This article highlights the Best Crypto Staking Platforms for Governance Tokens. When investors stake governance tokens, they passively earn rewards and actively participate in network votes.

Selecting the most appropriate platform is critical for maximizing balance, security, and flexibility. In this piece, I cover the most reliable platforms that offer high rewards with governance participation, and that offer a balance for novices and more seasoned crypto users.

What is Crypto Staking Platforms?

Crypto staking platforms are services or protocols that let holders of crypto currencies lock up or stake crypto within a block chain to earn crypto transaction validation and network securing rewards.

Users earn rewards in additional crypto tokens as interest, for example. These platforms optimize staking by managing nodes and offer different returns based on the crypto currency, time length of the stake and the fees of the platform.

Investors can earn passive income and stake crypto currencies on the networks, and this is the reason within the growth and security of the networks is the reason staking has become a popular way to earn passive income.

How To Choose Crypto Staking Platforms for Governance Tokens

Supported Governance Tokens – Make sure the platform supports the governance tokens you wish to stake, as not every platform supports every token.

Staking Rewards & APY – Look at the APY for staking given by various platforms. While higher rewards will catch your attention, be sure to determine whether they are sustainable.

Lock-Up Period & Flexibility – Some platforms require your tokens to be locked for a set time, while others offer flexible staking. Pick according to your liquidity.

Platform Reputation & Security – Look for reviews, audits, and check platform security. Governance tokens can be riskier, especially if the platform gets hacked.

Governance Participation – Some platforms offer staking governance rights, like voting on ecosystem governance tokens.

Fees & Penalties – Find out about staking fees, penalties for early withdrawal, and the slashing risks that can be imposed to rewards.

Ease of Use – Platforms designed with a simple interface and direct instructions on staking reduce the chance of user error.

Network Compatibility – Check the platform with the blockchain network of your governance token to prevent unresolvable technical issues.

Community & Support – Having a strong community and responsive customer service helps resolve problems fast.

Transparency & Reporting – Greater trust and control come from platforms with detailed reporting on rewards, staking status, and tokenomics.

Best Crypto Staking Platforms for Governance Tokens Points

- Lido Finance – Supports multiple governance tokens with flexible staking and transparent rewards.

- Binance Earn – Offers a wide range of tokens, competitive APY, and easy platform usability.

- Rocket Pool – Decentralized staking, strong security, and participation in Ethereum network governance.

- Kraken Staking – Reliable platform with insurance coverage, clear reporting, and moderate fees.

- OKX Earn – High flexibility, multiple token support, and responsive customer service.

- Coinbase Staking – User-friendly, regulated, supports governance participation, and transparent rewards.

- Everstake – Focused on governance token staking, with high APY and community-driven support.

- Ankr Staking – Multi-chain support, flexible lock-up, and accessible for beginners.

- Figment – Institutional-grade security, detailed reporting, and strong network governance participation.

9 Best Crypto Staking Platforms for Governance Tokens

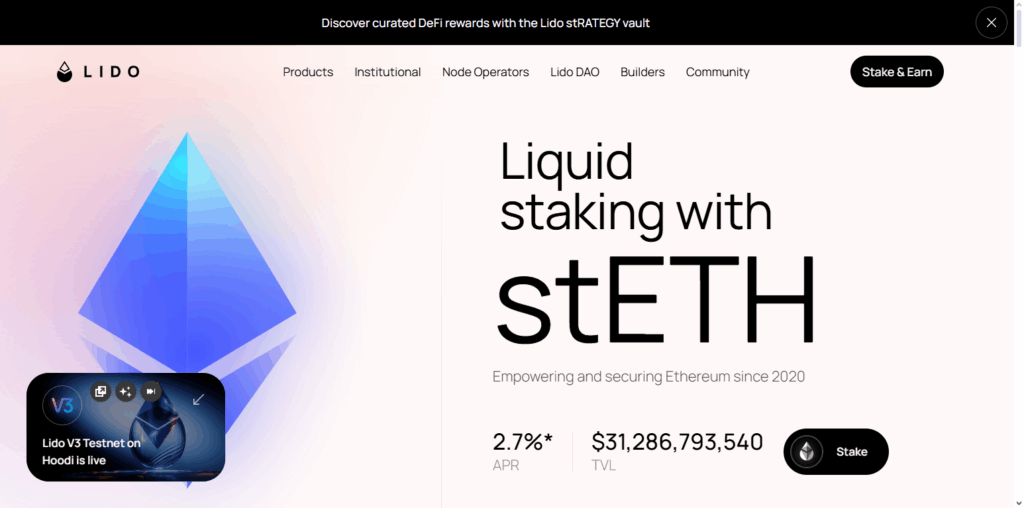

1. Lido Finance

Lido Finance has earned a reputation as one of the best crypto staking platforms for governance tokens because of its unique balance of flexibility, safety, and ease of use. Unlike traditional services, Lido lets users stake their tokens through liquid staking, meaning the tokens aren’t fully locked and can be utilized in other DeFi activities.

Lido supports a number of the biggest tokens, has a clear and fair system for reward allocation, and is fully decentralized so that there is no single point of failure.

Most importantly, Lido users can earn competitive staking rewards while taking part in governance activities, making Lido perfect for users wanting to earn staking rewards and have a say in their blockchain ecosystem.

Lido Finance Features

- Liquid Staking – While earning staking rewards, users borrow stTokens to use in DeFi.

- Decentralized Infrastructure – Reduces the risk to centralization and improves network security and reliability.

- Multi-Token Support – Staking and reward distribution for major governance tokens are transparent.

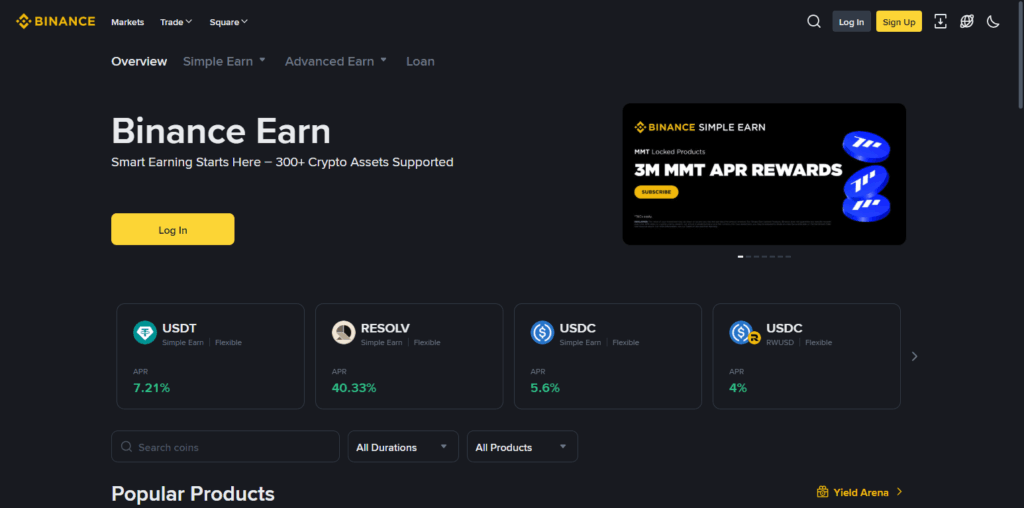

2. Binance Earn

Binance Earn is one of the most versatile crypto staking platforms for governance tokens. Furthermore, its staking services are among the most advanced. It features a large selection of governance tokens, providing users with varying staking styles, whether users prefer locked or flexible terms.

The ease with which users can execute strategies is coupled with high liquidity, competitive APY, and excellent interface design. Subsequently, staking becomes a streamlined and profitable endeavor.

The access offered to users is not while governance tokens and rewards are solely pre-gated, which allows users to take part in the decision-making process. This combination is what makes Binance Earn so beneficial for users.

Binance Earn Features

- Wide Token Support – Flexible and locked staking governance tokens come in many different types.

- Competitive APY – Annual yields are attractive and rewards are easy to track.

- User-Friendly Interface – Suitable for beginners and advanced users, the platform is easy to use.

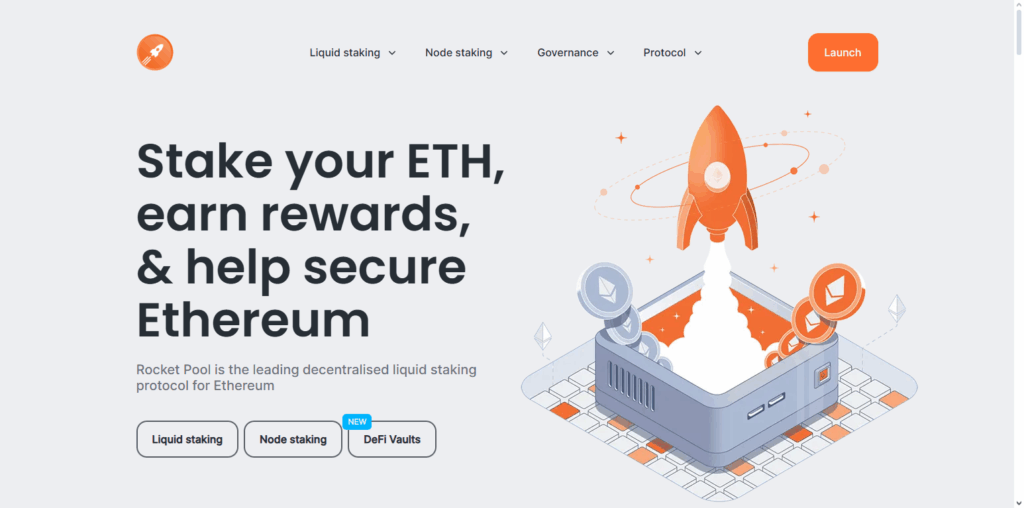

3. Rocket Pool

Rocket Pool stands out as one of the finest crypto staking platforms for governance tokens, especially for those who appreciate decentralization and security. Its innovative method enables users to stake Ethereum and governance tokens even without running their own validator nodes, broadening potential participants.

As a decentralized network, Rocket Pool lowers the likelihood of single points of failure and still provides attractive staking rewards.

Users are issued rETH tokens which signify their staked assets, and can be utilized within DeFi as well as in trade, ensuring liquidity while staking. With governance system participation, legislative network involvement, and transparency, decentralization turns Rocket Pool into a network of safety, flexibility, and control for token holders.

Rocket Pool Features

- Decentralized Validator Network – No need to run a node and incur technical complexities.

- rETH Tokens – Provides liquid tokens representing staked assets for use in DeFi.

- Active Governance Participation – Users can vote to influence and make protocol decisions.

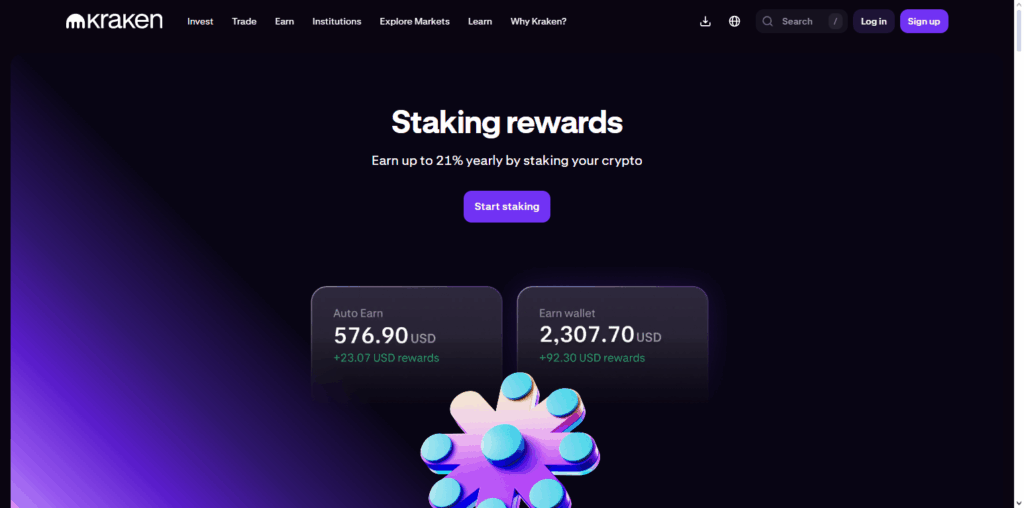

4. Kraken Staking

Staking on Kraken has grown to become a premiere crypto staking platform for governance tokens as a result of reliability, security, and user-friendliness. Protection of staked assets are guaranteed with institutional grade security, including cold storage and other forms of insurance.

As well as offering competitive rewards and various staking periods, Kraken accommodates different user investment objectives, as Triple P Kraken offers a very broad selection of governance tokens.

Staking on Kraken offers accessible participation in governance (i.e. users can vote on the networks) and complete reporting. Jet Staking Kraken offers users intuitive income streaming as well as participation in the governance network.

Kraken Staking Features

- Institutional-Grade Security – Assets that are staked come with cold storage, in insurance, and staked assets.

- Flexible Staking Options – Multiple governance tokens with variable lock-up periods for staked assets.

- Transparent Reporting – Users are given reports on the rewards and staking performance.

5. OKX Earn

OKX Earn is one of the top crypto governance token staking platforms, offering a diverse and easy-to-use ecosystem for any level of a user’s crypto journey. What makes it unique is the ability to provide users with both flexible and locked staking for a variety of governance tokens, allowing users to control the liquidity and length of the staking period.

OKX Earn won’t let users down on the value-added services, including custom reports on earnings and staking which users can analyze to maximize profits. It goes without saying that security is of utmost importance which is why there are additional proactive measures with multi-layer security systems and security responsive presence.

Staking is made efficient while enabling users to participate in governance fully and seamlessly. OKX Earn is the complete, and the ideal solution for token holders wanting a perfect balance of staking influence, instantaneous access, and reward value.

OKX Earn Features

- Flexible and Locked Staking – Offers both options to satisfy different liquidity needs.

- Advanced Analytics – Monitor staking rewards and analytics in real time.

- Responsive User Support – Customer guides and assistance with queries and problems in a timely manner.

6. Coinbase Staking

Coinbase Staking is preferred by many governance token holders because of its ease of use, safety, and compliance with legal regulations.

Staking with Coinbase has one of the simplest interfaces, which enables almost anyone to begin staking, while ensuring advanced security measures and insured custody to protect staked assets.

Coinbase offers competitive rewards for a variety of governance tokens and provides clear and transparent reporting of staking earnings.

Users can take part in governance and directly influence protocol changes from the platform. Coinbase staking is a good option to optimize rewards and influence because of the combination of safety, simplicity, and governance participation.

Coinbase Staking Features

- Regulated Platform – Totally compliant in safe environments which is perfect for beginners and institutional users.

- Reward Transparency – Staking performance and profit is detailed and easy to understand.

- Network Governance – Offers users direct voting to change and control network governance protocols.

7. Everstake

Everstake is a high-performance, reliable, and multi-chain supported crypto staking platform for governance tokens. Everstake’s differentiator is the combination of professional validator infrastructure and Everstake’s customer-focused capacity, which permits small investors and small amounts of governance tokens to also stake and do so safely and effectively.

Everstake’s staking is rewarding, and generous in analytics provided on staking and earned value so that users do not need to guess and can track staking and earned value.

Users can also take part in governance, allowing users to vote, make, and decide changes to the protocols and upgrades. Everstake has passionate and committed communities, transparency, and solid security which makes it an ideal platform to earn passive income as well as stay active on the governance of the ecosystem.

Everstake Features

- Professional Validator Infrastructure – Safe and guaranteed staking operations with Everstake’s pro validator infrastructure.

- Multi-Chain – Staking supported between different governance token networks.

- Rewarding – High APY with detailed analytics around flexible staking and competitive rewards.

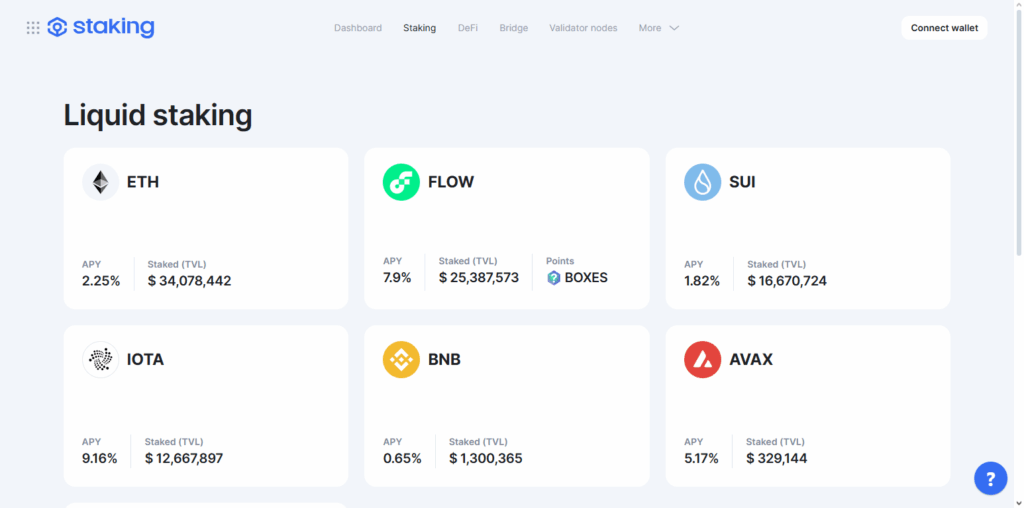

8. Ankr Staking

Ankr Staking offers seamless and flexible cross-chain staking for governance token holders. Its ease-of-use is a defining feature, as users can stake tokens without having to deal with intricate validator nodes.

This suitability to novice and sophisticated users alike brilliantly positions Ankr for any cryptocurrency investor. Ankr’s competitive staking rewards, flexible lock-up periods, as well as real-time performance tracking, mean optimally staking any series tokens is possible.

Moreover, staking holders participate in governance, staking protocol networks, and influence governance as well. Ankr Staking’s simplicity, profitability, and active governance participation for token holders are a brilliant trifecta.

Ankr Staking Features

- Simple – Users can stake tokens without having to deal with complex validator nodes.

- Multi-Chain and Flexible Staking – Multiple networks are supported along with flexible staking with adjustable lock-up periods.

- Rewarding – Earn rewards for participating in protocol governance.

9. Figment

Figment is a top-level staking platform for governor tokens with institutional-grade security and a professional-grade infrastructure.

Being high transparent and providing extensive reporting showcases rewards and network performance along with governance participation as a staker, tracking performance is a breeze. Staking rewards are competitive and flexible enough across numerous blockchains and governance tokens whereby investment strategies are seamless and numerous.

The platform encourages participation in network governance where stakers get to vote and make important decisions for the network. With all the combined factors of security and transparency, as well as active participation in governance, the platform is optimal for harvesting staking profits and also influence.

Figment Features

- Institutional Staking – Safe governance tokens staking with professional infrastructure and guaranteed institutional grade security.

- Rewarding – Clear and precise analytics around rewards, network performance and governance participation along with detailed reporting.

- Multi-Token Support – Provides rewards with governance control across different blockchain networks.

Pros & Cons

Pros:

- Earning Rewards – Users gain staking rewards without having to engage in active trading.

- Voting Rights – Users take part in governance through voting to shape the future of the protocol.

- Secure the Network – Proof of Stake and staking rewards are ways cryptocurrencies incentivize the secured and maintained networks.

- Staking Flexibility – Many providers offer various staking terms in the form of locked or flexible staking.

- Liquid Staking – Staking and unstaking in different DeFi applications is possible with liquid DeFi tokens.

- Staking Accessibility – Many platforms optimize the staking experience for users and offer beginners enhanced user interfaces.

Cons:

- Staking Restrictions – Illiquid staking assets due to lock-up periods can affect liquidity.

- Slashing – Built in penalties and lost rewards to misbehaving validators affect all users of the staking pool.

- Fee Structures – Stakeholders are prone to losses due to platform fee structures and commission withholdings.

- Volatile Rewards – Rewards can be of equity and native tokens which can lose value and change overall reward value.

- Control Centralization – DeFi systems and liquidity pools can cause a increase of transacting pools with control in poor decentralization.

- Rogue Contracts – Staked assets can be lost due to lost, insecure contracts or exploited contracts in smart systems.

Conclusion

To sum up, the safest and most flexible reward governance crypto staking platforms and most active network participation offer influence rewards and influence.

Of platforms like Lido Finance, Binance Earn, Rocket Pool, Kraken Staking, OKX Earn, Coinbase Staking, Everstake, Ankr Staking, and Figment, support at Everstake and Ankr Staking, multi-chain support at Figment and Coinbase, and institutional grade security at Kraken are notable.

Staking passive governance tokens offers empowerment and income since lock up periods, APY, and governance and decision making contribution of blockchain ecosystems opportunities are most rewarding.

FAQ

Staking involves locking your governance tokens on a platform to support network security or validation, earning rewards while retaining voting rights.

Top platforms include Lido Finance, Binance Earn, Rocket Pool, Kraken Staking, OKX Earn, Coinbase Staking, Everstake, Ankr Staking, and Figment.

No, rewards depend on network performance, platform fees, and token price fluctuations, so they may vary over time.