The Top Crypto Margin Trading Platforms that enable traders to use leverage to increase their positions will be covered in this article.

These platforms make it simpler to trade a variety of cryptocurrencies by providing sophisticated trading tools, affordable fees, and robust security.

Regardless of your level of experience, these platforms offer chances to optimize returns while skillfully controlling dangers.

What is Crypto Margin Trading Platforms?

Specialized cryptocurrency exchanges known as “crypto margin trading platforms” let users borrow money to expand their trading positions, increasing both the potential earnings and hazards. With margin trading, customers can trade with leverage, which allows them to hold a larger position than their actual capital, in contrast to traditional spot trading.

These platforms offer risk management capabilities such as stop-loss orders, isolated and cross-margin accounts, and real-time liquidation notifications. Additionally, they usually impose trading fees and interest on borrowed money. These platforms allow traders to trade more aggressively, access deeper liquidity, and diversify their tactics across a variety of cryptocurrency assets.

Benefits Of Crypto Margin Trading Platforms

Profit Potential – Margin trading goes one step further, giving traders the opportunity to earn even more from their investments through the use of leverage. This means that traders can earn on multiple investments beyond their original investment amount.

Higher Position Access – Margin trading allows traders to secure larger positions than what they could buy using their own money.

Strategy Diversification – Platforms that offer margin trading support multiple position trades at the same time through strategies like hedging, short-selling, and arbitrage.

Risk Management Tools – Most advanced trading services help traders manage risks through the offering of stop-loss, take-profit, and live margin ratio monitors.

Market Access and Liquidity – Pro traders especially enjoy the platforms that have a lot of resources and liquidity, especially when it comes to more unique and less value crypto assets.

Short Selling – Not all investments have to be on the buy side. Traders can also borrow crypto to sell, and then buy it back at a more favorable price.

Diverse Account Options – Strategies can be limited to a certain amount of risk taken, along with the adjusted cross and isolated margin accounts.

Free Training and Practice – Most margin trading services offer free demo accounts, to allow traders to get a feel of real world margin trading before investing their own money.

Best Crypto Margin Trading Platforms Point

- Gate.io Margin: Offers wide altcoin support with flexible and cross margin options for active traders.

- Phemex Margin: Known for fast execution, zero-fee spot trading, and beginner-friendly margin tools.

- CoinEx Margin: Simple margin trading with low fees and easy access for small to mid-level traders.

- Binance Margin: Industry-leading liquidity, multiple margin modes, and competitive interest rates.

- Bybit Margin: Advanced trading engine with isolated margin and strong risk management features.

- OKX Margin: Professional-grade margin trading with deep liquidity and robust portfolio tools.

- Bitget Margin: Copy trading integration with margin support, ideal for social traders.

- Kraken Margin: Highly regulated platform offering secure and transparent margin trading.

- Huobi Margin: Diverse crypto pairs with flexible leverage and global market coverage.

- KuCoin Margin: Popular for altcoin margin trading with lending market and flexible leverage.

10 Best Crypto Margin Trading Platforms

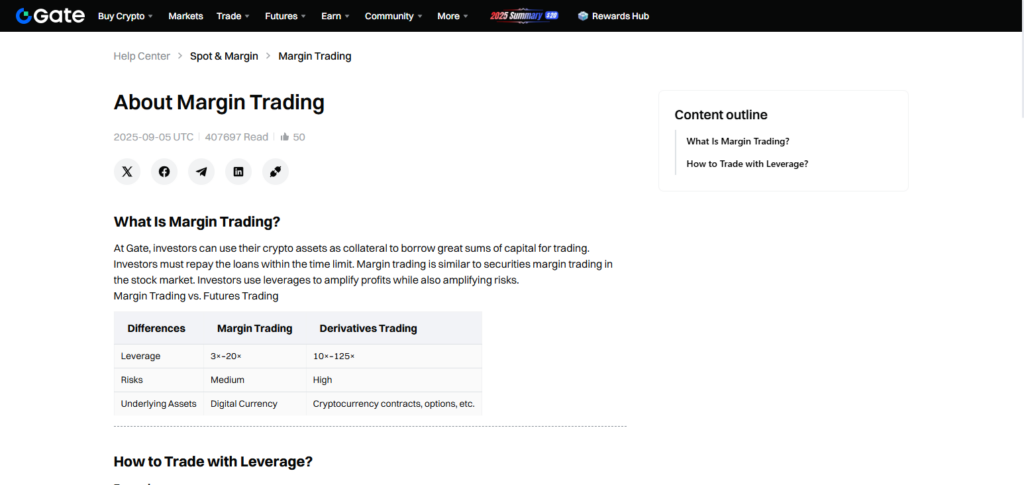

1. Gate.io Margin

Started in 2013, Gate.io is known for the variety of cryptocurrencies and trading pairs available to users, including margin traders. Spot margin trading allows up to 10x leverage, with higher margins available for futures.

Gate.io employs a tiered structure for maker/taker fee discounts with frequent traders and has cross/isolated margin options.

Gate.io can be accessed on both a web and a mobile app where advanced order types and features are available. Gate.io also provides NFTs, lending, and staking for those users who want to explore other avenues of trading.

Gate.io Margin – Features

| Feature | Description |

|---|---|

| Launched Year | 2013 |

| Margin Modes | Cross & Isolated |

| Leverage | Up to ~10× (varies) |

| Platform Access | Web, Mobile App |

| Supported Assets | Wide Altcoin Selection |

| Fee Structure | Tiered maker/taker fees |

| Risk Tools | Stop‑loss, Price Alerts |

| Extra Services | Staking, Lending, Spot |

Pros & Cons Gate.io Margin

Pros

- Large number of altcoins and trading pairs.

- Both cross and isolated margin modes are available.

- Discounts available at VIP tiers. Pricing is competitive.

- High liquidity on leading markets.

- Sophisticated features for experienced users.

Cons

- The interface may present a learning curve for new users.

- Most competitors offer more substantial higher leverage options.

- The response time for customer service is a bit slow.

- On some assets the margin interest rates may be more expensive.

- Availability tends to be regionally regulated.

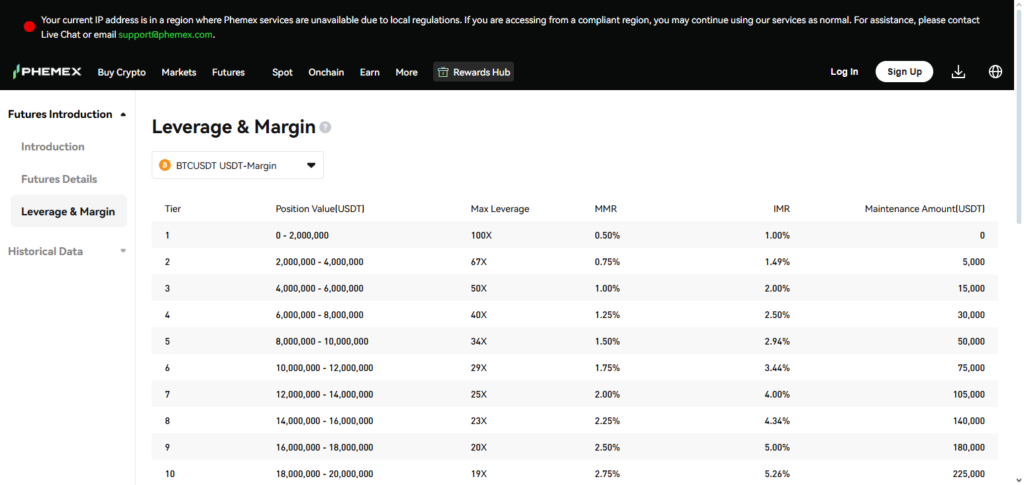

2. Phemex Margin

Phemex is a trader-oriented crypto exchange where users can utilize spot, margin, futures, and copy trading. Phemex’s margin trading allows users to borrow funds to enlarge their position, and provides leverage up to 5x on Spot and higher on the futures of that asset.

As users move up the tiers, they can enjoy additional discounts as well as lower prices. Buying a trading bot can also help users save money.

Trading bot features are available on the web, desktop, and mobile apps, which are designed for quick trade executions. Phemex also puts a lot of focus on speed, safety, and accessibility. This applies to users of all experience levels, from novices to experts.

Phemex Margin – Features

| Feature | Description |

|---|---|

| Launched Year | 2019 |

| Margin Modes | Cross & Isolated |

| Leverage | Moderate levels |

| Platform Access | Web, Mobile, Desktop |

| Supported Assets | Major Cryptos |

| Fee Structure | VIP Tier Discounts |

| Risk Tools | Demo Trading |

| Extra Services | Trading Bots |

Pros & Cons Phemex Margin

Pros

- Trading is executed rapidly.

- The interface is easy to navigate.

- Use of a demo trading mode is a nice feature.

- No KYC for basic functions (depending on your location).

- Management of bots is integrated.

Cons

- The asset selection is more limited than the major competitors.

- Sodium margin leverage is standard.

- Charting options are more basic than others.

- Support is only available during certain hours.

- Less international regulation.

3. CoinEx Margin

Founded in 2017, CoinEx is part of the ViaBTC Group. Its interface is simple and easy to navigate, with an additional option for margin trading on multiple crypto pairs.

Margin trading is the process of borrowing funds to trade, which increases your exposure to market risk. There are a variety of CoinEx’s risk management and forced liquidation features. Compared to competitors, fee structures remain low.

Maker and taker fees are low and can be offset by holding the CoinEx Token (CET). There are both mobile and web apps that include margin, futures, and staking, as well as P2P services. This platform is great for new traders who are starting to trade on margin.

CoinEx Margin – Features

| Feature | Description |

|---|---|

| Launched Year | 2017 |

| Margin Modes | Cross & Isolated |

| Leverage | Lower/Moderate |

| Platform Access | Web, Mobile App |

| Supported Assets | Popular Altcoins |

| Fee Structure | Low Fees + CET Discounts |

| Risk Tools | Liquidation Warnings |

| Extra Services | P2P, Futures |

Pros & Cons CoinEx Margin

Pros

- The design of the platform is easy to use.

- The fees associated with margin trading are inexpensive.

- Supports altcoins that are popular.

- New users can onboard easily.

- Available in web and mobile applications.

Cons

- The liquidity on certain pairs can be increased.

- There is a lack of in depth tools and advanced analytics.

- Reduced overall maximum leverage.

- Diminished international presence.

- Less availability of learning materials.

4. Binance Margin

Changpeng Zhao founded Binance, the biggest cryptocurrency exchange in the world and a top spot for margin trading, in 2017. With significant liquidity across hundreds of markets and leverage up to about 10× on spot pairings, it facilitates margin trading in both isolated and cross modes.

Starting at about 0.10% for spot trades, Binance’s cost structure is competitive and low; additional savings are available if payment is made in BNB or through VIP membership.

With sophisticated graphing, order types, and risk management capabilities, the platform is accessible through online, desktop, and mobile applications. Its extensive user base and ecosystem contribute depth and worldwide dependability.

Binance Margin – Features

| Feature | Description |

|---|---|

| Launched Year | 2017 |

| Margin Modes | Cross & Isolated |

| Leverage | Up to ~10× on many pairs |

| Platform Access | Web, Mobile App |

| Supported Assets | Extensive Market Coverage |

| Fee Structure | Low Fees + BNB Discounts |

| Risk Tools | Advanced Risk Widgets |

| Extra Services | Futures, Staking, Launchpad |

Pros & Cons Binance Margin

Pros

- Abundant liquidity throughout various markets.

- Attractive fee structure.

- Several margin options (isolated/cross).

- Available high leverage on numerous assets.

- Extensive learning materials.

Cons

- Complicated interface for newcomers.

- Some areas have legal limitations.

- Service outages during high volatility.

- Fees for funding can accumulate.

- KYC is needed for full service.

5. Bybit Margin

Bybit is another exchange that supports derivatives margin trading, and the company had a great reputation for being fast with their execution and strong on the derivatives/margin side of the business. They have a great range of pairs to trade with margin as well, with 100x on most of their margin crypto pairs.

They offer spot, futures, and perpetual contracts. Their fees are also very competitive with reasonably low maker/taker fees that increase with volume and for VIP traders.

They also have an appreciated mobile app and a great web platform, which are very user-friendly. Bybit also offers copytrading and has great charting, which makes them great for those who like to implement a lot of trading strategies.

Bybit Margin – Features

| Feature | Description |

|---|---|

| Launched Year | 2018 |

| Margin Modes | Cross & Isolated |

| Leverage | Up to ~100× |

| Platform Access | Web, Mobile App |

| Supported Assets | Spot + Derivatives |

| Fee Structure | Competitive Maker/Taker Fees |

| Risk Tools | Risk Limits & Alerts |

| Extra Services | Copy Trading |

Pros & Cons Bybit Margin

Pros

- Availability of high leverage.

- Quick processing and reliable system.

- Sophisticated analytics charting options.

- Solid system for derivatives.

- Low fees for trading.

Cons

- Difficult for beginners.

- Some areas have limited ability to convert fiat.

- Waiting times for support.

- Potential losses when trading with high leverage.

- Partial lack of jurisdictional regulation.

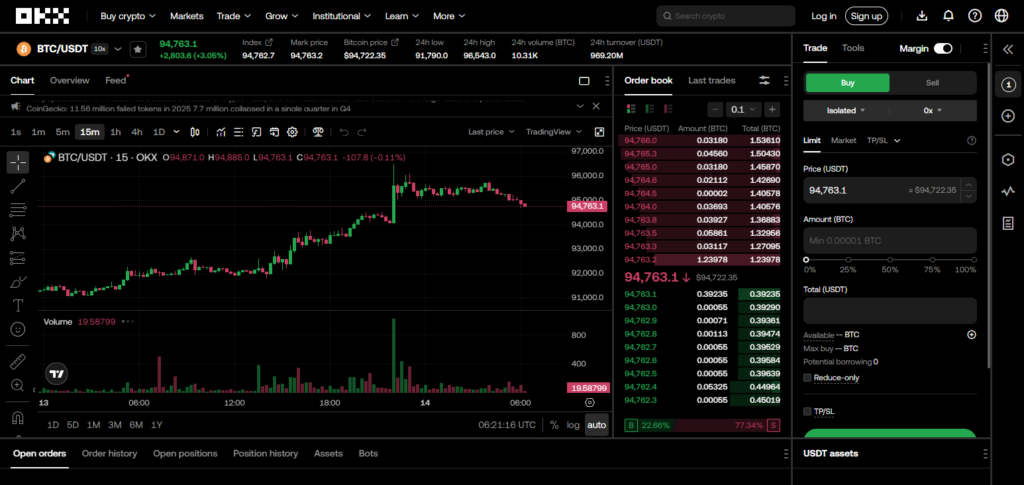

6. OKX Margin

OKX, formerly known as Okcoin, was founded in 2013 and changed its name to OKX in 2017. Professional traders may effectively distribute collateral across positions thanks to its sophisticated margin trading features, which include multi-currency and portfolio margin options. In spot and derivatives markets, the maker/taker model is frequently employed, and trading commissions are competitive.

Leverage on margin pairs can reach double digits. OKX is available through online, desktop, and mobile applications and offers deep liquidity and complex order types. Experienced traders seeking global market access and adaptable risk tools are drawn to its established infrastructure.

OKX Margin – Features

| Feature | Description |

|---|---|

| Launched Year | 2013 (Rebranded 2017) |

| Margin Modes | Cross, Isolated |

| Leverage | Moderate to High |

| Platform Access | Web, Mobile App |

| Supported Assets | Wide Range |

| Fee Structure | Tiered Fees |

| Risk Tools | Portfolio Margin |

| Extra Services | Futures, Options |

Pros & Cons OKX Margin

Pros

- Professional trading tools.

- Deep liquidity with narrow spreads.

- Different types of margin accounts.

- Sophisticated tools for managing risk.

- Excellent mobility app.

Cons

- May be hard to use for beginners.

- Available only in some countries.

- Steeper learning requirements.

- Increased rates of margin interest in volatile markets.

- Less beginner-friendly resources.

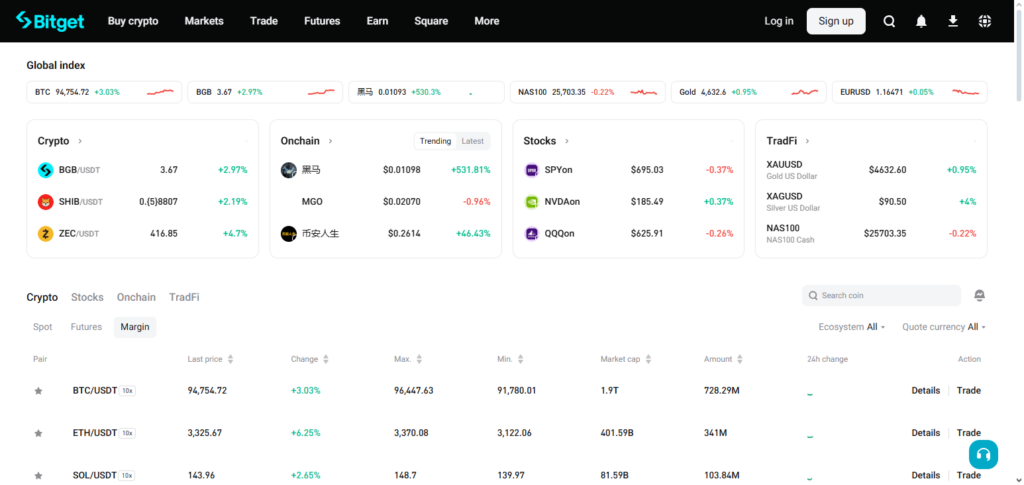

7. Bitget Margin

Bitget combines social trading and margin trading. Bitget began in 2018 and is a registered exchange in Seychelles. Users have the capability to follow and replicate the actions of others, which enhances the learning process and drives performance potential.

The platform interface allows the user to easily follow social traits and provides margin trading with leverage. In conjunction with margin trading, Bitget has competitive industry pricing in the derivatives market.

For holders of the exchange native token, BGB, additional privileges and discounts may be available. The interface for the platform is designed to focus on the social traits and enhanced user interface.

Bitget Margin – Features

| Feature | Description |

|---|---|

| Launched Year | 2018 |

| Margin Modes | Cross & Isolated |

| Leverage | Moderate |

| Platform Access | Web, Mobile App |

| Supported Assets | Spot + Margin |

| Fee Structure | Competitive + Token Perks |

| Risk Tools | Copy Trading Signals |

| Extra Services | Social Trading Platform |

Pros & Cons Bitget Margin

Pros

- Social trading and copy trading features.

- Discounts on competitor fees.

- Mobile experience is good.

- Strong community support.

- Multi-product ecosystem.

Cons

- Leverage options vary by asset.

- Not as deep liquidity as top exchanges.

- Margin trading tools could be richer.

- Education content is limited.

- Customer support could improve.

8. Kraken Margin

Kraken is one of the first licensed cryptocurrency exchanges, having been established in San Francisco in 2011. It provides transparent cost structures (open/rollover margin fees typically about 0.01–0.02%) and margin trading with leverage up to about 5× on specific cryptocurrency pairs.

Kraken places a high priority on security with sophisticated authentication mechanisms, cold storage, and strict regulatory compliance.

Despite having less leverage than some rivals, risk-conscious traders favor it because of its emphasis on safety. Margin, spot, futures, staking, and fiat integration are supported via fully functional web and mobile platforms.

Kraken Margin – Features

| Feature | Description |

|---|---|

| Launched Year | 2011 |

| Margin Modes | Cross Margin |

| Leverage | Up to ~5× |

| Platform Access | Web, Mobile App |

| Supported Assets | Major Cryptos Only |

| Fee Structure | Transparent Margin Fees |

| Risk Tools | Liquidation Tools |

| Extra Services | Staking, Fiat Support |

Pros & Cons Kraken Margin

Pros

- Highly secure and regulated.

- Transparent fee structure.

- Excellent fiat support.

- Strong reputation in the industry.

- Good for risk-aware traders.

Cons

- Lower maximum leverage.

- Fewer crypto pairs for margin.

- Interface can feel dated.

- Slower order execution at times.

- Not as strong mobile app.

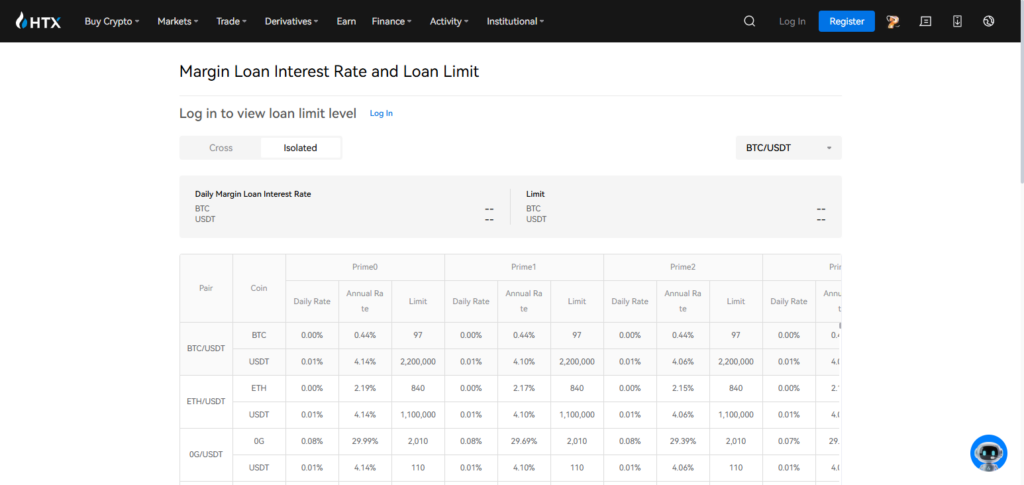

9. Huobi Margin

Founded in 2013, Huobi (now known as HTX in some areas) has developed into one of the biggest cryptocurrency exchanges globally. Although actual rates may differ by tier and region, it provides margin trading with competitive leverage options and trading fees.

Through web, desktop, and mobile apps, the platform offers a comprehensive range of trading products, such as spot, derivatives, and complex order types. Due to its extensive history and widespread market presence, Huobi offers a wide range of asset availability and liquidity, making it appealing to traders from many backgrounds and locations.

Huobi Margin – Features

| Feature | Description |

|---|---|

| Launched Year | 2013 |

| Margin Modes | Cross & Isolated |

| Leverage | Moderate |

| Platform Access | Web, Mobile App |

| Supported Assets | Many Trading Pairs |

| Fee Structure | Competitive |

| Risk Tools | Real‑time Margin Tools |

| Extra Services | Futures, Earn |

Pros & Cons Huobi Margin

Pros

- Wide asset variety.

- Competitive fees.

- Global market reach.

- Cross and isolated margin options.

- Deep liquidity on major pairs.

Cons

- Regulatory uncertainty in some areas.

- Platform complexity for new users.

- Support response times.

- Funding costs are variable.

- KYC enforced for advanced features.

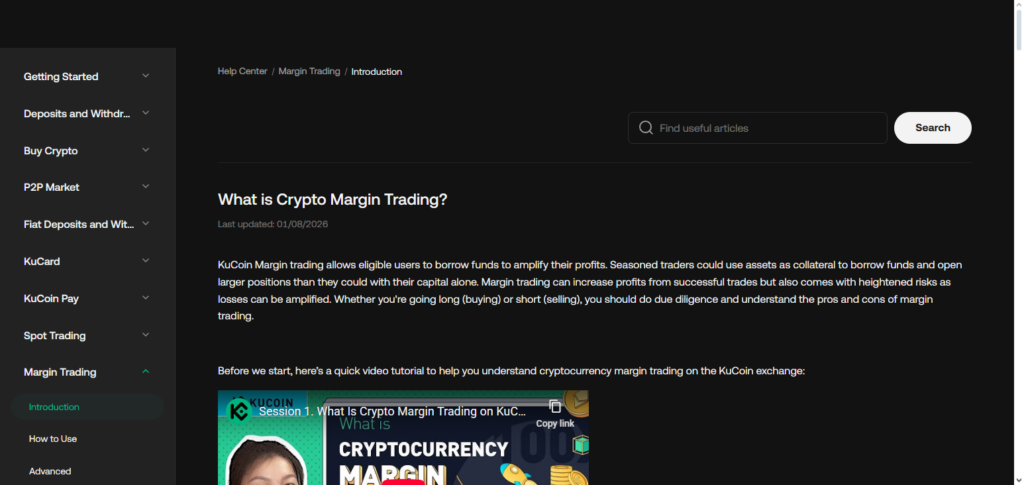

10. KuCoin Margin

KuCoin, which was established in 2017, is renowned for its extensive range of cryptocurrencies and margin trading choices.

It offers higher leverage for futures on numerous pairings and up to 10× leverage for spot margin. Fee structures are typically cheap, and volume-based VIP tiers and the KuCoin token (KCS) offer further discounts.

In addition to other ecosystem features like P2P, staking, lending, and trading bots, KuCoin’s platform provides web and mobile access. It is particularly appealing to traders looking for leveraged exposure to a range of smaller cryptocurrency assets due to its extensive market depth and features.

KuCoin Margin – Features

| Feature | Description |

|---|---|

| Launched Year | 2017 |

| Margin Modes | Cross & Isolated |

| Leverage | Up to ~10× |

| Platform Access | Web, Mobile App |

| Supported Assets | Broad Altcoin Support |

| Fee Structure | Low + KCS Discounts |

| Risk Tools | Risk Alerts |

| Extra Services | P2P, Lending, Bots |

Pros & Cons KuCoin Margin

Pros

- Large altcoin selection.

- Low trading fees with KCS discounts.

- Flexible leverage options.

- User-friendly mobile app.

- P2P, bots, and lending features.

Cons

- Liquidity varies by market.

- Risk tools related to margins can be improved.

- Faster support.

- Regulatory restrictions in certain countries.

- Certain features are locked without completing full verification.

Conclusion

Your trading objectives, degree of experience, and risk tolerance will determine which cryptocurrency margin trading platform is best for you. For active and experienced traders, platforms like Binance, Bybit, OKX, and Gate.io are perfect because of their substantial liquidity, affordable fees, and sophisticated margin capabilities.

While KuCoin and Bitget are great for altcoin-focused and social trading techniques, Kraken and CoinEx appeal to those that value security, regulation, and simplicity.

All things considered, the top cryptocurrency margin trading platforms enable traders take advantage of opportunities while prudently controlling leverage by combining robust risk management, transparent fees, dependable performance, and multi-device access.

FAQ

Margin trading lets you borrow funds to increase your trading position, amplifying potential gains — but also increasing risks, including liquidation if prices move against you.

Safety varies by platform. Reputable exchanges like Kraken, Binance, and OKX use strong security, regulation, and risk controls, but all leveraged trading carries inherent risks.

Fees usually include trading (maker/taker), interest on borrowed funds, and sometimes funding fees. Rates differ by platform, asset, and trading volume.

Margin trading is risky for beginners. It’s best to understand spot trading, risk management, and platform mechanics before using leverage.