What Is Animal Farm Dogs (AFD)?

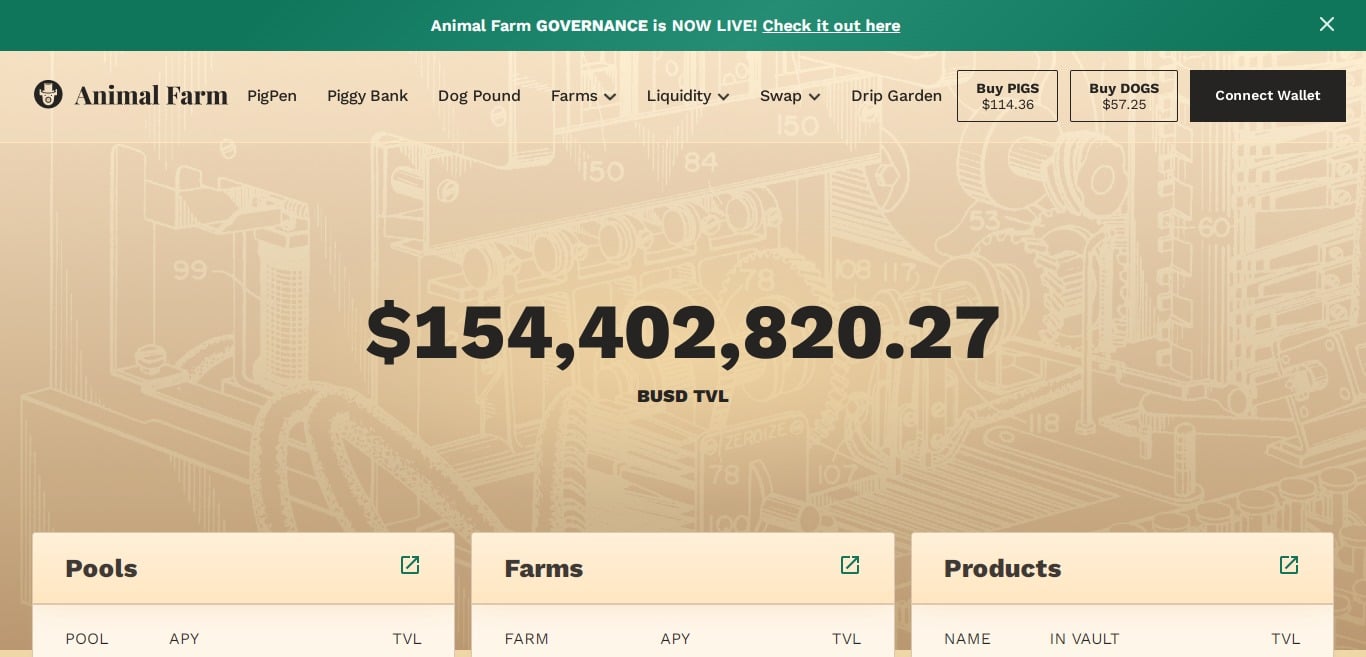

The Animal Farm is a platform that allows users to easily and trustlessly lend their crypto to decentralized exchanges, where the capital is then used to fill orderbooks and to make trading on these exchanges more liquid. Users earn a yield from the exchanges to which Animal Farm lends capital, paid out through the BUSD dividend model, as well as in the form of their native assets

The Animal Farm has two native tokens, AFD (DOGS) and AFP (PIGS). The Animal Farm offers a variety of financial instruments that you can only access with its native assets. Users benefit from innovative tokenomics, dynamic emissions, vesting, gamification, advanced game theory and lending via rehypothecation.

| Coin Basic | Information |

|---|---|

| Coin Name | Animal Farm Dogs |

| Short Name | AFD |

| Circulating Supply | 1,743,474 AFD |

| Max Supply | N/A |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

Dynamic Supply Control

Unlike other platforms that blindly emit rewards, Animal Farm utilizes an innovative fully decentralized Dynamic Supply Control Algorithm which adjusts yield within a sustainable range based on demand for the underlying assets and even becomes deflationary in times of low demand.

Full Governance Model

A full governance model which allows investors to secure ownership of the platform itself, not just the tokens. This ownership allows investors to vote on the curated roadmap proposals as well as secure dividends in the form of BNB and BUSD generated by platform fees without needing to sell the platform’s native assets.

Fully Decentralized Lending

Fully decentralized lending that does not rely on algorithmic stablecoins or any high risk exposure. Instead, collateralized TVL on Animal Farm is lent to Pancakeswap for an additional low risk yield aggregation compounded on top of native yield aggregation.

Crowd Funding & More

In addition to the governance token stakers earning BUSD dividends and having the power to vote on curated roadmap proposals, a small percentage of the yield generated through lending can be utilized in a crowd funding model where governance stakers can vote to pool funds in additional investment opportunities.

PigPen

PigPen is the Animal Farm’s governance staking pool which allows AFP holders to secure a shared ownership of the Animal Farm platform. PigPen is designed to pay stakers the highest BUSD dividend in the world. It pays stakers a BUSD dividend generated from 1/3 of all taxes paid on AFD transactions, 75% of all platform deposit/withdrawal fees, and 30% of yield generated through our collateral rehypothecation lending model. AFP staked in PigPen also earn PIGS generated from Piggy Bank fees and allow the user to vote on curated proposals regarding key platform roadmap and crowd funding decisions!

Who Are the Founders of The Animal Farm?

*Forex Shark is the creator of the The Animal Farm, DRIP Network, and R34P DAO projects. Forex Shark has extensive experience as a professional trader, financial educator, and cryptocurrency developer.

The Animal Farm Mechanics

*Earn Animal Farm Dogs (AFD) by staking single assets and liquidity pairs in Farm and Pool contracts. *Earn loyalty rewards and Animal Farm Pigs (AFP) by staking DOGS. *Earn AFP for the PigPen and PiggyBank by staking DOGS or LP assets.

Own Your Share

*The Animal Farm utilizes a full governance model that allows investors to secure ownership of the platform itself, not just the tokens. This innovative ownership model allows investors to exercise voting rights, while earning profit in the form of dividends (BNB and BUSD) without needing to sell the platform’s native assets.

Fully Decentralized Lending

*The Animal Farm allows for fully decentralized lending that does not rely on algorithmic stable coins or high risk models. Instead, collateralized TVL on Animal Farm is lent to PCS to provide an additional low-risk yield aggregation compounded on top of native yield aggregation. A percentage of the generated yield is used in a crowdfunding model where governance stakers can vote to allocate the funds to additional investment opportunities.

Leave a Reply