In this article, I will discuss the Non-custodial Staking Platforms, a new trend in the crypto space that enables users to earn rewards while retaining ownership of their assets.

Non custodial platforms are more secure and flexible since users are able to access their private keys during the staking process, making it easier for both novice and seasoned investors.

Key Point & Non-custodial Staking Platforms List

| Platform | Key Point |

|---|---|

| Lido | Offers liquid staking for Ethereum and other PoS assets with stETH tokens. |

| Rocket Pool | Decentralized Ethereum staking with support for solo stakers and node operators. |

| Staked.us | Institutional-grade staking services with non-custodial infrastructure. |

| Figment | Enterprise-level staking with advanced tools, APIs, and analytics. |

| StakeWise | Offers ETH liquid staking with reward splitting and DeFi integration. |

| Everstake | One of the largest PoS staking providers supporting 50+ networks. |

| Ankr Staking | Non-custodial staking with private key ownership |

| Chorus One | Focuses on PoS networks with in-depth research and validator services. |

| Stakin | Non-custodial staking with secure asset control |

| Allnodes | Supports many blockchain networks and protocols |

1.Lido

Lido is a non-custodial platform for staking since it does not require users to surrender their private keys to assets. Rather than freezing tokens in a centralized system, users are issued liquid staking tokens such as stETH which can be spent in the DeFi ecosystem and represents their staked assets.

This way, users maintain control and flexibility over their assets while earning staking rewards. What makes Lido different is the combination of decentralization and liquidity which seeks to improve the usability of staking within the Ethereum environment.

Lido Features

- Liquid Staking – Enables users to stake their assets and concurrently grants them liquid tokens which can be used for other transactions.

- Decentralized Validators – Operates a decentralized set of professional validators to protect the network.

- Wide Asset Support – Etheream, Solana and Terra are some of the assets supported.

2.Rocket Pool

Rocket Pool does not take custody assets as users are able to stake Ethereum while still maintaining control of their assets through decentralized smart contracts. Unlike custodial services, there is no need for private keys to be handed over with Rocket Pool.

Also, unlike other protocols, Rocket Pool’s unique offering is that he or she can become a node operator with a minimum of 16 ETH which helps further decentralization. In addition, protocols also issue rETH, a liquid staking token enabling the holders to flexibly use their tokens in various DeFi applications.

Rocket Pool Features

- Decentralized Staking Pool – ETH holders no longer have to operate nodes to stake ETH.

- rETH Token – Claims giving out tokens representing a staked asset liquid tokens.

- Community-Driven – Governed by the community making decisions as a collective.

3.Staked.us

Staked.us is a non-custodial staking platform because it gives investors the opportunity to earn rewards on their crypto assets without relinquishing control to a third-party service provider. Users retain control over their private keys while delegating stake to secure proof-of-stake networks.

Unique to this platform is an emphasis on institutional clients with complex needs, provisioning them robust infrastructure with uptime guarantees and in-depth performance reporting. This approach preserves user control, enabling scalable and reliable solutions for non-custodial crypto asset staking, thus earning the trust of many.

Staked.us Features

- Institutional-Grade Staking – Strictly tailored to institutional clients with extensive safety measures.

- Multi-Protocol Support – Enabled on numerous blockchains, including Ethereum, Solana, and Polkadot.

- Non-Custodial Options – Staking services can also be provided as non-custodial.

4.Figment

Figment a non custodial staking platform allows users to delegate their tokens without surrendering private key access. Users’ assets stay in their wallets, and Figment earns validator infrastructure fees for reward collection.

What differentiates Figment is integration of advanced data, governance APIs, and staking providing reputation-based rewards aiding user decision-making. This combination makes Figment a powerful choice in the presence of institutional and individual stakers due to its security, transparency, and deep network trust analytics.

Figment Features

- Validator Infrastructure – Offered by Figment are secure and reliable validators.

- Wide Blockchain Coverage – Includes several well-known networks such as Cosmos, Polkadot, and Tezos.

- Analytics & Reporting – Powerful tools for tracking the performance of staking in real-time.

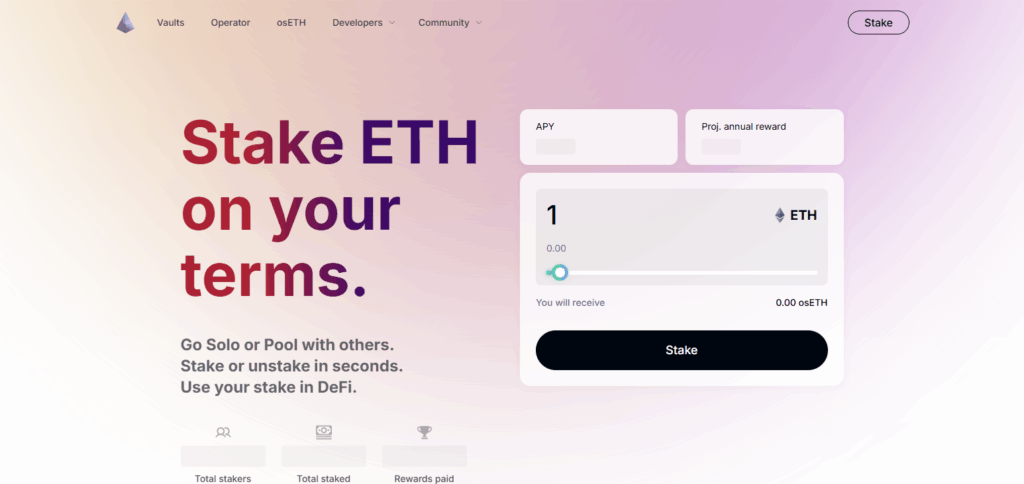

5.StakeWise

StakeWise maintains a non-custodial staking service since users can stake Ethereum without giving out private keys and through the use of smart contracts. Users get sETH2 and rETH2 in return which are both ERC20 tokens that represent their stakes and rewards and thus increases versatility in DeFi.

One of the most distinctive aspects of StakeWise is the ability to split staking rewards whereby users share yield or automate yield sharing and reward distribution. This is perfect for DAOs, teams or co-op staking strategies where collaborative decision making is prioritized but asset ownership is preserved.

StakeWise Features

- Compound Yield – Compounding enhances staking reward automation.

- Split Token Model – Allows more freedom in managing staked tokens and rewards separately.

- User-Friendly Interface – Smoothens the processes of staking and unstacking.

6.Everstake

Everstake operates as a non-custodial staking platform since users can delegate their tokens without relinquishing control of their private keys. Everstake blockchain becomes a validator of the user’s stake while the funds remain in the user’s wallet.

Its distinctive advantage is presence in more than 50 blockchain networks which makes diversification easy and accessible. This along with strong infrastructure and good educational materials makes Everstake a preferred platform for users who want security and multi-layered options for informed staking.

Everstake Features

- Validator Services – Maintains safe validator nodes on several blockchains.

- Wide Asset Support – Offers asset-based staking for Ethereum, Solana, Cosmos, etc.

- Comprehensive Reporting – Provides comprehensive analytics on staking activities.

7.Stakin

Stakin qualifies as a non-custodial staking platform since users do not have to relinquish their private keys or tokens to stake. While users retain full ownership of their assets, they delegate the stake to Stakin’s validator nodes.

Its primary distinguishing feature is the robust support for newly launched blockchain ecosystems and development of community governance coupled with a friendly interface that makes staking easy for novices and veterans alike.

This methodology provides security alongside transparency and promotes active participation in the network.

Stakin Features

- Stakin allows non custodial staking where the users have total control over their private keys.

- Stakin supports both emerging and well-known blockchain networks.

- Stakin has an intuitive interface which allows users to easily participate in peer governance systems.

8.Chorus One

Chorus One is a non-custodial staking platform as users can delegate tokens without losing control over their private keys, ensuring custodianship autonomy at all times. The decentralized validator ecosystem manages staking, which guarantees trust and transparency.

Unlike other platforms, Chorus One is deeply involved in governance, network research, and protocol development which is what distinguishes it. It provides sophisticated analytics for users to formulate important tactical decisions during the staking process while allowing them to retain full control over their assets.

Chorus One Features

- Institutional-Quality Staking – Prioritize the safety and trustworthiness of institutional clients.

- Multi-Blockchain Support – Staking on Cosmos, Polkadot, Solana, and others.

- Stake Management Tools – Sophisticated dashboard provides real-time staking insights.

9.Ankr Staking

Ankr Staking is categorized as non-custodial because users are able to stake their cryptocurrencies without relinquishing their private keys. Users do not lose control of their funds because they are not given to a centralized service, rather, users delegate stake through smart contracts.

Ankr’s competitive advantages are effortless integration with DeFi protocols and cross-chain multi-network agility which amplify Ankr’s rewards without compromising security or losing control. This constituents that staking is simple as well as reliable.

Ankr Staking Features

- Decentralized Staking Infrastructure – The provided distributed and decentralized nodes remove the necessity for running a personal validator while providing efficient and dependable staking. With the provided secured and distributed nodes, staking Ankr is simple and reliable.

- Multi-Chain Support – Supports staking on multiple blockchains including but not limited to Ethereum, Polygon and Binance Smart Chain which provides flexibility in asset class.

- User Friendly Platform – Simplistic liquid staking Interfaces and performance monitoring dashboards enable both newbie and expert users to track their Staking in real-time.

10.Allnodes

Allnodes operates as a non-custodial staking platform because it allows users full control of their private keys and funds to stake assets.

Compared to centralized platforms, Allnodes services users with direct connections to validator nodes without an asset transfer. Its distinctive feature lies in offering support for both masternode hosting and staking across several blockchains which provides multi-faceted reward earning opportunities. This co

Features

- Allnodes offers non-custodial staking for Bitcoin, granting patrons complete autonomy over their private keys.

- Extensive list of supported blockchain networks, masternodes, and node types.

- Simple configuration accompanied by constant supervision and dependable operational continuity.

Conclusion

To sum up, Non-custodial staking platforms enable users to earn rewards without losing full control of their private keys and assets. Such an approach increases security and transparency, lowers the need for centralized third parties, and improves flexibility. .

Different platforms have different liquid staking tokens, advanced analytics, or network coverage which suit different users. All in all, non custodial staking is an evolution crypto holders can trust as it shifts the focus to the user, which makes participation in securing and profiting from the blockchain networks more streamlined.