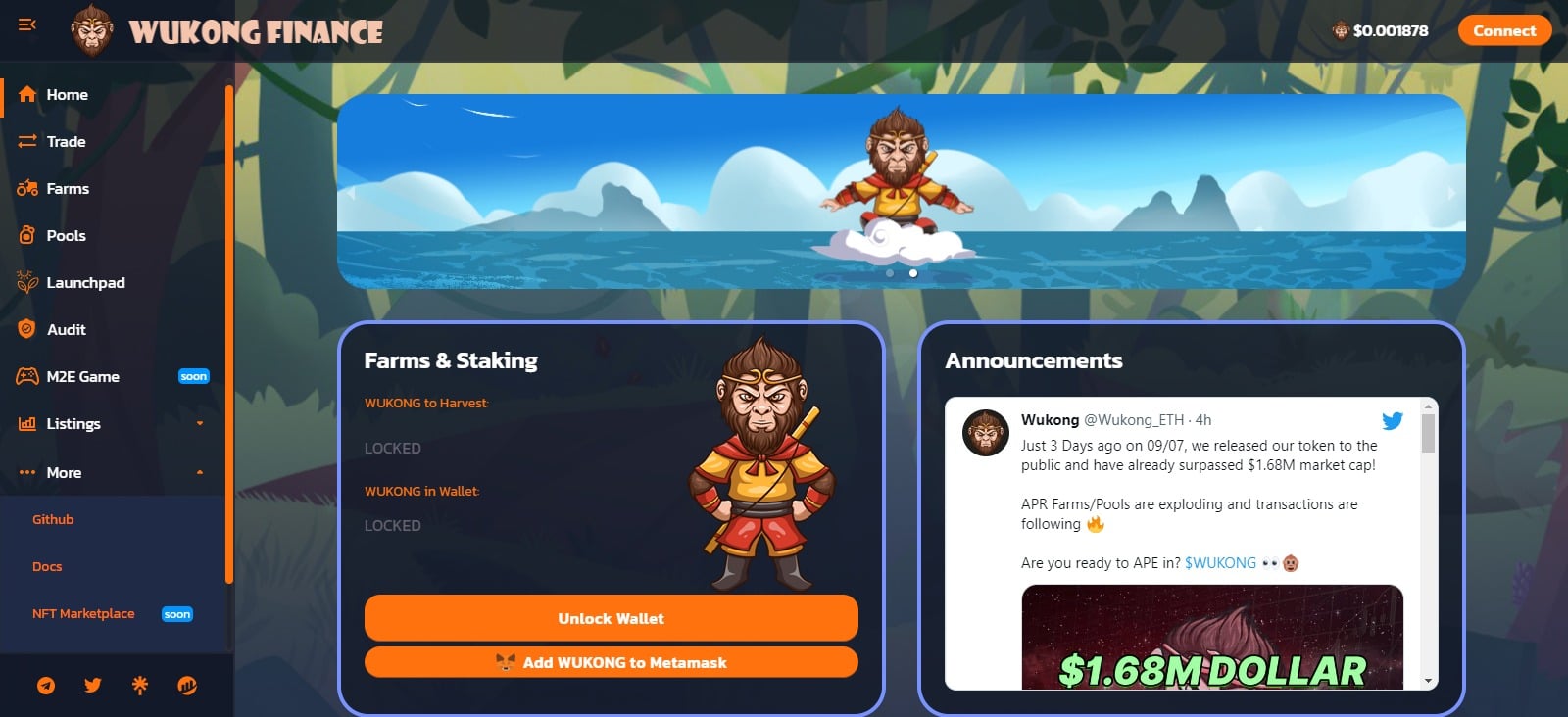

What Is Wukong Finance (WUKONG)?

Wukong Finance is a high security Yield farming DAPP and crypto platform running on the Ethereum Mainnet using the Uniswap Exchange. Offering a safe and secure platform with great APRs and functionalities is Wukong Finance’s highest priority.

The idea behind this project is to create a safe and secure place for farmers. Besides the regular high APR farms/pools and bushes, Wukong Finance Coin offers fun games and NFT to play and earn! This Finance is a community driven project with its own special perks governance token WUKONG.

| Coin Basic | Information |

|---|---|

| Coin Name | Wukong Finance |

| Short Name | WUKONG |

| Total Supply | 1,000,000,000 |

| Max Supply | 1,000,000,000 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

DOWNLOAD & SETUP METAMASK OR TRUSTWALLET

WUKONG Price Live Data

The live Monkey King price today is $0.001852 USD with a 24-hour trading volume of $848,762 USD. They update WUKONG to USD price in real-time. This is up 13.19% in the last 24 hours. The current CoinMarketCap ranking is #2954, with a live market cap of not available. The circulating supply is not available and a max. supply of 1,000,000,000 coins.

If you would like to know where to buy Monkey King at the current rate, the top cryptocurrency exchange for trading in Monkey King stock is currently Uniswap (V2). You can find others listed on crypto exchanges page.

Yield farming

The Wukong Finance yield farms allow users to earn WUKONG while supporting by staking LP tokens. APR is the annual percentage rate and refers to the yearly interest generated. The daily percentage shows the daily interest. Deposit fee. Some farms have a deposit fee to deposit tokens in the farm. This fee is used for rewards in the bushes and platform development. Harvest Lockup. The harvest lockup is an antibot mechanism that forces an 1 week lockup after harvesting. Use the swap to buy WUKONG token and to form LP pairs.

Risks of yield farming

When staking liquidity with LP tokens it’s important to understand the effects of impermanent loss. Binance wrote a great guide on impermanent loss, check out this binance academy article.

Bushes

The Wukong Finance Bushes offer high APR pools to stake WUKONG tokens and earn other tokens from current partners. Stake WUKONG, earn free tokens, the Wukong way!

APR is the annual percentage rate and refers to the yearly interest generated. Dividing the APR by 365 will give you the daily interest. Some bushes have a burn fee, this fee will automatically get sent to the burn address. The End status bar shows the remaining number of days left for the bush.

Emission rate

10 WUKONG per block –> 15 sec per block on Ethereum Mainnet –> 5760 blocks per day

9% of the emission rate was send to the dev’s address to fund the team, fund the Wukong’s marketing, fund airdrop contests and further partnership

Initial minted token : 1,000,000,000 WUKONG :

Deflationary mechanism

They created a strong burning mechanism that increases the token price constantly :

- 4% burn fee will be charged at each deposit on farms and 3% burn fee will be charged at each deposit on pools (current rate that could evolve in the future)

- The burning transaction fee will be used to/for :

- Distribution to WUKONG token holders via the Bushes

- Farming : The Wukong’s team will farm a part of these burning transaction fee to create more value and to distribute it to the community

- Security audit costs.

- Airdrop, contest and marketing : Wukong Finance will make frequent cool airdrops & contests and use a part of the transaction fee into marketing costs.

How To Add Liquidity

Adding liquidity allows the contributor to earn 0.17% swapping fees from the pairs they’ve provided. You can supply liquidity and start earning fees via the link here, When you add your token to a liquidity pool (LP), you will receive UNI-V2 tokens (Uniswap’s version of liquidity provider tokens).

As an example, if you deposited $WUKONG and $ETH into a liquidity pool, you would receive WUKONG-ETH LP tokens.

The number of UNI-V2 LP tokens you receive represents your portion of the WUKONG-ETH liquidity pool. You can also redeem your funds at any time by removing your liquidity.

Leave a Reply