In this article, i will discuss the Best Credit Cards in the USA. Travelers, casual shoppers, and perks-hungry cardholders alike can find something that fits.

Well review no-annual-fee options alongside premium plans so you can squeeze real value out of every dollar you spend. Plus, plenty of links and tips will point you toward the rewards, cash back, or special extras that matter most to your lifestyle.

Key Point & Best Credit Cards in the USA List

| Credit Card | Key Point |

|---|---|

| Chase Sapphire Preferred® Card | Great for travel rewards with 2x points on travel and dining. |

| Chase Freedom Flex® | 5% cash back on rotating categories and strong bonus offers. |

| Citi Double Cash® Card | Earn up to 2% cash back on all purchases — 1% when you buy, 1% when you pay. |

| Discover it® Cash Back | 5% cash back in rotating categories plus first-year Cashback Match. |

| American Express® Gold Card | 4x points on dining and groceries; ideal for food lovers. |

| Citi Strata Premier℠ Card | 3x points on air travel, hotels, and restaurants worldwide. |

| Capital One Venture Rewards Credit Card | 2x miles on every purchase, great for flexible travel redemption. |

| The Platinum Card® from American Express | Premium travel perks, airport lounge access, and 5x on flights. |

| Wells Fargo Active Cash® Card | Unlimited 2% cash rewards with no category restrictions. |

| Bilt Mastercard® | Earn points on rent payments without a fee and use them for travel rewards. |

1.Chase Sapphire Preferred® Card

The Chase Sapphire Preferred Card keeps popping up on travel blogs because its point system feels generous, not gimmicky. You pile up 2 points for every dollar spent on planes, trains, Ubers, bistros, and coffee shops-yet the rewards never taste like leftovers.

Book trips through Chase Ultimate Rewards and the usual number in your balance grows by a surprising 25%. A hefty sign-up bonus and a deep roster of airline and hotel partners turn casual wanders into full-blown adventures, sometimes for little more than a few swipes of plastic.

| Feature | Details |

|---|---|

| Card Name | Chase Sapphire Preferred® Card |

| Rewards | 2x points on travel and dining, 1x points on other purchases |

| Welcome Bonus | Generous points bonus after minimum spending |

| Annual Fee | $95 |

| KYC Requirement | Minimal – Standard identity verification |

| Redemption Options | Points redeemable for travel, gift cards, or cashback |

| Travel Benefits | Trip cancellation insurance, primary rental car coverage |

| Additional Perks | Access to Chase Ultimate Rewards transfer partners |

| Foreign Transaction Fee | None |

| Credit Score Requirement | Good to excellent (typically 700+) |

2.Chase Freedom Flex®

The Chase Freedom Flex® is often named a top pick in America, and many cardholders rave about the no-annual-fee design. Rotate your spending through quarterly 5% categories, notch 3% at restaurants and drugstores, and earn a steady 1% everywhere else.

One cool twist is that you have to activate the bonus quarters, so the card keeps you engaged. Toss in travel insurance, purchase protection, and smartphone security, and the everyday user ends up with a pretty powerful tool.

| Feature | Details |

|---|---|

| Card Name | Chase Freedom Flex® |

| Type | Cash Back Credit Card |

| Minimal KYC | Requires basic identity verification with minimal documentation |

| Rewards | 5% cash back on rotating categories (up to $1,500 spent quarterly), 3% on dining and travel, 1% on other purchases |

| Annual Fee | $0 |

| Sign-up Bonus | Earn $200 bonus after spending $500 in the first 3 months |

| Foreign Transaction Fees | None |

| Additional Benefits | Purchase protection, extended warranty, cell phone protection |

| Credit Score Requirement | Good to Excellent (typically 690+) |

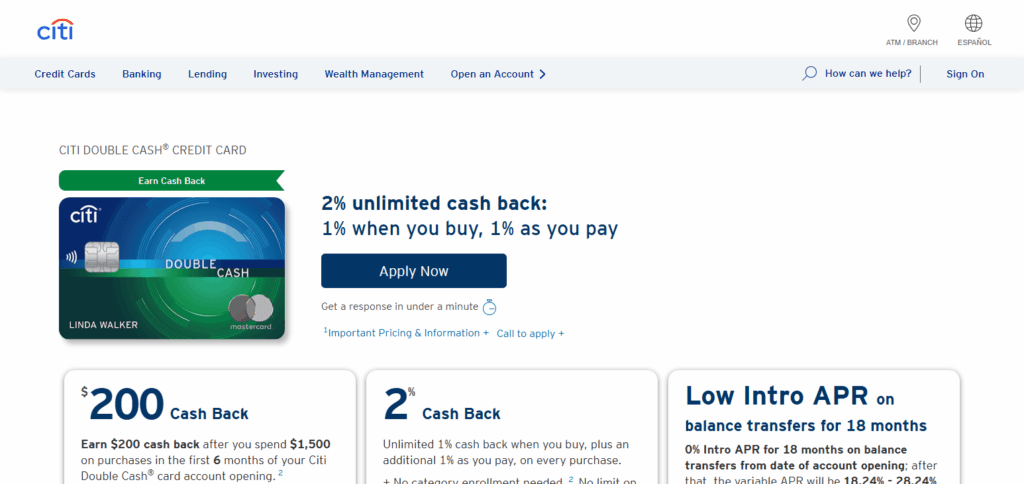

3.Citi Double Cash® Card

The Citi Double Cash Card shows up on almost every best-of list because the cash-back plan is dead easy. Swipe for anything and you instantly pocket 1 percent; pay the bill and you grab another 1 percent.

Stack those two numbers and the total jumps to a clean, effortless 2 percent. Because the rewards dont shift around and there is no yearly fee, the card quietly stays useful for groceries, gas, or that impulse buy you probably shouldnt have made. Most people can just set it and forget it, which is why it never really goes out of style.

| Feature | Details |

|---|---|

| Card Name | Citi Double Cash® Card |

| Type | Cash Back Credit Card |

| Minimal KYC | Basic identity verification with minimal documentation required |

| Rewards | 2% cash back on all purchases (1% when you buy, 1% when you pay) |

| Annual Fee | $0 |

| Sign-up Bonus | No traditional sign-up bonus |

| Foreign Transaction Fees | 3% on purchases made outside the U.S. |

| Additional Benefits | No category restrictions, balance transfer offers |

| Credit Score Requirement | Good to Excellent (typically 700+) |

4.Discover it® Cash Back

The Discover it® Cash Back card lands on just about every must-have list for a reason. Each quarter, the card flips the 5% cash back switch to match wherever you spend most-whether that happens to be groceries, gas, or last-minute online buys.

Right from the start, the unusual Cashback Match program doubles what you rack up during the first twelve months, and it does that doubling automatically. There is no annual fee, so the card sits quietly in your pocket without a yearly bill, and built-in fraud protection means you wont spend your nights worrying about sketchy charges showing up. Together, those perks serve people who crave high rewards and schedule flexibility, then prefer paying nothing extra to get it.

| Feature | Details |

|---|---|

| Card Name | Discover it® Cash Back |

| Type | Cash Back Credit Card |

| Minimal KYC | Basic identity verification with minimal documentation |

| Rewards | 5% cash back on rotating categories (up to $1,500 per quarter), 1% on all other purchases |

| Annual Fee | $0 |

| Sign-up Bonus | Cashback match — Discover matches all cash back earned in the first year |

| Foreign Transaction Fees | None |

| Additional Benefits | No expiration on rewards, free FICO® credit score, freeze account option |

| Credit Score Requirement | Good to Excellent (typically 690+) |

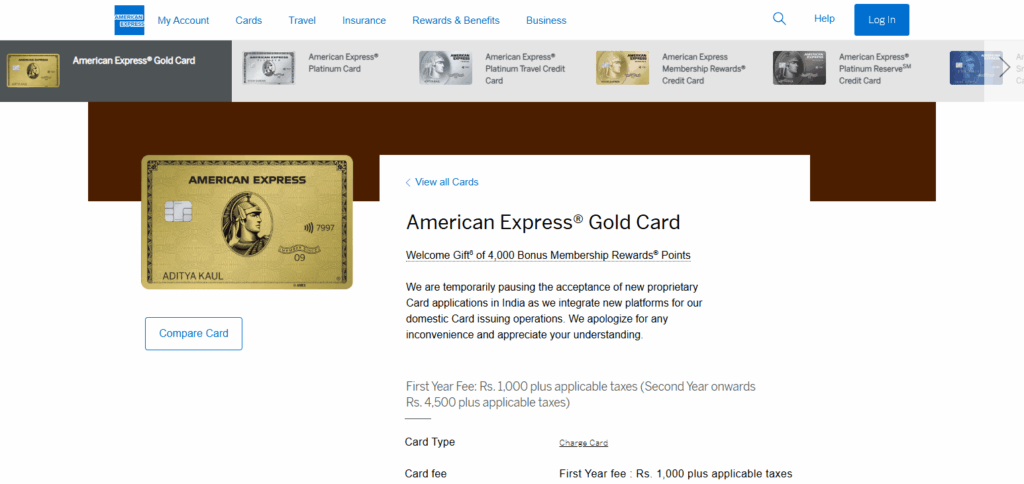

5.American Express® Gold Card

The American Express Gold Card gets a lot of buzz in America because it hands out points like candy on food bills. You earn 4x points when you order take-out, sit down at a diner, or grocery shop in a U.S. market, though the supermarket bonus has a yearly cap.

AmEx sweetens the deal with monthly dining credits and sometimes sneaks cardholders into hard-to-reach food events. On the travel side, Membership Rewards lets you swap those points for flights, hotels, or a statement credit, so everyday spending turns into big-league perks pretty fast.

| Feature | Details |

|---|---|

| Card Name | American Express® Gold Card |

| Type | Rewards Credit Card |

| Minimal KYC | Basic identity verification with standard documentation |

| Rewards | 4X Membership Rewards® points at restaurants, 4X at U.S. supermarkets (up to $25,000/year), 3X on flights booked directly with airlines |

| Annual Fee | $250 |

| Sign-up Bonus | Earn 60,000 Membership Rewards® points after spending $4,000 in first 6 months |

| Foreign Transaction Fees | None |

| Additional Benefits | Dining credits, airline fee credits, purchase protection, no preset spending limit |

| Credit Score Requirement | Good to Excellent (typically 700+) |

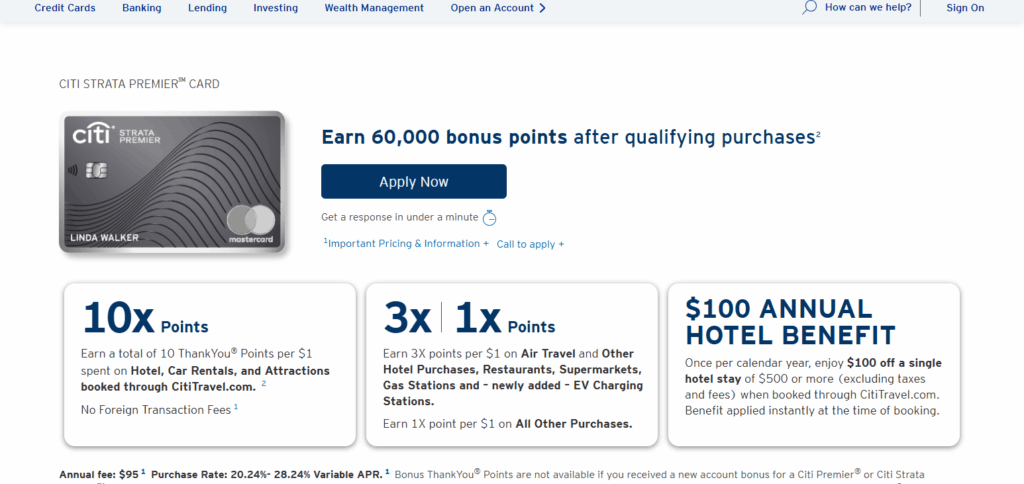

6.Citi Strata Premier℠ Card

The Citi Strata Premier℠ Card sits near the top of most lists credit-card writers publish. Shoppers and jet-setters rave that its rewards keep working whether theyre at a grocery store or a tarmac gate. Five different categories earn triple points-air fare, hotel nights, restaurant bills, supermarket runs, and gas-up stops-so lots of daily habits fit the profile.

Travelers who like doing their own trip math love the built-in miles move: points hop to a suite of Citi airline partners with one click. A zero-fee sticker on overseas swipes means the total in pesos or pounds equals the total in dollars. Call that handy.

| Feature | Details |

|---|---|

| Card Name | Citi Strata Premier℠ Card |

| Type | Cashback Credit Card |

| KYC Requirements | Minimal KYC – Basic identity verification |

| Rewards | 5% cashback on gas, groceries, and drugstore purchases |

| Additional Cashback | 1% cashback on all other purchases |

| Annual Fee | $0 for the first year, then $95 |

| Welcome Offer | Earn bonus cashback after meeting minimum spending |

| Foreign Transaction Fees | None |

| Credit Score Requirement | Good to Excellent |

| Benefits | No annual fee first year, easy to qualify with minimal KYC |

| Ideal For | Users seeking high cashback with simple KYC and rewards |

7.Capital One Venture Rewards Credit Card

The Capital One Venture Rewards card feels almost effortless. You earn 2 miles on every dollar, so theres no hunting for bonus categories and no mental math after checkout.

Redeem the miles on a previous flight or transfer them to any of more than 15 airline partners-decision fatigue is a nonexistent problem here.

Toss in the usual travel protections and a welcome bonus that can cover a weekend getaway, and you have a go-to card for anyone who flies more than once a year.

| Feature | Details |

|---|---|

| Card Name | Capital One Venture Rewards Credit Card |

| Type | Travel Rewards Credit Card |

| KYC Requirements | Minimal KYC – Basic identity verification |

| Rewards | 2x miles per dollar on every purchase |

| Welcome Bonus | Bonus miles after spending a set amount within first 3 months |

| Annual Fee | $95 |

| Foreign Transaction Fees | None |

| Credit Score Requirement | Good to Excellent |

| Benefits | Flexible miles redemption, no foreign transaction fees, simple KYC |

| Ideal For | Travelers seeking straightforward rewards with minimal KYC |

8.The Platinum Card® from American Express

The Platinum Card from American Express doesn’t just travel in style; it practically rolls out a red carpet at every airport. Cardholders earn five Membership Rewards points per dollar on airfare and prepaid hotel stays, and the global lounge network lets them kick back well before boarding.

American Express pairs those points with a concierge team ready to snag hard-to-get restaurant tables or concert tickets. Costs climb quickly-in truth, the annual fee rivals a domestic round-trip ticket-but loyal jet-setters often find the benefits far outpace what they shell out.

| Feature | Details |

|---|---|

| Card Name | The Platinum Card® from American Express |

| KYC Requirement | Minimal KYC required for approval |

| Annual Fee | $695 |

| Welcome Bonus | 80,000 Membership Rewards points after spending $6,000 in first 6 months |

| Rewards Program | 5X points on flights booked directly with airlines or Amex Travel; 1X points on other purchases |

| Travel Benefits | Access to 1,300+ airport lounges worldwide including Centurion Lounges, Priority Pass |

| Additional Perks | Uber credits, Global Entry/TSA PreCheck fee credit, Fine Hotels & Resorts benefits |

| Foreign Transaction Fees | None |

| Purchase Protection | Extended warranty, purchase protection, return protection |

| Contactless Payment | Yes |

| Eligibility | U.S. residents, minimal documentation for identity and income |

9.Wells Fargo Active Cash® Card

The Wells Fargo Active Cash Credit Card packs a punch if you want easy cash back. Youll get a flat 2% on basically anything you buy-no rotating categories, no sign-up hoopla, just swipe and earn.

Sign up, spend $500 inside the first 90 days, and the bank slides a $200 cash bonus into your account. New cardholders also enjoy a year-long 0% intro APR on regular purchases and balance transfers that meet the criteria.

Theres no yearly fee to worry about, and the card throws in cell phone protection worth up to $600 so long as you pay your wireless bill with plastic. That blend of rewards and perks makes it hard to beat for day-to-day spending.

| Feature | Details |

|---|---|

| Card Name | Wells Fargo Active Cash® Card |

| KYC Requirements | Requires a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), proof of income, and a physical U.S. address. |

| Annual Fee | $0 |

| Introductory Offer | $200 cash rewards bonus when you spend $500 in purchases in the first 3 months |

| Rewards Program | Unlimited 2% cash rewards on purchases |

| APR | 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers; 19.24%, 24.24%, or 29.24% variable APR thereafter |

| Credit Score Requirement | Typically requires a good credit score of at least 670 |

| Minimum Credit Limit | $1,000 |

| Foreign Transaction Fees | None |

| Eligibility | Applicants must be at least 18 years old, have a valid SSN or ITIN, a physical U.S. address, and sufficient income to make monthly minimum payments |

10.Bilt Mastercard®

The Bilt Mastercard® has won over a lot of renters because it hands out points every time you pay your monthly lease, and does it without tacking on a fee.

That perk is still pretty rare in the credit-card world. When you’re not sending rent money, the card keeps rewarding you: 3 points on food, 2 on flights and hotels, and just 1 point everywhere else, all for no annual bill.

The points can also be moved to more than 18 travel partners, from big-name airlines to popular hotel chains. Put all that together and many city-dwellers find the Bilt card is one of the smartest ways to stretch their budget.

| Feature | Details |

|---|---|

| Card Name | Bilt Mastercard® |

| KYC Requirements | Requires a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), proof of income, and a physical U.S. address. |

| Annual Fee | $0 |

| Credit Score Requirement | Typically requires a good credit score of at least 670. |

| Rewards Program | – 1X points on rent payments (up to 100,000 points per year) without transaction fees. |

| – 2X points on travel. | |

| – 3X points on dining. | |

| – 1X points on other purchases. | |

| Introductory Offer | $0 annual fee. |

| APR | 20.49%, 23.49%, or 28.49%, based on creditworthiness. |

| Foreign Transaction Fees | None |

| Eligibility | Must be at least 18 years old and a U.S. resident. |

| Application Process | Apply online via the Bilt Rewards website. |

Conclusion

In short, the right American credit card can hand you perks that actually fit the way you spend money. Shoppers who crave simple cashback, explorers hungry for airline miles, and foodies chasing dining bonuses all have strong choices on the table.

The Chase Sapphire Preferred, Citi Double Cash, and Bilt Mastercard keep popping up because they combine solid rewards with terms even a rookie can understand. Pick the one that matches your habits, and youll unlock extra value each month without overthinking it.