In this article, I will cover the Top Bridging Aggregators for Advanced DeFi Strategies with a focus on swift, secure, and cost effective cross-chan asset transfer platforms.

These aggregators route optimization, cost, and multi blockchain facilitation unlock the potential for borderless DeFi strategies. Whether it’s yield farming, arbitrage, or cross-chain liquidity management, such tools will become integral for the DeFi strategy of the future.

What is Bridging Aggregators?

A bridging aggregator is a DeFi platform letting users transfer tokens and digital assets across different blockchain networks borderlessly. A bridging aggregator differs from a single bridge in that it connects multiple bridges and liquidity sources and optimally selects routes for each transaction while maximizing speed, cost, and reliability.

These platforms ease cross-chain transfers, gas fees, and slippage, enabling users to perform sophisticated DeFi activities such as arbitrage, yield farming, and multi-chain liquidity management.

Bridging aggregators streamline several networks and protocols into a single interface, thus simplifying intricate cross-chain processes for both novice and veteran users of DeFi.

How to Choose Top Bridging Aggregators for Advanced DeFi Strategies

Security

- Use of audited smart contracts.

- Track record and security measures for platforms.

- Detached and non audited code.

Supported Networks and Tokens

- Supported blockchains by the aggregator.

- Token compatibility for all assets.

- Multi-chain supported for flexibility in strategies.

Fees and Gas Optimization

- Transaction fees analysis for multiple aggregators.

- Platforms which minimize gas usage and slippage.

- Forefront and concealed costs.

Speed and Efficiency

- Transaction processing speed.

- Cross-chain route optimization to ease the hesitation.

- Aggregators with least effect of network congestion.

User Interface and Experience

- Easy to use platforms.

- Transaction status updates.

- Advanced DeFi strategies analytics.

Reputation and Community

- Feedback of the community and reviews.

- Active user and developer supported.

- When choosing a platform, make sure there is more than enough support behind it.

Support for Other DeFi Tools

- Ensure there is support for wallets, DEXs, and additional DeFi protocols.

- Always prefer aggregators that provide APIs or SDKs for trade automation.

- Search for platforms that enable yield farming, staking, or liquidity management.

Key Point & Top Bridging Aggregators for Advanced DeFi Strategies List

| Bridging Aggregator | Key Points |

|---|---|

| Synapse Protocol | Cross-chain liquidity and swaps with low fees; supports multiple chains. |

| Symbiosis Finance | Offers cross-chain swaps, liquidity pools, and DeFi integration. |

| THORChain | Decentralized liquidity network; enables cross-chain asset swaps. |

| Jumper Exchange | Fast cross-chain swaps; optimized for low slippage transactions. |

| Portal Bridge | Secure bridging solution; focuses on Ethereum-compatible chains. |

| Rhinofi | Efficient bridging for large transactions; supports multiple assets. |

| Axelar Network | Decentralized communication; connects smart contracts across chains. |

| Router Protocol | Multi-chain liquidity routing; reduces gas costs for swaps. |

| Across Protocol | Fast and secure asset transfers; emphasizes Layer 2 networks. |

| deBridge | Universal cross-chain protocol; supports both assets and arbitrary data. |

1. Synapse Protocol

Synapse Protocol is noted as one of the best bridging aggregators for advanced DeFi strategies because it offers cross-chain DeFi liquidity and efficient asset swapping.

Unlike standard bridges, Synapse works at speed, with low transaction fees, and excellent security.

This allows DeFi users frictionless asset movement across multiple blockchains. Its liquidity pools and smart contract integrations let advanced traders deploy yield optimization, arbitrage, and multi-chain portfolio management strategies.

Interoperability and scalability in the protocol makes it perfect for sophisticated DeFi operations. It offers the flexibility and reliability needed to execute complex cross-chain strategies.

Synapse Protocol Features

- Cross-Chain Transfers: Enables secure and speedy transfers within numerous blockchain networks.

- Low Fees: Economically bridges by optimizing gas costs.

- User-Friendly Interface: Easy and simple for novice and seasoned DeFi enthusiasts.

2. Symbiosis Finance

Symbiosis Finance is regarded as a leading aggregator DeFi bridging interface due to its multi-chain swap and liquidity system.

Its unique integrated DeFi functionalities in addition to seamless token transfers set it apart, allowing users to engage with multiple protocols and yield opportunities in a yield farming multichain ecosystem.

Its architecture facilitates swift, low-fee transactions and enhanced security, optimal for intricate multi-chain strategies.

Traders and developers can utilize Symbiosis Finance to proficiently perform arbitrage, portfolio allocation, and liquidity management spanning multiple blockchains. It is focused on strategic diversity and interoperability, greatly enhancing its appeal to advanced users in DeFi.

Symbiosis Finance Features

- Liquidity Optimization: Captures liquidity in pools for the seamless routing of assets.

- Multi-Chain Support: Effortlessly bridges tokens across key chains.

- Security Measures: Conducts audits and safeguards smart contracts.

3. THORChain

THORChain stands out among aggregators for advanced DeFi strategies due to its fully decentralized liquidity network, enabling direct cross-chain swaps without wrapped assets.

Its unique continuous liquidity pools let users trade native tokens across multiple blockchains, mitigating friction and counterparty risk.

THORChain’s trustless environment enhances the experience for advanced DeFi users by enabling arbitrage, yield optimization, and multi-chain portfolio management.

Seamlessly integrated via low fees and high transaction speeds, as well as layered complex security, THORChain facilitates ecosystem-spanning strategies for developers and traders alike.

It has thus become a fundamental component for users attempting to access genuine cross-chain liquidity within DeFi.

THORChain Features

- Decentralized Liquidity Network: Transfers any asset on any blockchain and swaps it for any other asset without the need for wrapped tokens.

- Fast Transactions: Offers instantaneous swaps for assets in growing support.

- Non-Custodial: Complete control of the funds set to transfer is retained by the users.

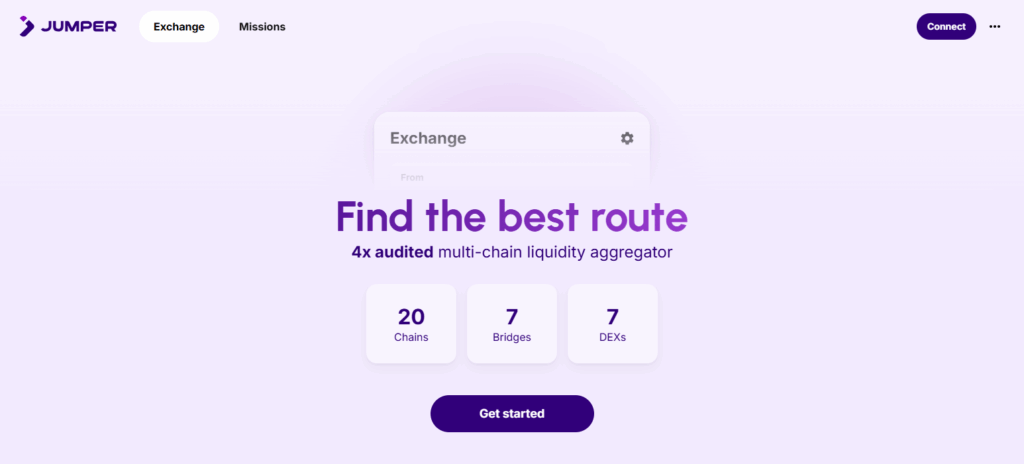

4. Jumper Exchange

Jumper Exchange has specialized in advanced DeFi strategies that focuses on speed and efficient minimal slippage during cross transactions.

This focus on performance has helped it emerge as a leading bridging aggregator in the industry. Routing algorithms track optimized liquidity paths to help users perform as large or complex swaps as possible when it comes to time and expenses.

Through integration across several blockchains and DeFi protocols, Jumper Exchange simplifies inter-chain asset transfers and multi-chain strategy execution.

Advanced traders have access to low latency swaps to perform arbitrage, yield farming, and ecosystem cross diversification. Jumper has integrated crypto security practices to provide user friendly infrastructure to sophisticated DeFi users that need efficient and flexible cross-chain solutions.

Jumper Exchange Features

- Aggregator Functionality: Efficiently routes across numerous bridges.

- Cost Efficiency: Charges the lowest fees for seamless cross-chain swaps with minimal slippage.

- Multi-Asset Support: Transact with various tokens on different networks.

5. Portal Bridge

Portal Bridge is a premier bridging aggregator for custom DeFi strategies and fosters security and interoperation across different blockchains.

Its architecture allows for rapid and reliable movement of both tokens and data which is ideal for DeFi activities that span across multiple chains. For more advanced users, Portal Bridge allows for Layer 2 frictionless integrations and route optimized transactions to reduce overall costs and fees.

DeFi traders and developers can use its reliable and efficient capabilities to help with liquidity management, arbitrage, and executing multi-chain strategies. The Portal Bridge’s reliability, efficiency, and security features makes it a popular option for seamless cross-chain financial activities.

Portal Bridge Features

- Cross-Chain Messaging: Efficiently transfers and bridges tokens along with other chains.

- Layer-2 Integration: Integrated with Ethereum Layer-2 for expedited shifts.

- Reliable Security: Smart contracts are used to secure user funds.

6. Rhinofi

Rhinofi facilitates DeFi strategies with advanced bridging aggregation tailored for high-volume and high-efficiency transfers. It’s unique architecture enables minimal slippage alongside slippage-optimized routing and is tailored for complex multi-chain executions.

Rhinofi boasts support for numerous asset classes and is compatible with major DeFi protocols for optimized funds, advanced liquidity management, active arbitrage, and yield strategies.

Performant transaction processing with strong security and integrity makes Rhinofi a multi-chain strategy DeFi solution. Rhinofi is positioned in the top bridging solutions for their unmatched precision and confident interoperability on cross-chain DeFi strategies.

Rhinofi Features

- Fast Settlements: Near-instant bridging of assets.

- Multi-Chain Connectivity: Ethereum, BSC, Polygon, and others.

- User-Focused Interface: Manages assets across blocks simply.

7. Axelar Network

Axelar Network prides itself as a bridging aggregator for sophisticated DeFi strategies to enable secure decentralized communication between blockchains.

In contrast to traditional bridging techniques, Axelar allows smart contracts to communicate freely across several chains. This allows users to perform sophisticated DeFi works without any third-party service.

Axelar’s proprietary protocol guarantees fast, consistent transfer of messages and assets, thus easing friction of multi-chain strategies.

Advanced users can access Axelar for arbitrage, liquidity management, and cross-chain yield optimization at limited risk. Axelar Network has interoperability, scalability, and strong security, thus providing complex DeFi users with a solid foundational framework.

Axelar Network Features

- Interoperability: Connects disparate blockchain ecosystems.

- Developer-Friendly: Offers APIs for DeFi app cross-chain integration.

- Secure Protocol: Cross-chain message routing with end-to-end encryption.

8. Router Protocol

Router Protocol is the primary bridging aggregator concerning sophisticated DeFi strategies on account of the innovative multi-chain liquidity routing system that streamlines transfers on multiple blockchains.

Their expertly designed technology routes swaps on the most optimal paths, eliminating fees and slippage, and boosting speed. Users can utilize cross-chain arbitrage on several DeFi protocols for seamless yield farming and nuanced portfolio diversification.

The security, reliability, and scalability of Router Protocol also empower advanced users to manage liquidity and assets confidently. Their unmatched efficiency and flexibility set Router Protocol apart as the premier Nascent DeFi Operations solution.

Router Protocol Features

- Cross-Chain Liquidity: Efficient aggregation for token transfers.

- Multi-Network Support: 15+ networks for asset bridging.

- Fast Execution: Cost and delay benchmarking for routing.

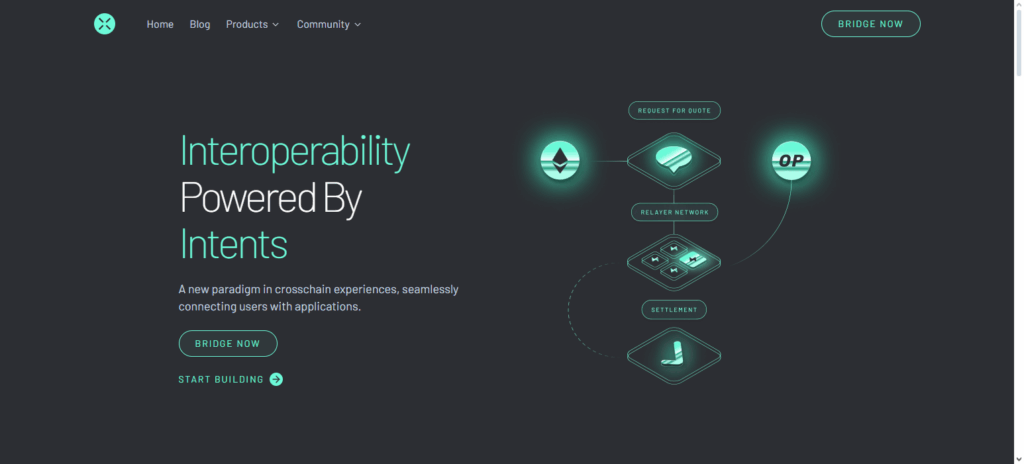

9. Across Protocol

Across Protocol is among the fastest bridging aggregators of DeFi strategies due to a focus on speed, security, and Layer 2 optimization. Its design allows users to shift assets across chains quickly while keeping gas fees low, and is therefore well suited for advanced multi-chain operations.

Across Protocol handles high value transactions with low risk and low slippage, and therefore allows sophisticated traders to execute arbitrage, liquidity management, and yield optimization in a timely manner.

Because of its cross-chain interoperability, rapid settlement, and stringent security, Across Protocol allows DeFi users to execute advanced strategies with ease. For its effectiveness and dependability, Across Protocol is a leading choice for advanced DeFi users.

Across Protocol Features

- Optimized Transfers: Bridging gas fee and slippage reduction.

- Time-Efficient: Cross-chain asset movement with little delay.

- Multi-Chain Compatibility: Ethereum, Optimism, and Arbitrum.

10. deBridge

DeBridge is a leading bridging aggregator for enhanced DeFi techniques due to its genuinely universal cross-chain solution that facilitates any type of asset transfer and any type of arbitrary data.

Its protocol allows unparalleled blockchain interactivity so that advanced users can perform complex multi-chain operations with the utmost ease. DeBridge minimizes the friction to liquidity management arbitrage and yield optimization with fast, ultra-low-cost transactions coupled with strong security protocols.

Its ability to perform advanced token and smart contract interactions makes deBridge ultra-appealing to high-end DeFi users. The combination of these features makes deBridge the premier choice for advanced cross-chain finance.

deBridge Features

- Composable Bridges: Seamlessly integrate multiple blockchains and DeFi protocols.

- Flexible Transactions: Supports token, and NFT transfers.

- Secure and Audited: Third-party audits, alongside internal security protocols.

Pros & Cons Top Bridging Aggregators for Advanced DeFi Strategies

Pros

- Efficiency: Outstanding in locating the optimal quickest path for cross-chain transfers.

- Cost-Effective: Outstanding in lowering the transaction gas fees and slippage.

- User Friendly: Outstanding in bridging the gap and simplifying complex bridging concepts for novices and experts.

- Multi-Network Support: Outstanding in enabling seamless transfers of blockchain assets over different chains.

- Enhanced Strategy Execution: Outstanding in assisting in the sophisticated DeFi strategies like yield farming and arbitrage.

- Security Features: Top-notch aggregators have advanced protective measures to safeguard the funds.

Cons

- Smart Contract Risks: Possible risks and issues to do with the aggregator or the bridge contracts.

- Limited Token Support: Possible chances not all tokens will be supported by some aggregators.

- Network Congestion: Possible chances of the chains that have high traffic getting congested and slowing down.

- Fees Can Vary: Possibilities of gas fees skyrocketing due to high demand and over-crowded traffic.

- Learning Curve: Advanced DeFi strategies that require deeper understanding of the ecosystem.

Conclusion

Bridging aggregators are important in advanced DeFi strategies assisting in transferring tokens across different chains.

They streamline transactions for quickness, cost savings, and dependability, assisting users in accessing optimal pathways with minimal fees and slippage.

Utilizing these platforms enables traders, developers, and DeFi users to better implement complex strategies, extend their activities across dozens of chains, and improve portfolio efficiency.

For any user operating within the multi-chain DeFi world, using the best bridging aggregators is necessary to ensure optimal performance, security, and ease in cross-chain activities.

FAQ

It reduces transaction fees, minimizes slippage, and ensures faster, more reliable cross-chain transfers.

Popular aggregators include LI.FI (Jumper), Rango, Rubic, deBridge Router, Rhino.fi, Socket (Bungee), XY Finance, Squid Router, MetaMask Bridges, and Symbiosis Finance.

Yes, top aggregators implement robust security measures, but users should always double-check network compatibility and contracts.