The Top On-Chain Asset Management Vaults (ETF 2.0), the next development in decentralized finance, will be covered in this article.

These vaults give investors visible, safe, and effective means to increase their cryptocurrency holdings by automating risk management, yield optimization, and portfolio management directly on-chain.

We’ll examine the top platforms that are transforming cryptocurrency investing, from Enzyme Finance to Karpatkey Vaults.

How To Select On-Chain Asset Management Vaults (ETF 2.0)

Security & Audit History

Engage only vaults that have the smart contracts verified and audited. Vaults that track their hacks and vulnerabilities are the most secure.

Yield Performance

Evaluate the vaults performance and the yield over time. Consistent yield will always be better than high yield for a a short term.

Strategy Transparency

Ensure that the vault is open with it’s strategies and how it’s managing the risk. This vault is likely to pass.

Supported Assets & Diversification

More vaults means better risk management and better diversification. This results in a better overall performance to the portfolio.

Fees & Costs

Less fees means maximal net returns. Advanced strategies may have a higher fees, and these can be justified.

Automation & Ease of Use

The best vaults for passive investors will be the ones with automation of the rebalancing, the compounding, and the yield optimization.

Community & Governance

Evaluate the vault’s community and the governance. Governance of the community results in better vaults as they are better adapted to the market.

Reputation & Reviews

Examine reviews from customers and DeFi analysts. Reliable and reputable platforms are less risky and offer greater confidence in your investment.

Key Point & Top On-Chain Asset Management Vaults (ETF 2.0) List

| Vault | Key Point |

|---|---|

| Enzyme Finance (MLN) | A decentralized asset management platform enabling users to create, manage, and invest in fully customizable on-chain funds. |

| Sommelier Finance | Provides automated DeFi strategies with yield optimization, combining liquidity management and trading execution for maximum returns. |

| Yearn Vaults | Offers automated yield farming strategies, optimizing users’ crypto assets across multiple protocols with minimal manual intervention. |

| Balancer Smart Pools | Allows flexible, self-balancing liquidity pools that adapt to market conditions while earning fees and yield for users. |

| Ribbon Finance | Focuses on structured DeFi products, including options and yield strategies, to enhance returns and reduce risk. |

| Bitwise Onchain Vaults | Tokenizes professionally managed portfolios, offering diversified, automated exposure to crypto assets with transparency. |

| dHEDGE | Non-custodial asset management platform leveraging synthetic assets, allowing investors to follow skilled managers’ strategies. |

| Ondo Finance | Provides structured products and vaults for risk-adjusted yield, combining stable income with innovative DeFi strategies. |

| Karpatkey Vaults | On-chain vaults focused on multi-strategy yield optimization, allowing investors to access professional-grade portfolio management. |

1. Enzyme Finance (MLN)

Users can create, administer, and invest in completely customized on-chain funds using Enzyme Finance (MLN), a decentralized protocol.

It provides total transparency, enabling investors to monitor fund plans in real time without the need for middlemen. Fund managers can create automated methods for risk management and yield optimization using the platform, which covers a variety of asset classes.

Top On-Chain Asset Management Vaults (ETF 2.0), such as Enzyme Finance, enable professional and retail investors to directly access institutional-grade fund management on-chain, bridging the gap between decentralized and traditional finance.

Enzyme Finance (MLN) Features, Advantages & Disadvantages

Features:

- On-chain fund management is fully decentralized

- Custom strategies can be built

- Fund tracking and transparency in real time

- DeFi protocols integration

- Automated portfolio and risk management

Advantages:

- Intermediaries can control and manage funds

- Funds can be managed in a very transparent manner and audit is very easy.

- Strategy flexibility can be catered for retail and also for professional investors.

- Unrestrained access for diversified opportunities in DeFi

- Oversights and errors caused manually eliminated

Disadvantages:

- Adept knowledge of DeFi is a must for best results

- Some smart contracts have possible risks, even after auditing

- Assets that are off-chain are poorly supported

- Depending on fund strategy there are possible fees

- Even with market volatility there are impacts on money you can expect back

2. Sommelier Finance

Sommelier Finance combines trading, liquidity management, and yield optimization with automated DeFi strategy execution. In order to maximize profits while minimizing manual labor, users can allocate funds into dynamic strategies that automatically adapt to shifting market conditions. Its methodology effectively captures high yields by integrating with key DeFi platforms.

For cryptocurrency investors looking for expert portfolio management, top On-Chain Asset Management Vaults (ETF 2.0) like Sommelier Finance offer a smooth experience, guaranteeing security and performance while lowering operational complexity for users seeking strategic but passive involvement in the DeFi ecosystem.

Sommelier Finance Features, Advantages & Disadvantages

Features:

- Strategies in DeFi for Auto execution.

- Management of liquidity that is adjustable

- Bots for trading and the integration of others

- Yield optimization on different protocols

- Transactions that suffice in gas

Advantages:

- Automated strategies increase and optimize returns

- No more work manually for investors

- Trading of complex

- Different platforms in DeFi supported seamless

- Processes that can be audited and are transparent

Disadvantages:

- Some players may be new and the complexity is very high.

- Profits in DeFi can be lost and there is no other option.

- Gas costs on some networks.

- Fewer asset types than competing vaults.

- Possibility of impermanent loss on liquidity strategies.

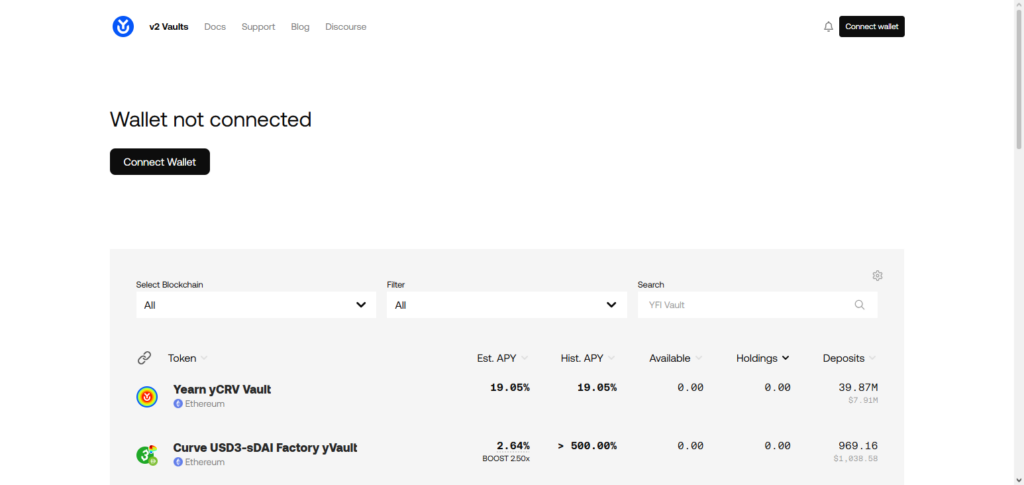

3. Yearn Vaults

By distributing user assets over several DeFi protocols, Yearn Vaults automate yield farming and maximize profits without requiring ongoing supervision. Every vault employs algorithmic techniques intended to reduce risk and increase profit.

Tokens are deposited by users, and the vaults take care of lending, staking across platforms, and providing liquidity. Top On-Chain Asset Management Vaults (ETF 2.0), like as Yearn Vaults, have transformed cryptocurrency passive income by enabling users to effectively generate large dividends.

Even tiny investors can profit from sophisticated DeFi methods that were previously only available to institutional players thanks to the vaults’ smart contracts, which automatically handle compounding returns.

Yearn Vaults Features, Advantages & Disadvantages

Features:

- Automated

yield farming strategies. - Dispersed asset allocation across various DeFi protocols.

- Compounding returns.

- Vaults with strategies for specific tokens.

- Governance through YFI tokens.

Advantages:

- Investment strategy is hands-free making it attractive for passive investors.

- Expected high yields across DeFi platforms.

- Execution is on-chain and transparent.

- Strategies are community-driven.

- Diversification across strategies is offered.

Disadvantages:

- Smart contract risk.

- Experienced users are preferred.

- Some strategies can underperform in a volatile market.

- Net yields can be affected by gas fees.

- A trust in community-led governance is required.

4. Balancer Smart Pools

Investors can establish self-balancing liquidity pools with Balancer Smart Pools, which dynamically modify token weights and allocations based on market conditions. These pools maximize asset exposure and yield while collecting fees from trades.

In contrast to single-asset methods, users can engage in diversified pools, which lowers risk. Leading On-Chain Asset Management Vaults (ETF 2.0), such as Balancer Smart Pools, combine DeFi yield farming with automated portfolio rebalancing to reduce user intervention and increase investor exposure to a variety of assets.

This novel strategy guarantees ongoing optimization for liquidity providers and improves capital efficiency.

Balancer Smart Pools Features, Advantages & Disadvantages

Features:

- Automated liquidity pooling for self-balancing pools.

- Adjustable token ratio allocation.

- Automated portfolio rebalancing.

- Liquidity providers earn fees.

- DeFi protocol integration.

Advantages:

- Portfolio optimization without manual intervention.

- Liquidity Providing earns fees.

- Decreasing manual asset management.

- Multi-token diversification is supported.

- Transparency and openness are available.

Disadvantages:

- The risk of impermanent loss.

- Am understanding of an Automated Market Maker is required.

- Pool adjustments incur gas costs.

- Returns can be damaged by a downturn in the market.

5. Ribbon Finance

Ribbon Finance specializes in structured DeFi solutions that maximize returns while reducing risk, such as options and yield-enhancing tactics.

Assets can be deposited by users into vaults that automatically carry out complex financial strategies, like managing options expirations or selling covered calls. Top On-Chain Asset Management Vaults (ETF 2.0) like Ribbon Finance give cryptocurrency investors access to structured income instruments and derivatives that were previously only available in institutional markets.

The platform is perfect for customers who desire higher yields and strategic risk management without having to actively trade or keep an eye on complicated DeFi instruments because it provides transparent and secure implementation of advanced methods.

Ribbon Finance Features, Advantages & Disadvantages

Features:

- Structured products of DeFi

- Vaults for Options and Derivatives

- Yield enhancement automated

- Strategies that are managed for risk

- On-chain execution that is transparent

Advantages:

- Optimized returns with controlled risk

- Access to advanced DeFi instruments

- Strategies that are fully automated

- Execution that is transparent and can be audited

- Great for those who invest with a focus on yield.

Disadvantages:

- Complexity might discourage newcomers

- Results can be affected by changes in the market

- Assets supported are limited at the start

- Risks associated with smart contracts

- Fees are charged for specific strategies

6. Bitwise Onchain Vaults

Bitwise Onchain Vaults offer automatic, diversified exposure to a variety of digital assets by tokenizing expertly managed cryptocurrency portfolios. Investors retain control over their assets and on-chain transparency while receiving institutional-grade management.

The vaults use smart contracts to carry out risk reduction, yield farming, and rebalancing. Retail users can access carefully chosen, expertly managed portfolios without the need for middlemen thanks to Top On-Chain Asset Management Vaults (ETF 2.0), such as Bitwise Onchain Vaults.

This method guarantees that users can profit from both automated strategy execution and diversification inside a safe, decentralized framework, democratizing high-quality crypto asset management.

Bitwise Onchain Vaults Features, Advantages & Disadvantages

Features:

- Portfolios that are managed professionally and tokenized

- Rebalancing that is automated

- Multi-asset exposure

- On-chain transparent management

- DeFi Protocols Integration

Advantages:

- Access to management of professional-grade portfolios

- Risk is reduced by diversification

- Automation of compounding that increases

- Transparency on the chain

- Retail users will find investing less daunting

Disadvantages:

- Individual assets are controlled less

- Risk of smart contracts and protocols

- The net yield is reduced by management fees

- Underperformance in volatile markets of some strategies

- Dependent on the performance of the professional managers

7. Ondo Finance

Using synthetic assets, dHEDGE is a non-custodial asset management platform that lets investors follow the strategies of knowledgeable managers. Users maintain complete control over their money while utilizing professional expertise to maximize profits.

The platform offers automated and transparent management by integrating with DeFi protocols for trading, lending, and staking. Leading On-Chain Asset Management Vaults (ETF 2.0) such as dHEDGE enable users to safely and effectively access expert techniques on-chain.

It is a great option for investors who want guided exposure to intricate DeFi chances without losing control of their money because of its performance tracking, risk metrics, and reward systems, which guarantee both accountability and significant returns.

dHEDGE Features, Advantages & Disadvantages

Features:

- Your assets are managed in a way that is non-custodial

- Strategies of skilled management are followed

- Integration of synthetic assets

- Trading and yield automation

- Visible performance tracking

Advantages:

- Complete fund ownership.

- Profiting from the execution of expert strategies.

- Informed decisions due to the risk metrics.

- Available to retail and professional investors.

- Effortless and automated distribution of assets.

Disadvantages:

- Dependent on the skill of the managers being followed.

- Risks from Smart contracts and DeFi protocols.

- Restrictions to synthetic assets that are supported.

- Gas costs may decrease the profit.

- Possible subpar performance of strategies.

8. Ondo Finance

Ondo Finance provides risk-adjusted yield-focused vaults and structured solutions. Its platform blends cutting-edge DeFi techniques, like tranche-based investment products that divide risk and reward among users, with reliable income schemes.

Investors can take advantage of automated execution and portfolio management while selecting strategies that suit their risk tolerance.

Top On-Chain Asset Management Vaults (ETF 2.0), like Ondo Finance, give consumers access to advanced DeFi instruments that maximize profits while upholding confidentiality and transparency. Both cautious and growth-oriented investors can take part in superior on-chain asset management methods because to the vaults’ effective handling of several risk layers.

Ondo Finance Features, Advantages & Disadvantages

Features

- Risk tranches structured products

- Automated yields with risk-adjusted strategies

- Focus on steady income

- DeFi multi-layered integration

- Execution of smart contracts is transparent

Advantages

- Risk-adjusted return is good for conservative investors

- Less manual effort due to automation

- Strategies are auditable and transparent

- Advanced DeFi products available

- Balanced and yield-oriented portfolios are supported

Disadvantages

- Few options with high risk and high returns

- Can be hard for beginners due to the complexity

- Stays dependant on the integrated protocols

- Lack of smart contract security

- Less liquidity due to lock-in periods

9. Karpatkey Vaults

With a focus on multi-strategy yield optimization, Karpatkey Vaults give investors immediate on-chain access to professional-grade portfolio management.

In order to optimize profits, the vaults dynamically modify how they deploy assets across loan, staking, and liquidity procedures. Diversification, automated compounding, and risk management without human supervision are all advantageous to users.

Prominent On-Chain Asset Management Vaults (ETF 2.0) such as Karpatkey Vaults guarantee institutional-quality performance for both professional and retail investors.

These vaults offer a smooth transition between conventional asset management techniques and the decentralized, automated possibilities of DeFi by making complex investment strategies accessible through transparency and full on-chain execution.

Karpatkey Vaults Features, Advantages & Disadvantages

Features

- Yield optimization with multiple strategies

- Automated rebalance across protocols

- Crypto exposure diversification

- Integrated risk management

- Transparency on chain

Advantages

- Portfolio management of institutional quality to retail clients

- Less manual effort and monitoring

- Maximized returns by automated compounding

- Smart contracts are transparent and can be verified.

- Compatible with multiple DeFi protocols.

Disadvantages:

- Difficult for newcomers to understand.

- Risks with smart contracts and protocols.

- Performance changes with the state of the market.

- Fees can eat into your total profits.

- Must trust the vault management strategies.

Conclusion

The next development in decentralized finance is represented by Top On-Chain Asset Management Vaults (ETF 2.0), which bridge the gap between blockchain-based automation and conventional asset management.

Enzyme Finance, Yearn Vaults, Balancer Smart Pools, and other platforms provide investors with automated, transparent, and extremely effective ways to maximize returns with the least amount of human involvement.

Both professional and retail users can safely engage in intricate DeFi strategies thanks to these vaults, which democratize access to sophisticated portfolio management.

ETF 2.0 vaults are revolutionizing the way investors manage cryptocurrency assets by fusing yield optimization, risk management, and on-chain transparency, making professional-grade techniques available to everybody.

FAQ

On-Chain Asset Management Vaults (ETF 2.0) are decentralized platforms that automate portfolio management, yield farming, and investment strategies directly on the blockchain. They allow investors to earn optimized returns while maintaining transparency and control of their assets without intermediaries.

These vaults use smart contracts to deploy assets across DeFi protocols, rebalance portfolios, and execute yield strategies automatically. Users deposit tokens, and the vault handles strategy execution, compounding, and risk management on-chain.

While top vaults like Enzyme Finance, Yearn Vaults, and Ribbon Finance are audited and highly secure, all DeFi platforms carry some risk, including smart contract vulnerabilities and market volatility. Investors should always conduct due diligence.

These vaults are designed for both retail and professional investors. Anyone with a crypto wallet can deposit assets and access sophisticated strategies that were previously limited to institutional investors.

Key benefits include automated yield optimization, reduced manual management, portfolio diversification, access to complex strategies like options or derivatives, and complete on-chain transparency.