In this article, I will discuss the Portfolio Diversification With Crypto Index Tokens. Investors can manage risk and easily handle it as it eliminates the exposure to various cryptocurrencies through one single asset.

Moreover, by merging manifold assets into one token, crypto index funds provides balanced and efficient methods to diversify portfolios and maximize growth potential.

Key Point & Portfolio Diversification With Crypto Index Tokens List

| Index/Fund Name | Key Point |

|---|---|

| DeFi Pulse Index (DPI) | Tracks top DeFi tokens, offering diversified exposure to the DeFi sector. |

| Metaverse Index (MVI) | Focuses on tokens related to virtual worlds, NFTs, and gaming ecosystems. |

| NFT Index (NFTI) | Provides exposure to NFT-related projects and platforms. |

| PieDAO Balanced Crypto Pie (BCP) | A balanced portfolio of BTC and ETH using PieDAO’s automated rebalancing. |

| ETH 2x Flexible Leverage Index (ETH2x-FLI) | Offers 2x leveraged exposure to ETH with automatic risk management. |

| Synthetix Index Token (sDEFI) | Synth-based index tracking top DeFi tokens via Synthetix protocol. |

| Balancer Smart Pools | Customizable index pools with dynamic weight adjustments and liquidity features. |

| PowerPool Dynamic Set Index (PDSI) | Uses dynamic allocation strategies among top DeFi assets with automated governance. |

| Galaxy Crypto Index Fund | Institutional-grade index fund offering exposure to major crypto assets. |

1.DeFi Pulse Index (DPI)

DeFi Pulse Index (DPI), one of the most innovative tokens in the market today, acts as a one-stop solution for most relevant DeFi assets.

It aims to give the investors an integrated view of the decentralized finance sector’s performance by providing a weighted allocation to the selected assets, which dynamically adjusts with the changing market conditions.

DPI’s strength lies within its carefully selected constituents, which drive most innovations assuring the capture of ever-evolving opportunities in the DeFi ecosystem. This flexibly engineered balance makes it suitable for investors who strive to diversify their portfolios in a rather simplistic manner.

Features

- Exposure to Leading DeFi Projects: DPI provides access to a wide range of opportunities in the DeFi space as it tracks the top decentralized finance (DeFi) tokens.

- Rebalanced for Top Performance: The index is strategically rebalanced to capture the most impactful and liquid tokens within the DeFi realm. This ensures optimal exposure.

- Lower Risk through Diversification: With multiple holdings of DeFi tokens, DPI is less risky than a single asset investment in a highly volatile DeFi market.

2.Metaverse Index (MVI)

The Metaverse Index (MVI) adds convenience by clustering top metaverse assets into one token, enabling easier diversification.

It aims at capturing the projects building the virtual worlds, games, and digital assets with wide exposure to this nascent industry. It’s unique in capturing the development of deeply engaging experiences online by emphasizing the synergy of technology and culture.

For investors, this lowers the barrier to exposure to a diverse range of metaverse assets. It minimizes risk while enables participation in a fast growing digital frontier, all with one metaverse index token.

Features

- Focus on Virtual Economies: MVI seeks out tokens that fuel virtual worlds, gaming, and digital economies, capturing the growing metaverse sector.

- Broad Exposure to Gaming & NFTs: Tokens from gaming platforms and NFT projects are included in the index, maximizing investment opportunities across these emerging sectors.

- Flexible Market Access: Without requiring much research, MVI provides access to the metaverse sector and the opportunity to take advantage of further developments in this area.

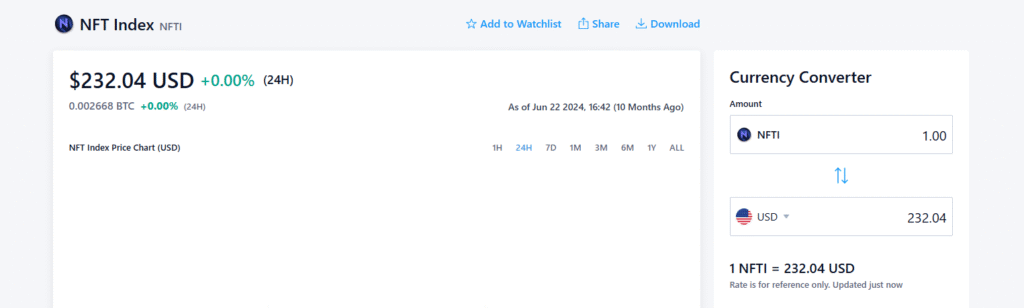

3.NFT Index (NFTI)

NFT Index (NFTI) integrates several NFT-related tokens into single investment, thus providing diversification and exposure to the overarching NFT ecosystem.

Its tokens encompass those from marketplaces, infrastructure projects, and major platforms which facilitate the adoption and proliferation of NFTs. NFTI’s uniqueness lies in its capacity to garner value across multiple segments of the NFT space—not exclusively from digital collectibles.

This index makes it easier to invest in a rapidly developing sub-genre of digital assets. It mitigates risk while enabling them to take advantage of the market expansion in regard to asset ownership, thus increasing investment returns.

Features

- Diversified NFT Exposure: NFTI provides diversified access to the NFT ecosystem by bundling various assets related to NFT.

- Concentrate on Digital Art and Collectibles: The scope of the index captures tokens connected to art NFTs, collectibles, and ownership, thus granting exposure to trends in digital assets.

- Capture Growth in a Niche Market: NFTI allows for effortless investment in a growing interest, avoiding the need to acquire individual NFT tokens.

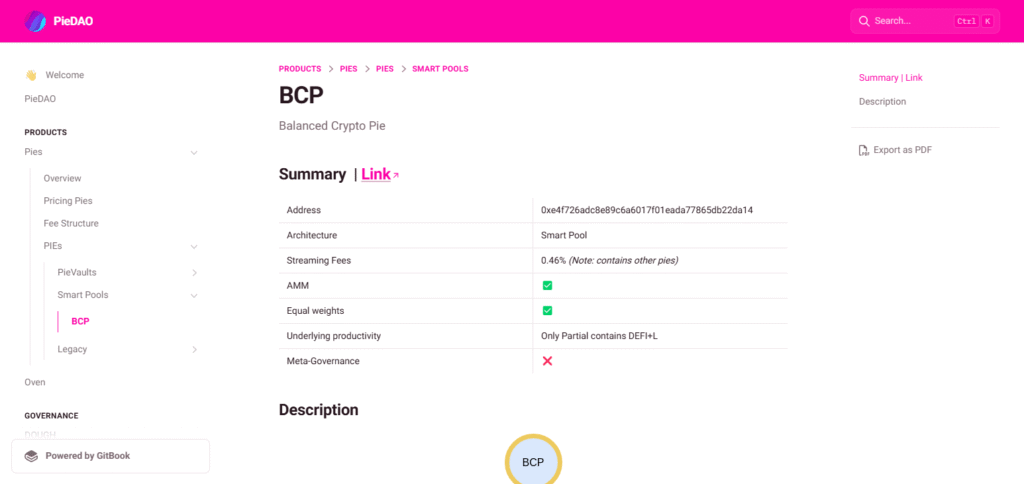

4.PieDAO Balanced Crypto Pie (BCP)

Balanced Crypto Pie (BCP) from PieDAO allows for portfolio diversification as it integrates prominent cryptocurrencies such as Bitcoin and Ethereum into one balanced index token.

Aimed at stability, BCP manages to sustain the two assets at a 50/50 allocation which reduces volatility and captures market growth.

Its most notable feature is simplicity and automation as investors are pre-set to gain automatic exposure to the leading assets in the crypto market without active intervention, making it perfect for those looking for a reliable diversified crypto investment.

Features

- Automatic Rebalancing: With BCP, there is a balanced investment with Bitcoin and Ethereum where both are equally allocated at 50%, which is adjusted automatically.

- Long Term Stability: The index still focuses on stable and low volatility assets which allows long-term investors in crypto to reduce their risk exposure.

- Simplistic Crypto Coverage: Enhanced market coverage of BCP aids easier investment in the biggest and oldest cryptocurrencies without burdening investors.

5.Index Coop’s ETH 2x Flexible Leverage Index (ETH2x-FLI)

ETH 2x Flexible Leverage Index (ETH2x-FLI) by Index Coop offers portfolio diversification by combining leverage and automation risk management into a single token.

It provides double the exposure to Ethereum meaning investors are able to increase their gains but also reduces the risk of liquidation through built in rebalancing mechanisms.

Its unique feature is the optimal mix of leverage and safety, said to be perfect for those wanting high returns but no complicated margin trading. ETH2x-FLI has simplified leveraged investing making it an active tool for diversified portfolios seeking aggressive growth.

Features

- Exposed To Leveraged Ethereum: Offers 2x leveraged ETH exposure enabling higher returns while maintaining the second largest cryptocurrency in the market.

- Dynamic Risk Management: Limitations to liquidation risks are enabled through pre-set automatic rebalancing and risk management strategies built into the index.

- Flexible Investment Strategy: Increased growth opportunities without increasing risks associated traditional margin trading makes ETH2x-FLI leverage safe providing balanced growth moderated by conservative risk.

6.Synthetix Index Token (sDEFI)

Synthetix Index Token (sDEFI) enables portfolio diversification by packaging DeFi tokens into one synthetic token. It is built on the Synthetix protocol and tracks some of the best DeFi projects without the need to hold each individually.

sDEFI’s uniqueness is in its synthetic form, allowing for borderless and permissionless access to the DeFi ecosystem with less slippage and greater liquidity. This is ideal for investors with minimal slippage looking to access a diverse portfolio through one token.

Features

- Decentralized Finance Exposure: With trackings of top DeFi projects, sDEFI provides access to DeFi’s growth ecosystem using the Synthetix protocol.

- Synthetic Asset Structure: sDEFI employs synthetic assets which allow investment in the DeFi market without physically owning every token.

- Lower Slippage and High Liquidity: Being sDEFI in nature guarantees liquidity and decreases slippage while enhancing investment efficiency.

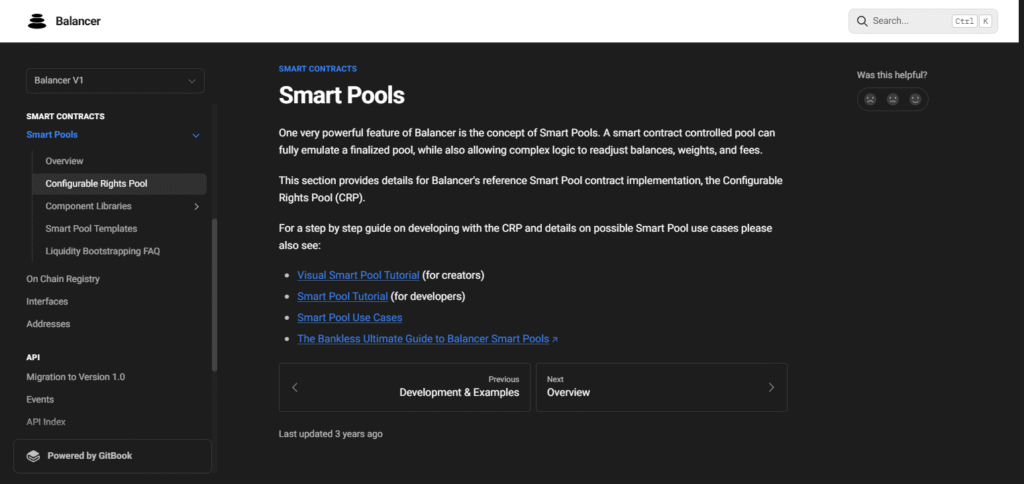

7.Balancer Smart Pools

Balancer Smart Pools facilitate the diversification of portfolios by enabling users to create customizable cryptocurrency index funds with varying asset allocations.

Unlike conventional fixed-ratio indices, Smart Pools offer automated rebalancing based on custom rules, providing dynamic exposure to multiple tokens.

Their distinct characteristic lies in including up to eight assets with changeable proportions, allowing users to strategize and manage risk.

Because of this ability, Balancer Smart Pools serve as a distinct and powerful means for constructing personal diversified investment portfolios in cryptocurrency.

Features

- Customizable Asset Weighting: Users can create personalized crypto index funds of up to eight assets with Balancer Smart Pools, customizing their desired risk and exposure.

- Dynamic Rebalancing: Anytime the asset weighting is reallocated, pre-determined targets are the control objectives during the automatic adjustment.

- Maximized Liquidity: Balancer has put Smart Pools’ high liquidity under constant control to ensure that substantial trades are executed without significant price slippage.

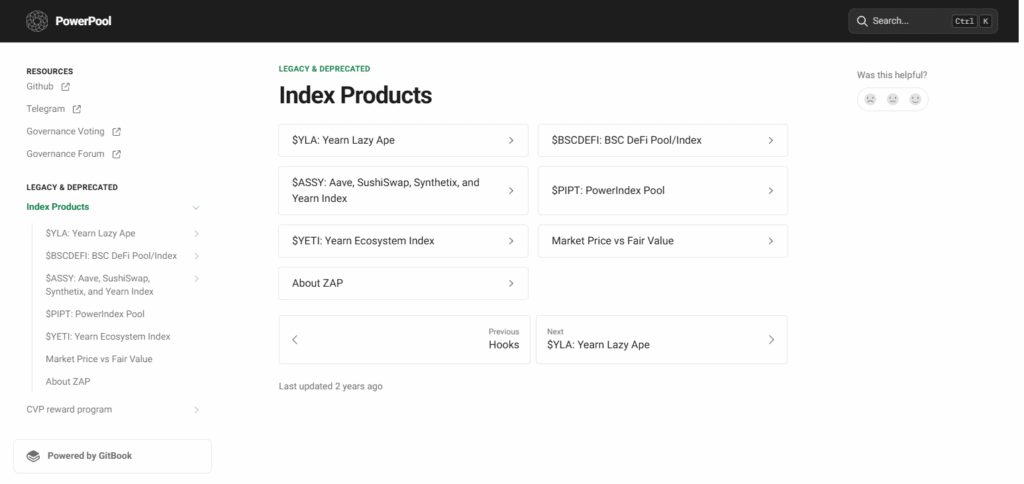

8.PowerPool Dynamic Set Index (PDSI)

The PowerPool Dynamic Set Index (PDSI) promotes diversification of portfolios by merging crucial DeFi assets in a dynamic index created by governance.

PDSI performs rotations in the index’s constituents based on community proposals and success evaluation metrics, unlike static portfolios which have a set range of assets.

The adaptive nature of PDSI is due to its governance structure: the index constituents can be changed mechanically through voting as they are not bound to market caps or predefined allocations. PDSI becomes a tool for exposure to the DeFi ecosystem through one token which is easy to maintain with flexible asset allocation strategies.

Features

- Dynamic Rebalancing: Ongoing modifications of included DeFi assets is driven by governance shifts under PDSI for unlimited market momentum.

- Community-Centric Governance: The index is managed by a community of defenders which best protects the interest of users being served.

- Broad DeFi Exposure: PDSI enables diversified access to important DeFi tokens meaning that investors have exposure to a total pool of decentralized financial services.

9.Galaxy Crypto Index Fund

The Galaxy Crypto Index Fund allows for investment diversification through exposure to the largest cryptocurrencies in one’s single investment.

It monitors a carefully chosen list of large market cap assets, assuring that no digital asset is overexposed and that there is sufficient exposure to both old and new digital assets.

Its distinguishing aspect is the fund’s institutional-grade focus which offers advanced risk management strategies usually reserved for big investors.

This is optimal for investors who want diversified exposure to crypto but want it protected and safeguarded with sophisticated market analytics to lower risk and simplify investing.

Features

- Institutional Grade Investment: As with other funds offered by Galaxy, the Galaxy Crypto Index Fund is managed at a professional level, having sophisticated risk control and strategy.

- Balanced Exposure to Major Cryptos: The fund includes coverage of many major cryptocurrencies which tends to be stable, and shows growth.

- Access to Traditional Investors: Tailored toward institutional investors, it provides sharp exposure to the crypto market for a wider audience.

Conclusion

To sum up, exposure to various indices within the crypto markets is easily feasible through portfolio diversification with cryptocurrency index tokens, which in turn balances risk.

Index tokens aggregate multiple successful projects into a single performing asset, thus many index tokens provide better market exposure.

From established sectors such as Bitcoin and Ethereum to DeFi and NFT emergent sectors and even the metaverse, these tokens facilitate better management. Cryptographic index tokens serve the purpose of obviating complex management tasks and provide optimally calculated resource management.