In this article, I will discuss the Best Crypto Futures Trading Platforms that offer high liquidity, competitive fees, advanced trading tools, and reliable security for traders.

Both novice and seasoned traders wishing to trade cryptocurrency futures effectively can benefit from these platforms, which are popular for leveraged cryptocurrency trading and support a wide range of futures contracts.

What is Crypto Futures Trading Platforms?

Online exchanges that enable traders to purchase and sell cryptocurrency futures contracts—agreements to trade a particular cryptocurrency asset at a fixed price in the future—are known as cryptocurrency futures trading platforms.

In addition to providing tools like margin, risk management, and sophisticated charts to mitigate market volatility, these platforms enable leveraged trading, allowing users to handle greater holdings with little capital.

Benefits Of Crypto Futures Trading Platforms

Leverage Trading – Traders are enabled to open larger positions that require less capital.

Profit Regardless of Trends – Traders can take both long and short positions, profit from increasing prices, and profit from decreasing prices.

High Liquidity – Big platforms can provide fast execution of trades and limited slippage thanks to a great depth of their order books.

Risk Management – Tools like take profit, stop loss, and liquidation ensure that risk is spread out.

Low Cost of Trading – Compared to traditional markets, their maker and taker fees are great.

Diverse Selections of Assets – Futures on all altcoins, Bitcoin, and Ethereum are available.

Sophisticated Trading Tools – Tools such as professional indicators, auto trading, and charts are available, along with other advanced features.

Key Point & Best Crypto Futures Trading Platforms List

| Platform | Key Points |

|---|---|

| Binance Futures | Highest liquidity, wide contract variety, up to 125x leverage, advanced trading tools, and deep order books for major pairs. |

| Bybit | User-friendly interface, strong derivatives focus, fast execution, up to 100x leverage, and reliable risk management features. |

| OKX Futures | Supports perpetual & delivery futures, portfolio margin mode, competitive fees, and robust trading infrastructure. |

| MEXC Futures | Low entry barriers, high leverage options, frequent new listings, and suitable for both beginners and altcoin traders. |

| Kraken Futures | Regulated platform, strong security standards, transparent fee structure, and ideal for professional traders. |

| Huobi Futures | High liquidity in Asian markets, multiple contract types, flexible margin modes, and advanced charting tools. |

| KuCoin Futures | Beginner-friendly futures trading, wide altcoin coverage, competitive fees, and integrated trading bots. |

| Gate.io Futures | Extensive altcoin futures selection, flexible leverage, advanced order types, and risk control tools. |

| CoinEx Futures | Simple interface, stable performance, low fees, and good support for emerging crypto futures pairs. |

| AscendEX Futures | Institutional-grade trading tools, deep liquidity for select pairs, and advanced risk management features. |

1. Binance Futures

Binance is the largest crypto exchange vendor founded in 2017 by Changpeng Zhao. Binance Futures offers quarterly and perpetual futures on 250+ futures pairs. Binance is one of the best crypto futures trading platforms for both novice and seasoned investors due to its market depth and liquidity.

Futures trading normally begins with fees in the range of 0.02% on the Maker and 0.04%-0.05% on the Taker. There is a fee discount for trading high volumes and using the BNB token. The platform has a website and mobile app and also provides an API for advanced charting, robust execution, and cross-margining.

Binance Futures Features, Pros & Cons

Key Features

- Order books and liquidity are deep

- Perpetual and quarterly contracts in the hundreds

- Leverage goes up to 125x

- Multiple order types and advanced charting

- Margin is cross & isolated

Pros

- The liquidity is impressive on large pairs

- The fee structure is good

- Futures markets are diverse

- Insurance funds and good security

- Platforms for web and mobile are simple

Cons

- It is complicated for more novice users

- To gain complete functionality, you must do a KYC

- Fees can be high for some of the less liquid tokens

- Many updates create confusion on the platform

- Users are restricted in many countries

2. Bybit

Bybit was started in 2018 by Ben Zhou and has established itself as one of the top exchanges with a focus on derivatives. They has the fastest execution, deep liquidity, and an easily navigable platform. These features make Bybit one of the best crypto futures trading platforms for leveraged trading.

With Bybit futures, you can get 100x leverage on various perpetual contracts. Trading fees are generally 0.02% on the Maker and 0.055% on the Taker.

Tiers are available for high-volume traders to reduce fees.The application is compatible with hundreds of perpetuals and offers copy trading, grid bots, and risk management tools through web, iOS/Android applications, and an API.

Bybit Features, Pros & Cons

Key Features

- Engine for matching

- Isolated margin & perpetuals

- Leverage of around 100x

- Investors can use bots and copy trading

- Tools for managing risk

Pros

- Execution of trades is very fast

- It is easy and simple for users to get started

- On the main pairs liquidity is good

- Documentation is thorough

- Support is available at all hours

Cons

- Bybit has less contracts available than Binance

- Fees for takers are a little more than average

- You cannot use many fiat currencies

- Many parts of the world are not very regulated on this platform

- It is riskier when high leverage is used

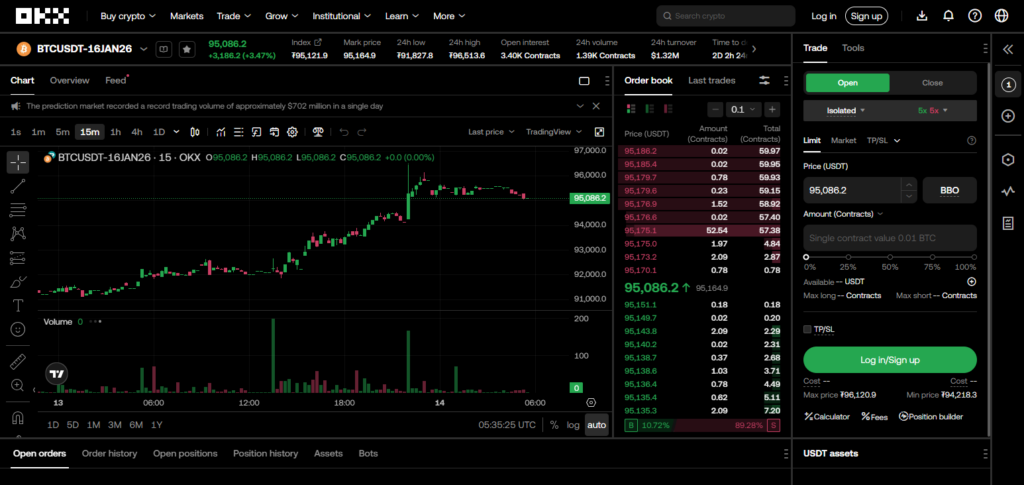

3. OKX Futures

OKX Futures is the derivatives branch of OKX (formerly OKEx), which started in 2017 and underwent rebranding in 2022. As a best crypto futures trading platform, OKX offers advanced order types and risk management tools on hundreds of pairings for both perpetual and delivery futures.

Futures trading usually includes about 0.02% maker and 0.05% taker fees which are considered competitive in the market, and leverage up to ~125x based on asset liquidity. From web, desktop, and mobile, OKX also offers integrated Web3 wallet functionality, DeFi tools, and fiat on-ramping.

OKX Futures Features, Pros & Cons

Key Features

- Delivery and perpetual futures

- Up to 125x leverage

- Integrated wallets and DeFi links

- Advanced charting options

- Portfolio margin mode

Pros

- Fee competitiveness

- Multitude of margin options

- Liquidity for BTC/ETH

- Reliable infrastructure

- UI for web and mobile

Cons

- Complexity of portfolio margin

- Overall futures offering

- Support lag

- Regional regulations

- UI may confuse beginners

4. MEXC Futures

MEXC Futures is a product of MEXC, a 2018-founded exchange registered in the Seychelles that facilitates spot, margin, and derivatives trading on thousands of assets.

With 0% maker and minimal taker costs (~0.02%) on numerous perpetual futures pairs, as well as sporadic margin and ETF products, it is regarded as one of the top crypto futures trading platforms for altcoin exposure and economical trading.

In some areas, leverage offerings might reach 200x or higher. Staking, P2P trading, and awards are all part of MEXC’s ecosystem, which can be accessed through web and mobile apps.

MEXC Futures Features, Pros & Cons

Key Features

- Low fees

- Futures for many altcoins

- High leverage

- Fast listings

- Simple to use

Pros

- Very low trading fees

- Exposure to many altcoins

- Simple for beginners

- New markets often

- Basic charting options

Cons

- Less liquidity on larger pairs

- Possible feeds on price lag

- Few tools for institutions

- Regulatory transparency

- Advanced functionality lacking

5. Kraken Futures

Kraken Futures are part of Kraken, one of the most established crypto exchanges launched in 2011 in San Francisco. It is well-known for strong security and regulatory compliance. The Kraken Futures is one of the best crypto futures trading platform for conservative and institutional traders due to the transparency and trust built over the years.

On the futures, the most common fees are around 0.02% maker and 0.05% taker, and the leverages are also more conservative (for example 50x max) than on other platforms, but the risk controls are more robust. Kraken also has their platforms on web and API and have transparent fee structures.

Kraken Futures Features, Pros & Cons

Key Features

- Highly regulated

- Great security

- Spot and futures integration

- Moderate leverage

- Clear Fee Schedule

Pros

- Clear and Security

- Structure for Institutions

- Reliable Execution

- Easy to Use

Cons

- Limited number of future markets

- Smaller competitors offer greater leverage

- Small traders pay higher fees

- Advanced orders are more restricted

- Promotions are less frequent

6. Huobi Futures

Huobi Futures is a division of Huobi Global, an exchange that was established in 2013 and has grown to be one of the biggest platforms for derivatives, especially in Asia.

Huobi, the top cryptocurrency futures trading platform, provides a variety of perpetual and deliverable futures with strong liquidity, multi-currency margin options, and competitive maker/taker fee brackets (often ~0.02%/0.04–0.05% depending on native token discount and volume).

Huobi facilitates web, mobile, and API trading and incorporates sophisticated charting and risk features.

Huobi Futures Features, Pros & Cons

Key Features

- Various margin options

- Wide range of futures contracts

- Low trading costs

- Detailed analytical charts

- Liquidity for Asian markets

Pros

- High liquidity in Asian markets

- Wide variety of contracts

- Various margin options

- Good risk management tools

- Good community

Cons

- Can’t be used in some jurisdictions

- Confusing fee system

- Slow customer support

- Complicated UI for beginners

- Slow performance during high volatility

7. KuCoin Futures

KuCoin Futures is a part of KuCoin, a well-known crypto trading platform founded in 2017, and is well-known in the industry for offering great altcoin trading and user-friendly crypto trading.

KuCoin is also one of the best crypto futures trading platforms for access to low market cap crypto tokens, as well as automated trading features like bots and copy trading.

The typical fees for futures are in the range of 0.02% maker and 0.06% taker, with leverage often in the range of 100–125x for select markets. KuCoin provides a mobile and web trading platform that includes promotional features and token-based fee discounts.

KuCoin Futures Features, Pros & Cons

Key Features

- Futures on altcoins

- Trading bots & copy trading available

- Leverage up to around 100x

- Cross margin and isolated margin

- Deals and discounts are great

Pros

- Large variety of altcoins

- Good automation options

- User friendly on phones

- Good community

- incentvize

Cons

- Compared to the top exchanges they have less liquidity

- Complex fee tiers

- Inconsistent support

- Uncertainty around regulations

- Some UI sections have problems

8. Gate.io Futures

Gate.io Futures is a division of Gate.io, an exchange that was established in 2013, offers thousands of cryptocurrency assets, and is regarded as one of the top platforms for trading altcoin derivatives futures.

Competitive fee ranges of 0.02% maker and ~0.05% taker are common in futures markets, and leverage on several pairs can reach up to 125x.

Additionally, Gate.io is accessible via online, desktop, and mobile platforms and provides advanced order types, copy trading, and trading bots. It places a strong emphasis on technological tools and wide asset coverage.

Gate.io Futures Features, Pros & Cons

Key Features

- Futures on many tokens

- Multiple order types

- Adjustment of leverage

- Tools for risk management

- API Integration

Pros

- Many token markets available

- Variety of leverage options

- Advanced charting tools

- Platform is always being improved

- Positive for seasoned traders.

Cons

- Reduced liquidity in majors.

- Difficult UI for novices.

- Complex fee structure.

- Support delays are frequent.

- Less conventional trust.

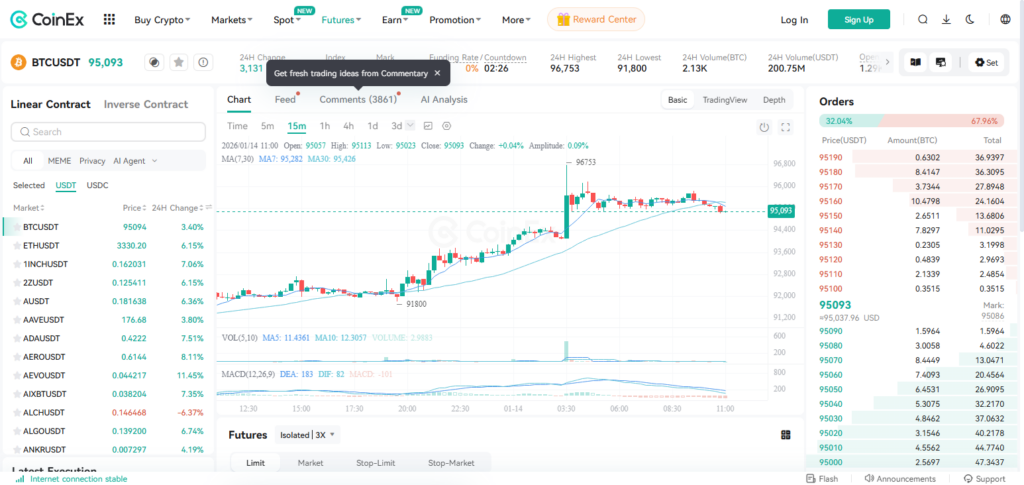

9. CoinEx Futures

CoinEx Futures comes from CoinEx, an exchange founded in 2017 that has gained trust for its operational reliability and has gained popularity for its simple fee structure. They are frequently mentioned in the sector as one of the top providers of crypto futures trading for beginners and intermediates.

CoinEx’s futures usually have approximately 0.03% for makers and 0.05% for takers, on most perpetual markets, and offer leverage of around 100x. The platform is accessible via the web and mobile, and combines spot, margin, staking and earn services.

CoinEx Futures Features, Pros & Cons

Key Features

- Stable,simple interface.

- Mid to low fee structure.

- Perpetual contracts.

- Isolated / cross margin.

- Integrated wallet.

Pros

- Learning curve is easy.

- Consistent performance.

- Stable low fees.

- Nice for beginners.

- Onboarding is fast.

Cons

- Fewer contracts to select.

- Less liquidity.

- Advanced tools are lacking.

- Promotions are limited.

- Reduced brand presence.

10. AscendEX Futures

AscendEX (previously BitMax), a worldwide cryptocurrency trading platform established in 2018 by Wall Street quantitative veterans, is the provider of AscendEX Futures. Because of its institutional-grade trading tools and risk-managed leverage options (often up to 100x), it is regarded as one of the top cryptocurrency futures trading platforms.

The platform offers cross-asset collateral features and integrated risk controls for spot, margin, and futures. Although AscendEX’s futures products may have fewer pairs than those of larger exchanges, its fee structures for derivatives are competitive, and it is available on the web and mobile platforms for a variety of trading methods.

AscendEX Futures Features, Pros & Cons

Key Features

- Tools for Institutionals.

- Risk protection tools.

- Charting suite.

- Moderate leverage.

- Cross-asset collateral.

Pros

- Designed for professionals & institutions.

- Robust risk mitigation.

- Flexible collateral.

- Secure the exchange’s infrastructure.

- Web & API options.

Cons

- Less variety in future pairs.

- Reduced liquidity in most markets.

- Increased fees for small traders.

- UI is not seamless for beginners.

- Tutorials are limited.

Conclusion

Your trading objectives, risk tolerance, and degree of experience will determine which cryptocurrency futures trading platform is best for you. Platforms with substantial liquidity, minimal fees, and sophisticated trading tools that are ideal for professional and high-volume traders include Binance Futures, Bybit, and OKX Futures.

For traders looking for competitive cost structures and wider altcoin exposure, MEXC, KuCoin, and Gate.io Futures are the best options. In the meanwhile, users that value security, transparency, and institutional-grade features are drawn to Kraken Futures and AscendEX Futures.

All things considered, the top cryptocurrency futures trading platforms in 2026 offer both novice and expert futures traders by combining good liquidity, reasonable costs, dependable technology, and solid risk management.

FAQ

A crypto futures trading platform is an exchange where traders buy and sell futures contracts—agreements to buy or sell a cryptocurrency at a predetermined price on a specific future date. These platforms allow leverage trading, letting users amplify potential gains (and risks) by borrowing funds against collateral.

Binance Futures, Bybit, and OKX Futures typically have the highest liquidity, especially for major crypto pairs like BTC and ETH. High liquidity helps reduce slippage during large trades.

No. Futures fee structures vary. Most major platforms charge fees in the range of 0.02% (maker) and 0.04–0.06% (taker), with discounts for high-volume traders or those holding native tokens (e.g., BNB on Binance). Always check the official fee schedule before trading.

Beginners are advised to use lower leverage (e.g., 3x–10x) to manage risk. High leverage increases both profit potential and the chance of liquidation. Risk management tools (stop-loss/take-profit orders) are essential for all futures traders.