I will discuss TradingFunds in this article. The platform provides traders with access to real capital without needing to risk their money. The platform has many account options. From instant funding to evaluation challenges to instant funding.

The platform has colaborated with advanced trading tools to help traders manage their risk while providing an opportunity to share in profits. TradingFunds helps traders of all skill levels to grow their trading abilities and earn profits.

What is TradingFunds?

For traders who wish to access actual trading capital without having to risk their own money, TradingFunds is a cutting-edge platform. It offers funded trading accounts, enabling novice and seasoned traders to hone their abilities in a low-risk setting.

Before being granted access to capital for actual trading, traders must pass an evaluation process to demonstrate their approach and consistency. To promote expansion and profitability, the platform provides sophisticated trading tools, risk management systems, and educational materials.

TradingFunds connects ambitious traders with professional-level prospects through customizable account sizes, profit-sharing models, and attentive support.

Key Point

| Category | Details |

|---|---|

| Platform Name | TradingFunds |

| Founded | 2022 |

| Type | Funded Trading Platform / Proprietary Trading |

| Target Users | Beginner and Experienced Traders |

| Account Types | Funded Accounts with Various Capital Sizes |

| Trading Instruments | Forex, Stocks, Cryptocurrencies (depending on platform availability) |

| Profit Model | Profit-Sharing between Trader and Platform |

| Evaluation Process | Traders complete a challenge to prove consistency and strategy |

| Risk Management | Structured rules and limits to minimize losses |

| Tools & Features | Advanced trading tools, charts, analytics, and educational resources |

| Customer Support | Email, Live Chat, Tutorials, FAQs |

How To Set Up TradingFunds?

Step 1 – Create an Account

- Go to TradingFunds’ official website.

- Press the “Sign Up” or “Register” button

- Enter all necessary personal information like full name, email address, contact information, etc.

- Click on the link in your email to confirm your email address and activate your account

Step 2 – Complete your Profile

- If necessary, add the identification documents.

- Enter your trading experience and the required information on your preferred trading instruments and level of risk.

Step 3 – Choose an Account Plan

- Choose a size of the funded account that matches your trading experience.

- Go through the terms and conditions especially the profit-sharing and trading policies.

Step 4 – Evaluation Process

- Show your trading skills on a demo or challenge account.

- Abide by all risk management policies and fulfill the profit target set by the platform.

Step 5 – Approvals

- As soon as you finish your evaluation, TradingFunds will approve your account.

- Then, you will have access to real trading capital.

Step 6 – Go Live

- With the trading platform that was assigned to you, start making trades and use the trading tools that were given to you.

- Follow the platform rules and monitor your trading performance.

TradingFunds Account Types and Pricing Structure

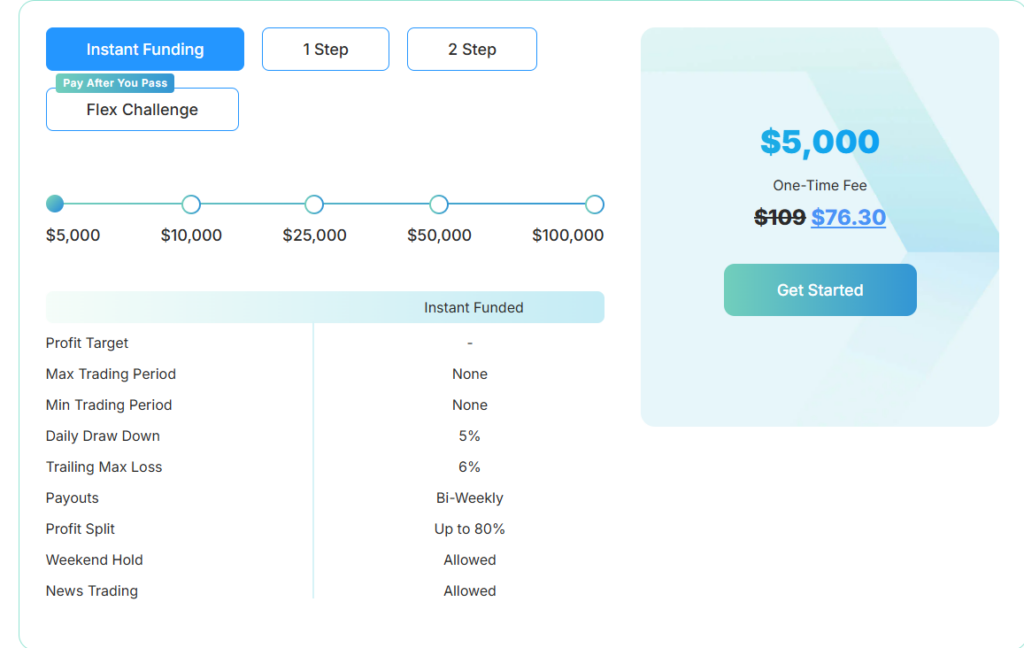

Instant Funding Accounts

As one of the unique features of the Instant Funding option, traders can bypass the evaluation process and gain immediate access to funded accounts.

These accounts can be purchased for $81.75 for the $5,000 account (originally $199, now discounted to $81.75) to $899.25 for the $100,000 account (originally $1,199, now discounted to $899.25).

All accounts have a 5% loss daily drawdown limit, 6% trailing max loss, business news trading, and 80% to 100% profit cut split ownership. Payouts for the accounts are on a bi-weekly roll.

One-Step Challenge Programs

The One-Step Challenge Programs consist of pieces of instant funding and standard evaluations. Evaluation fees for $5,000 and $10,000 accounts start at $44.25 and costs go as far as $366.75 for larger accounts.

All account sizes from $5,000 to $100,000 can fall into this category. The guidelines for these accounts are a standard 10% profit over a 4 days minimum opening on the account.

The added risk is a 4% daily drawdown loss and an 8% trailing max loss. All participants to these programs can earn a fully funded account, have a profit split of 80% and payouts on a bi-weekly schedule.

Two-Step Challenge Programs

The Two-Step Challenge offers the opportunity to earn profit split accounts with the same pricing and account sizes. Phase 1 costs $44.25 and accounts can be between $5,000 and $100,000. In both phases, traders must complete a 6% profit target, and maintain a minimum of three days of trading.

The risk parameters include a 5% daily drawdown, and an 8% static max loss. Once both phases are complete, traders are allocated an 80% profit split, bi-weekly payouts, and unfettered trading access.

Flex Challenge Option

The Flex Challenge does not have a challenge, and evaluation fees are as low as $9 regardless of the account size due to a pay after you pass structure.

Account size to choose from are $5,000 to $100,000, with the evaluation fee only paid after the challenges are complete. The financed account pricing starts at $66 and $791, respectively.

How TradingFunds Works

Sign Up and Registration: When you want to trade on TradingFunds for the first time, you will have to provide your credentials, including your name and trading experience .

Choose an Account Plan: Funded accounts offer competitive payment plans, so select the account which is trading experience and payment flexibility best suited to you .

Evaluation: All controllers have to finish a total Evaluation Trading, where you will have to show your trading strategy, the management of the trading risk, and the trading performance, so you have to have an evaluated trading strategy to execute .

Approval and Funding: After you finish the evaluation, The funded account will be opened to you to manage an actual capital trade, so you will have to manage the trade in your risk and strategy .

Start Trading: When you manage the capital, you will have to use the platforms management, and resources for your trading while you manage your risk .

Profit Sharing: Based on the profit distribution of TradingFunds, you will receive a percentage of the profits you consolidate to the TradingFunds .

Withdrawals: Based on the established conditions and policies of the trading platform, you will be able to take out your earned profit.

Benefits of Using TradingFunds

Trade Without Personal Risk

Use company money to enter the markets with your own capital.

Skill Development

Practice your strategy to perfection in a safe environment.

Advanced Tools

Use top of the line trading tools and get access to premium analytics and resources.

Flexible Account Options

Experience various account sizes along with different financing arrangements to choose whichever fits your bill best.

Profit Opportunities

You get to trade with a funded account and keep a portion of the profits you make.

Structured Risk Management

Follow the outlined rules to limit drawdown and keep the account viable.

Support and Education

Utilize all educational resources for free, get feedback to sharpen your strategy, and get customer support to answer all your questions.

Trading Rules and Risk Management

Daily Drawdown Limit

Every day, regardless of gain or loss, there will be a maximum limit on how much money can be lost in a day. This amount is generally set in the range of \4 to \5 of the account.

Maximum Loss Limit

There is a trailing or static maximum loss of 6/7.5/8 \% of the account. This is in place to protect the account from large drawdowns.

Minimum Trading Days

Some account programs have a requirement to lose under the daily drawdown for a minimum of 3 to 4 days in order to be considered consistent.

Profit Targets

There is a Profit Target in place for the evaluation or challenge phases to be able to qualify for fully funded accounts.

Position Sizing

There are specific rules in place that dictate how large of a trade can be made in order to mitigate the higher risk from over-leveraging.

Weekend & News Trading

Some accounts allow for holding over the weekend and news trading while many others have a restriction on that.

Account Monitoring

There is always account monitoring in order to ensure that all rules stipulated are being followed. If a trader is in violation of one of the account rules, there may be account reset or even terminated completely.

Risk Management Tools

Risk management is in place in the system and includes stop-loss orders, trailing stops, and trade alerts to mitigate risk.

TradingFunds Fees and Commissions

| Fee Type | Details |

|---|---|

| Instant Funding Accounts | $81.75 for $5,000 (discounted from $199) up to $899.25 for $100,000 (down from $1,199) |

| One-Step Challenge | Evaluation fees from $44.25 (smallest account) to $366.75 (largest account) |

| Two-Step Challenge | Phase 1 evaluation starts at $44.25; Phase 2 pricing varies by account size |

| Flex Challenge | $9 initial fee; remaining evaluation fee paid only after passing; funded account cost $66–$791 depending on size |

| Profit Sharing | Up to 80% of profits goes to the trader, depending on the account program |

| Withdrawal Fees | Typically minimal; depends on payout schedule and method |

| Deposit Fees | Varies depending on payment method; usually standard processing charges apply |

TradingFunds Platforms

| Platform Name | Availability | Key Features / Notes |

|---|---|---|

| TradeLocker | Supported by TradingFunds | Main trading platform used by TradingFunds for funded accounts; integrates tools and real‑time market data. |

| TradingView Integration (Charts) | Available via TradeLocker | Provides advanced charting within the TradeLocker environment (no direct MT4/MT5). |

| MT4 / MT5 Platforms | Not available on TradingFunds | Unlike many other prop firms, TradingFunds does not support MetaTrader 4 or 5 for trading. |

Key Features of TradingFunds

Funded Trading Accounts

TradingFunds gives you real-life money to trade with, so you won’t have to finance any of the trades with your own money.

Low-Risk Environment

Thanks to the rule structure and risk management, traders will always have the lowest amount of risk possible.

Advanced Trading Tools

Trading with informed decisions is possible with professional trading charts, analytics, and indicators.

Profit Sharing Model

If you are successful, you earn a percentage of the money you made from your trades.

Flexible Account Sizes

New traders and experienced traders are both accommodated with different levels of funding.

Evaluation Process

Traders are funded after they consistently show they can trade at a profitable level.

Educational Resources

There are many different support options to help traders improve their trading strategies.

Responsive Customer Support

If you have any questions regarding your account, there is a support team to help you.

Pros and Cons of TradingFunds

| Pros | Cons |

|---|---|

| Access to real trading capital without risking personal funds | Evaluation process may be challenging for beginners |

| Opportunity to earn profits through funded accounts | Profit-sharing reduces total earnings compared to full ownership |

| Low-risk trading environment with structured rules | Some account plans may have limited flexibility |

| Advanced trading tools and analytics | Withdrawal rules may have restrictions or delays |

| Flexible account sizes suitable for all experience levels | Requires consistent performance to maintain funding |

| Educational resources and customer support available | Not all strategies may be allowed under platform rules |

Customer Support and Community

| Category | Details |

|---|---|

| Live Chat Support | Real‑time chat available on the website for quick assistance. |

| Email Support | Contact via for queries and help. |

| Contact Form | Submit inquiries through the official website contact form. |

| Support Hours | Typically available from 09:00 AM to 6:00 PM CET. |

| Social Media Community | Active presence on Facebook, Instagram, and Twitter for updates and engagement. |

| FAQ / Knowledge Base | Comprehensive FAQ and knowledge resources available online to answer common questions. |

| Trader Feedback | Traders often praise responsive support and helpful agents in reviews. |

Conclusion

TradingFunds gives traders real trading capital with little capital at risk on their part. Overall account programs such as Instant Funding, One-Step, Two-Step, and Flex Challenges allow traders with different levels of expertise and goals to access the functionality of the different programs.

The platform includes advanced trading aids, risk management, and instruction. TradingFunds has an excellent reputation characterized by competitive profit splits, customizable account sizes, and outstanding customer service. TradingFunds is a great option for those seeking to build their trading skills to profitability and want the leverage of a low risk, well managed.

FAQ

TradingFunds is a proprietary trading platform that provides traders with funded accounts after completing an evaluation or via instant funding options, allowing them to trade real capital without risking their own money.

You can obtain funding by passing one of the available programs—Instant Funding, One‑Step Challenge, Two‑Step Challenge, or Flex Challenge—each with specific profit targets and risk rules.

TradingFunds typically supports a range of instruments depending on the program, such as forex, indices, commodities, and cryptocurrencies. Specific availability may vary by account type.