In this article, I will discuss how to Stake Tokens on Cross-Chain Pools, as participating in multiple blockchains while earning rewards can be quite lucrative.

I will outline the techniques to stake while maximally increasing the rewards and navigating the various risks.

This guide is designed for both beginners and veterans in DeFi, enabling anyone to understand cross-chain staking and make more informed decisions about their crypto assets.

What Are Cross-Chain Pools?

Cross-chain pools are decentralized liquidity pools that permit users to stake and/or swap tokens across multiple blockchains with ease. Unlike traditional single-chain pools, these cross-chain pools use bridging technology to connect disparate blockchain networks, allowing tokens to migrate and interact beyond their native chains.

This increased interoperability boosts liquidity, mitigates transaction congestion, and expands potential earnings. Investors who stake tokens in cross-chain pools can engage in yield farming, liquidity provisioning, and governance activities across multiple blockchains selectively. Cross-chain pools eliminate the barriers of isolated networks and facilitate a more efficient DeFi ecosystem.

How to Stake Tokens on Cross-Chain Pools

Example: How to stake tokens on cross-chain pools

Step 1: Select a Cross-Chain Platform

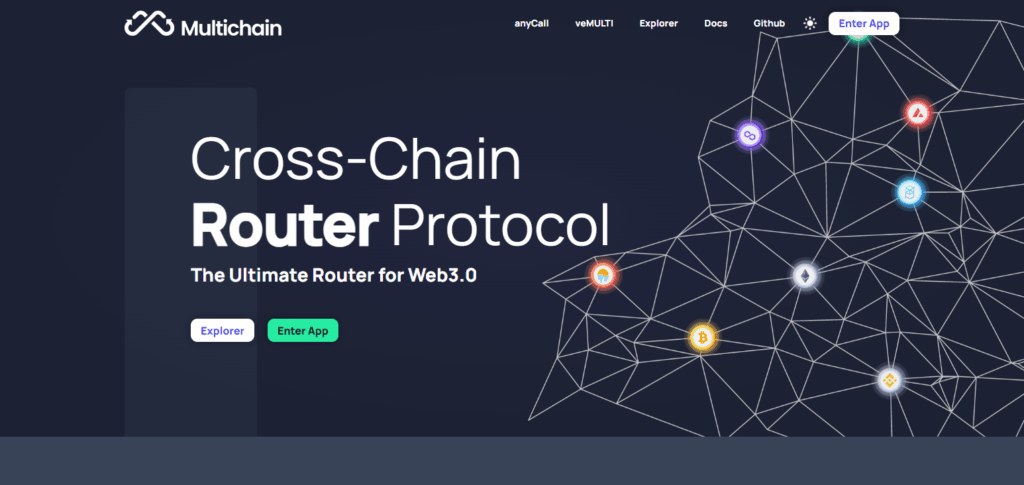

Select a cross-chain liquidity pool on the trusted platform, Multichain (previously Anyswap).

Step 2: Link Your Wallet

Link a Web 3.0 wallet, such as MetaMask, having the ether tokens to stake, as well as some native gas-fee crypto, e.g., eth, bnb, to cover gas.

Step 3: Bridge Crypto to the Selected Chain

Suppose your tokens are sitting on the Ethereum chain, and the staking pool is on Binance Smart Chain (BSC). In this case, you’ll need to use the cross chain bridge and approve transaction on the relevant chain to the other.

Step 4: Staking Pool Selection

In the Portfolio section, there is a section titled “Pools.” Select a cross-chain pool attached to your crypto (for instance, USDC-ETH).

Step 5: Token Submission

The smart contract needs to be approved. Once approved, you can deposit your tokens to the pool. Upon staking, the platform will notify you.

Step 6: Perform Tracking and Collect your Returns

As long as your tokens are staked, they can start to earn yield. Token yield can be tracked in your wallet or the app dashboard. Your wallet can be staked and re-staked.

Step 7. Withdraw any time.

When you want to leave, simply cash out your tokens and claim any remaining rewards. You might have to bridge tokens back to the first chain if necessary.

Why Stake Tokens on Cross-Chain Pools?

Earn Passive Income – Stakers get yields or rewards for providing liquidity on multiple blockchains.

Enhanced Liquidity – Cross-chain pools permit tokens to move across networks which reduces fragmentation and aids in market optimization.

Access to Multiple Ecosystems – Users are not restricted to a single network as they can access DeFi opportunities on various blockchains.

Portfolio Diversification – Staking in multi-chain pools enables investors to distribute their assets across chains which minimizes over-reliance on a single blockchain.

Support Network Growth – By staking, they help secure cross-chain infrastructure which also promotes wider adoption of blockchain technology.

Lower Transaction Bottlenecks – Interoperability reduces congestion on a single chain which translates to lower costs and faster transaction speeds.

Benefits of Cross-Chain Staking

The following are the key benefits of cross-chain staking in easy bullet points:

Higher Reward Potential – Cross-chain pools usually yield greater value compared with solo-chain pools.

Portfolio Diversification – Staking in multiple blockchains decreases the reliance on a single network.

Access to Multiple Ecosystems – Gain access to various DeFi platforms and protocols.

Improved Market Liquidity – Fragmented markets are united, which results in easier token transfers and swaps.

Less Network Congestion – Cross-chain activity is balanced, which reduces delays and transaction fees.

Improved Interoperability – Inter-chain connections and collaboration are enhanced which strengthens the entire ecosystem.

Investor Freedom – Staking assets to a network with the most favorable conditions is simpler to accomplish.

Tips for Safe Staking on Cross-Chain Pools

Select Trustworthy Platforms – Only use platforms that have been audited and have a reasonable record regarding security.

Look For Audited Contracts – See if the contracts for the staking pool have been audited to reduce the chance of exploits.

Wallets Use – Stick to hardware wallets or use highly acclaimed Web3 wallets like MetaMask and Trust Wallet.

Dip Your Toes – Before risking large sums of money to test the process and see if it is safe and protected, experiment with a small amount.

Security of the Bridge – Because cross-chain pools depend on bridges, the platform should have solid bridging technology.

Transaction Fees – Ensure gas fees and transaction costs are low to avoid unnecessary losses.

Bug Fixes – Official project channels should be monitored for new updates or possible alerts to security weaknesses.

Best Practices to Maximize Rewards

Re-Stake Earned Rewards – Withdrawals should come much later if the intention is to earn compound rewards.

Track Pool Performance – Always monitor APY (Annual Percentage Yield), when able switch to better offering pools.

Diversify Across Pools – To reduce the risk taken on and the wider return of cross-chain staking, spread the tokens in different pools.

Time Your Transactions – In staking and claiming, gas fees are more economical when the network is congested.

Monitor for Announcements – Track announcements of new rewards, protocol upgrades, or new governance votes.

Keep Your Funds Safe – Always use reliable wallets, and allocate the best private key protection for tokens under staking.

Withdraw With A Strategy – to increase the overall profit, market conditions should still be in favor when withdrawals are taken out.

Risks and Challenges

Smart Contract Vulnerabilities – Due to staking contract bugs or other exploits, risks to funds are apparent.

Bridge Security Risks – Cross-chain bridges are often breached and, thus, rely heavily on the broader security environment.

Market Volatility – Any sudden drops in value of staked tokens will automatically deteriorate the staked reward and may even lead to losses.

Impermanent Loss – Token price divergence can lead to worse value liquidity pools and thus staked rewards.

High Transaction Fees – On-chain smaller amounts of staked tokens can lead to disproportionate gas losses on the network.

Lock-Up Periods – Some liquidity pools arbitrarily limit the withdrawal of funds and thus free extremist access to liquidity.

Regulatory Uncertainty – The imposition of new regulations may bring compliance issues to the users of cross-chain platforms.

Pros & Cons

| Pros | Cons |

|---|---|

| Higher reward potential compared to single-chain staking | Smart contract vulnerabilities may cause fund losses |

| Access to multiple blockchain ecosystems and DeFi platforms | Bridge security risks make cross-chain pools common hack targets |

| Portfolio diversification across different networks | Market volatility can reduce the value of staked tokens |

| Enhanced liquidity through interoperability | Impermanent loss when providing liquidity in pools |

| Reduced network congestion and lower transaction bottlenecks | High gas and transaction fees can cut into profits |

| Flexibility to move assets and stake on better pools | Lock-up periods may limit access to funds |

Conclusion

Cross-chain pools allow the earning of passive income while supporting the cross-chain movement of assets.

Investors, through the bridging of assets across different networks, earn better returns and have enhanced liquidity while gaining access to other DeFi opportunities.

But, one must not forget— the risks of bridge security, smart contract risk, and of course, market risks. With a little research, secured wallets, and a staking strategy, cross-chain staking can be a valuable resource for maximizing returns in a connected crypto ecosystem.

Always ease in, distribute your investments across the pools and don’t stop following the changes on the platforms to maximize your security.

FAQ

It can be safe if done on audited and trusted platforms, but risks like bridge hacks, smart contract bugs, and market volatility remain.

This depends on the platform, but commonly supported tokens include ETH, USDT, USDC, BNB, and other ERC-20 or BEP-20 assets.

Simply go to the platform’s dashboard, select your staking pool, and click “Withdraw.” Some pools may require bridging tokens back to your original chain.