In this article, I will discuss How To Stake Your Bridging Aggregator LP Tokens. Staking these tokens allows you to earn passive rewards while aiding cross-chain liquidity.

I will provide you valuable tips and steps to ensure that you are getting the best out of your crypto. This will help you maximize on your LP tokens as the DeFi ecosystem continously evolves.

What is LP Tokens?

Liquidity Providers Tokens or LP tokens are harvested from users that add liquidity to pools in DeFi. Once you deposit tokens into a liquidity pool on Uniswap or SushiSwap, LP tokens are given to you through an automatic exchange signifying your ownership in that pool.

LP tokens are beneficial for receiving a share of the pool’s wealth, fee, and assets. LP tokens as well are stakeable which means holders could earn rewards from other DeFi protocols.

How To Stake Your Bridging Aggregator LP Tokens

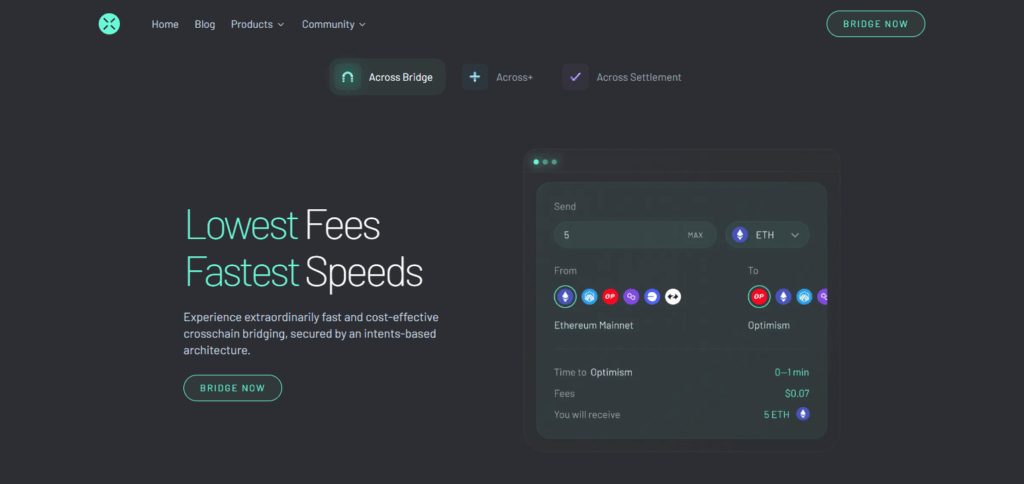

By staking bridging aggregator LP tokens, you are able to cross-chain yield farming which allows you to earn rewards and provide liquidity at the same time. The example below uses Across Protocol:

Step-by-Step Guide to Staking LP Tokens on Across Protocol

Provide Liquidity

Visit the Across Pool page and ensure to connect the appropriate wallet.

Select a liquidity pool of your choice and deposit tokens to earn LP tokens.

Navigate to Staking

Locate the Staking section on the same platform and find liquidity LP token staking.

Click the arrow to unlock the liquidity staking section.

Stake Your LP Tokens

Type in the quantity of LP tokens you wish to stake, or opt to select “MAX.

After ensuring the details entered are correct, proceed to click “Stake.”

Finally, approve the transaction in your wallet.

Earn Rewards

You will have fees from all the bridging transactions add to your LP tokens which will be earned.

On the rewards page, you will be able to track your staking.

Unstake When Needed

Confirm transaction and select the number of staked tokens you wish to withdraw.

Go to the unstaking section first for you to unstake the token.

Other place Where To Stake Your Bridging Aggregator LP Tokens

Beefy Finance

Beefy Finance remains at the top among bridging aggregator LP tokens for staking since it provides automated yield enhancement spanning various blockchains. What sets it apart are its auto-compounding vaults which reinvest the profits generated from the LP pools, perpetually increasing the earnings.

This method of token management enhances returns over time while also supporting numerous bridging aggregators, providing users with token diversification and cross-chain access with ease. Multi-chain access, as well as an intuitive interface, makes Beefy an easy candidate for efficient and high-yield staking of LP tokens.

SushiSwap

SushiSwap stands out as a trustworthy site for staking bridging aggregator LP tokens because it is fully equipped with cross-chain pool liquidity and advanced farming functions. The primary distinguishing characteristic is the Onsen Menu which actively incentivizes certain LP pairs with enhanced rewards, including bridging aggregators.

In addition, SushiSwap is multi-chain so users can earn yield on LP tokens from different networks in a single location. This makes it a tactical choice for users aiming at constant returns and multi-chain liquidity exposure.

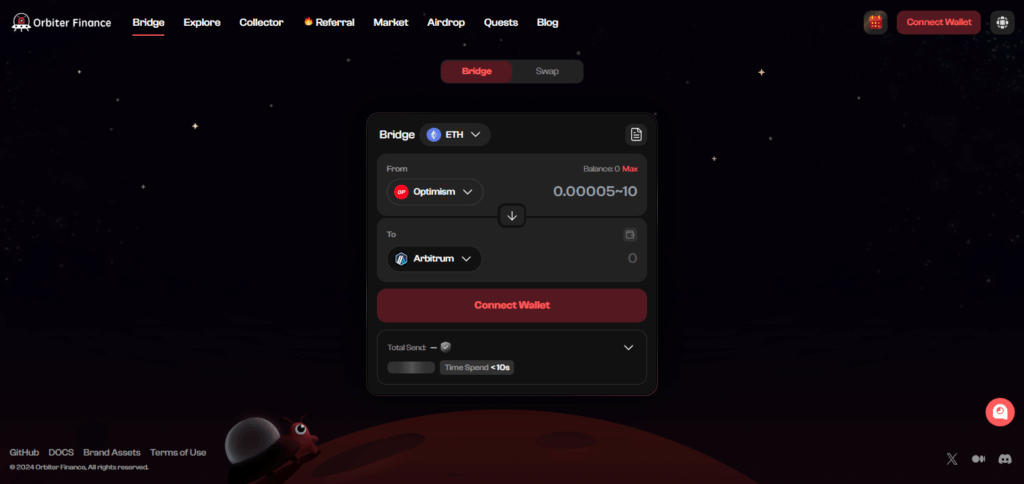

Orbiter Finance

Orbiter Finance is one of the most advanced staking platform that bridges multiple chains. It enables users to stake bridging aggregator LP tokens across 70+ chains including Ethereum Layer 2 ecosystems like zkSync, Arbitrum, Optimism, etc.

Through its O-Pool system and the ZK-SPV technology, trustless, rapid cross-chain transactions are executed in 10-20 seconds. Orbiter refuses wrapped tokens and central validators, providing a trust-minimized environment that enables effortless LP token staking. Users of cross-chain DeFi services offered at speed, low-cost, and security deem Orbiter as their go-to choice.

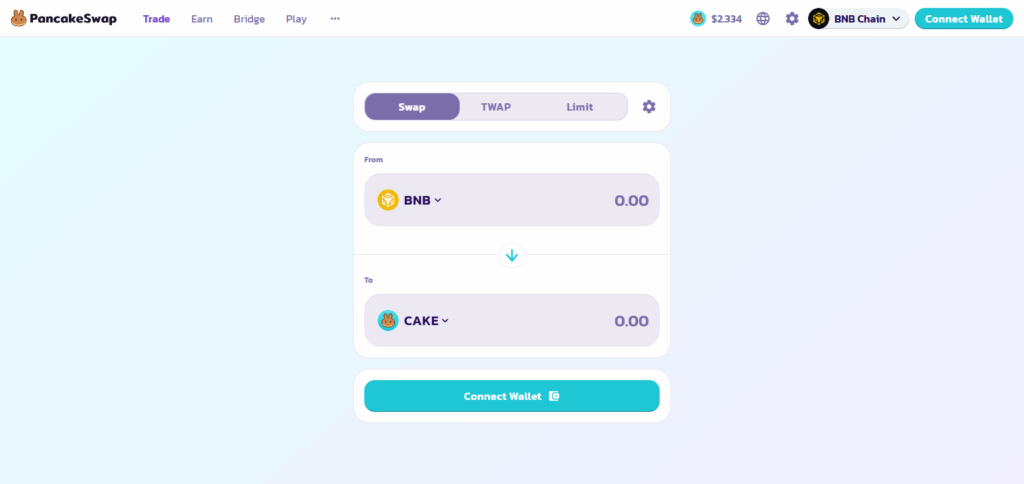

PancakeSwap

PancakeSwap is one of the most popular choices for staking bridging aggregator LP tokens due to it’s fast transactions and low fees on Binance Smart Chain (BSC). It is PancakeSwap that offers many more ways of farming by allowing users to stake LP tokens with even more boosted rewards through Syrup Pools.

It is very easy to get cross-chain liquidity opportunities with the help of the strong community and user-friendly interface which allows users to access these opportunities safely and smartly in the expanding DeFi ecosystem to maximize their earning PancakeSwap staking rewards.

Why Stake Bridging Aggregator LP Tokens?

Earn Passive Income: Incentive token payouts can turn staked LP tokens into a viable source of passive income.

Increased ROI via Auto-Compounding: Beefy Finance, among other platforms, auto-compounds rewards, allowing earning increases over time without added labor.

Highest Capital Efficiency: LP Tokens have better capital efficiency than idle assets because they are actively utilized on multiple chains when staked.

Aid Active Cross-Chain Liquidity Staking: Staking improves liquidity maintenance across bridges which improves efficiency of the network and experience of the users.

Strategic Marketing Access: Protocols provide governance, underutilized opportunities, bonus rewards, or selective access to other mark for LP token stakers.

Prerequisites Before Staking

Setting Up a Crypto Wallet: Make sure to have a non-custodial wallet like MetaMask and Trust Wallet which is ready for multi-chain configurations.

Add Liquidity to A Pool: In order to receive LP tokens, you are required to provide liquidity to a supported bridging aggregator.

Gas Tokens Sufficiency: Possess sufficient native tokens such as ETH, BNB or MATIC to spend on the network’s gas fees for staking and withdrawal.

Checking Platform Compatibility: Ensure that the staking platform accepts your LP token and the network they operate on.

Complete Lock-in Clause: Examine the staking terms, including lock-in duration, withdrawal limits, and reward claiming intervals.

Is It Worth It to Stake Bridging Aggregator LP Tokens?

Get Staking Rewards to Blast off

Staking may grant generous APYs, increasing returns on investment compared to simple “holding on to the tokens.”

Maintains Liquidity and Ease of Transfer

Staking works towards keeping liquidity and allows transfer of assets from one blockchain to another by supporting cross-chain ecosystems.

Highest Growth without Effort

Many platforms offer auto-compounding which elevates your rewards for you. Always winning!

Precautions to Take

Profits can be affected by risks involving impermanent losses, smart contract vulnerabilities, and changing prices of the tokens.

Requires Hands on Management

Change staking pools to different pools to maximize benefits via strategy changes on rotation. This is crucial if you want increased benefits.

As a Whole

Taking calculated risks with proper selection will lead to higher profits from pegging bridging aggregator LP tokens as a DeFi strategy.

Tips to Maximize Your Staking Rewards

Pick a Pool With a High APY

Pick pools with high yields but ensure to check the reliability of the platform in order to lessen the risk.

Reinvest Rewards Automatically

Enable the auto-compounding feature to optimally restake earned rewards, or manually claim them to improve overall returns.

Reduce Risk by Spreading Assets Crossing Platforms and Chains

Strategically lessen risk by distributing LP tokens between multiple bridging aggregators and various blockchains.

Keep an Eye on Gas Costs

Participate in staking activities on networks with low transaction costs to ensure that the fees earned offset the profits.

Make Sure to stay Updated

Track new opportunities for staking, reward changes, protocol updates, and adjust your strategy as needed.

Risks and Considerations

Impermanent Loss

Value decline by holding paired tokens over a time period relative to value increase by holding staked LP tokens.

Smart Contract Vulnerabilities

Inadequacies in bridging or staking contracts may result in financial loss due to fund stealing hacks.

Platform Risk

Potential compromise on streamlined applications owing to less stringent gateways.

Market Volatility

Price fluctuations pre and post time of purchase around a specified date results aggravating gain or loss.

Gas Fees

Net profit diminishment particularly during transaction on Ethereum side chains.

Lock-Up Periods

Restricted access to liquidity while bound by certain terms within designated time intervals.

Pros and Cons

| Pros | Cons |

|---|---|

| Earn passive income through rewards | Risk of impermanent loss |

| Supports cross-chain liquidity | Potential smart contract vulnerabilities |

| Auto-compounding increases yields | Market volatility affects token value |

| Access to governance and incentives | Gas fees can reduce overall profits |

| Diversifies DeFi exposure | Lock-up periods may limit token access |

Conclusion

In summary, staking bridging aggregator LP tokens enables one to passively earn income while aiding liquidity and cross-chain DeFi ecosystem development.

Earning rewards through passive income streams is possible by staying diligent full managed accounts fee structures and rewarded staking.

These underline the dual value of LP token staking even for novice investors alongside avid traders. Staking LP tokens presents fresh new opportunities for yield optimization and long-term portfolio expansion irrespective of one’s experience level.