In this article, I will describe the Best Ethereum Aggregators, which are designed to assist users in optimizing yields, minimizing trading costs, and effectively combining access to multiple DeFi protocols.

These aggregators automate the strategy building processes, optimize token swaps, and reduce slippage, simplified the yield farming and trading activities for all levels investors, novice and expert alike. Identify Ethereum aggregators from this list that will provide you the most and safest returns.

What is Ethereum Aggregators?

Ethereum aggregators are tools or platforms that pool liquidity and provide trading services across multiple decentralized exchanges or DEXs on Ethereum. Users can trade on most DEXs and access best prices and lowest DEX trading fees through a single interface instead of trading on one DEX.

Ethereum trade value is maximized through order splitting, efficient transaction routing, and slippage reduction. Besides aggregating liquidity, Ethereum trading can provide advanced services such as trading token swaps, conducting price comparisons, and offering trading analytics.

These services are most useful in Aggregate Ethereum trading and are available to any user in DeFi and Ethereum Ethereum trading analytics.

Why Use Ethereum Aggregators

Most Profitable: They check numerous decentralized exchanges (DEXs) to locate the best price available for a trade.

Less Slippage: They split DEX orders to reduce the price slippage and slippage.

Cheaper: They pinpoint the transaction and gas price routes.

Less Time: Instead of wasting time hopping from exchange to exchange, they use one seamless interface.

More Available Tokens: They connect to a greater number of DEXs and, as a result, provide a larger variety of ERC-20 tokens.

More Sophisticated Trading Applications: Many of them provide analytics, trade routing, and price comparison.

Less Counterparty Risk: Trades are completed and settled on-chain as opposed to relying on off-chain execution from a centralized exchange.

Key Point & Best Ethereum Aggregators List

| Platform | Key Features / Notes |

|---|---|

| Yearn Finance | Automated yield optimization across DeFi protocols; vault strategies |

| Beefy Finance | Multi-chain yield optimizer; auto-compounding vaults |

| Convex Finance | Boosts Curve LP yields; staking and CRV rewards |

| Harvest Finance | Automated yield farming; farm aggregation across multiple protocols |

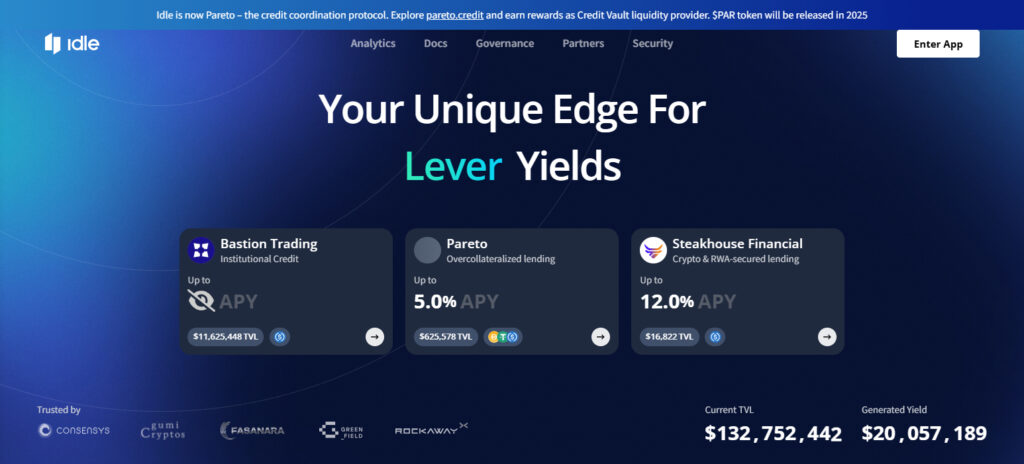

| Idle Finance | Optimizes stablecoin yields; risk-adjusted strategies |

| Metavisor | DeFi investment aggregator with strategy management |

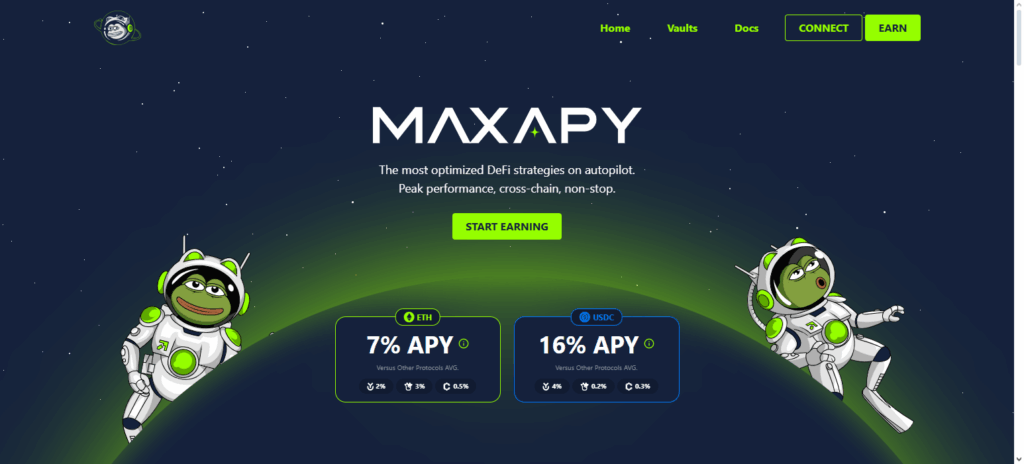

| maxAPY | Highest potential annual yield across all platforms |

1. Yearn Finance

Yearn Finance remains the most sophisticated Ethereum yield aggregator. Automating yield optimization means users passively maximize returns. Its distinctive vault strategies monitor a myriad of DeFi protocols and dynamically adjust the allocation of funds to the most profitable opportunities.

They do this while averting gas costs. Other platforms gas automate every aspect of optimizing a strategy and do not step back to analyze safety and efficiency. This is not the case with Yearn Finance. Using advanced smart contracts, it manages safety and slippage. Users enjoy the benefit of passive income, advanced yield farming, and the absence of constant attention that holds most yield strategies.

The community of advanced users that has the module built and the strategies designed to automate remains the most sophisticated. For this reason, Yearn Finance remains the most sophisticated Ethereum yield aggregator.

| Feature | Details |

|---|---|

| Platform Name | Yearn Finance |

| Type | Ethereum Aggregator / Yield Optimizer |

| KYC Requirement | Minimal / Not required for basic use |

| Supported Tokens | Multiple ERC-20 tokens |

| Key Function | Automated yield farming and vault strategies |

| Max APY* | 15-20% |

| Gas Fees | Variable; optimized via smart contracts |

| Security | Audited smart contracts, decentralized |

| User Level | Beginner to advanced |

| Unique Point | Automatically reallocates funds across DeFi protocols for max returns |

2. Beefy Finance

One of the best Ethereum aggregators is Beefy Finance, with its automated compounding vaulted aggregators and cross-chain yield optimizing.

Its automated reward boosting feature is one of its core strengths, as no manual compounding is required on the user’s end. Beefy Finance caters to any and all phases of risk and a large array of tokens and protocols in the DeFi space.

Its operational cost returns, along with the open-access DeFi space, make its guarantee of asset safety with smart contract automation, no risk placed operational cost, and no smart contract abuse at all.

Its dedicated emphasis on automation, access to multiple protocols, and yield consistency positions it as one of the best options to Ethereum users.

| Feature | Details |

|---|---|

| Platform Name | Beefy Finance |

| Type | Ethereum Aggregator / Yield Optimizer |

| KYC Requirement | Minimal / Not required for basic use |

| Supported Tokens | Multiple ERC-20 tokens |

| Key Function | Auto-compounding vaults for yield optimization |

| Max APY* | 12-18% |

| Gas Fees | Variable; optimized via smart contracts |

| Security | Audited smart contracts, decentralized |

| User Level | Beginner to advanced |

| Unique Point | Multi-chain support with automated compounding for higher rewards |

3. Convex Finance

Convex Finance is one of the most efficient Ethereum aggregators available for yield traders because it specializes in optimizing Curve Finance liquidity provider (LP) rewards.

It permits users to stake Curve LP tokens and earn enhanced CRV and CVX rewards without having to directly lock resources on Curve. It automates the complicated reward optimization and fee distribution processes, ensuring users’ manual work is minimized.

Combining high annual percentage yields thus low gas costs on transfers, and ease of use in the interface, convincingly targets the casual and professional participants of DeFi. Owing to its efficiency, reward optimization, and straightforward services, Convex Finance is one of the most efficient Ethereum aggregators available.

| Feature | Details |

|---|---|

| Platform Name | Convex Finance |

| Type | Ethereum Aggregator / Yield Booster |

| KYC Requirement | Minimal / Not required for basic use |

| Supported Tokens | Curve LP tokens, CRV, CVX |

| Key Function | Boosts Curve liquidity rewards and optimizes staking |

| Max APY* | 10-16% |

| Gas Fees | Variable; optimized via smart contracts |

| Security | Audited smart contracts, decentralized |

| User Level | Beginner to advanced |

| Unique Point | Maximizes Curve LP rewards without requiring users to lock assets directly |

4. Harvest Finance

Harvest Finance is an Ethereum aggregator that offers automated yield farming and is recognized as a leader in its field. The ability to optimize returns while lowering gas fees and minimizing hands-on management is unparalleled.

Harvest Finance’s automated fund allocation to the most lucrative farms means users do not need to supervise their accounts to ensure profits are being earned.

The platform’s safety and certainty are built around audited smart contracts that minimize risk exposure.

The user interface is simplified and makes yield farming available to novice and expert yield farmers thanks to the efficient auto-compounding vaults. This is why Harvest Finance is often regarded as the best Ethereum aggregator.

| Feature | Details |

|---|---|

| Platform Name | Harvest Finance |

| Type | Ethereum Aggregator / Yield Farming Optimizer |

| KYC Requirement | Minimal / Not required for basic use |

| Supported Tokens | Multiple ERC-20 tokens |

| Key Function | Aggregates yield farming strategies across protocols automatically |

| Max APY* | 8-15% |

| Gas Fees | Variable; optimized via smart contracts |

| Security | Audited smart contracts, decentralized |

| User Level | Beginner to advanced |

| Unique Point | Automatically reallocates funds to the most profitable farms with minimal effort |

5. Idle Finance

Idle Finance is the top Ethereum aggregator singularly focused on stablecoin and token yield optimization. What sets Idle Finance apart is that it automatically allocates capital to different lending and liquidity instruments according to their performance and risk profile, allowing users to capture the maximum yield at a defined risk.

The repetitive processes of rebalancing and auto-compounding their capital is done risk-efficiently to save users on gas fees and reduce the friction of manual adjustments. Minimally, users will appreciate the clean interface and the security of their funds in smart contracts, regardless of their investing experience.

The seamless interworking of these systems in automation, risk-adjusted yield optimization, and manual effort minimization contributes to why Idle is among the top Ethereum aggregators.

| Feature | Details |

|---|---|

| Platform Name | Idle Finance |

| Type | Ethereum Aggregator / Yield Optimizer |

| KYC Requirement | Minimal / Not required for basic use |

| Supported Tokens | Stablecoins and multiple ERC-20 tokens |

| Key Function | Risk-adjusted yield optimization across multiple DeFi protocols |

| Max APY* | 7-12% |

| Gas Fees | Variable; optimized via smart contracts |

| Security | Audited smart contracts, decentralized |

| User Level | Beginner to advanced |

| Unique Point | Allocates funds automatically based on risk and performance to maximize returns |

6. Metavisor

Metavisor is an Ethereum aggregator that merges the automation of yield optimization with strategy management to make DeFi investing easier. Metavisor’s customizable investment strategies allow users to manage their own risk.

Regarding profit optimization, Metavisor monitors several protocols and reallocates funds to the most lucrative targets, optimizing gas fees and slippage.

While Metavisor is designed to be user-friendly and suitable for novice DeFi users, the volume of performance data makes the platform equally valuable for professionals. For integrating automation with flexibility and effective use of resources, Metavisor is one of the most reliable Ethereum aggregators.

| Feature | Details |

|---|---|

| Platform Name | Metavisor |

| Type | Ethereum Aggregator / DeFi Strategy Manager |

| KYC Requirement | Minimal / Not required for basic use |

| Supported Tokens | Multiple ERC-20 tokens |

| Key Function | Customizable investment strategies with automated yield optimization |

| Max APY* | 6-12% |

| Gas Fees | Variable; optimized via smart contracts |

| Security | Audited smart contracts, decentralized |

| User Level | Beginner to advanced |

| Unique Point | Allows users to balance risk and reward with automated fund reallocation |

7. maxAPY

maxAPY is an Ethereum aggregator designed to achieve maximum possible annual percentage yields by optimally routing users’ funds through top-rated DeFi protocols. It excels in real-time optimization by focusing on several protocols to obtain the best yields in the market while lowering gas fees and slippage.

Automated compounding is another feature maxAPY has to offer. It provides users with maximized returns while they sleep. Users can calculate risks thanks to the thorough performance reports provided by maxAPY.

By focusing on smart automation and high-yield strategies, maxAPY has positioned itself as one of the top Ethereum aggregators for users looking to earn passive income.

| Feature | Details |

|---|---|

| Platform Name | maxAPY |

| Type | Ethereum Aggregator / Yield Optimizer |

| KYC Requirement | Minimal / Not required for basic use |

| Supported Tokens | Multiple ERC-20 tokens |

| Key Function | Real-time yield optimization and automated compounding |

| Max APY* | 20%+ |

| Gas Fees | Variable; optimized via smart contracts |

| Security | Audited smart contracts, decentralized |

| User Level | Beginner to advanced |

| Unique Point | Continuously analyzes multiple DeFi protocols to maximize returns |

Pros & Cons

Pros:

- Best Prices: Aggregators scan multiple DEXs to find the best deals.

- Reduced Slippage: Efficiently splitting and routing orders help minimize price impact.

- Lower Fees: Identifying routes with lower gas and transaction costs.

- Time-Saving: A unified interface to trade across several marketplaces.

- Access to More Tokens: Aggregators link with various DEXs, providing a more extensive range of tokens.

- Automated Yield Optimization: Certain aggregators help to auto-compound rewards to maximize passive income.

- Enhanced Security: Because trades are on-chain, the risk of using centralized exchanges is lower.

Cons:

- Smart Contract Risk: Aggregator contracts may have bugs or become exploits.

- Platform Dependency: The aggregator’s liquidity is reliant on the DEXs that are connected.

- Variable APY: Counterparty liquidity and overall market conditions impact interest rates.

- Gas Fees: Complex trade routing may lead to higher gas fees.

- Limited Control: Automated strategies that don’t suit risk preferences of all investors.

Conclusion

To sum it all up, Ethereum aggregators transformed the landscape of DeFi trading by enabling users to optimize yields, minimize slippage, and obtain assorted tokens from different platforms.

Top aggregators such as Yearn Finance, Beefy Finance, Convex Finance, Harvest Finance, Idle Finance, Metavisor, and maxAPY automate strategies, provide seamless routing of capital, and offer returns with risk management, thereby streamlining and enhancing the profitability of yield farming, and farming and trading as a whole.

Even though automated systems, efficiency, and optimized APYs run the risks of smart contract exploitation and poorly defined average percentage yields, it is safe to say that Ethereum aggregators are a must for all investors, regardless of their experience level, who want to maximize returns, streamline, and automate management of their Ethereum holdings.

FAQ

Top aggregators include Yearn Finance, Beefy Finance, Convex Finance, Harvest Finance, Idle Finance, Metavisor, and maxAPY.

While most use audited smart contracts, there is always some risk of bugs or exploits. Always invest carefully and use reputable platforms.

Yes, most aggregators have intuitive interfaces and automated strategies, making them suitable for both beginners and experienced DeFi users.

They typically earn a small performance or service fee from the yields generated for users.