ~$400K | Often up to ~300K | Up to ~$1.28M+ | Some firms offer several million scaling |

| Ease of Access | Instant funding option with no evaluation | Instant & multi-step challenges | Very simple (purchase → trade) | Often requires multi-step evaluation |

Is MasterFunders Legit and Safe?

MasterFunders employs robust strategies aimed at protecting the company and its account holders. Each trader undertakes a validation process before entering a funded account. Internal systems protect the company from the misuse of its resources.

Internal systems evaluate and monitor all traders for compliance. All dealings that evaluate the trader’s competency are done via a simulator to hold no actual monetary value.

Being a prop firm means MasterFunders does not hold client money for security reasons. Clients buy challenge products digitally which means no worries about the mismanagement of funds.

Almost all prop firms operate without regulation, and MasterFunders tries to maintain some credibility by establishing clear policies, strict internal policies, and implementing fast consistent payments. All of the above makes MasterFunders a trader-friendly firm. It has become very reliable.

Pros & Cons

| Pros | Cons |

|---|---|

| Low entry cost – challenges start as low as $5, making it accessible to many traders. | Proprietary platform only – does not support popular trading platforms like MetaTrader 4/5, which many traders prefer. |

| Generous profit split of up to 90% on funded accounts. | Reporting mixed reviews on support – some users report slower responses and communication issues. |

| Flexible trading rules – includes news and weekend trading and fewer restrictions compared with many prop firms. | Strict challenge requirements – some challenge types (e.g., 24-hour) have strict rules that many traders find hard to meet. |

| Fast payouts reported — some users received withdrawals quickly (even within minutes). | Not regulated and relatively new, with limited independent reviews (which may concern risk-averse traders). |

| Simple signup and diverse tradable markets including forex, commodities, indices, and crypto. | Possible confusing challenge rules — some traders have reported unclear criteria around rules like margin usage. |

| Scaling plans and unique features like Second Life/Reset offering extra challenge attempts. | Demo or simulated trading environment – funded accounts may still be simulated rather than live capital. |

Conclusion

For traders who wish to advance their abilities in a secure, risk-free setting, MasterFunders provides an easy-to-use approach. The platform guarantees that traders can practice, hone their tactics, and demonstrate their skills before managing real funds by emphasizing demo-based difficulties.

It is appropriate for both novice and seasoned traders because to its variable funded account sizes, reasonable entry costs, and straightforward structure. MasterFunders is excellent in terms of transparency, use, and trader-friendly terms, even though it may lack some sophisticated account types. All things considered, it stands out as a helpful and growth-oriented prop firm for both professional and aspiring traders.

FAQs

MasterFunders is a proprietary trading firm that offers traders the opportunity to earn funded accounts by completing evaluation challenges in a demo environment.

Traders purchase a challenge, trade on a demo account to meet profit targets and risk rules, and upon successful completion, receive a funded account with real profit potential.

No. All trading during the evaluation phase is done on a demo account, which means you don’t risk your own trading capital.