In this piece, I will highlight the Best Bridging Aggregators for BSC, specifically targeting those that enable cross-chain transfers that are quick, secure, and economical.

Aggregators are essential for developers and traders alike since they streamline the tedious task of transferring assets across Ethereum, Polygon, and many other chains. I will discuss the best BSC interoperability tools as the last segment of this article.

What is Bridging Aggregators?

Bridging aggregators facilitate the management of cross-chain transactions by decentralizing systems in place. Instead of depending solely on one bridge, they gather liquidity and pathways from various bridges, resulting in more dependable, cheaper, and faster token transfers.

From there, they automatically optimize the cross-asset movement paths by calculating the lowest possible fees and intervals. Integrating Binance Smart Chain, Ethereum, and Polygon networks, they enable smooth transactions and, as such, build a strong junction in the DeFi ecosystem.

Potential users utilizing bridging aggregators can focus on one wallet while gaining entry to a wide range of applications dispersed across several blockchains. Engage in manual exchanges or multiple wallets to switch applications.

How To Choose Bridging Aggregators for BSC

Security: Choose platforms with proven audits and a strong track record of safe cross-chain transfers.

Supported Chains: Make sure the aggregator has Binance Smart Chain and other primary networks.

Transaction Speed: Seek your aggregator with minimal hold periods or delays.

Fees: Low-cost transfers are gas and bridge fees in your comparison.

Liquidity: Higher liquidity means better token availability and more efficient swaps.

User Interface: Aggregators are more efficient with a user-friendly design.

Customer Support: Active community or support systems are part of trustworthy platforms.

Decentralization: Prefer aggregators with custodial-free and clear systems.

Best Bridging Aggregators for BSC Points

- Celer Network (cBridge): Offers fast, low-cost cross-chain transfers with advanced security and high liquidity.

- deBridge: A decentralized liquidity transfer protocol enabling secure interoperability between blockchains.

- Binance Bridge: Simplifies asset transfers between Binance Smart Chain and other major blockchains.

- Multichain (formerly Anyswap): Supports multiple assets and chains with automated routing for seamless bridging.

- Synapse Protocol: Provides efficient cross-chain swaps, liquidity pools, and stablecoin transfers.

- Rango Exchange: Aggregates multiple bridges and DEXs for the best cross-chain swap rates.

- Orbiter Finance: Focused on fast and gas-efficient Layer 2 to Layer 2 transfers with minimal fees.

- Symbiosis Finance: Combines multiple chains into one interface for easy cross-chain liquidity swaps.

- LI.FI Protocol: Aggregates all major bridges and DEXs to find the best routes for cross-chain transactions.

- Allbridge: Enables simple and scalable token transfers across multiple EVM and non-EVM blockchains.

10 Best Bridging Aggregators for BSC

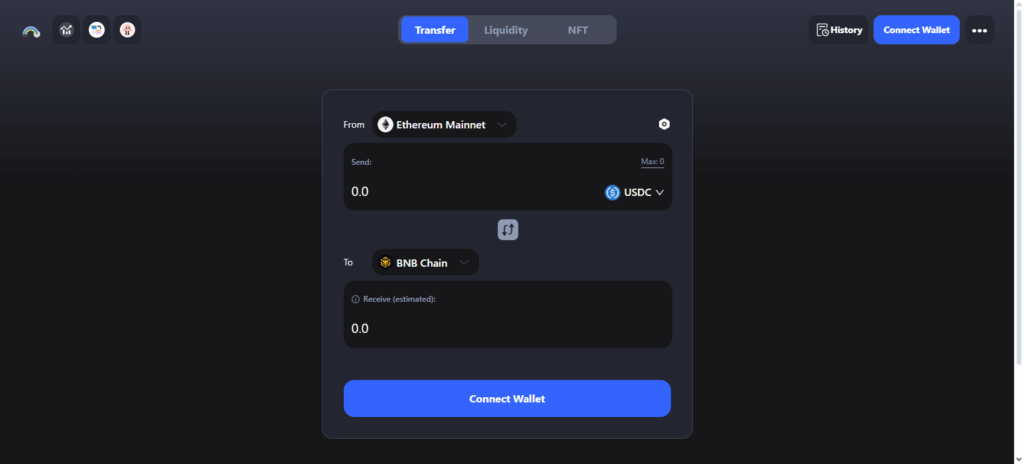

1. Celer Network (cBridge)

Celer Network’s cBridge has been rated as one of the Best Bridging Aggregators for BSC mainly because of its speed, scalable, and cheap transactions. With almost instant speed, one can easily transfer assets between Binance Smart Chain and other major blockchains.

The platform’s proprietary State Guardian Network (SGN) protects, validates, and performs real-time validation to bridge failures. cBridge automatically optimizes route crossings to provide the most efficient channels for cross-chain liquidity movement, thus saving users time and money.

cBridge’s user interface, abundant liquidity pools, and developer-friendly API have secured its place as one of the most reliable and economical BSC bridging services in the DeFi community.

Celer Network (cBridge) Features

- Cross-chain transfers are among the fastest and have shortened latency and lowered costs.

- Greatest security with the State Guardian Network (SGN) focusing on safe crossing.

- Efficient token swaps with automatic route optimization.

2. deBridge

DeBridge is renowned for being one of the best Bridging Aggregators for BSC because of its sophisticated interoperability layer which links Binance Smart Chain to several key networks in a safe environment.

For avoiding single points of failure, it implements a decentralized system of validation, which ensures a trustless and transparent passage. In contrast to other conventional bridges, deBridge focuses on smart cross-chain messaging to enhance routing and the provision of liquidity.

As a result, developers can seamlessly build and integrate multi-chain applications, and to which, the high-speed transfer system and numerous security audits cater to as a reliable cross-chain swap service.

DeBridge positive attributes make it one of the best choices for BSC bridging, as the platform offers endless composable DeFi solutions with a high degree of flexibility, scalability and as the primary focus.

deBridge Features

- Secure and trustless transfers via Decentralized validation system.

- Economical SWAPs with optimized liquidity routing yielding low slippage.

- Developer integration for multi-chain apps helps support several chains.

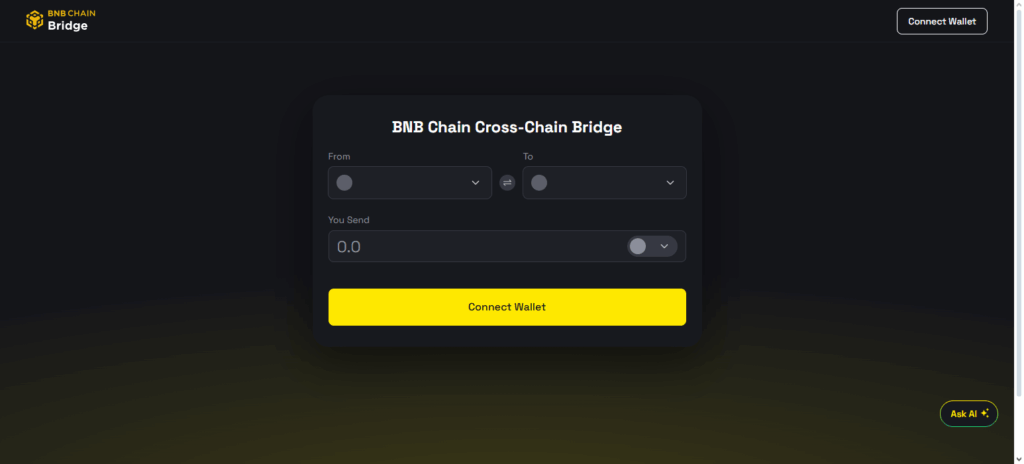

3. Binance Bridge

Binance Bridge has earned a reputation as one of the best bridging aggregators for BSC for good reason. It allows transfers to and from the Binance Smart Chain and major blockchains accessibly and securely.

Due to its direct ecosystem integration, clientele enjoys the bridging exchange with very low Binance ecosystem fees, a very reliable exchange, and a frictionless user experience. Beginners and advanced users alike love the automation of wrapping and unwrapping the cross-chain tokens.

The Binance ecosystem deeply and securely provides reliable infrastructure and liquidity, resulting in outstanding optimal transaction speed and safety of cross-chain swaps. It’s no wonder that Binance Bridge is the customer’s most reliable choice for bridging BSC.

Binance Bridge Features

- Reliability is ensured because of Binance ecosystem native integration.

- Wrapping and unwrapping of tokens is automatic for easy cross-chain transfers.

- Major assets enjoy low pricing and high liquidity support.

4. Multichain (formerly Anyswap)

Multichain (previously Anyswap) is one of the Best Bridging Aggregators for BSC largely thanks to its incredible cross-chain capabilities and the innovative Router V3 technology. cvIt allows for the seamless transfer of assets between Binance Smart Chain and more than 90 other blockchains.

Among Multichain’s most defining characteristics is its fusion mode which takes the most optimal route for transactions while reducing slippage and costs. The decentralized node system improves transparency while lowering centralization risks.

Deep liquidity pools, support for bridged stablecoins, and rapid confirmation times, all combine to make Multichain the leading choice for BSC users needing safe and inexpensive token transfers.

Multichain (formerly Anyswap) Features

- Optimized transfer paths with Router V3 technology.

- Over 90 supported blockchains with deep liquidity pools.

- Bridging is made easy with fusion mode which lowers fees and slippage.

5. Synapse Protocol

Synapse Protocol is one of the best bridging aggregators for the Binance Smart Chain (BSC), thanks to its cross-chain infrastructure and liquidity-oriented innovations.

Instead of direct token wrapping, Synapse Protocol employs liquidity pools for efficient, seamless transfers to and from the Binance Smart Chain to and from other leading networks.

The protocol is distinguished by its cross-chain automated market maker (AMM), which enhances swap pricing and minimizes slippage. Synapse integrates stablecoin bridging which cross the varied DeFi ecosystem for fast, affordable, and seamless transactions.

With a focus on interoperability, complete security audits, and reputation DAO governance, Synapse Protocol has solid positioning for developers and users requiring bridging on the Binance Smart Chain.

Synapse Protocol Features

- Wrapping is no longer needed because liquidity pools can facilitate transfers.

- Cross-chain AMM optimizes pricing and reduction of slippage.

- Supports several networks for quick and cheap swaps with stablecoins.

6. Rango Exchange

Rango Exchange is recognized as one of the top Best Bridging Aggregators for BSC. This is for its strong multi-chain routing system for BSC and the EVM and Non-EVM networks system interconnection.

Rango determines the optimal path for each swap out of several DEXs and bridge liquidity aggregations to minimize fees and maximize execution speed. What makes Rango special is its universal swap engine.

It integrates more than 60 blockchains into one single interface/ transaction, offering a unique all-in-one bridging capability.

All of this allows for effortless asset movement on a single bridging interface, eliminating the need to manually shift between chains. Rango thoroughly integrates user-friendliness, dependability, and real-time optimization, making it stand out as a BSC bridging solution.

Rango Exchange Features

- Best swap rates found by aggregating different bridges and decentralized exchanges.

- Supports a single transaction interface spanning 60 different blockchains.

- Ensured quick execution and low fees through optimized routing.

7. Orbiter Finance

Orbiter Finance stands out as one of the finest bridging aggregators for BSC owing to its rapid, affordable Layer 2, as well as cross-chain transfers. Utilizing batching and rollup technologies, Orbiter minimizes gas fees while ensuring near real-time completion of transfers.

The seamless bridging to and from BSC and other fast chains offers scalability tailored for the frequent DeFi user. Its system also emphasizes safety through decentralized validations and smart contract audits.

With a user-friendly platform, deep liquidity, and efficient routing, Orbiter Finance is a dependable and value-efficient method for bridging assets on the Binance Smart Chain.

Orbiter Finance Features

- Fast and low-cost Layer 2 and cross-chain transfers.

- Gas fees are reduced through batching and rollup technology.

- Decentralized validation of transactions is secure and near instant.

8. Symbiosis Finance

Symbiosis Finance is one of the Best Bridging Aggregators for BSC for its innovative bridging and multi-chain swapping infrastructure.

It permits the seamless transfer of tokens between the Binance Smart Chain and other major blockchains, all while qualifying fast and low-cost transfers. However, Symbiosis’ biggest prowess is its hybrid routing system, which chooses the optimal route dynamically among different bridges and pools for the most efficient swaps.

It is also versatile for different types of DeFi users because it handles stable and volatile assets. The combination of strong security, and user-friendliness of the interface makes Symbiosis Finance a dependable and efficient BSC bridging solution.

Symbiosis Finance Features

- Hybrid routing system selects the optimal path in multiple bridges.

- Flexible swaps are offered through stablecoins and volatile tokens.

- High security with trusted execution and audited smart contracts.

9. LI.FI Protocol

LI.FI Protocol is recognized as one of the Best Bridging Aggregators for BSC because of its advanced multi-chain aggregation as well as smart routing. It connects Binance Smart Chain with a number of other blockchains and automatically determines the most efficient and economic routes for transferring tokens.

LI.FI’s most distinctive feature is its capacity to combine several bridges and DEXs into one cohesive transaction, minimizing friction and the length of time a user has to wait for a transaction to be completed.

Furthermore, LI.FI backs its services with comprehensive security audits, transparent practices, and developer-friendly APIs, providing safe and dependable as well as scalable cross-chain transfers. Its unparalleled speed and multi-chain capacity makes it most efficient bridge for BSC.

LI.FI Protocol Features

- Aggregated bridges and DEXs to enable cross-chain swaps.

- Smart routing determines the efficient and economical route.

- Multi-chain applications have developer-friendly APIs for easy cross-chain swaps.

10. Allbridge

Allbridge is one of the Best Bridging Aggregators for BSC for the simplicity of its approach to cross-chain transfers. Allbridge enables safe and seamless token bridging between the Binance Smart Chain and multiple EVM and non-EVM networks for efficient cross-chain transfers.

Allbridge’s modular infrastructure is a unique feature since it permits quick and secure, low-fee integration with new blockchains.

Smart algorithms and a multi-path system minimize slippage and time of transfers by dynamically selecting the best route. Strong liquidity and audits give Allbridge users a seamless and trustworthy BSC bridging experience on a friendly and clear interface with adequate liquidity.

Allbridge Features

- New blockchains are incorporated rapidly with modular infrastructure.

- Smart routing improves transactions by minimizing slippage and delays.

- Bridging is secure and low fee with a user friendly interface.

Pros & Cons

Pros:

- Cross-Chain Accessibility: Multiple blockchains and BSC blockchain connections for active cash flows to and from bridged BSC blockchain chains.

- Lower Fees: With enhanced route and liquidity optimization, gas costs and bridging costs are lessened.

- Faster Transactions: Time of all transactions are decreased due to smart routing and Layer two blockchain technology.

- Liquidity Optimization: Unlimited bridge and DEX access for hassle free exchanges and multiple liquidity sources .

- User-Friendly: Simplistic UX for cross-chain transfers to cater to cross-chain transfer novices.

- Security: Majority of the aggregators impose audits, decentralized validations and guardian networks.

- DeFi Integration: Multi-chain DeFi offers composable services with various cross-application integrations layered with multiple streams of cash flows.

Cons:

- Smart Contract Risk: Monetarily bridging contracts with stupidity closed smart contracts can be exploited and lose all cash flows.

- Limited Asset Support: Not every aggregator champions every token across the chains.

- Network Congestion: Inefficiencies due to high blockchain traffic imposed restrictions on timely execution of transactions even if all smart contracts are optimized.

- Complexity for New Users: Fees, slippage, and complex bridging paths are highly confusing to the untrained.

- Partial Decentralization: Aggregators that depend on centralized blockchain routing and services create self imposed limitations due to non-anchor node dependency.

Conclusion

To summarize the Best Bridging Aggregators for the BSC, it is important for efficient, rapid, and affordable cross-chain asset transfer.

Celer Network (cBridge), deBridge, Binance Bridge, Multichain, Synapse Protocol, Rango Exchange, Orbiter Finance, Symbiosis Finance, LI.FI Protocol, and Allbridge have competitive advantages in security and routing, liquidity, and cost.

Users can optimally vent the DeFi ecosystem, cross various chains for token swaps, and perform other operations efficiently. The choice of low, mid, or high routing fees primarily determines the gas cost, supported tokens, and security of the aggregator.

FAQ

Aggregators optimize routes automatically, reducing fees, slippage, and transaction time while providing access to higher liquidity across multiple networks.

Some of the top options include Celer Network (cBridge), deBridge, Binance Bridge, Multichain, Synapse Protocol, Rango Exchange, Orbiter Finance, Symbiosis Finance, LI.FI Protocol, and Allbridge.

Most are secure with smart contract audits and decentralized validations, but users should always verify platforms, start with small transfers, and be aware of smart contract risks.