About Zyberswap Coin

Zyberswap Coin is one of the first decentralized exchanges (DEX) with an automated market-maker (AMM) on the Arbitrum blockchain. Compared to its competitors, Zyberswap allows the swapping of crypto assets with the lowest fees! Rewards from Staking and Yield Farming are among the most lucrative in the entire Arbitrum ecosystem. Additionally, Zyberswap aims to fully involve its users in decision-making. All major changes will be decided via Governance Voting.

Zyberswap Coin Point Table

| Coin Basic | Information |

|---|---|

| Coin Name | Zyberswap Coin |

| Short Name | ZYB |

| Circulating Supply | 51,780.00 ZYB |

| Max Supply | 20,000,000 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

Why Arbitrum?

Arbitrum is a layer-2 scaling solution for Ethereum that allows faster and cheaper transactions by using off-chain computations. It works by allowing parties to transact off-chain and only settling on-chain when necessary, which reduces the number of transactions that need to be processed by the Ethereum blockchain. This makes it possible to build applications that can handle a larger volume of transactions without the cost and speed limitations of the Ethereum mainnet.

Arbitrum is currently the most popular Layer-2 Blockchain, with over $1.6B of TVL. Zyberswap is dedicated to expanding the capabilities and opportunities in decentralized finance by aligning with the vision of Ethereum and utilizing the layer-2 scaling solutions of the Arbitrum network.

Token Swap

As an automated market-maker (AMM), Zyberswap allows decentralized exchanges of various coin pairs at the lowest fees possible. Users can trade coins in the Arbitrum network in a non-custodial manner without going through any centralized intermediary and paying excessive fees. With Zyberswap, the trading fees will be distributed to liquidity providers. This ensures liquidity providers are incentivized to provide the depth of liquidity needed to give you the best prices across the board.

What Are Liquidity Pools?

Liquidity Pools are a place to pool tokens (otherwise known as liquidity) so that users can use them to make trades in a decentralized and permissionless way. To pool liquidity, the supplied amount must be equally divided between two coins: the primary token and the base token. Zyberswap’s liquidity pools allow users to provide liquidity.

When they do so, they will receive ZLP tokens (Zyberswap Liquidity Provider tokens) as proof of providing liquidity. If a user deposited $ZYBER and $ETH into a pool, they would receive ZYBER-ETH LP tokens. These tokens represent a proportional share of the pooled assets, allowing users to reclaim their funds at any point.

What are the Fees?

Every time the pool is used to trade between $ZYBER and $ETH, a 0.25% fee is taken on the trade. 0.15% of that trade goes back to the LP pool. Your aim is to have the lowest fees that are still allowing lucrative rewards for those that are providing the liquidity. Which is crucial to maintain a sustainable and healthy Decentralized Exchange. You can supply liquidity and start earning fees here.

How to provide liquidity?

Zap allows you to easily provide liquidity with only one token.

- You can add liquidity using only one token in the trading pair. Zap will automatically perform swaps using the one token you provide and automatically balance the trading pair to a 50/50 split before adding liquidity.

- You can add liquidity even if the number of the tokens you provide in the trading pair is not perfectly balanced with the current pool.

- When removing liquidity, Zap allows you to receive only one token in the trading pair.

What is Yield Farming?

Yield farming is a method of earning rewards or interest by depositing your cryptocurrency into a pool with other Zyberswap users. Zyberswap farms are designed to incentivize users to provide liquidity for their favorite token pairs. Users who create and stake their liquidity provider (LP) tokens in farms on Zyberswap will earn trading fees and $ZYBER utility tokens.

Why Choose Zyberswap Coin?

Decentralized Applications

One of the key features of Arbitrum is the Arbitrum Bridge, which allows for the transfer of assets between the Ethereum mainchain and the Arbitrum sidechain. The Arbitrum Bridge is a smart contract that facilitates the transfer of assets between the Ethereum mainchain and the Arbitrum sidechain. It allows users to lock their assets on the mainchain and then mint an equivalent amount of assets on the sidechain. This process is called “bridging” assets. Once the assets are on the sidechain, users can interact with them in a faster and cheaper way than they could on the mainchain.

When they are ready, they can then “unbridge” the assets, which will destroy the sidechain assets and release the locked assets on the mainchain. The Arbitrum Bridge is intended to allow users to take advantage of the speed and low cost of the Arbitrum sidechain while still being able to interact with the mainchain ecosystem.

Governance Voting

The ultimate mission of Zyberswap is to become a fully community-driven Decentralized Exchange on the Arbitrum blockchain, where all significant decisions are governed by the community members. Zyberswap’s users are warmly encouraged to actively participate in discussions on the official Discord server. Zyberswap will allow all holders of the $ZYBER token to determine the direction in which the project should go. To achieve that, all decisions will be polled via the Snapshot voting mechanism.

Snapshot

Snapshot voting refers to a method of voting on blockchain-based projects that allows holders of a particular cryptocurrency to vote on proposals or changes to the network. This is typically done through a smart contract, which takes a “snapshot” of the blockchain at a specific point in time to determine which addresses hold how many coins and thus have how many voting rights.

Holders can then use their coins to cast a vote, with the number of coins held determining the weight of the vote. This method of voting is intended to be transparent, secure, and decentralized, allowing holders of the cryptocurrency to have a say in the direction and governance of the project.

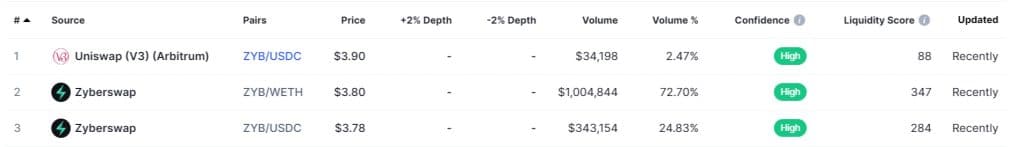

Where Can You Buy Zyberswap Coin?

Tokens Can Be Purchased On Most Exchanges. One Choice To Trade Is On Uniswap (V3) (Arbitrum), As It Has The Highest ZYB/USDC. e Trading Volume, $8,947 As Of February 2021. Next is OKEx, With A Trading Volume Of $6,180,82. Other option To Trade Include ZYB/USDC And Huobi Global. Of Course, It Is Important To Note That Investing In Cryptocurrency Comes With A Risk, Just Like Any Other Investment Opportunity.

Market Screenshot

Zyberswap Coin Supported Wallet

Several Browser And Mobile App Based Wallets Support Zyberswap Coin. Here Is Example Of Wallet Which Zyberswap Coin – Trust Wallet For Hardware Ledger Nano.

Roadmap

Leave a Reply