The Top Crypto Copy Trading Platforms for 2026 will be covered in this post. By automating the replication of professional traders’ tactics, copy trading enables investors to reduce complexity and save time.

In order to assist both novice and seasoned users in selecting the most dependable crypto copy trading options, we will investigate platforms with confirmed performance, strong security, affordable fees, and sophisticated risk management.

What Is Crypto Copy Trading?

Investors can automatically replicate the trades of seasoned or professional cryptocurrency traders in real time using a trading technique called “crypto copy trading.” Users choose a lead trader and set aside some of their money to follow that trader’s strategy rather than manually maintaining positions, making orders, or evaluating charts.

The follower’s account is proportionately affected when the lead trader opens, changes, or closes a position. Although it still necessitates risk management and performance monitoring, this strategy saves time for busy investors, helps novices learn from experts, and offers a more hands-off method of participating in cryptocurrency markets.

Unique & Important Factors That Define the Best Copy Trading Platforms

Trader Transparency & Verified Performance

A copy trading platform has to have transparent traders with clear metrics, such as the history of their profits, win/loss ratio, drawdowns, and overall risk. If the performance is verified, their followers can easily make the best risk decision based on the track record of the lead trader.

Advanced Risk Management Tools

The best copy trading platforms give their users the option of setting capital allocation limits, loss threshold limits, trailing stop loss, and an auto-pause feature on their investments. This protects their investments to a certain extent, even if the trader that they are copying does poorly.

High Liquidity & Fast Execution

The best trading and copy trading platforms have big liquidity and trading slippage, meaning good platforms will have very fast and accurate trading based on the prices that the lead traders have.

Flexible Fee Structures & Profit-Sharing Models

The best copy trading platforms provide their users with transparent trading fees, coordinated with a performance-based profit shared balanced on the usage and styles of the traders, based on their trading volume and the size of their capital.

Security & Fund Protection

The leading platforms offer the best possible protection to their users and their funds with the best security. Things like two-factor verification (2FA), cold storage, audit security, and insurance funds are used to protect the users.

Automation and AI Strategy Support

Some systems provide automated trading bots and AI-powered strategies so that users can mimic human trading as well as algorithmic trading.

Regulatory Compliance & Global Availability

Adhering to regional regulations and licensing requirements gives credibility, legal protection, and peace of mind to users when they are trading and depositing funds in different countries.

Key Point & Best Crypto Copy Trading Platforms List

| Platform | Key Points |

|---|---|

| Binance Copy Trading | Industry-leading liquidity, verified elite traders, real-time performance metrics, flexible risk controls, and seamless integration with Binance Spot and Futures markets. |

| Bitget | Strong social trading ecosystem, transparent trader rankings, customizable stop-loss settings, beginner-friendly interface, and high follower capacity for top traders. |

| Gate.io | Wide altcoin access, detailed trader performance analytics, automated trade mirroring, advanced security features, and multi-market copy trading options. |

| MEXC | Zero-fee promotions, fast trade execution, diverse futures traders, low minimum investment, and simple one-click copy trading dashboard. |

| Bybit | High-speed trading engine, professional futures traders, risk ratio display, flexible leverage controls, and smooth mobile copy trading experience. |

| KuCoin | Large global trader community, transparent profit-sharing model, wide crypto selection, easy onboarding, and built-in portfolio tracking tools. |

| OKX | Institutional-grade security, advanced trader analytics, smart risk management tools, multi-asset copy trading, and deep liquidity across markets. |

| Zignaly | Profit-sharing model, AI-powered trader strategies, automated portfolio management, non-custodial options, and transparent performance tracking. |

| Pionex | Built-in trading bots, automated grid strategies, low trading fees, copy trading for bot strategies, and strong API integration support. |

| CoinEx | Simple copy trading setup, low trading fees, stable platform performance, clear trader history insights, and beginner-focused risk controls. |

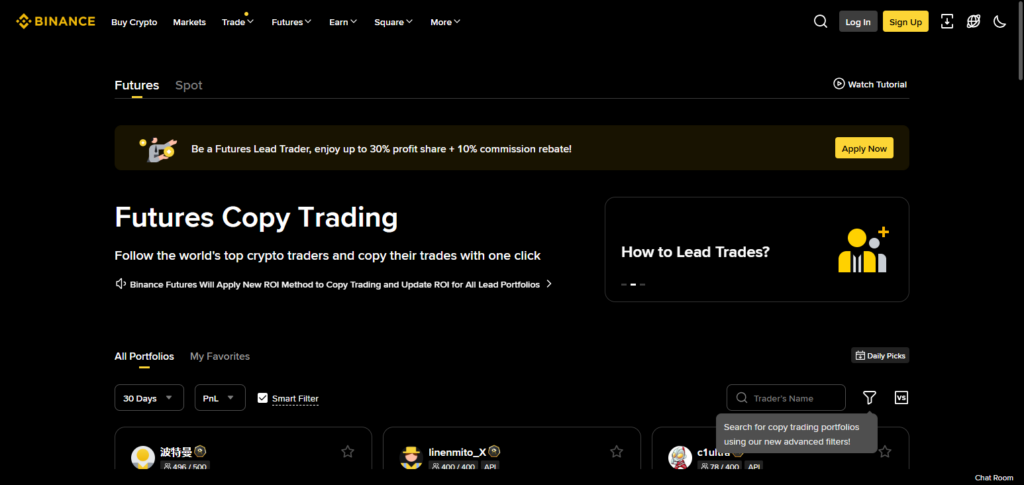

1. Binance Copy Trading

The largest cryptocurrency exchange in the world, Binance was established in 2017 and incorporates a highly scalable copy trading function into its futures and spot markets. With strong security and great liquidity, users can automatically replicate the trades of seasoned lead traders across numerous trading pairs.

In addition to conventional trading costs (such as 0.1% on spot trades and lower fees with discounts), Binance gives lead traders a profit share of roughly 10% in addition to trader fee commissions.

Additionally, Binance offers leverage choices, risk management tools, comprehensive performance monitoring, and even mock (practice) copy trading for novices prior to live implementation.

Binance Copy Trading – Features

| Feature | Description |

|---|---|

| Founded Year | 2017 |

| Liquidity | Very high across spot & futures markets |

| Trader Pool | Large, global network of verified lead traders |

| Fees | Standard trading fees (~0.1%) + profit share |

| Security | Institutional-grade with SAFU fund & cold storage |

| User Interface | Beginner-friendly with advanced analytics |

| Risk Management | Stop-loss, take-profit & manual risk controls |

| Asset Coverage | Extensive crypto selection |

Binance Copy Trading Benefits & Drawbacks

Benefits

- Highly Liquid — Less slippage on trades with deep order books.

- Traders Pool — More seasoned leaders to follow.

- Security — Decent defense with SAFU protection.

- Extensive Features — Advanced tools, diagrams, and risk management options.

- Asset Variety — Numerous coins on spot & futures.

Drawbacks

- Fees — The standard exchange fees are higher than some rivals.

- Beginners — The UI is not beginner friendly.

- Costs of Profit Share — Followers pay leaders a cut of their profit.

- Regulatory Constraints — Some countries impose limited access.

- Traders — More competitive to identify people who keep winning.

2. Bitget

Bitget is known for its specialized social and copy trading ecosystem. Bitget is the copy trading industry leader in terms of quantity with 2018 founded company, and is highly regarded for its thousands of beginner friendly trading copy.On regular spot trading,

Bitget’s fees are roughly 0.1% for maker/taker, and leverage traders pay futures fees of about 0.02%/0.06%; the profit-sharing rates are trader dependent.

With strong analytics, educational materials, and lower spot fees, Bitget is a preferred option for potential copy traders.

Bitget – Features

| Feature | Description |

|---|---|

| Founded Year | 2018 |

| Copy Trading Hub | Robust social trading ecosystem |

| Fees | Competitive (around 0.1%), varied by plan |

| Trader Analytics | Detailed performance and risk stats |

| Risk Tools | Custom stop-loss & take-profit |

| UI/UX | Easy onboarding for beginners |

| Support | Educational resources included |

| Asset Coverage | Wide variety of spot & futures pairs |

Bitget Benefits & Drawbacks

Benefits

- Robust Social Trading — Big ecosystem with solid rankers.

- User Friendly — Over simplified design.

- Controls Risk — Adjustable stop-loss & take profit.

- Learning — Helps on-board traders with guides.

- Competitively Priced — More inexpensive than some modern exchange trading services.

Drawbacks

- Market Variety Vs Major Exchanges — Less limited asset depth.

- Profit Sharing on Winners — Costs accumulate over time.

- Fewer Advanced Tools — Less sophisticated than Binance or OKX.

- Dependence on Trader Quality — Success varies by selected leader.

- Liquidity Gaps — Tend to occur on lower volume pairs.

3. Gate.io

Gate.io, founded in 2013, is among the oldest worldwide crypto exchanges. It has the most extensive assortment of crypto, including copy trading for users to automatically follow the trades of other, more seasoned traders. Gate has a standard trading fee of around 0.1-0.2% per trade on most tiers.

The fees vary, including volume and VIP tiers. The platform’s altcoin assortment is unmatched, featuring thousands of coins and sophisticated trading options like bots, leverage, and margin trading. Copy trading involves strategically setting trades and carries risk like all trading, thus necessitating a deliberate trader and risk control selection.

Gate.io – Features

| Feature | Description |

|---|---|

| Founded Year | 2013 |

| Copy Trading | Mirror traders with advanced settings |

| Fees | Vary by user level; ~0.1–0.2% typical |

| Asset Selection | Thousands of altcoins |

| Analytics | Comprehensive trader performance data |

| Risk Management | Adjustable risk controls |

| Security | Multi-tier systems & cold storage |

| Trading Bots | Optional automated strategies |

Gate.io Benefits & Drawbacks

Benefits

- Enormous Altcoin Selection — Thousands of different tokens.

- Copy Flexibility — Ability to set follower parameters.

- Tools & Bots — Other automation options.

- Lengthy Track Record — One of the oldest crypto exchanges.

- Performance Stats — Traders have access to stats with good transparency.

Drawbacks

- New Traders May Find it Too Complex — Advanced features can be confusing for newcomers.

- Variable Fees on Traders — Depends on volume and tier.

- Concerns with Security History — Issues in the past impact reputation (now mitigated).

- Less Intuitive UI — Learning curve is necessary.

- High Liquidity Pairs Are Less Available — Some altcoins have low trading volume.

4. MEXC

MEXC was established in 2018 and has rapidly become a worldwide exchange with an extensive premium assortment of cryptocurrencies. It has basic copy trading features, allowing users to directly replicate the trades of other professional traders.

MEXC’s regular trading costs are very reasonable, especially if customers keep its native coin for cheaper prices. The copy trading function also offers AI Model Copy Trade, where users can replicate the strategies of AI with actual money. This provides a seamless automation with more strategy options for sophisticated users and also for novices.

MEXC – Features

| Feature | Description |

|---|---|

| Founded Year | 2018 |

| Copy Trading | Mirror pros & AI-based models |

| Fees | Competitive; discounts with native tokens |

| Asset Variety | Large token-listing pool |

| Automation | AI model strategy options |

| Risk Management | Customizable settings |

| Interface | Clean, modern trading dashboard |

| Mobile App | Full copy trading support |

MEXC Benefits & Drawbacks

Benefits

- Options with AI Strategies — Additional automation through model copy trading.

- Low Fees Available — Especially with token payment discounts.

- Variety of Assets — Better range with unknown coins.

- Quick Execution — Good matched engine results.

- Mobile Capability — Copy trading is supported on the full app.

Drawbacks

- Fewer Users – Less activity compared to Binance/Bybit.

- AI Strategy Underperformance – Automated strategies can still fail.

- Costs of Profit Sharing – Followers incur the same costs.

- Not as Recognized – Relatively smaller established exchange than the competitors.

- Less Options with Copy Trading Derivatives – More of an emphasis in the spot markets.

5. Bybit

Bybit, which started operations in 2018, is a predominant derivatives exchange that has now also added copy trading for its spot and futures markets. Users can follow and copy trades of certain selected traders and can also specify some of their own risk controls like take profit and stop loss.

Bybit is also known to have a fairly typical maker/taker fee structure of 0.02-0.06% for futures and 0.1% for spot. Lead traders are also incentivized with 10-15% profit share from their followers. The platform is feature rich with good analytics and is known for its transparency, making it very popular with traders of all levels.

Bybit – Features

| Feature | Description |

|---|---|

| Founded Year | 2018 |

| Copy Trading | Supports spot & futures mirroring |

| Fees | Maker/taker around ~0.02–0.06% |

| Trader Performance | Transparent stats |

| Risk Tools | Stop-loss / take-profit |

| UI | Fast execution & charting tools |

| Community | Large follower base |

| Support | Multi-language help & tutorials |

Bybit Benefits & Drawbacks

Advantage

- Immediacy of Trading — Optimal for replication of futures.

- Great User Experience Design — Comprehensive charts and trade tools.

- Clear Results — Stats for leaders are transparent.

- Mobile & Desktop Interconnection — Fluid functionality across platforms.

- Low Volume Frequent Trading Fees — Ideal for high activity traders.

Disadvantages

- More Significant Learning Requirements — Learning and applying futures can be difficult for new users.

- Accumulating Profit Share Fees — Additional costs for followers.

- Less Variety of Spot Assets Compared to Binance — Assets in a less extensive collection.

- Limited Functionality in Some Countries — Features less accessible for a particular region.

- Risk Involved with Leverage — Copy trading on futures uses increased risk on losses.

6. KuCoin

KuCoin, which started its operations in 2017, offers crypto traders a more flexible copy trading solution which is embedded in its full exchange services which has an extensive altcoin offering.

Their base structure accommodates spot, futures, and leveraged products with trading fees typically around 0.1% for both maker and taker, which can be adjusted through VIP tiers and native token perks.

KuCoin includes copy trading with transparent trader performance and profit-sharing, along with tools to track follower returns and risk. KuCoin’s diverse markets and ecosystem supports both passive strategies and hands-on leading trading for advanced and novice investors.

KuCoin – Features

| Feature | Description |

|---|---|

| Founded Year | 2017 |

| Copy Trading | Flexible follow settings |

| Fees | Competitive (~0.1%) + token discounts |

| Trader Pool | Broad global community |

| Analytics | Clear performance history |

| Assets | Wide range of coins |

| Risk Management | Adjustable for followers |

| Extra Tools | Portfolio tracking & dashboard |

KuCoin Benefits & Drawbacks

Benefits

- Large Community of Traders — Multiple signals to follow.

- Reduced Trading Fees with Token Ownership — Savings while trading with KuCoin Token (KCS).

- Flexibility in Trading (Alchemy) — Both Spot and Futures.

- Enhanced Portfolio Features — Robust tracking tools.

- Beginning-Friendly UI — Straightforward and user friendly.

Drawbacks

- Fewer Advanced Features — Absent ultra-pro sophisticated analytics.

- Profit Share Fees Still Apply — Expense to followers.

- Temporary Liquidity Limitations on Minor Pairs — Coin dependent.

- Global Reach is Less Compared to Binance/OKX — Somewhat smaller presence.

- Security Fees — No exchange is risk-free.

7. OKX

Founded in 2013, OKX (previously OKEx) is a significant international exchange renowned for its strong liquidity, sophisticated trading tools, and support for multi-asset copy trading.

Lead traders usually receive an 8–13% profit share, and investors can mirror traders in both spot and perpetual futures.

Standard trading fees start at 0.05–0.1%, depending on volume. Advanced analytics, intelligent sync automation for strategy replication, and extensive asset coverage are some of OKX’s tools. Both inexperienced and experienced traders find it appealing because to its robust infrastructure and affordable pricing.

OKX – Features

| Feature | Description |

|---|---|

| Founded Year | 2013 |

| Copy Trading | Multi-asset support |

| Fees | Competitive (~0.05–0.1%) |

| Liquidity | Deep markets, strong volume |

| Trader Insights | Advanced analytics |

| Risk Controls | Smart sync & safety tools |

| Security | High-end infrastructure |

| Asset List | Extensive crypto offerings |

OKX Benefits & Drawbacks

Benefits

- Deep Liquidity — Great market depth.

- Multi-Asset Copy Support — Spot + derivatives.

- Smart Risk Features — Automate and safeguard sync.

- Global Infrastructure — Great uptime and dependability.

- Low Fees — Competitive with top rivals.

Drawbacks

- Steep Learning Curve for Beginners — Advanced feature set can be intimidating.

- Profit Share Costs — Fees still apply during copy.

- Lack of Smaller Tokens — Primarily focus on larger assets.

- Regional Limitations — Some features are restricted in certain countries.

- Futures Copy is More Complex — More complex than spot.

8. Zignaly

Launched around 2019, Zignaly is a crypto trading terminal platform that integrates with major exchanges, including Binance and KuCoin to facilitate automated trade copy, profit-sharing models, and copy trading.

Unlike native exchange platforms, Zignaly allows followers to profit, where followers only pay fees out of the profit made to lead traders, thus eliminating mandatory monthly subscriptions.

Aside from the integrated exchange, the trading fees are still applicable, and the active traders can take advantage of the observable performance metrics. Zignaly continued to profit share and streamlined portoflio diversification to automated functions and transparent rules.

Zignaly – Features

| Feature | Description |

|---|---|

| Founded Year | ~2019 |

| Copy Trading | Profit-sharing signals |

| Fees | Dependent on connected exchange |

| Integration | Connects with Binance, KuCoin, etc. |

| Trader Models | AI & veteran strategies |

| Risk Tools | Custom risk parameters |

| Non-Custodial | Optional non-custodial setup |

| Transparency | Clear performance history |

Zignaly Benefits & Drawbacks

Benefits

- Profit-Sharing Only — No subscription required in most instances.

- Connects to Major Exchanges — Integrates Binance/KuCoin liquidity.

- Non-Custodial Option — More control for traders.

- – AI + Human Signals — Mixture of strategies available.

- – Transparent Performance Stats — Simple to assess and analyze.

Drawbacks

- – Depends on Linked Exchange Fees — An additional fee layer.

- – Profit Sharing Can Still Be Costly — When strategies are consistently profitable.

- – Platform Is Not an Exchange — Third-party execution dependence.

- – Smaller Community — Less of a social experience than larger exchanges.

- – Limited Native Tools — Less order varieties.

9. Pionex

Pionex was founded in 2019 and is well-known for its integrated trading bots and automated tools, such as copy trading of bot strategies that automatically replicate predetermined algorithmic techniques like grid or DCA bots.

Pionex effectively passes on its minimal exchange fees, which are typically under 0.05% each trade. It offers a distinct approach to passive trading with obvious automation, making it helpful for traders who favor rule-based execution over hand signaling, even if its copy trading focuses on bot tactics rather than individual human traders.

Pionex – Features

| Feature | Description |

|---|---|

| Founded Year | ~2019 |

| Copy Trading | Bot-strategy copying |

| Fees | Low (~0.05%) |

| Built-in Bots | Grid, DCA & automated systems |

| Automation Focus | Rule-based signals |

| Risk Tools | Bot risk settings |

| Mobile App | Full bot & copy support |

| Interface | Simple for beginners |

Pionex Benefits & Drawbacks

Benefits

- – Low Trading Fees (about 0.05%) — Very cheap.

- – Built-in Bots for Automation — DCA, grid, etc.

- – Bot-Strategy Copy Focus — Passive trading is simplified.

- – Simple UX — User friendly across all experience levels.

- – All-in-One Platform — Offers both exchange and bot services.

Drawbacks

- – No Human Trader Signals — Only bot trading strategies.

- – Underperformance of Bots in Some Markets — Bots can be trend dependent.

- – Smaller Asset Variety — Less assets than larger exchanges.

- – Less Social Interaction — Does not function as a social copy network.

- – Not Ideal for Advanced Manual Traders — Less freedom for independent trading.

10. CoinEx

The ViaBTC Group created CoinEx in 2017. It provides a worldwide exchange environment with copy trading capabilities that enable customers to duplicate market techniques. Its native CET token offers fee reductions, staking, and governance advantages in addition to competitive standard trading fees.

With a variety of pairs and instruments, integrated risk management, and transparent trader metrics for copy trading, CoinEx covers both spot and derivatives markets. It is a good option for people looking for straightforward, beginner-friendly replicas of successful traders’ actions due to its extensive asset availability and long track record.

CoinEx – Features

| Feature | Description |

|---|---|

| Founded Year | 2017 |

| Copy Trading | Beginner-oriented mirror trades |

| Fees | Competitive + token discounts |

| CET Token | Reduces fees & boosts benefits |

| Asset Coverage | Many trading pairs |

| Risk Tools | Stop-loss & limits |

| User Experience | Simple and clean |

| Security | Standard exchange protection |

CoinEx Benefits & Drawbacks

Benefits

- – Low and Competitive Fees — This is particularly true when customers use a tokens (CET) for discounts.

- – Beginner-Focused Design — Smooth and uncluttered with focused tools.

- Decent Asset Coverage — Good selection of coins.

- Standard Risk Tools — Stop-loss & limits.

- Copy Trading Available — Easy mirroring for followers.

Drawbacks

- Smaller Leader Pool — Fewer signal providers.

- Not as Many Features as Big Exchanges — Limited advanced analytics.

- Profit Sharing Costs Add Up — Standard fee model.

- Less Liquidity Than Top Tier Markets — Especially small-cap coins.

- Lower Brand Awareness — Less global market share than Binance/OKX.

Conclusion

To enable customers to participate in the market with confidence, the top cryptocurrency copy trading platforms integrate transparency, affordable fees, robust security, and demonstrated trader performance.

Platforms with substantial liquidity, sophisticated risk management features, and sizable communities of verified lead traders include Bitget, Bybit, OKX, KuCoin, and Binance Copy Trading. For those looking for hands-free strategies, Zignaly and Pionex provide creative profit-sharing and bot-driven automation.

Selecting a regulated, reputable platform guarantees safer and more reliable copy trading results, but the best option ultimately depends on your risk tolerance, favorite assets, and fee sensitivity.

FAQ

Platforms typically earn through trading fees (maker/taker fees), profit sharing with lead traders, or subscription fees for premium strategies. Some also charge performance fees only when followers profit.

Safety varies by platform. Established exchanges like Binance, OKX, KuCoin, Bitget, and Bybit have robust security systems, cold storage, and compliance programs. Always enable 2FA and use risk controls like stop-loss.

Expect trading fees (e.g., 0.05–0.1 % per trade), and if copying a trader, a profit share (commonly 5–15 %) of gains. Fees depend on the exchange and your VIP/fee discount status.

Yes. Copy trading doesn’t eliminate risk — if the lead trader loses, your account mirrors those losses. Always review performance history, drawdowns, and risk settings before following.