About Yield Protocol

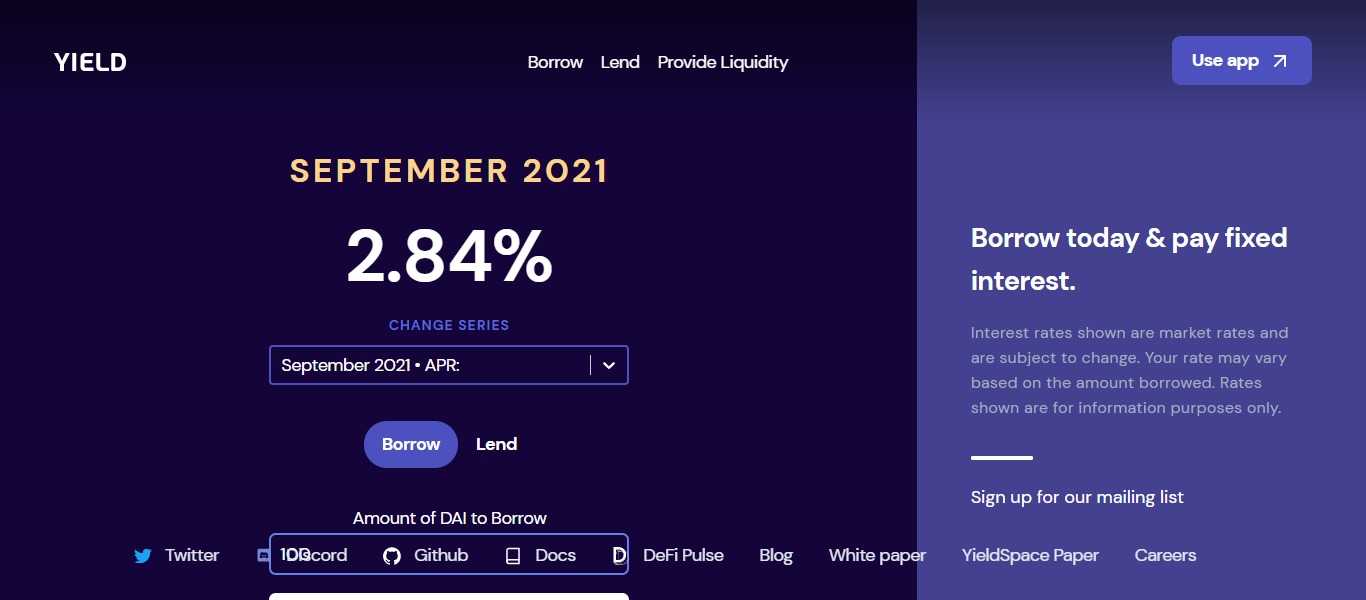

Yield Protocol brings collateralized fixed-rate, fixed-term borrowing and lending and interest rate markets to decentralized finance. Yield Protocol allows users to have a “set and forget” experience, instead of constantly rebalancing the assets across DeFi in an effort to minimize the borrow rates or maximize the lending yields

Yield Protocol doesn’t have an own token yet and could potentially launch one in the future. It is highly likely that they may do an airdrop to early users of the platform if they launch their token.

| Basic | Details |

|---|---|

| Token Name | Yield Protocol |

| Platform | ETH |

| Support | 24/7 |

| Airdrop End | N/A |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

Step-by-Step Guide:

- Visi the Yield Protocol dashboard.

- Connect your Ethereum wallet.

- Now deposit or borrow tokens.

- There is a chance that users who’ve made transactions on the platform may get an airdrop if they introduce their own token.

- Please note that there is no guarantee that they will do an airdrop and that they will launch their own token. It’s only speculation.

Borrow today & pay fixed interest.

Interest rates shown are market rates and are subject to change. Your rate may vary based on the amount borrowed. Rates shown are for information purposes only.

Acknowledgments

This paper is heavily indebted to discussions with Hayden Adams, Arthur Breitman, Vitalik Buterin, Jill Carlson, Karl Floersch, Alex Herrmann, Ben Jones, Martin K¨oppelmann, Zubin Koticha, Aparna Krishnan, Hart Lambur, Teo Leibowitz, Robert Leshner, Lev Livnev, Allison Lu, Matt Luongo, James Prestwich, Cyrus Younessi, and Noah Zinsmeister. The authors are particularly grateful to Paradigm for supporting this research.

Market making

The above applications depend on the existence of a liquid market in some fyToken. Traders who want to profit from such a market could deposit liquidity into Uniswap [10], an automated market maker protocol.

Uniswap v2 supports arbitrary ERC20-ERC20 pairs [12]. These make it possible to market-make directly betweeen fyTokens and the underlying tokens (when those are ERC-20s), such as fyDAI/DAI. Providing liquidity to such pairs is relatively less risky, because you know what the relative prices of those assets will be upon maturity, so your losses as a liquidity provider are capped.

Borrowing, lending, and leverage

fyTokens enable a fungible market for fixed-term secured lending on-chain. By minting, holding, and/or trading fyTokens, users can synthetically borrow and lend the target asset. Users are guaranteed a particular interest rate if they hold the position to maturity.

Lending

Buying fyTokens is economically similar to lending the target asset. Because fyTokens are not redeemable until expiration, they are likely to trade at a discount until maturity, particularly if there is demand to borrow the target asset. This means the value of fyTokens (denominated in the target asset) will tend to appreciate over time as they approach maturity. This is analogous to the interest earned by lenders in other protocols.

In order to make this more familiar for users, an application could present an interface that emphasizes the market value of their fyTokens, rather than the face value, as well as showing them the expected annualized yield if they held those tokens to maturity. For example, if a user spent $100 to buy 103 fyUSD, the interface would display their current value of $100, with that number gradually tending to rise until it hits $103 upon expiration.

Minting fyTokens

Once a token contract exists for a particular fyToken, anyone can deposit collateral to create a vault. These vaults are analogous to (and named after) the vaults in the Maker system [9]. The owner of a vault can mint fyTokens, which adds to the vault’s debt. They can also burn fyTokens to reduce their debt. The debt of a particular vault must not exceed the value of its collateral plus some required margin, or it will be liquidated, as described in section 3.5.

Mechanism

This section describes the fyToken mechanism at a high level. For simplicity, this description assumes the existence of a synchronous free on-chain price oracle for the underlying asset. Section 5 discusses other constructions of fyTokens that do not depend on this assumption. fyTokens differ from each other in four dimensions: target asset (or oracle), collateral asset, expiration time, and collateralization requirement. Anyone can define a particular fyToken by specifying those four parameters.

For example, there would be one fyToken for a given USD oracle, backed by ETH, settling at 11:59 PM on December 31, 2019, with a 150% collateralization requirement. Applications will be somewhat incentivized to converge on focal points (i.e., by conventionally only buying or selling fyTokens that expire at the end of each quarter), to ensure that liquidity is not too fragmented. fyTokens that settle to synthetics or a floating-rate lending platform, as described in section 3.4, should mirror the parameters (such as collateralization requirement) used by the target platform.

Leave a Reply