This Article will examine how cryptocurrency can be taxed, looking at some of the best software solutions for this.

With the growth in market volume, it becomes more important for investors to understand and follow through with tax reporting intricacies.

Having a holistic portfolio tracker to automatically calculate taxes owed saves time and energy; platforms like these are necessary for staying within legal bounds while optimizing one’s tax situation.

Let us go over what I believe are among the most promising candidates in crypto-taxation software development – together we’ll learn about them and give ourselves an edge in the ever-changing world of cryptocurrencies!

How We Pick The Best Crypto Tax Software?

Accuracy – We give importance to the software which calculates taxes correctly for many kinds of cryptocurrency transactions like trading, staking, mining etc.

Integration – The best crypto tax software should be able to work well with popular digital currency exchanges as well as wallets; this makes it easier for users because they can import their transaction data into one place

User Experience – When selecting top programs we look at how easy they are to use and if the user interface is intuitive enough that people won’t get lost or frustrated trying to figure out what do next on the platform.

Reporting Capabilities – Reporting is important and so the right software must have a wider range of reporting options at least one of which should meet all necessary local authority requirements on matters tax.

Security – Given that dealing with financial information mandates upholding security, we check whether there’re any security features like data encryption protocols or secure storage practices employed by each program under review.

Customer Support –Responsive accessible customer support during tax season can’t be overlooked. It plays a critical part in helping clients resolve issues that may arise when they are using specific services for filing returns.

Pricing – Pricing matters too but more importantly we want to ensure value for money while looking at cost effectiveness vis-à-vis functionalities provided by different packages available in market.

30 Best Crypto Tax Software In 2024

1.CoinTracker

Smoothly run your crypto taxes with CoinTracker. Keep track of your transactions from different exchanges and wallets, create tax reports that are friendly to IRS, and effortlessly stay compliant.

CoinTracker makes the complex world of cryptocurrency taxation simple through intuitive interfaces and powerful features which ensure accuracy for every investor in crypto.

2.ZenLedger

Transform your experience of filing for crypto taxes using ZenLedger. In just a few minutes, consolidate transactions across major exchanges and wallets hassle free while generating extensive reports on taxes.

This never seen before accuracy or efficiency is possible with automated calculations, real-time market data as well as CPA assisted support that streamlines the tax process for all levels of investors in cryptocurrencies.

3.Koinly

To make it easier to report your cryptocurrency taxes, try Koinly. This software syncs with exchanges and wallets automatically so you don’t have to enter anything by hand.

They also create accurate tax reports which cover more than 100 countries all over the world, with the help of real-time market prices and an intuitive user interface.

That makes sure compliance is as smooth as possible for people who have invested in crypto assets this saves them time while reducing mistakes during filing their returns.

4.CryptoTrader.Tax

Do away with the hassle of calculating capital gains on cryptocurrencies by using CryptoTrader.Tax. All that is needed is importing transactions from different wallets or exchanges; after which IRS compliant tax reports will be generated within minutes.

With setting options such as customization and support from professionals in the field; any investor can easily calculate his/her own profits/losses through digital currencies since they are considered taxable events under federal law – making this a very convenient application during tax season!

5.CoinTracking

CoinTracking can empower your crypto tax journey. You can seamlessly track your crypto transactions across many platforms, generate in-depth tax reports and optimize the tax burden.

This is a powerful tool that offers extensive analytics and customizable features for both beginners and experts in trading to ensure accurate and efficient cryptocurrency tax compliance in a fast-changing environment.

6.Accointing

The management of crypto taxes has been transformed by Accointing. Transactions from exchanges or wallets are easily synchronized while detailed tax reports are generated for more than 20 countries.

Portfolio tracking, performance analysis among other robust features provided by this software make it easy for investors to comply with taxes on digital assets hence giving them peace of mind during this season and beyond.

7.TokenTax

TokenTax is software that can help you with reporting your crypto taxes. It will automatically synchronize transactions from exchanges and wallets, as well as create accurate tax reports for different jurisdictions.

This platform provides a complete solution for digital currency investors by utilizing tools like tax-loss harvesting and expert support to ensure compliance while maximizing savings on taxes easily.

8.TaxBit

Make your cryptocurrency taxation better through TaxBit. It is designed to work well with most wallets and exchanges by integrating them so that one does not have any difficulties importing or exporting data from one place to another when needed for taxation purposes.

In addition, this application also has advanced features for optimizing taxes more so those incurred during audits conducted by Internal Revenue Service (IRS). Therefore, users can calculate accurately report their digital asset earnings without having much knowledge about complex rules governing such calculations because everything is simplified in TaxBit system itself.

9.CryptoTaxCalculator

Have your crypto tax calculations simplified by CryptoTaxCalculator. This can be achieved by easily uploading transactions from exchanges and wallets plus producing extensive tax reports for different tax jurisdictions.

Customizable options and live market data for real time are featured in CryptoTaxCalulator so as to ensure precise tax reporting among all levels of cryptocurrency investors thereby giving them peace of mind amidst the ever-changing world of digital money taxation.

10.BearTax

Make your crypto tax workflow better with BearTax. Transactions from various exchanges and wallets can be brought together seamlessly while generating detailed tax reports that fit many countries.

The process of filing taxes becomes easy for individuals who have invested in cryptocurrencies because Bear Tax has simple interfaces.

That are user-friendly besides advanced features meant for optimizing on taxes thus ensuring accuracy during compliance which may otherwise become complex due to nature cryptocurrency taxation.

11.CryptFolio

Cryptofolio will make your crypto tax journey easier. This is possible by merging transactions from different platforms and wallets and then creating tax reports that fit within your legal jurisdiction.

It has easy-to-use interfaces coupled with strong analytics to simplify tax compliance for digital currency investors like you; this ensures accurate reporting which in turn optimizes tax responsibilities and makes filing taxes less tedious.

12.Blox

Blox is the best solution for managing your cryptocurrency taxes automatically. By syncing transactions from various exchanges as well as wallets, it becomes easier to generate comprehensive tax reports that meet global standards.

With real-time tracking of portfolios and adjustable features, Blox provides user-friendly interface necessary for precise calculation and reporting of crypto taxes therefore empowering investors during this season with required knowledge on how they should go about dealing with taxes while investing into cryptocurrencies.

13.Coinpanda

Make your crypto tax experience better with Coinpanda. This means you have to import transactions from exchanges and wallets easily so as to produce comprehensive tax reports for more than 65 countries.

Tax compliance for cypto investors can be made easier through such features as advanced tax-loss harvesting besides intuitive interfaces that provide accurate reporting and insights for optimizing tax liabilities while minimizing errors.

14.Coinly

Coinly, all you need to do is simplify your cryto tax reporting process. You can import transactions from exchanges and wallets without any difficulties, then generate detailed tax reports that are compatible with many different taxing authorities.

The calculations of how much one owes in taxes on their cryptocurrency investments should be easy when they use a user-friendly interface or customizable settings provided by Coinly which enable them calculate accurately what they owe therefore report correctly about it hence empowering investors to confidently navigate through this year’s taxes season.

15.Coinwink

Revolutionize the way you manage crypto tax with Coinwink. Synch transactions between various exchanges and wallets without a hassle, while generating detailed tax reports for easy meeting of legal obligations.

With adaptability and live market statistics, this platform allows users to accurately compute their cryptocurrency taxes; thus giving them peace of mind during the taxing season as well as any other time.

16.CoinGecko

Make your cryptocurrency taxation journey easier with CoinGecko. Track transaction effortlessly across many different exchanges and wallets then create custom-made tax reports in line with relevant laws or regulations.

Real-time market data together with user-friendly interfaces make it easy for investors to comply with tax requirements on cryptocurrencies while also providing accurate reporting that can help them optimize their liabilities against such levies during the filing process itself too.

17.CoinMarketCap

CoinMarketCap makes it easy to manage your crypto taxes. Track transactions from different wallets and exchanges conveniently and create tax reports that meet global standards.

This platform ensures compliance with tax laws by providing intuitive interfaces as well as real-time market data which can be used for generating accurate reports on how to reduce liabilities or gain maximum savings during taxing periods while investing in digital assets.

18.Coincodex

Reporting cryptocurrency taxes has never been this simple before! Coincodex enables you to optimize your tax reporting in the crypto space. Import all exchanges’ transactions seamlessly onto a single platform, then generate detailed tax reports based on various jurisdictions around the world that suit specific needs according to different countries’ rules and regulations concerning taxation of virtual currencies like Bitcoin or Ethereum etcetera.

Use this user-friendly interface with customizable features such as settings which make it easy for anyone regardless of their knowledge level about how best calculate cryptocurrency taxes accurately so as not only comply but also save time when preparing them henceforth enabling us navigate through these seasons confidently knowing everything is done correctly

19.BitcoinTaxes

Make your crypto tax reporting simple with BitcoinTaxes.com. It is easy to import transactions from wallets or exchanges and get detailed tax reports that meet worldwide standards.

You can accurately calculate and report cryptocurrency taxes by using such advanced features as FIFO, LIFO, and specific identification methods which are included in BitcoinTaxes.com.

This will help you comply with all necessary regulations so that your peace of mind as an investor is assured.

20.TaxToken

Improve your experience while dealing with crypto taxes using TaxToken.io. You can connect exchanges and wallets seamlessly and generate tax reports that cover various jurisdictions.

Real-time market data combined with customizable settings makes TaxToken.io a user-friendly platform for accurate calculations on cryptocurrency taxes during reporting; thus enabling investors to confidently and easily navigate through the tax season.

21.BitTaxer

Uncomplicate your crypto tax management with BitTaxer. Allow transactions from exchanges and wallets to be imported without effort and generate detailed tax reports that comply with the regulations globally.

BitTaxer ensures accuracy in filing taxes for cryptocurrency investors by making the process easy to understand with its intuitive interfaces and advanced features of tax optimization which simplifies the complex nature of cryptocurrency taxation.

22.Crypto FIFO LIFO Calculator

Simplify your crypto tax calculations using Crypto FIFO LIFO Calculator. Calculate gains and losses effortlessly through LIFO or FIFO methods then produce detailed tax reports for accurate reporting.

Offering a streamlined approach to accurately calculate and report on cryptocurrencies taxes, this software has friendly user interfaces coupled with customizable settings thereby empowering investors during this tax season to confidently navigate through it knowing they have complied.

23.Gilded

Revise the way you handle your cryptocurrency taxes. All the transactions from the exchanges and digital wallets are imported smoothly. Reports that satisfy global regulations concerning tax can be generated as well.

Gilded provides automated reconciliation and real-time market data which make it possible for cryptocurrency investors to comply with tax laws easily thus ensuring precision in dealing with complex matters relating to digital assets taxation.

24.Coinbalance

Make it easier for yourself when reporting crypto taxes through Coinbalance. Record all the transactions made on different exchanges or wallets without struggling; then come up with a detailed tax report that complies with various jurisdictions’ standards.

With simple interfaces and adjustable parameters, Coinbalance enables accurate calculation and reporting of taxes on cryptocurrencies thereby giving power back into hands of any investor during this season – making their journey smooth while boosting confidence level too!

25.Coinlib

Make your coin tax management easy with Coinlib. Monitor all your transactions from different exchanges and wallets without any problem, and produce tax reports that meet the standards of all countries around the world.

In the midst of real time market data and user-friendly interfaces, Coinlib simplifies tax compliance for cryptocurrency investors — providing accurate reporting and insights to navigate through tax season easily.

26.CoinJar

Simplify your crypto tax reporting process by using CoinJar. Importing transactions from other exchanges or wallets is a breeze; it also enables you to generate complete tax reports that follow different jurisdictions in terms of taxes.

With its simplicity in usage together with customization options provided on the interface itself, CoinJar becomes an ideal tool for calculation accuracy when dealing with cryptocurrency as well as ensuring that accurate records are maintained which can be used during filing returns hence empowering individuals who invest in such assets towards having confidence during this period while at same time making everything smooth so they do not have problems later on.

27.Shrimpy

Shrimpy can change how you manage your crypto taxes. You will be able to seamlessly monitor transactions from wallets and exchanges and produce tax reports that go in line with global regulations.

With portfolio management tools that are advanced and real time market data, Shrimpy simplifies compliance of taxes for cryptocurrency investors by ensuring preciseness thus making it easy for them to operate within the complicated tax system.

28.Solana

Solana is a platform for blockchain technology hence does not provide its own software specifically designed for taxation purposes or related tasks like tracking records on taxes paid; however there exist many third party softwares which can do this job if required by someone who wants more information about Solanas token transaction history as recorded through their system so far (SOL).

These programs are usually equipped with features such as accurate calculation methods supporting various types of cryptocurrencies besides providing necessary reporting tools needed for tax purposes concerning any digital asset including SOL among others according to relevant revenue collection authorities regulations globally.

29.TurboTax Crypto

TurboTax offers specialized solutions for crypto taxes that can be integrated into their tax filing platform without any issues.

You can import transactions from exchanges and wallets effortlessly so as to generate extensive tax reports which conform to the requirements of IRS.

This software has user-friendly interfaces coupled with expert support hence making it easy for people who invest in cryptocurrencies to comply with tax regulations while maximizing deductions during this period.

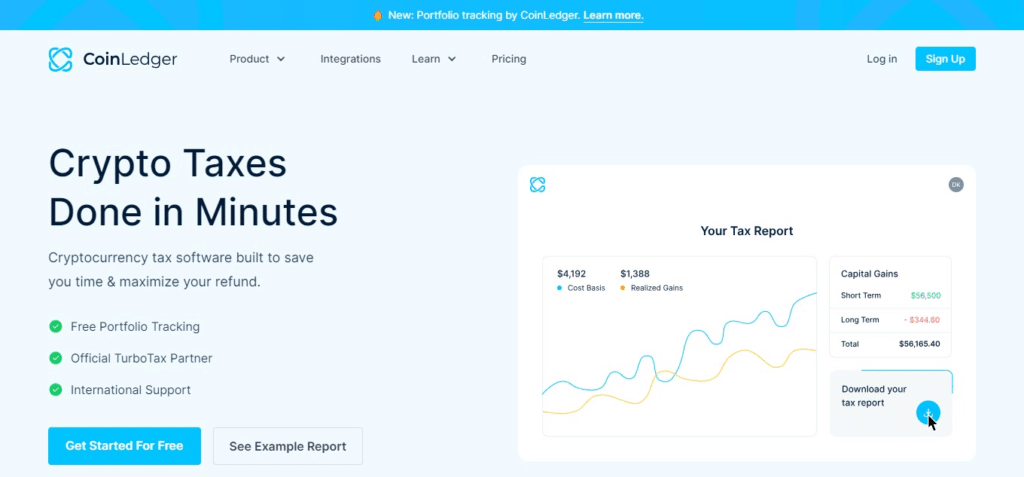

30.Coinledger

Coinledger simplifies crypto-tax reporting. Follow seamlessly transaction exchanges and wallet trackings, create detailful tax reports complying with different jurisdictions.

With an intuitive interface and customizable settings, it allows for accurate calculation of cryptocurrency taxes based on which investors are empowered to navigate through tax season confidently.

How Does Crypto Tax Software Work?

These tools help to report taxes on digital money when it seems like too much work. They get connected with many different exchanges and wallets to make importing data easier.

After linking, they pick up transactional information by themselves; this includes trades, purchases, sales, transfers, etc.

They then use that information together with applicable tax rules plus algorithms for calculating gains or losses made from such transactions as well as resultant tax obligations accurately.

With this method being automated saves time and guarantees adherence to the law hence offering detailed reports needed for filing taxes.

Is Crypto Tax Software Expensive?

Pricing strategies of cryptocurrency tax software differ significantly. Some suppliers propose costless editions having fundamental characteristics, whereas others establish multi-level pricing models contingent on the range of functions and services.

To choose the right software, a person should analyze its worthiness vis-à-vis the price. An informed decision can be made by taking into account such aspects as correctness, simplicity, support service and other features available at any given price level.

Conclusion

To sum up, the importance of choosing the right crypto tax software cannot be overstated because it guarantees correct tax reporting and observance.

This can be achieved by these means: automatic data inputting; application of applicable tax regulations; computations of profits and losses among other things that simplify taxation procedure for people who invest in digital currency.

They come with different features and pricing structures therefore one should pick what suits them most while still giving good value for money.

At the end of it all, if you want peace of mind when dealing with taxes and easy adherence to them then invest in trustworthy cryptocurrency tax software.