In this article, I will cover the Defi Aggregator Tokens To Invest that have potential for investment. These tokens symbolize platforms that enhance DeFi trading by merging the liquidity of various providers.

Having knowledge of these tokens can aid investors who monitor technologies, emerging communities, and real-world applications, deeming them valuable within the context of evolving opportunities in the DeFi ecosystem.

Key Point & Defi Aggregator Tokens To Invest List

| Platform | Key Point |

|---|---|

| 1inch (1INCH) | Aggregates DEX prices to offer users the best token swap rates. |

| Matcha (0x Protocol) | Uses 0x API to find optimal prices across multiple liquidity sources. |

| ParaSwap (PSP) | Prioritizes gas efficiency and slippage control in token swaps. |

| Jupiter (JUP) | Leading aggregator for the Solana ecosystem, optimizing cross-DEX swaps. |

| Raydium (RAY) | Integrates order book and AMM liquidity for trading on Solana. |

| THORChain (RUNE) | Enables cross-chain swaps without wrapped tokens or centralized bridges. |

| Uniswap (UNI) | Pioneer in AMM-based DEXs with wide Ethereum ecosystem support. |

| Balancer (BAL) | Offers customizable liquidity pools with flexible token ratios and weights. |

| SushiSwap (SUSHI) | Community-driven DEX with yield farming and multichain support. |

| dYdX (DYDX) | Specializes in decentralized perpetual trading with low fees and high speed. |

1.1inch (1INCH)

1INCH is a token for a DeFi aggregator that is worth investing in due to its unique capability of scanning decentralized exchanges for the best token prices almost instantly.

Its smart routing algorithm splits trades on different platforms so that users receive the trade with the lowest possible slippage and gas costs.

Unlike other single-platform DEXs, 1inch utilizes wide liquidity pools for each pack to maximize all swaps. This added feature makes it one of the most sophisticated solutions in DeFi trading which makes trading in 1 inch highly valued.

Features

- Best Price Aggregation: Enables users to obtain the optimum liquidity swap rate since it sources liquidity from numerous DEXs.

- Gas Optimization: Uses gas-cutting routing algorithms for gas token transactions.

- Governance Token: Protocol decisions and upgrades are left to be voted upon by the 1INCH holders.

2.Matcha (0x Protocol)

Investing in DeFi aggregator tokens like Matcha, which is built on 0x Protocol, is appealing due to its simplicity and smart order routing capabilities.

Matcha’s unique advantage is providing ease of trading while collecting liquidity from both automated and proprietary market makers.

Unlike most platforms, Matcha offers easy to understand execution and fee policies which is advantageous for novices and veterans alike. This combination of user friendliness with high liquidity access makes it one of the top investments in the DeFi aggregator space.

Features

- User-Friendly Interface: Efficiently aggregates plenty of sources to streamline DeFi trading.

- Transparent Pricing: Reports a detailed description of fees charged and slippage experienced in a swap beforehand.

- Integration Flexibility: Permissionless and decentrilized order trading routing.

3.ParaSwap (PSP)

ParaSwap (PSP) is notable for its focus on transaction efficiency and user empowerment. Individual approvers do not require a specific investment strategy to benefit from the cost efficiency offered by the aggregator.

PSP’s most distinguishing characteristic is its proprietary engine which undermines custom routing optimization not only by price, but also by gas fee minimization.

In addition, developers can utilize the API offered by ParaSwap to include sophisticated trading functionalities further increasing the value of the platform beyond the normal exchange. For these reasons, PSP has the added edge and belt in the scope of Defi Investment.

Features

- Multi-DEX Aggregation: Optimizes trading execution through several liquidity sources.

- Smart Order Routing: Splits larger orders into smaller pieces that are better priced.

- DeFi Wallet Integration: Facilitates trading through popular wallets with easy integration.

4.Jupiter (JUP)

Jupiter (JUP) is an attention grabbing DeFi aggregator token in the Solana ecosystem worth investing in. It possesses a distinctive competitive advantage in performing rapid and inexpensive swaps by routing trades through the most optimized DEXs on Solana.

Its seamless compatibility with wallets allows real-time discovery of prices which highly enhances accessibility. Focusing on improving the liquidity and speed of transactions on the chain gives JUP a significant edge making it a crucial dependable asset in the DeFi aggregator frontier.

Features

- Solana Ecosystem Focus: Low-cost and speedy Solana DEX swaps enabled by liquidity aggregation.

- Cross-DEX Routing: Best pricing from a multitude of Solana AMMs.

- Developer-Friendly API: Advanced dApp tools that allow easy integration of dApp swap features.

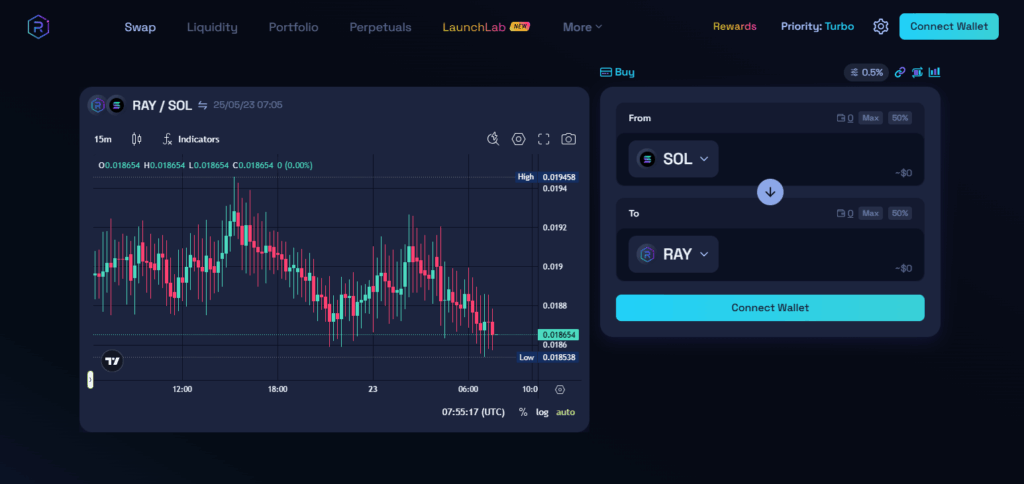

5.Raydium (RAY)

Raydium is an exceptionally appealing DeFi aggregator token for investment because of its unique hybrid type that features an automated market maker (AMM) with a central order book.

This system enables Raydium to maintain high liquidity and competitive pricing on the Solana blockchain. Raydium’s deep liquidity and automated market maker retail store give it exceptional trade execution.

The compatibility with Solana’s speed and low fees makes RAY a prime target for investors focused on DeFi.

Features

- AMM and Aggregator Hybrid: Raydium is an Automated Market Maker (AMM) and an aggregator built on Solana that merges liquidity pools and order books features for users.

- Yield Farming: Provides additional staking and farming rewards over and above swap services.

- Fast Transactions: takes advantage of Solana’s transaction throughput for faster execution.

6.THORChain (RUNE)

THORChain (RUNE) is different from other tokens of DeFi aggregators since it permits true cross-chain swaps without the use of wrapped assets or centralized bridges.

This liquidity protocol gives users the freedom to trade Ethereum, Bitcoin native tokens and several other tokens across blockchains (known as cross-chain swapping).

THORChain’s interoperability between the blockchain ecosystems enables users to take advantage of services in other chains overcoming the limitations of DeFi. RUNE’s value will rise as it gains more prominence in cross-chain transactions.

Features

- Cross-Chain Swaps: Facilitates the swapping of assets between different blockchains without the need of wrapping.

- Decentralized Liquidity Network: Deploys RUNE for collateral and incentives within liquidity pools.

- Permissionless Access: Any person is free to supply liquidity or make trades.

7.Uniswap (UNI)

Uniswap (UNI) is still among the best tokens to invest in for DeFi aggegators because of its automated market making infrastructure on Ethereum.

The primary reason for this advantage is the nature of the protocol’s architecture, which is decentralized, allowing for liquidity provision and fee earning without requiring a sender and receiver intermediary.

Uniswap also continues to advance with features such as concentrated liquidity and fee tiering improving efficiency of capital. Being a basic layer of DeFi, UNI assists in governance, presenting scholarly value and decentralized trading evolution’s อmpact.

Features

- Pioneer AMM: Created the concept of Automatic Market Maker (AMM) with a user-friendly and non-custodial protocol.

- Token Governance: Promotes active participation of communitystakeholders via the governance model where protocol changes and fees are controlled by ownership of tokens.

- Wide Adoption: A large number of users provide liquidity and utilize services on various Ethereum compatible chains.

8.Balancer (BAL)

With Balancer, users can make more sophisticated investment decisions which is why BAL is an attractive investment for advanced DeFi users. Balancer pioneered liquidity provision, and even traditional AMMs cannot come close to its innovation.

Users can create highly customizable liquidity pools with 8 tokens that have custom weightings and Balancer takes care of the rest. BAL becomes even more appealing when considering the deflationary tactics Balancer is using. Despite the need for more liquidity soloutions, BAL tokens remain a strategically priced asset.

Features

- Customizable Pools: Permits the creation of active liquidity pools of various multi-token in different proportions alongside ratio parameters.

- Smart Order Routing: Consolidates liquidity across various pools to improve swap outcomes.

- Protocol Governance: BAL empowers voters to decide on changes such as fee policies and modification enhancements to the platform.

9.SushiSwap (SUSHI)

The community-oriented SushiSwap (SUSHI) DeFi token receives attention due to its cross-chain growth multifaceted business model.

Its most innovative feature is merging a decentralized exchange with other profit generating services such as yield farming, lending, and staking on a single platform.

This facilitates user growth and retention within Ethereum, BNB Chain, and Polygon’s ecosystems. These evolving opportunities in DeFi make SushiSwap adaptive and user-focused, strengthening the value of SUSHI for diversifying It marked investments.

Features

- Community Driven: Prioritizes governance via community focused measures within the project’s ecosystem featuring the SUSHI token which enhances the platform’s treasury.

- Multi-Chain Presence: Functions across Ethereum and numerous layer 2 and side chains.

- Additional Features: In addition to swaps, platforms provide yield farming, lending, and launchpads.

10.dYdX (DYDX)

dYdX (DYDX) is a tempting token for investors interested in DeFi aggregators since it offers advanced features in decentralized perpetual trading with high-speed, low-cost transactions.

dYdX is different from typical AMM-based dDEXs because it features advanced derivatives and margin trading which caters to the professional trader. Its layer 2 scaling solution also improves the UX by decreasing fees and latency.

This combination of refined trading features and eFficient infrastructure תקף DYDX as a powerful token in the fluctuating world of DeFi trading.

Features

- Decentralized Derivatives Exchange: Concentrates on perpetual contracts and margin trading.

- Layer 2 Scaling: Employs StarkWare’s rollups for quick and inexpensive transaction processing.

- Governance Token: Allows participation in governance and fee distribution to DYDX token holders.

Conclusion

In conclusion Defi aggregator tokens represent a distinct form of digital assets by consolidating access to diverse pools of liquidity and streamlining trade execution across different platforms.

Their cost-reduction capabilities, minimized slippage, and improvement of innovative user experiences makes frictionless liquidity provision vital in the ever changing world of DeFi.

Holding these tokens Integrates investors with innovative frameworks designed to achieve greater system efficiencies, interactions among diverse services and unabated user autonomy which positions them for growth in the mainstream ecosystem of Decentralized Finance.