In this article I will discuss the Best Bridging Aggregator With Lowest Slippage and thus helps you to find one of the best platforms for cross-chain crypto transfers.

Slippage affects every trade, especially during a high volume exchange so you need the right aggregator. I will also describe the best protocols to reduce costs while enabling seamless, low-cost asset transfers across blockchains.

Key Point & Best Bridging Aggregator With Lowest Slippage List

| Protocol/Service | Key Point |

|---|---|

| Across Protocol | Fast and secure cross-chain token transfers with low fees. |

| Synapse Protocol | Provides seamless interoperability and bridging across multiple blockchains. |

| Portal Token Bridge | Enables bridging of tokens across diverse chains with a focus on speed and security. |

| Allbridge | Multi-chain bridge supporting a wide range of tokens and networks. |

| Stargate Finance | Unified liquidity protocol for cross-chain asset transfers with native liquidity pools. |

| Arbitrum Bridge | Official bridge for transferring assets between Ethereum and Arbitrum Layer 2 network. |

| Celer cBridge | Offers fast, low-cost, and secure cross-chain token transfers using Layer 2 scaling tech. |

| Hop Protocol | Cross-rollup token bridge designed for instant and trustless transfers. |

| 1inch | Aggregates liquidity from multiple DEXes and bridges for best trade prices. |

| OpenOcean | Aggregator for DEXes and bridges to optimize swaps and cross-chain transactions. |

1.Across Protocol

Across Protocol is recognized as the best bridging aggregator because of its unique approach aimed at reducing slippage concerning token transfers.

It guarantees optimal swap rates and minimal capitol price impact by a achieving through a system of connected decentralized liquidity pools and sophisticated routing algorithms.

Its structure centers on safety and speed, lowering costs and slippage relative to other bridges while optimizing each transaction’s route in real-time. This makes Across Protocol ideal for effortless and inexpensive cross-chain transfers.

Features

- Focused Fast Transfers with Minimal Slippage – Cross-chain swaps are quick and low-slippage due to specializing in bonded transfers and using relayers.

- Efficient Routing – Criteria of liquidity and fee dynamics are used to select the optimal route in real time for the best rates.

- Security-Focused Design – Designed with decentralized validation to guarantee secure transfer of assets between numerous blockchains ensures safety.

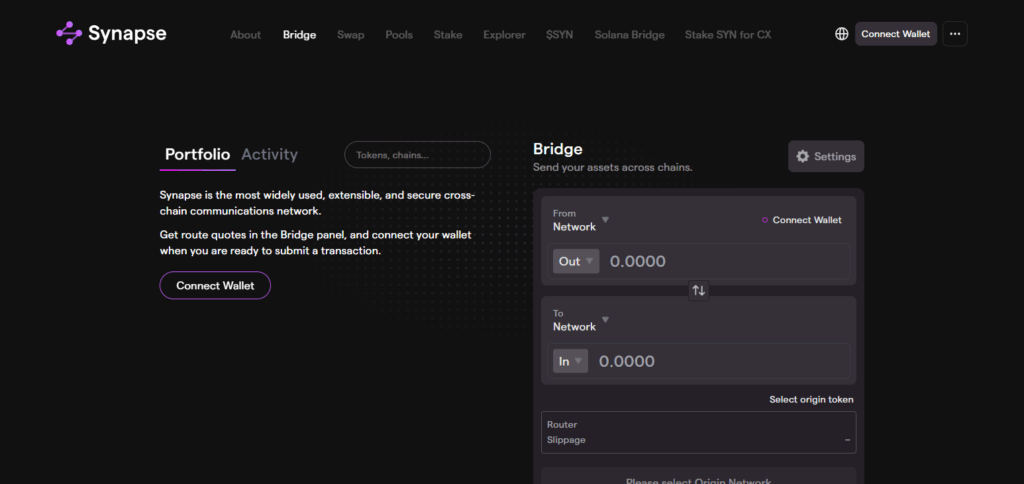

2.Synapse Protocol

Synapse Protocol stands out as a leading bridging aggregator by integrating a sophisticated cross-chain messaging system and an improved liquidity pool, minimizing slippage during token transfers. Its proprietary multi-chain framework facilitates effortless and economical swaps by routing transactions through the paths with the least resistance.

This lowers the price impact for significant trades. Moreover, Synapse maintains competitive slippage rates whilst slashing high and redundant costs, placing the slippage well beneath most competitors, which requires fast and reliable bridging during decentralized validation secure the full range of security measures.

Features

- Cross-Chain Interoperability – Assets can be seamlessly bridged over several chains with stable pricing mechanisms in place.

- Efficient AMM Model – Slippage is minimized as deep liquidity pools are maintained on each supported chain.

- Secure and Fast Messaging Layer – Cross-chain swaps are guaranteed to have low latency and high reliability.

3.Portal Token Bridge

Best bridging aggregator remains Portal Token Bridge thanks to its uniquely low slippage which comes from the use of liquidy pools that change based on market conditions. Its smart routing technologies undersells price mark routing to lower the impact during transfers so that users gain maximum value during transfers.

The bridges connection with other blockchains, as well as it’s speed and security focus greatly improves the efficiency of overall transactions. The shift in liquidy and advanced routing are responsible for Portal Token Bridge being one of the best options when looking for cross-chain swaps with low slippage.

Features

- Unified Token Bridge – A single, secure interface allows for multi-chain low-slippage swaps.

- Optimized Path Selection – Paths with the lowest price impact are selected for enhanced efficiency, ensuring optimal price impact reduction.

- High-Speed Transfers – Market fluctuation-slippage is avoided by prioritizing the execution speed of transfers.

4.Allbridge

Allbridge is known as one of the best bridging aggregators as it manages to achieve low slippage due to having a network of liquidity providers on different blockchains. Its one of a kind protocol achieves liquidity equilibrium and optimally routes transactions to minimize price impact even on large transfers.

Supporting a wide assortment of tokens and chains enables Allbridge to guarantee users fast, secure swaps with low fees and slippage. This flexible approach of multi-chain interoperability renders Allbridge to be one of the most effective solutions for cross-chain asset transfers.

Features

- Multi-Chain Support – Provides low-slippage transfer flexibility across many blockchains for wide-range connection of different blockchains.

- Dynamic Liquidity Balancing – Modifies and optimizes real-time pool ratios to decrease slippage.

- Transparent Fee Structure – Protects bridge fee margins to maintain low costs, low slippage, and predictable expenditure.

5.Stargate Finance

Stargate Finance as a leading bridging aggregator is the unit with the least slippage using their liquidity pools across several blockchains. Stargate differs from traditional bridging techniques since it links liquidity directly as opposed to relying on broken pools.

This decrease power while ensuring easier and consistent completion of swaps. Outbound and outbound transfers are done faster without incurring the huge fees associated with other bridges. This feature makes Stargate the ideal for inter-chain movements.

Features

- Unified Liquidity Pools – Shared cross-chain pools mitigates fragmentation and reduces slippage.

- Instant Guaranteed Finality – Executes on-chain transfers with final confirmation which prevents slippage.

- Seamless Native Asset Transfers – Direct transfer of native tokens mitigates conversion slippage.

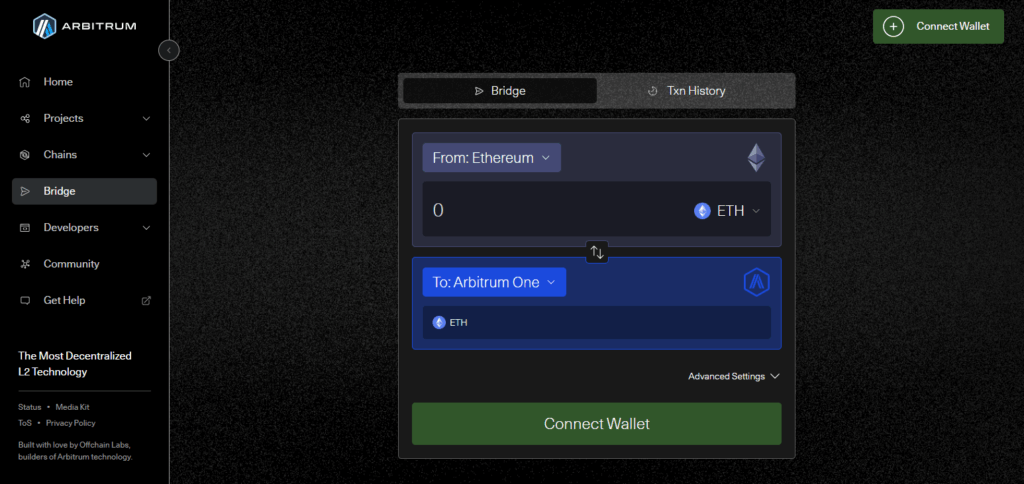

6.Arbitrum Bridge

Arbitrum Bridge is known as one of the best bridging aggregators due to its extremely low slippage, being directly linked to Ethereum and Arbitrum’s Layer 2 network. Using its proprietary rollup method, it thins out the queued transactions to alleviate the congestion and calms the price impact during transfer.

Capable of achieving high-speed finality and economical bridging, it relieves the slippage on users moving assets between chains which results in none or minimal slippage. These features in conjunction make Arbitrum Bridge one of the best choices for cross-chain transfers with low slippage and high security.

Features

- Layer 2 Rollup Efficiency – Utilizes rollups for faster, cheaper, and low slip transactions.

- Direct Chain Link to Ethereum – Eliminates intermediaries preserving value retention of tokens during bridge crossing.

- High Throughput Design – Large volume processing capabilities with low price impact.

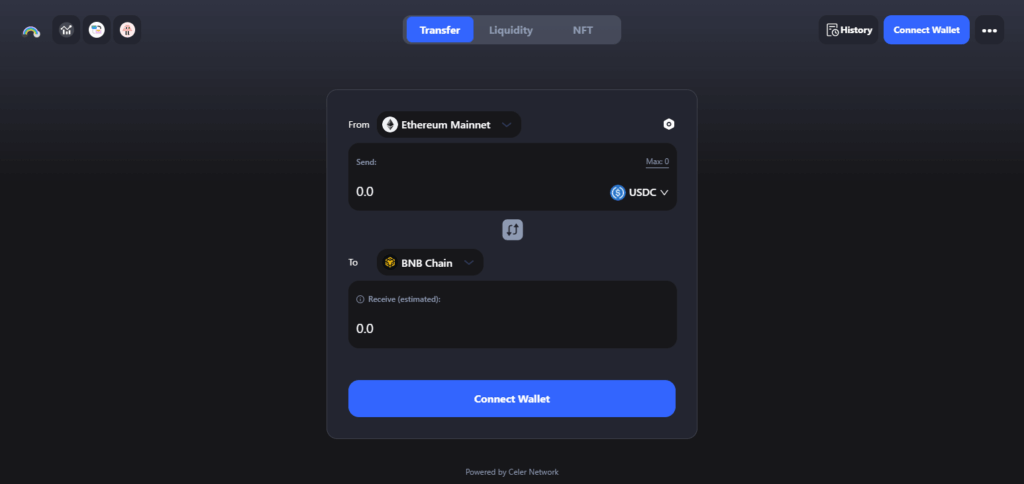

7.Celer cBridge

Celer cBridge is widely regarded as one of the most efficient bridging aggregators because of its cBridge’s off-chain state channels and cBridge’s large liquidity provider network ensure better slippage cross-chain transfers. cBridge State Channels yield faster, lower-cost off-chain transactions that smooth price impacts.

Furthermore, price impacts are mitigated through optimal path selection by cBridge’s smart liquidity. Due to cBridge’s intelligent routing system, the most effective method that minimizes fees while maximizing liquidity is chosen. Because of all the previously mentioned features, Celer cBridge is effective at executing dependable cross-chain asset transfers with minimal slippage.

Features

- Layer 2 State Channel Technology – Off-chain scaling improves speed, lowers slippage.

- Smart Liquidity Routing – Maintains advantageous rates by routing through optimal channels.

- Robust Liquidity Network – Ensures accurate and stable swaps through extensive coverage.

8.Hop Protocol

Hop Protocol is the leading bridging aggregator with ultra-low slippage, which stems from its specialized architecture designed for cross-rollup transfers. Moreover,

Hop minimizes price impact by using liquidity pools on each supported chain, allowing instant token swaps, as well as confirming transfers with fast, automatic RPC calls. Its emphasis on soft and hard dependencies on Layer 2 Plane scaling, along with shared liquidity between rollups, allow for fast and economically efficient bridging.

Such distinctive techniques of liquidity engineering coupled with instant settlement make Hop Protocol best suitable for users with deadlines who require efficient low slippage cross-chain transfers.

Features

- Cross-Rollup Liquidity Pools – Ensures liquidity is retained between L2s for immediate low slippage transfers.

- Minimal Waiting Time – Settles trades without lengthy confirmation delays, preventing slippage from price alterations.

- Designed for Rollup Optimization – Tailored for Layer 2 expansion with low cost transactions.

9.1inch

1inch earns the title of the best bridging aggregator as it pulls liquidity from several decentralized exchanges and bridges so that users experience the lowest slippage possible.

Based on an advanced routing algorithm, its processes also divides transactions between several different platforms, interfaces, and ecosystems to reduce the impact it has on market prices as well as any upcoming fees.

This type of smart aggregation enables cross-chain transactions through different blockchains while also taking into account and utilizing a great network of liquidity sources offering a seamless experience at reasonable costs which is ideal for Forex traders.

Features

- DEX Aggregation Engine – Eaggregates rates from numerous DEXs and bridges to select the most efficient slippage.

- Smart Order Routing – Executes Traded on multiple platforms concurrently enabling transaction splitting.

- Realtime Price Watching – Alerts users on price fluctuations on the market regularly to curb slippage on larger trades.

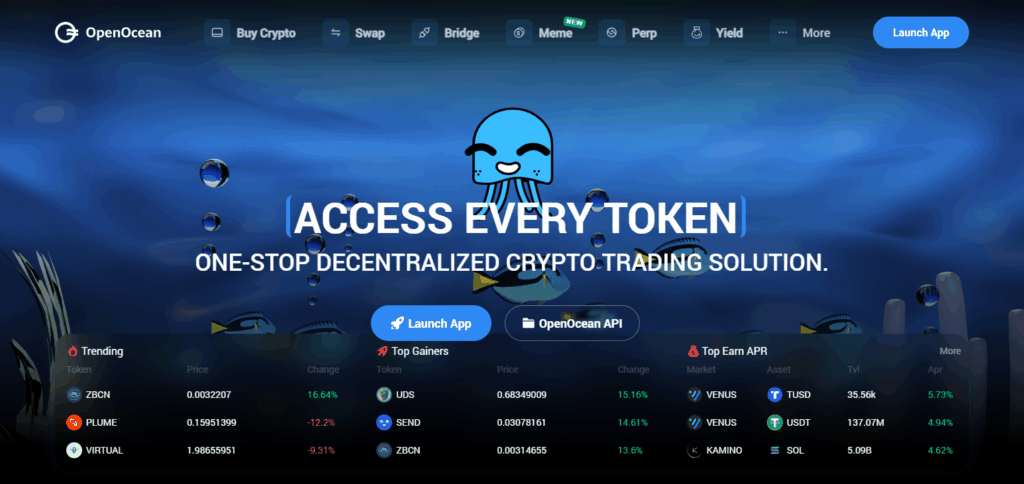

10.OpenOcean

OpenOcean stands out in the industry as a bridging aggregator by synthesizing liquidity from multiple DEXs and Bridges.

This aggregation deepens the liquidity available on chains, significantly reducing slippage when carrying out transactions. Using their proprietary all-in-one aggregation protocol, OpenOcean automatically routes a trade through diverse networks and sources of liquidity to give the best possible rate.

Customers benefit from cross-chain swaps with minimal price impact and fewer fees due to effective price optimization. Such combined smart routing makes OpenOcean a reliable solution for cross-chain asset transfers with low slippage.

Features

- Cross Chain DEX Aggregator – Compiles centralized and de centralized loaning and borrowing platforms for efficient swap of tokens.

- AI Trade Routing – Determines the optimal route for executing trades through an advanced artificial intelligence system with minimal slippage.

- All in One DeFi Portal – Provides complete DeFi services within single platform with effortless bridging and stable prices.

Conclusion

To sum up, the most effective bridging aggregators with the lowest slippage are those that combine sophisticated routing systems and cross-chain technologies with deep liquidity pools which enable the efficient and inexpensive transfer of assets.

They focus on reducing price impact and fee costs while providing smooth, quick, and secure bridging transactions to users. Ranging from dynamic liquidity pools to Layer 2 solutions and multi-source aggregation, the best bridging aggregators offer consistent low-slippage swaps, enabling asset transfers across various blockchains with user confidence.