What Is Crypto Airdrop?

A cryptocurrency airdrop is a marketing tactic used by blockchain and cryptocurrency projects to give out free tokens or coins to a targeted audience within the community. The custom of delivering supplies to specific locations by aircraft is where the word “airdrop” originates. In the realm of cryptocurrencies, analogously, these digital assets are dispersed at no cost to wallet addresses of current token holders or persons who satisfy specific requirements, such belonging to a particular online community or having taken part in an initial coin offering (ICO).

Airdrops are frequently utilized to increase community involvement, create awareness, and grow a user base. A crypto airdrop allows users to hold, trade, or use free tokens inside the project’s ecosystem. Typically, participants receive the tokens straight into their wallets. While airdrops can be a valid strategy for organizations to grow their communities, participants should use caution and confirm the legitimacy of announcements in order to steer clear of possible fraud.

What Is Term Structure Airdrop?

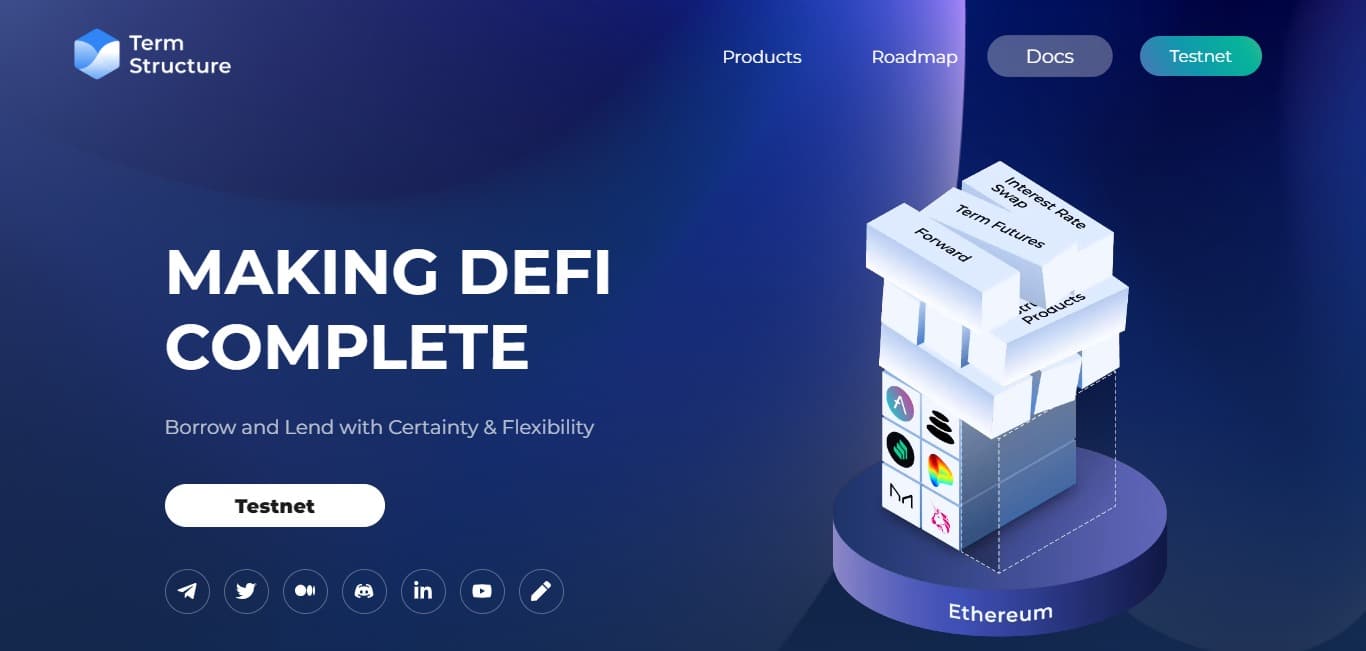

Term Structure is a decentralized fixed-income protocol powered by zkTrue-up, a platform that enables peer-to-peer lending and borrowing with fixed interest rates. By leveraging the power of decentralized technology, Term Structure aims to create a more efficient and accessible fixed interest rate market ecosystem.

Term Structure has raised $4.25M from investors like HashKey Capital and Cumberland. They don’t have their own token yet but could launch one in the future. Early users who do testnet actions may get an airdrop if they launch their token.

Basic Term Structure Airdrop Points

| Basic | Details |

|---|---|

| Token Name | Term Structure Airdrop |

| Platform | ETH |

| Support | 24/7 |

| Total value | n/a |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

How To Claim Term Structure Airdrop Step-by-Step Guide:

- Visit the Term Structure testnet page.

- Connect your wallet.

- Change the network to Goerli.

- Now get some testnet ETH from here.

- Return to the testnet page, click on “Faucet” located at the top of the page and claim testnet tokens.

- Now go to “Deposit” and deposit the testnet tokens.

- Go to “Primary markets” and Borrow or Lend tokens.

- Now got to “Secondary markets” and Buy or Sell tokens.

- They’ve not confirmed to launch their token or do an airdrop but early testnet users may get an airdrop if they launch their own token.

How To Check Term Structure Airdrop Is Real Or Fake

Checking the legitimacy of a crypto airdrop can be a bit tricky, as scammers often use sophisticated techniques to create fraudulent airdrop campaigns that appear to be legitimate. Here are some steps you can take to verify the authenticity of a crypto airdrop:

- Examine the project: Seek out details regarding the project that is purportedly carrying out the airdrop. To learn about the project’s objectives, technology, and staff, go to their official website and read the whitepaper.

- Examine the official channels: Check the information by visiting the project’s official website, blog, or social media accounts (Twitter, Telegram, Reddit, etc.). These are the official avenues for communication. Airdrops are usually announced via official channels by legitimate projects.

- Avoid Receiving Unsolicited Messages: If you obtain information about the airdrop by unsolicited direct messages, emails, or social media posts, proceed with caution. These channels are frequently used by scammers to pose as authentic enterprises.

- Check Social Media Profiles: See if the airdrop has been publicized by visiting the project’s official social media pages. To confirm the legitimacy of the account, look for the blue verification checkmark on social media sites like Twitter.

- View Community Comments: Look through discussion boards and community forums to check if any other people have confirmed the airdrop. If the information is not shared or if there are rumors of questionable activity, proceed with caution.

- In summary, it’s important to conduct thorough research, verify the source and instructions, look for feedback from other users, and trust your instincts when evaluating the legitimacy of a crypto airdrop. By taking these steps, you can minimize the risk of falling for a fraudulent airdrop and protect your assets and personal information.

What are the risks of participating in an airdrop?

There are many hazards associated with taking part in an airdrop, which is a free distribution of cryptocurrencies or tokens to a large number of wallet addresses. Initially, it is crucial to thoroughly confirm the integrity of the airdrop, since unscrupulous individuals frequently fabricate airdrops to deceive recipients into divulging confidential keys or personal data, hence resulting in possible misappropriation or deception. Furthermore, there may be dangers associated with the project’s reputation and viability even with legal airdrops.

Tokens that are airdropped can be worthless, and the project might end up being a fraud or falling short of expectations. Moreover, giving out their public wallet addresses when taking part in airdrops exposes consumers to possible spam, phishing, and targeted assaults. To effectively reduce these dangers, participants must be cautious, thoroughly investigate the project, and be cautious of requests for sensitive information during the airdrop procedure.

Term Structure Airdrop Roadmap

Term Structure Airdrop Pros Or Cons

Pros of participating in an airdrop:

- Broad Distribution: The project’s reach can be expanded by using airdrops to swiftly transfer tokens or assets to a wide number of users.

- Engagement of the Community: Airdrops have the potential to foster and grow a community around a project or cryptocurrency.

- Marketing and Awareness: A new project or token can become more well-known and widely discussed through airdrops.

Cons of participating in an airdrop:

- Absence of Targeting: Users who are not sincerely interested in the project may be drawn to airdrops, which could result in a community that is less involved.

- Costs: There are expenses associated with conducting an airdrop, such as transaction fees and other administrative costs.

- Dumping Risk: Airdropped token recipients may sell them rapidly, causing a sharp decline in value.

Term Structure Airdrop Final Verdicts

Finally, by integrating zkTrue-up technology, Term Structure presents a fresh approach to fixed-income protocols, making it a prospective participant in the decentralized finance (DeFi) space. The platform distinguishes itself by addressing the need for accessibility and efficiency in the fixed interest rate market by enabling peer-to-peer lending and borrowing with fixed interest rates.

The fact that Term Structure was able to successfully raise $4.25 million from renowned investors like Cumberland and HashKey Capital is evidence of the trust and support that the company has gained. The initiative is well-positioned for future expansion and development thanks to this financial support.

Term Structure suggests that a token may be introduced in the future, despite the fact that it does not currently have a native token. This calculated move may increase the platform’s usefulness and encourage user engagement. Of particular note, early adopters participating in testnet activities can profit from future airdrops when the token is officially released.

A promising trajectory is set by Term Structure’s dedication to innovation, decentralization, and user interaction as it navigates the ever-changing world of decentralized finance. With its distinct features and support from reliable investors, the project’s development will surely be interesting to follow in the rapidly developing field of decentralized fixed-income protocols.