This article discusses the best crypto tools for gas fee optimization. These tools helps users save money while efficiently executing transactions across multiple blockchains.

These tools utilize real time data, artificial intelligence, and automation gas savings, transaction failures, blockchains performance. This is beneficial for traders, developers, and DeFi investors.

Why Use Crypto Tools for Gas Fee Optimization

Save Transaction Costs: These tools value time as well as unnecessary gas expenses for users. This is accomplished by determining optimal times and prices for executing transactions within the gas price.

Avoid Failed Transactions: Transaction failure is inevitable when trying to execute ones with lower gas prices. Predicting gas prices in your transactions in real time for gas fee optimization eliminates this.

Increased Efficiency: Saving time is a great feature offered by automation. They will execute your transactions when the conditions of the network will be most favorable.

Multi-Chain Support: Users of these tools quickly identify the most cost-efficient network as most of these tools provide comparisons of gas fees across multiple chains.

Increase Developer Insight: Developing tools such as Tenderly and Alchemy provide developers with the ability to evaluate and refine gas consumption in smart contracts.

Optimized DeFi: Gas fee optimization in the crossing of streams allows gas-earning swaps to be executed in the gas-inefficient region lowering the overall cost of operation.

Strategic Planning: Analytical tools provide network insights which allows users to execute transactions at strategic times.

Use Automation: Automated systems manage gas in the most complex way, and the result is seamless interaction with the blockchain.

Key Point & Best Crypto Tools for Gas Fee Optimization List

| Tool Name | Key Features | Use Case / Purpose | Unique Advantage |

|---|---|---|---|

| GasHawk | Predicts Ethereum gas prices and automates low-cost transactions | Helps users save ETH on gas fees using AI-driven scheduling | Automated gas optimization for smart contract users |

| Blocknative Gas Estimator | Real-time mempool tracking and accurate gas fee predictions | Used by traders and developers to estimate the optimal transaction speed and cost | Precise estimation based on live network data |

| MEVX | Multi-chain gas tracker with wallet integration | Monitors gas fees across major blockchains and supports transaction planning | Provides cross-chain gas comparisons in one dashboard |

| Tenderly Gas Profiler | Developer-focused gas analysis tool | Analyzes and optimizes gas usage for smart contract execution | Offers in-depth simulation and cost breakdown per function |

| DeFi Llama Gas Tracker | Tracks gas prices and DeFi protocol costs in real-time | Ideal for DeFi users tracking yield farming or swapping costs | Integrates with DeFi Llama’s ecosystem for aggregated insights |

| Alchemy Gas Tools | Part of Alchemy developer suite with API integration | Helps developers estimate, simulate, and reduce gas costs in dApps | Developer-grade accuracy with on-chain and off-chain data |

| Bungee Exchange | Aggregates bridges and swaps with gas optimization | Allows users to move assets cross-chain at the best gas rates | Built-in gas-efficient routing for cross-chain transactions |

| Instadapp | A DeFi smart wallet and management platform that allows users to optimize, manage, and automate strategies across multiple DeFi protocols like Aave, MakerDAO, and Compound. | Instadapp combines multiple DeFi transactions into a single on-chain operation, significantly reducing gas usage and execution costs. | Unified DeFi dashboard with automated yield strategies and gas-efficient transactions, simplifying complex DeFi interactions. |

| Gelato Network | Gelato executes smart contract transactions at optimal times when gas fees are lower, saving users unnecessary costs. | A decentralized automation protocol that executes smart contract tasks on behalf of users, enabling recurring transactions, DeFi strategies, and smart contract automation. | Provides fully automated and trustless execution of smart contract tasks, reducing manual intervention and ensuring timely operations. |

| Arbitrum One | Arbitrum processes transactions off-chain, drastically lowering Ethereum gas fees while keeping the security of the mainnet intact. | A Layer 2 scaling solution for Ethereum designed to reduce gas fees, increase transaction throughput, and enhance smart contract efficiency. | Combines Ethereum security with high-speed, low-cost transactions, making DeFi and dApps more scalable and user-friendly. |

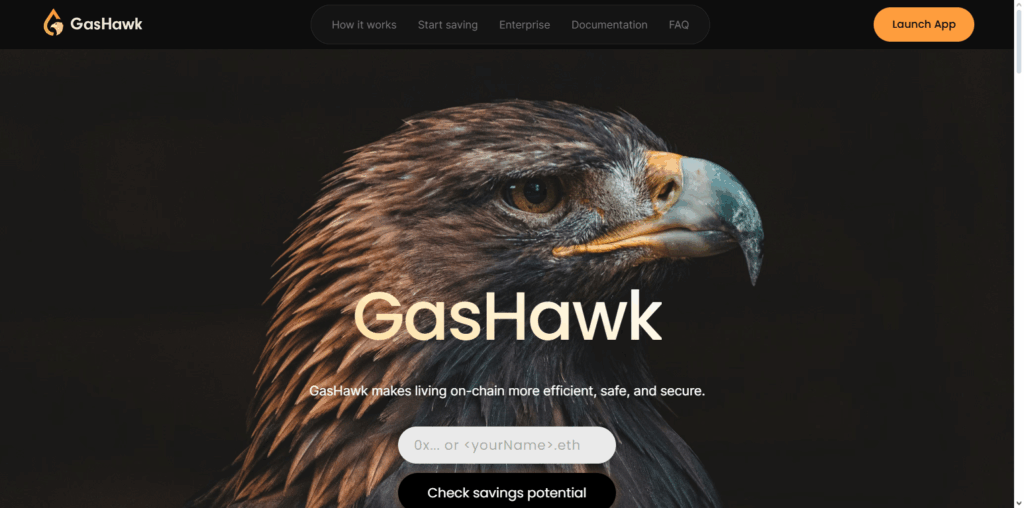

1. GasHawk

GasHawk stands out as one of the best tools for optimizing gas fees in the crypto space. Regarding the automation functionality, it can analyze the system conditions of Ethereum and execute the transactions when gas fees are the lowest.

With respect to manual estimators, GasHawk saves users in excess of many ETH because it watches the mempool and saves ETH by calculating when transactions can be postponed.

For advanced users, automation is a must for profitable transactions in DeFi, NFTs, and complex systems to help reduce the need for user supervision.

Particularly, in the crypto space, there is a need for software that can predict costs and adjust them to optimize profits for users. GasHawk will be the right product for traders, developers, and DeFi users as it effectively improves the optimizing prediction function and real-time adjustment of software profits.

GasHawk Features

- AI-Powered Gas Prediction: GasHawk is capable of determining the most economical time for Ethereum transactions due to its artificial intelligence technology that evaluates Ethereum network conditions.

- Automated Transaction Scheduling: Saves time and money by automatically performing transactions when gas fees reduce.

- Smart Contract Optimization: Active users of the blockchain can interact with automated gas optimized DeFi and NFT smart contracts with advancements in gas efficiency.

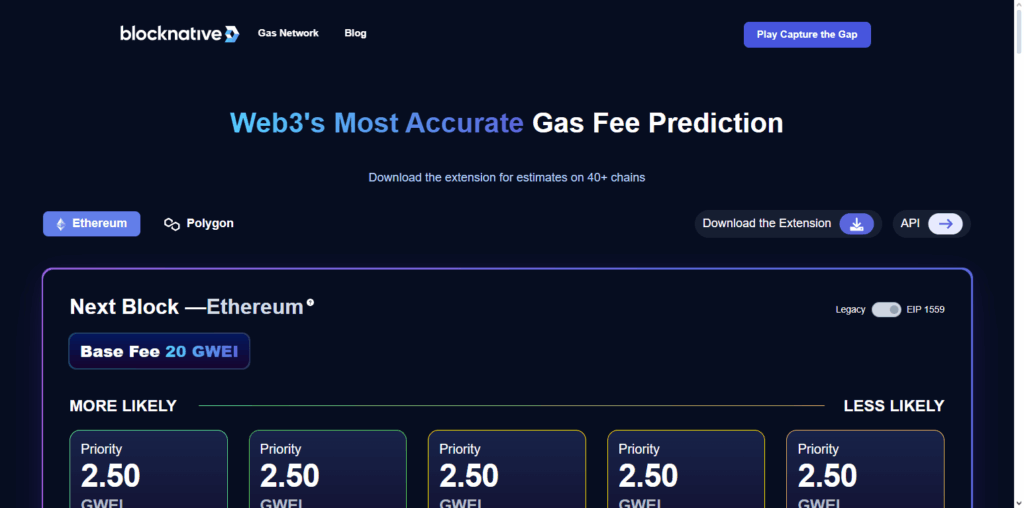

2. Blocknative Gas Estimator

For gas fee optimization, Blocknative Gas Estimator is one of the foremost crypto gas tools. This is because it provides precise, current gas estimations analytics by utilizing real-time mempool data, not averages from the past.

It assesses all Ethereum transactions periodically so it can provide the most accurate price estimations for transactions that require fast, medium, or slow confirmations. Having this information is critical in fast moving crypto environments for both developers and traders, since it helps prevent overpayment and failed transactions.

Its combination with dApps, wallets, and exchanges solves most optimization cases gas and provides a hands-off approach with the Best Blocknative Gas NFT Estimator.

Blocknative Gas Estimator Features

- Real-Time Mempool Tracking: Monitors pending transactions constantly to deliver the most accurate gas predictions.

- Custom Gas Recommendations: Personalized fee suggestions are provided for gas prices targeted at fast, medium, or slow confirmations.

- Developer Integration: Integrates gas estimation seamlessly for developers through API into wallets and dApps and gas estimation into dApps.

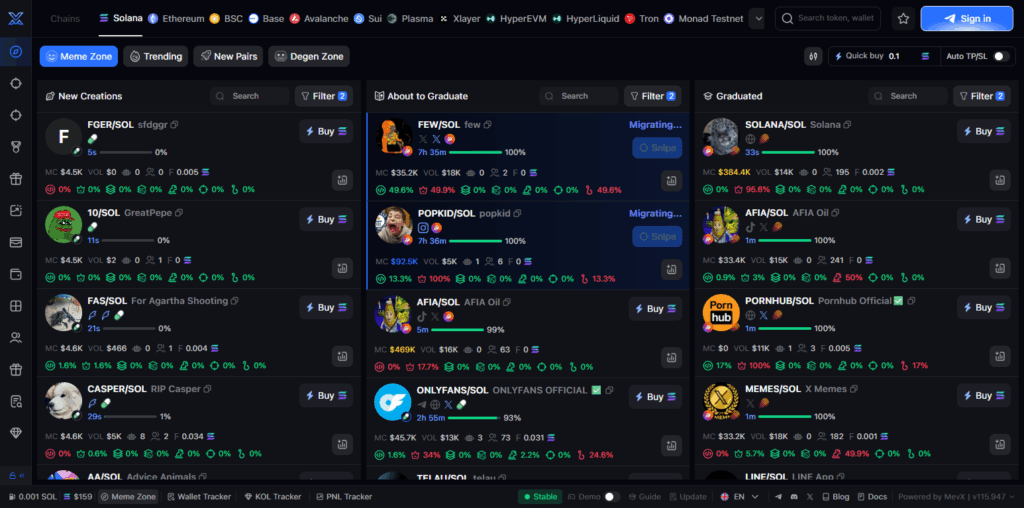

3. MEVX

MEVX is one of the top tools in the crypto industry for optimizing gas fees. It provides a multi-chain gas tracking feature that allows users to check real-time gas fees across various blockchains. With MEVX, users can determine the most affordable network to perform swaps, bridge transfers, or engage in DeFi activities.

MEVX has an intuitive feature that sets it apart from other services… It has a built-in wallet that lets users perform transactions in real-time based on current gas prices. MEVX doesn’t just make calculations based on one blockchain.

It combines the data from Ethereum, BNB Chain, Polygon, and others to provide users with precise gas fee estimates. Overall, MEVX’s intuitive design helps users save a significant amount of time and money across multiple transactions.

MEVX Features

- Multi-Chain Gas Monitoring: Monitors and records real time gas prices for Ethereum, BNB Chain, Polygon, and other networks.

- Wallet Integration: Users can perform transactions through the gas integrated MEVX platform.

- Cross-Chain Comparison: Helps users in determining the cheapest network by showing gas fees in cross comparison.

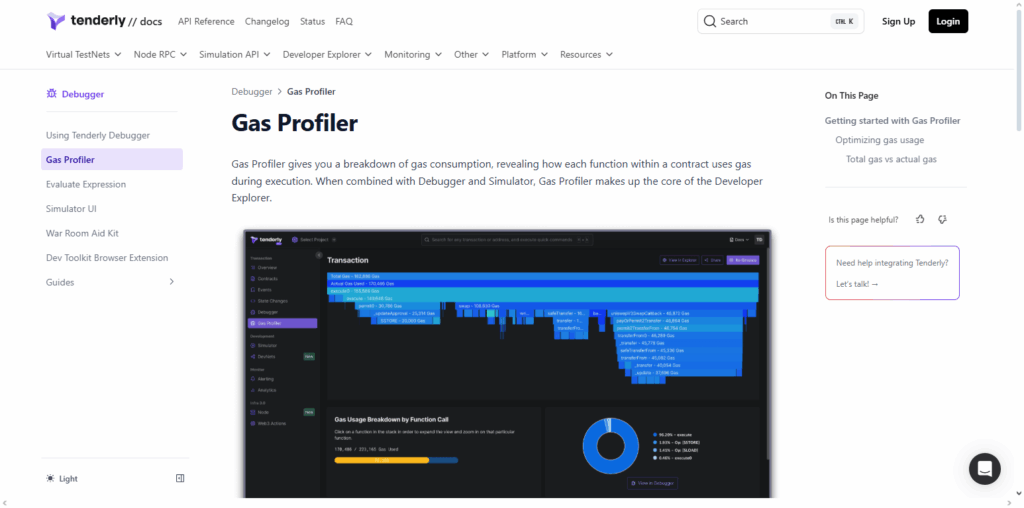

4. Tenderly Gas Profiler

Tenderly Gas Profiler is one of the best crypto tools for gas fee optimization since it provides detailed analyses of the gas consumption of smart contracts. It allows developers to simulate, track, and optimize gas transactions to diagnose and remediate the functions or portions of code that incur the highest costs before deployment.

The real-time gas breakdown and visualization tools are particularly helpful, allowing developers to optimize with pinpoint accuracy. Gas simulations across various network states prevent expensive execution failures, which is helpful in avoiding costly mistakes. This tool is best for developers wanting to create faster, cheaper, and more scalable dApps.

Tenderly Gas Profiler Features

- Detailed Gas Analysis: Offers a comprehensive breakdown of smart contract gas consumption for every function and transaction.

- Simulation Environment: Provides a testing environment where contract optimization is possible before expensive deployment.

- Real-Time Monitoring: Monitors gas consumption during a transaction and optimization is possible during completion.

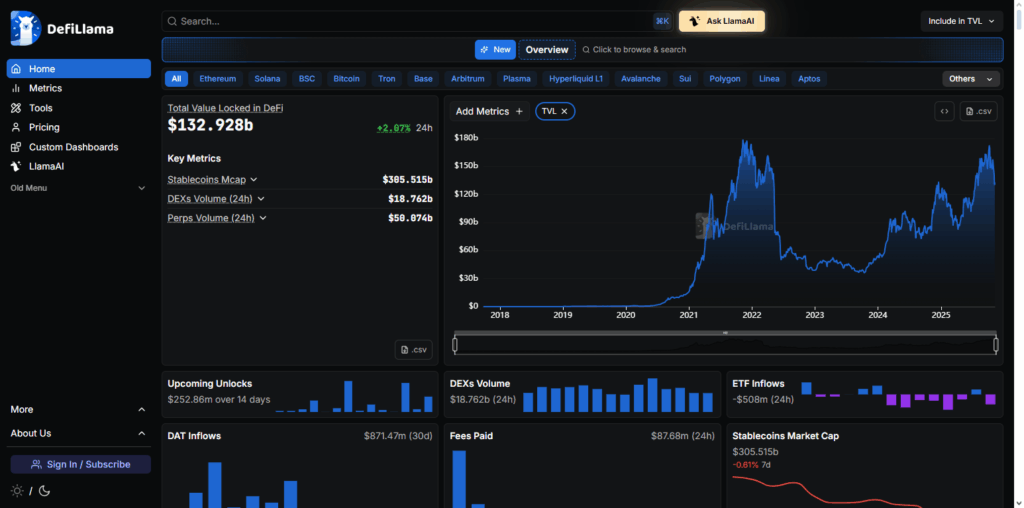

5. DeFi Llama Gas Tracker

DeFi Llama Gas Tracker is one of the best crypto tools for gas fee optimization because of its clear, real-time, and multi-DeFi protocols network gas prices attribution.

It merges gas tracking with DeFi estimators, which is a rarity, allowing an evaluation of the gas fees as one of the costs of yield farming, swaps, or lending.

It uniquely captures gas data harvesting live and on-chain, as opposed to old estimators which are off-chain and don’t withhold gas data.

It captures the gas and DeFi performance data to allow users to pick the best time and the best platform to execute a transaction, thus maximizing profits and minimizing the unnecessary costs associated with blockchain transactions.

DeFi Llama Gas Tracker Features

- DeFi-Centric Tracking: Tracks gas fees associated with DeFi protocol activities, swaps, and yield farming.

- Real-Time Updates: Shows live gas costs within major blockchains and provides on-chain proof of the data.

- Integrated Analytics: Merges gas consumption data with DeFi analytics for transaction planning enhancements.

6. Alchemy Gas Tools

Alchemy Gas Tools remains a highly utilized tool for crypto gas fee optimization. It integrates customized gas estimations with accurate gas fee predictive algorithms right into the Alchemy API suite.

It allows dApps to predict, simulate transactions and dynamically configure transaction fees based on real time changing network conditions.

The tool goes a step above by integrating on-chain data with the advanced infrastructure analytics from Alchemy to provide estimations with greater accuracy and in a shorter time frame. Developers can fully automate gas adjustments to avoid transaction losses and sky-high costs, and to lower evaporated spendings.

The lack of complex integrations and the Alchemy Gas Tools developer design position Alchemy Gas Tools as the most powerful and most adaptable tool for the scalable, highly optimized, and economically optimized blockchain applications available on the market.

Alchemy Gas Tools Features

- API-Based Estimation: Through the Alchemy developer suite and APIs, gas estimates are provided.

- Transaction Simulation: Assists in the adjustment and simulation of gas prior to executation to avoid failed transactions.

- Automation Ready: DApp developers can automate gas control to ensure optimization on a consistent basis.

7. Bungee Exchange

Bungee Exchange is top tier when it comes to optimizing gas fees in crypto. If you need gas fee optimization, look no further.

With advanced gas fee trackers, Bungee Exchange compares gas fees, liquidity, and transaction speeds across integrated networks and provides users the best deal for the transaction Bungee goes even further by integrating gas optimization wherever possible, optimizing the gas paths to make sure the the gas fees spent are the cheapest possible.

Cross-chain transfers Bungee Exchange minimizing transaction costs. Cost effective and accessible for traders and users in DeFi. Bungee Exchange seeks to empower traders and users in DeFi by refining execution and reducing transaction costs.

Bungee Exchange Features

- Smart Route Optimization: Selects the optimal route for gas-efficient cross-chain swaps and bridging.

- Multi-Bridge Integration: Connects to multiple bridges and DEXs to locate the cheapest route for transaction.

- Instant Fee Comparison: helps to see a live comparison of the gas and slippage rates before a transfer is finalized.

8. Instadapp

Because it cleverly combines several DeFi transactions into a single, effective operation, Instadapp is regarded as one of the best cryptocurrency tools for gas fee optimization, greatly lowering Ethereum network fees.

Instadapp reduces the number of on-chain transactions needed by automating intricate methods across platforms like Aave, Compound, and MakerDAO, which saves money and time. While preserving security and asset control, its clever batching and transaction routing guarantee optimal execution.

For both retail and institutional users looking to optimize returns without going over budget on transaction costs, Instadapp’s special blend of automation, gas efficiency, and cross-protocol interoperability makes it a vital tool.

Instadapp Features

- Transaction Batching: DeFi transactions are on-chain executed in a single operation instead of individually which reduces gas and execution cost.

- Cross-Protocol Optimization: Users are enabled to execute primary and secondary actions of DeFi strategies on Aave, Compound, and MakerDAO without repeated on-chain executions.

- Automated Execution: Routine DeFi operations are automated which ensures optimal gas control as assets remain within a user’s control and transactions are secured.

9. Gelato Network

Because it automates and schedules smart contract transactions, Gelato Network is among the greatest cryptocurrency tools for gas fee optimization, enabling users to carry out operations when gas prices are at their lowest.

Gelato uses decentralized automation to minimize the need for ongoing human oversight, guaranteeing that transactions take place at the best moments to cut expenses. By integrating with several DeFi protocols, it reduces superfluous on-chain interactions and facilitates effective batching and execution of intricate methods.

Because of its special blend of automation, time optimization, and cross-platform interoperability, Gelato is a vital tool for institutional and retail customers that want to minimize Ethereum gas costs while increasing productivity.

Gelato Network Features

- Scheduled Transaction Automation: Smart contracts are executed during time slots when gas fees are lower to reduce costs for users.

- Cross-Protocol Integration: Automated strategies with gas cost efficiency are executed using multiple DeFi protocols and kept on minimal on-chain actions.

- Trustless Automation: Gas cost inefficiency is resolved with manual intervention removal through reliable decentralized secure task execution.

10. Arbitrum One

Because Arbitrum One functions as a Layer 2 scaling solution for Ethereum, drastically lowering transaction costs while preserving Ethereum’s security, it is regarded as one of the greatest cryptocurrency solutions for gas charge minimization.

Arbitrum One reduces network congestion and expensive gas costs by processing transactions off-chain and effectively settling them on the mainnet. Without requiring code modifications, its compatibility with current Ethereum smart contracts guarantees smooth integration for DeFi apps, NFTs, and dApps.

The platform optimizes gas usage while maintaining decentralization, making it perfect for both individual users and institutions looking to carry out frequent or complicated transactions efficiently due to its high throughput and cheap execution costs.

Arbitrum One Features

- Layer 2 Scaling: Gas fees for Ethereum are greatly reduced as transactions are executed off-chain. Security for the mainnet is still intact.

- High Throughput: The system is able to take on a higher volume of transactions per second to alleviate congestion in the network and reduce cost delaying inefficiencies.

- Interoperability with Ethereum: Allows you to use any Ethereum dApp or smart contract on Layer 2 without any alterations to the code and uses gas savings in an optimal way.

Risk & Consider

Network Volatility– Gas prices can change rapidly and become unpredictable due to congestion in the network. This makes even the best estimations unpredictable at times.

Smart Contract Vulnerabilities– Automated gas tools depend on smart contracts which can be poorly designed or left unprotected and become compromised.

API and Data Delays– Data feeds come in real time, but there can be small intervals when they are offline, which disrupts the accuracy of the data and timing of the transaction.

Multi-Chain Complexity– Cross-chain tools may have issues regarding network operations and interoperability or issues surrounding blockchain bridges.

Over-Automation Risks– Executing strategies automatically can result in transactions being placed that may not align with the intended strategy or control due to rapid market fluctuations.

Privacy Concerns– Tools designed for analytic purposes can create privacy issues by storing transaction or wallet addresses.

Technical Knowledge Requirement– Platforms designed for developers such as Tenderly or Alchemy are not usable without a complex understanding.

Integration Challenges– These tools may require additional development in order to integrate into dApps or trading systems to ensure systems are running smoothly.

Conclusion

Optimizing transaction costs and improving transaction efficiency on the blockchain can be done through the best crypto gas tools optimization.

Bungee Exchange, Alchemy Gas Tools, DeFi Llama Gas Tracker, Tenderly Gas Profiler, MEVX, Blocknative Gas Estimator, and GasHawk have different strengths, from automation and cross-chain gas comparisons to real-time analytics.

Developers, DeFi investors, and traders in the crypto space will appreciate the use of these tools because they guarantee quicker, cost-optimized transactions.

Gas tools optimization makes blockchain transactions affordable and more accessible to every crypto user by automating, predicting, and analyzing data.

FAQ

Crypto gas fee optimization tools help users minimize transaction costs by predicting, tracking, and automating gas fee usage across blockchains. They analyze real-time network data to suggest the best time and rate for executing transactions efficiently.

Gas optimization tools are essential because blockchain networks like Ethereum often experience fee volatility. These tools help users avoid overpaying during congestion and reduce failed transactions due to underpricing.

Most leading tools such as GasHawk, Blocknative, and Tenderly are built with high security standards. However, users should always verify authenticity, avoid sharing private keys, and connect wallets only to trusted platforms.

For beginners, DeFi Llama Gas Tracker and Bungee Exchange are user-friendly and don’t require technical knowledge, making them ideal for quick fee insights and optimized transactions.