What Is Crypto Exchange ?

The term “crypto exchange,” which stands for “cryptocurrency exchange,” refers to a digital marketplace where users may purchase, sell, and exchange cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others for fiat currency like US dollars or euros.

Like a typical stock exchange, a cryptocurrency exchange allows buyers and sellers to trade equities. On a crypto exchange, individuals trade digital currencies rather than equities.

To make trading easier, cryptocurrency exchanges provide a range of trading pairs as well as numerous features like market and limit orders, stop-loss orders, and other trading tools. Some exchanges additionally offer other services including access to real-time market data and digital wallets for storing cryptocurrency.

Cryptocurrency exchanges can in a variety of forms, such as centralized, decentralized, and peer-to-peer exchanges. Each offers a different set of features and advantages, but they all give consumers a way to access and engage with the cryptocurrency market.

What Is Uniswap Crypto Exchange ?

Uniswap is one of the most popular cryptocurrency decentralized exchanges (DEXs), launching in November 2018. It pioneered the automated market maker (AMM) model, instead of the traditional order book-based used by exchanges. Uniswap runs on the Ethereum blockchain and uses a number of smart contracts to securely swap ERC-20 tokens between users.

Uniswap Crypto Exchange Quick Facts

| Exchange Name | Uniswap |

| Exchange Service | Spot and futures trading |

| Exchange Launch Year | November 2018 |

| Made In | New York City |

| Mobile App | Android & IOS |

| Fiat Option | Available |

| KYC | Required |

| 2FA Security | Available |

| Referral Program | Not Allowed |

| Support | Email & Live Chat Option Available |

| Official Website | Click Here To Visit |

How To Register At Uniswap Exchange?

To register on Uniswap , click Register Now button at the top of the page. You can also start creating an account directly through the form on the main page.

You only need to enter your e-mail and come up with a password. If there is a referral code, it is also entered at this stage. Password requirements: at least 8 characters, numbers, upper and lower case.

Click ” Create Account ” then go to your email to verify it. Enter the code you received and registration is complete. You can start replenishing your account.

Uniswap Exchange Supported Countries

Uniswap Exchange is a cryptocurrency exchange that supports users from various countries around the world. However, the availability of services may vary depending on the location of the user.

Exceptions are the US, China, Japan and countries in the Middle East. Syria and North Korea are also countries whose nationals cannot trade on Uniswap .

How To Verify Your Uniswap Cryptocurrency Account ?

There is no mandatory verification at Uniswap , but you can pass it if you wish. At the moment, the only restriction imposed on unverified users is the withdrawal limit of Free. In the future, depending on the actions of regulatory authorities, conditions may change.

For verification, you can use one of four documents to choose from: passport, driver’s license, identity card or residence permit. Artificial intelligence is used to evaluate the authenticity of documents. This service is provided by the Onfido online identification service, already used by the Uniswap , Revolut platforms.

How To Buy Crypto Or Deposit Crypto At Uniswap Crypto Exchange?

There are two main options for topping up your balance on Uniswap . Firstly, you can buy cryptocurrency with a bank card – it’s fast and convenient. Go to the ” Buy crypto ” -> ” Buy crypto with a credit card ” section.

Choose a cryptocurrency (currently there are 13 coins available for purchase in this way). Enter the amount and select the fiat currency to be used for payment.

After that, you will need to select a payment channel: each of them has conditions. You can choose between Simplex, Mercuryo, Banxa and Moonpay. Click ” Buy ” next to the appropriate option.

Agree to the terms and confirm the transition to the site of the payment provider. Enter information about the card and its owner, confirm the transaction. Cryptocurrency will be credited to the exchange account within a few minutes.

Second Method

You can transfer digital assets to the balance of the exchange from any external crypto wallet. For this:

- Go to the “Deposit” section from the “Assets” menu.

- From the drop-down list, you can select the cryptocurrency you want to deposit into your account.

- The wallet address will appear. You need to copy it and send funds to it from another wallet or exchange. Please note that only bitcoin can be sent to bitcoin addresses, similarly with other coins.

- You can also click “Show QR code” – for transfers from a mobile wallet, this is a more convenient option.

How To Withdraw Crypto Asset From Uniswap Exchange ?

Having completed all the necessary trading operations, it’s time to withdraw the received assets to an external wallet. Go to ” Assets ” -> ” Withdraw “. Please note that the operation is only available after enabling two-factor authentication in the settings. This is for added security and requires less than a minute, so don’t neglect this measure.

Select a cryptocurrency and enter the withdrawal amount. Each coin has its own withdrawal fee, for example, for BTC it is 0.00057 BTC. Click ” Output “. By default, the exchange processes applications three times a day, however, hourly withdrawals are available for Premium users. Also, the time of receipt of the cryptocurrency is affected by the workload of the blockchain network.

How To Secure Your Uniswap Account ?

There are several steps you can take to help secure your Uniswap account and protect your funds:

- Use a Hardware Wallet: To safely store your Ethereum and other cryptocurrencies, think about utilizing a hardware wallet like Ledger or Trezor. Your private keys are kept offline in hardware wallets, making it harder for outsiders to access them remotely.

- Store Your Private Keys Offline: If a hardware wallet is not being used, store your private keys offline in a secure location. The risk of hacking is increased if you save them on your computer or any other device that is connected to the internet.

- Use a Strong Password: If you use an Ethereum wallet service or software-based wallet, be sure to create a strong and distinctive password for your wallet account. Avoid choosing passwords that are simple to guess and think about using a password manager to securely manage them.

- Activate Two-Factor Authentication (2FA): If your Ethereum wallet or wallet service allows two-factor authentication, turn it on. By asking you to input a one-time code given to your mobile device when logging in or carrying out crucial tasks, 2FA adds an extra degree of security.

- Maintain Software Updates: Maintain the most recent security patches and features by routinely updating your Ethereum wallet program and any related applications.

- Watch Out for Phishing Attempts and Links: Watch out when accessing websites or clicking on links related to Uniswap or your Ethereum wallet. Verify URLs twice at all times to prevent falling for phishing scams.

- By taking these steps, you can help protect your Uniswap account and reduce the risk of unauthorized access to your funds.

Uniswap Trading View

Different exchanges have various trading philosophies. There is also no “this overview is the best” point of view. You should decide for yourself which trading perspective is ideal for you. The order book, or at least a portion of it, a price chart for the selected cryptocurrency, and order history are typically displayed in all of the displays. Additionally, they typically have purchase and sell boxes. Try to take a look at the trading view before selecting an exchange to make sure it feels correct to you.

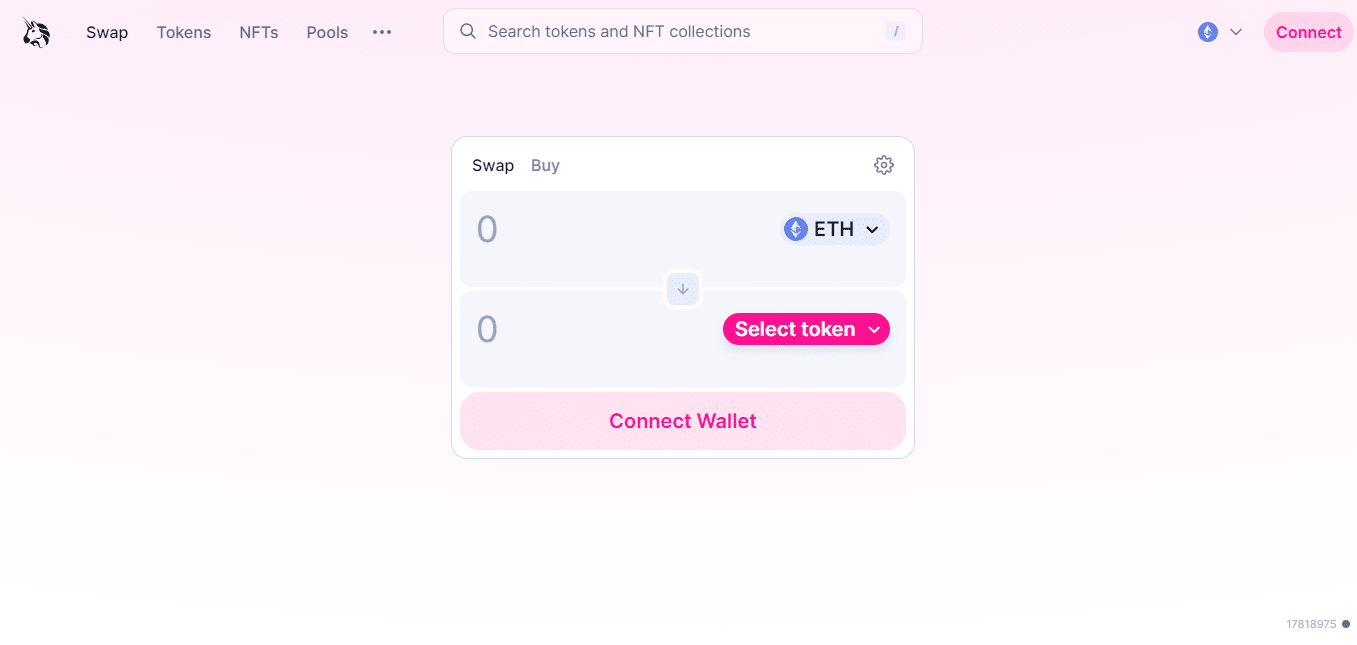

It’s not really a “trading view” at this exchange. It is actually a swap interface. The user interface is quite basic. You connect to your wallet, select which tokens you wish to exchange for which others, and then you just do the exchange. It’s difficult to see how this procedure could have been simplified. Below is a photo of the Uniswap swap interface:

Fees taken when buying virtual currency

Uniswap Trading Fees

Many exchanges collect what we refer to as taker fees from users and what we refer to as maker fees from users. The primary remedy for this is to merely impose “flat” rates. When an exchange uses flat fees, it means that both the creator and the taker pay the same amount.

The flat cost for each trade on this exchange is 0.30 percent. This is arguably 0.25% above the average for the entire industry. So Uniswap has a respectable offering in terms of trading fees.

Uniswap Withdrawal fees

There are exchanges out there that have low trading fees but then slap you with exorbitant withdrawal fees when you try to leave. Because once you’re in, there are withdrawal fees associated with leaving. But this conversation is on the other end of the spectrum.

The network costs are only assessed when a transaction is actually carried out. The standard industry fee for each withdrawal of Bitcoin is 0.00053 BTC. The network fees vary from day to day but often range from 15% to 20% of the average BTC withdrawal cost charged by businesses worldwide. As a result, this exchange has a competitive offering for withdrawal costs.

Deposit Methods

Uniswap does not accept any deposits of fiat currency. This means that the new crypto investors (i.e., the investors without any previous holdings of crypto) can’t trade here. In order to purchase your first cryptos, you need a so called entry-level exchange, which is an exchange accepting deposits of fiat currency

Trade On Go Uniswap Is 100% Mobile Friendly

Both iOS and Android mobile devices can use the Uniswap exchange mobile app. Users may manage their accounts, buy and sell cryptocurrencies, and keep track of their trading actions while on the road thanks to the exchange’s mobile application.

The mobile app’s user-friendly interface is mobile device optimized, making it simple to use and navigate. Additionally, it offers real-time price charts, order books, and trading history so that customers can keep up with the most recent market trends and make wise trading choices.

How To Contact Uniswap Customer Support Team?

If you need help with your Uniswap account or have any questions, you can contact Uniswap customer support through the following methods:

Review the Documentation: Uniswap’s official website (https://uniswap.org/) contains extensive documentation and FAQs. By reading through these resources, you can find answers to a lot of frequent queries and problems.

Community forums: Interact with the Uniswap community on Reddit, Telegram, or Discord, among other platforms. Your queries might be answered by other users or community members.

Social Media : Check To receive updates on announcements and other essential information, follow Uniswap on Twitter (@Uniswap).

Projects for Tokens: If you are having problems with a particular token on Uniswap, you may need to contact the project’s developers or go to their official website for assistance.

Exercise Caution: Take extra care to avoid scams. Due to the decentralized nature of Uniswap, unscrupulous actors may attempt to pose as support staff in order to access your cash. Never give anyone pretending to be from Uniswap support your secret keys or sensitive information.

Features Of Uniswap Crypto Exchange

Available At Android & IOS Store

Uniswap Cryptocurrency Exchange exchange application available on both world famous mobile store google play store and iOS store . You Can download App and start trading.

Convenient Payment Methods

Uniswap accepts a wide range of payment methods, including UK bank transfers, debit cards, and credit cards.

Trading Pairs:

Uniswap supports a wide range of trading pairs, including BTC, ETH, USDT, USDC, and more. This allows traders to access a variety of cryptocurrencies and trade them against each other.

Automated Market Making

Uniswap uses an automated market maker concept in which users contribute liquidity to liquidity pools rather than traditional order books. Algorithms balance these pools, which have two assets each, to decide the exchange rate for the assets.

Liquidity Pools

Users can take part in the provision of liquidity by contributing two assets of equal value to a liquidity pool. They are compensated with tokens known as liquidity provider (LP) that reflect their portion of the pool. A percentage of the trading fees go to liquidity providers, who can also withdraw their money whenever they want.

No Listing Requirements

Anyone can start a trading pair on Uniswap by supplying liquidity to a new pool, unlike centralized exchanges that frequently require projects to go through a listing process.

Transparent and open source

Since Uniswap’s smart contract code is open source, anyone may access it and audit it. Transparency and security are improved as a result.

Non-Custodia

Because Uniswap is a DEX, users can keep custody of their private keys and money, lowering the chance of hacks or other exchange-related losses.

Simple and intuitive user interface

Uniswap’s user interface is suitable to both experienced cryptocurrency traders and DeFi (Decentralized Finance) newbies.

Uniswap Good Or Bad Points

Uniswap is a cryptocurrency exchange that allows users to buy and sell various cryptocurrencies. Here are some potential good and bad points of using Uniswap :

Good points:

- Decentralization: Uniswap is a decentralized exchange (DEX), which means that it doesn’t rely on a centralized body to manage funds or regulate trading. As a result, there is less chance of manipulation or censorship and transparency is increased.

- Accessibility: Uniswap makes cryptocurrency trading available to anybody with an internet connection without the requirement for an account or KYC verification. Through this accessibility, consumers can preserve control over their private keys and advance financial inclusion.

- Liquidity Provider (LP) Incentives: By putting assets into liquidity pools, users can supply liquidity to the platform and get rewards for their contributions. This encourages users to provide liquidity, increasing the total liquidity and trade efficiency of the platform.

- Wide Variety of Assets: Uniswap supports a huge selection of tokens, including tokens with lower liquidity and trading pairs uncommon on centralized exchanges, which helps to create a more varied trading ecosystem.

- Smart Contract Security: Uniswap has undergone security audits from a number of companies, and because its code is open-source, the community may continuously examine and enhance its security.

Bad points:

- Impermanent Loss: When liquidity providers provide liquidity to volatile trading pairs, they may experience impermanent loss. When the value of the assets in the pool dramatically changes from when they were deposited, this event takes place.

- High Gas Fees: Because Uniswap uses the Ethereum blockchain, there may be times when the gas costs are high due to network congestion. Due to this, trading and supplying liquidity may become costly, especially for smaller trades.

- Limited Scalability: Uniswap has scalability problems, which could result in network congestion during times of heavy demand, like other decentralized applications on Ethereum.

- Lack of Regulation: Because Uniswap is a decentralized exchange, there is no direct regulatory control of its operations, which could cause some users to worry about market integrity, investor protection, and possible illegal activity.

- Interface Complexity: Because new users must comprehend ideas like gas fees, wallet integration, and token approvals, the user interface of Uniswap and other DEXs can be frightening and perplexing.

Is Uniswap Is Safe Platform To Trade ?

Decentralized means that Uniswap doesn’t depend on a single entity to manage user funds or carry out trades. By doing this, the danger of hackers or potential exit scams linked to centralized exchanges is diminished.

Reputable security companies have conducted many audits of Uniswap’s smart contracts to find and address problems. However, no system is totally risk-free; over time, vulnerabilities may still be found or added.

The risk of “impermanent loss” for liquidity providers as a result of market volatility can have an impact on their overall earnings as compared to merely keeping the tokens. Platforms for automated market makers (AMMs), such as Uniswap, have this feature.

Although Uniswap was created with security in mind, users still need to exercise caution and accept accountability for their activities. Make sure you are using the proper Uniswap URL, securely connect your wallet, and exercise caution when it comes to scams and phishing attempts.

Uniswap Conclusion

Since the protocol is decentralized, there is no single centralized entity in charge of managing and operating the exchange; rather, peer-to-peer (P2P) exchanges take place. Additionally, Uniswap aims to address the liquidity issue that other exchanges have by design. Uniswap V3 is the third version of the protocol, updated to increase compensation and provide individual LPs more control and flexibility. In May 2022, the protocol’s lifetime trading volume of $1 trillion was attained, with Uniswap V3 supporting more than 46.5% of all DEX trading volume.