This article will highlight the Best Crypto Swap Exchange and describe how specific platforms can optimize the speed, ease, and efficiency of cryptocurrency trading.

Users can instantly exchange tokens on crypto swap exchanges at low cost, with minimal slippage, and with strong security. Knowing the best exchanges can help any trader, regardless of their level, execute trades more thoughtfully, quickly, and safely.

What is Crypto Swap Exchange?

A Crypto Swap Exchange lets users quickly and easily trade one cryptocurrency for another. With no order books or intermediaries, users can instantly trade crypto.

Swap mechanics do not require the tedious buying and selling through limit or market orders. Users can easily and quickly switch crypto —for example, Ethereum for Bitcoin or altcoins for stablecoins —at a lower cost.

Because they do not require complex crypto trading tools, these trading platforms increase accessibility and speed, making them widely used by traders.

They support liquidity and are a great facility for people who need immediate access to multiple cryptocurrencies.

How To Choose a Crypto Swap Exchange

Security Measures – The platform should offer robust security with strong encryption, 2FA, and cold storage available for user funds.

Supported Cryptocurrencies – Look to see if the exchange supports the tokens that you intend to trade. The more the exchange offers, the more flexibility you have.

Transaction Fees – Look to see the fees for swapping and if they are reasonable, keeping in mind that lower fees are more cost effective for frequent trading.

Liquidity – This means that the exchange has sufficient funds available to carry out a trade with little to no slippage.

User Interface – This should enable swapping quickly with little to no errors.

Speed of Transactions – The faster the execution of trades the less of a chance there will be for variance in the price of the token.

Reputation and Reviews – This will guide you to reputable platforms that will save you from scams.

Regulatory Compliance – This is a good indicator of the exchanges safety.

Customer Support – This will add peace of mind in the case of transaction errors or problems with their account.

Integration with Wallets – This will add convenience so you don’t have to go through multiple steps to connect your crypto wallet.

Key Point & Best Crypto Swap Exchange List

| Exchange | Key Points |

|---|---|

| 1inch | Aggregates liquidity from multiple DEXs for best rates; low slippage. |

| THORChain | Cross-chain swaps without wrapping tokens; decentralized liquidity network. |

| PancakeSwap | Runs on Binance Smart Chain; low fees and high liquidity for BEP-20 tokens. |

| Curve Finance | Optimized for stablecoin swaps; minimal slippage and low fees. |

| SushiSwap | Multi-chain DEX with yield farming; community-governed token incentives. |

| Matcha | Aggregates orders from multiple DEXs; user-friendly interface. |

| KyberSwap | On-chain liquidity protocol; instant token swaps with competitive rates. |

| OpenOcean | Multi-chain DEX aggregator; supports DeFi derivatives and cross-chain swaps. |

| Raydium | Solana-based DEX; fast swaps with integrated liquidity pools. |

| Jupiter | Solana ecosystem DEX aggregator; finds best prices across Solana DEXs. |

1. 1inch

1inch has gained a reputation as one of the best places to swap crypto for a reason. Using sophisticated liquidity aggregation technology, the platform analyzes multiple decentralized exchanges to deliver the best possible price and slippage.

Rather than routing trades through DeFi exchanges as most DEXs do, 1inch saves users time and money by splitting trades to multiple DEXs and executing them in parallel. Even large or intricate trades are automatically routed through Defi’s most efficient DEXs.

1inch supports and offers security features like audits and multi-signature wallets on multiple blockchains. Lastly, their user-friendly interface offers trading features needed by professionals and is beginner-friendly.

| Feature | Details |

|---|---|

| Exchange Type | Decentralized Exchange (DEX) Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Optimism, Arbitrum, Avalanche |

| KYC Requirement | Minimal/No KYC required for swapping tokens |

| Liquidity Source | Aggregates liquidity from multiple DEXs |

| Transaction Fees | Varies by blockchain; platform does not charge extra fees |

| Unique Feature | Smart routing algorithm finds the best prices and splits trades to reduce slippage |

| Security | Non-custodial, audited smart contracts, multi-signature support |

| Best For | Traders seeking optimal rates, fast swaps, and cross-chain support |

2. THORChain

THORChain provides some of the best crypto swap exchanges because it performs true cross-chain swaps without the need for wrapped tokens or middlemen.

This means users can swap Bitcoin, Ethereum, and other major cryptocurrencies, and keep ownership all the way. Its decentralized network provides liquidity so that any user can supply liquidity and earn rewards.

This means the network has predictable depth and can provide low slippage. The automated market-making algorithms that THORChain develops provide trade efficiency.

THORChain swaps are fast, support multiple blockchains, and offer strong decentralization, flexibility, and security. This makes THORChain an exceptional platform.

| Feature | Details |

|---|---|

| Exchange Type | Decentralized Cross-Chain DEX |

| Supported Chains | Bitcoin, Ethereum, Binance Smart Chain, Litecoin, and more |

| KYC Requirement | Minimal/No KYC required for swapping tokens |

| Liquidity Source | Decentralized liquidity pools provided by network participants |

| Transaction Fees | Low network fees; no extra platform fees |

| Unique Feature | True cross-chain swaps without wrapped tokens |

| Security | Non-custodial, audited smart contracts, robust decentralization |

| Best For | Traders wanting cross-chain swaps with minimal friction and full control |

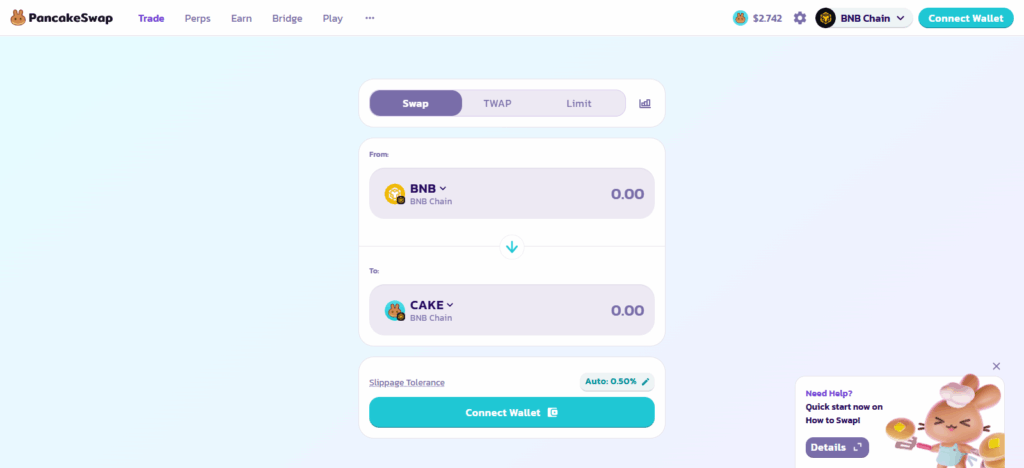

3. PancakeSwap

PancakeSwap is one of the best crypto swap exchanges because it runs on the Binance Smart Chain (BSC), which offers lower transaction costs and faster confirmation times than Ethereum-based DEXs.

It provides access to numerous BEP-20 tokens and high-liquidity pools, maximizing the profit earned from swaps. It also has yield farming and staking, and integrates lotteries, which, along with the token swaps, provide several streams of earning potential.

It is also one of the very few decentralized markets which has a simple, and convenient interface, and a governance system which lets the community and token holders make important decisions on the system.

These, along with the considerate Automated Market Making (AMM) system, make it a very solid and impressive option to use, no matter if the user is a novice, or an experienced trader.

| Feature | Details |

|---|---|

| Exchange Type | Decentralized Exchange (DEX) |

| Supported Chains | Binance Smart Chain (BSC) |

| KYC Requirement | Minimal/No KYC required for swapping tokens |

| Liquidity Source | Liquidity pools contributed by users |

| Transaction Fees | Low BSC network fees; platform charges minimal or no extra fees |

| Unique Feature | Fast, low-cost swaps with integrated yield farming and staking |

| Security | Non-custodial, audited smart contracts |

| Best For | Traders seeking low fees, high liquidity BEP-20 token swaps, and rewards |

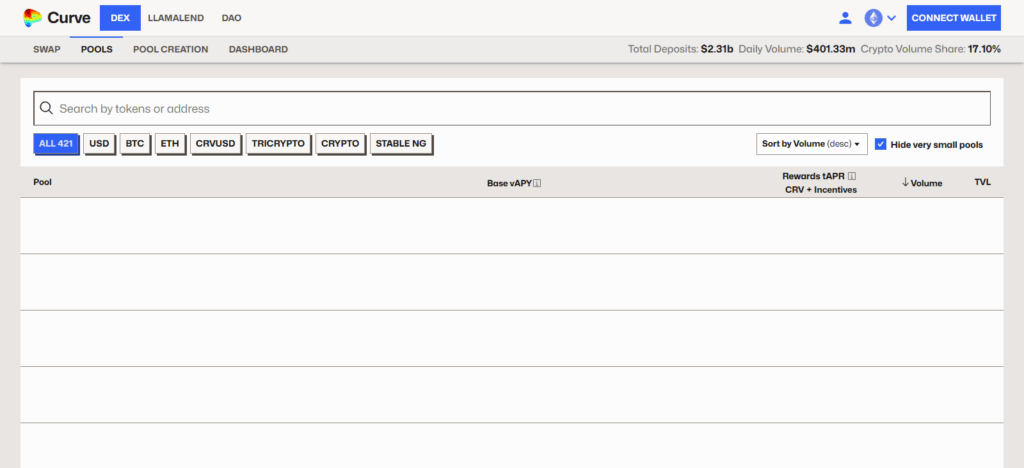

4. Curve Finance

Curve Finance is one of the best crypto swap exchanges because it is optimized for stablecoin and pegged-asset trading, minimizing slippage and providing some of the lowest fees in DeFi.

Its custom automated market maker (AMM) algorithm keeps spreads tight between assets of comparable value, making it perfect for large-volume swaps at the lowest possible cost.

Along with security audits and multi-chain and trade execution, Curve Finance is reliable and tailored to low-volatility assets. Strong liquidity incentives and yield farming let users earn while providing liquidity. It is efficient and cost-effective for stablecoin swapping.

| Feature | Details |

|---|---|

| Exchange Type | Decentralized Exchange (DEX) |

| Supported Chains | Ethereum, Polygon, Fantom, Avalanche, Arbitrum |

| KYC Requirement | Minimal/No KYC required for swapping tokens |

| Liquidity Source | Specialized stablecoin and pegged-asset liquidity pools |

| Transaction Fees | Very low fees optimized for stablecoin swaps |

| Unique Feature | Minimal slippage swaps for stablecoins and low-volatility assets |

| Security | Non-custodial, audited smart contracts |

| Best For | Traders focusing on stablecoin swaps with low fees and high efficiency |

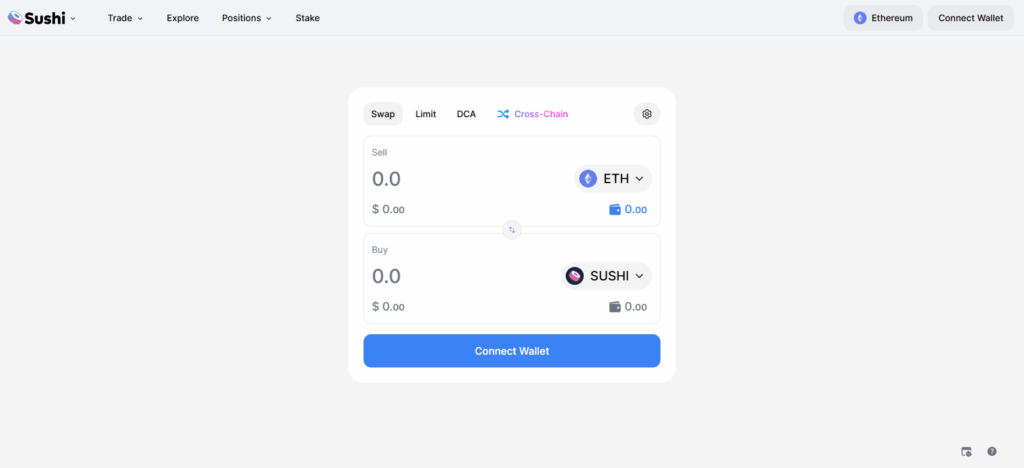

5. SushiSwap

SushiSwap is one of the top cryptocurrency swap exchanges due to its decentralized trading and strong community governance.

This allows users to benefit from efficient trading while also participating in the platform’s governance. SushiSwap is built on several blockchains, enabling users to perform a wide variety of token swaps with deeply liquid pools.

This guarantees low slippage, even for large orders. The platform allows users to earn passive income in the form of yield farming, staking, and lending, which are provided while users perform trading.

For traders, especially those with more experience, SushiSwap is an excellent platform due to its substantial decentralization, security, and cross-chain features. Users of decentralized finance will appreciate SushiSwap for its flexibility, rewards, and control.

| Feature | Details |

|---|---|

| Exchange Type | Decentralized Exchange (DEX) |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Fantom, Avalanche, and more |

| KYC Requirement | Minimal/No KYC required for swapping tokens |

| Liquidity Source | User-contributed liquidity pools |

| Transaction Fees | Low network fees; platform does not add extra fees |

| Unique Feature | Multi-chain support with yield farming, staking, and community governance |

| Security | Non-custodial, audited smart contracts |

| Best For | Traders seeking multi-chain swaps with additional DeFi earning options |

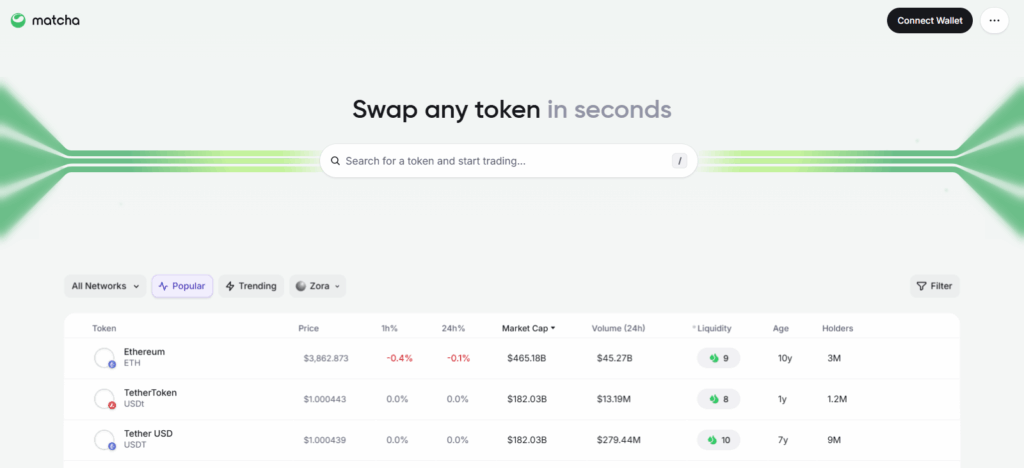

6. Matcha

Considered one of the best crypto swap exchanges, Matcha is a DEX aggregator that sources liquidity from various decentralized exchanges to ensure users get the optimal rate for every trade.

Its smart routing technology tracks price fluctuations across various DEXs, enabling the splitting of large orders to reduce slippage, execution time, and risk.

User friendliness is paramount to Matcha, as it provides a simple interface for beginners and retains complex DeFi tools for advanced users.

With transparent pricing, multi-chain support, and strong security measures, Matcha provides a fast, reliable, and efficient swapping experience, making it a top choice for cost-effective crypto trades.

| Feature | Details |

|---|---|

| Exchange Type | Decentralized Exchange (DEX) Aggregator |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Arbitrum, Avalanche |

| KYC Requirement | Minimal/No KYC required for swapping tokens |

| Liquidity Source | Aggregates liquidity from multiple DEXs |

| Transaction Fees | Varies by blockchain; no extra platform fees |

| Unique Feature | Smart routing ensures best prices and low slippage for all trades |

| Security | Non-custodial, audited smart contracts |

| Best For | Traders seeking optimized rates and seamless multi-DEX swaps |

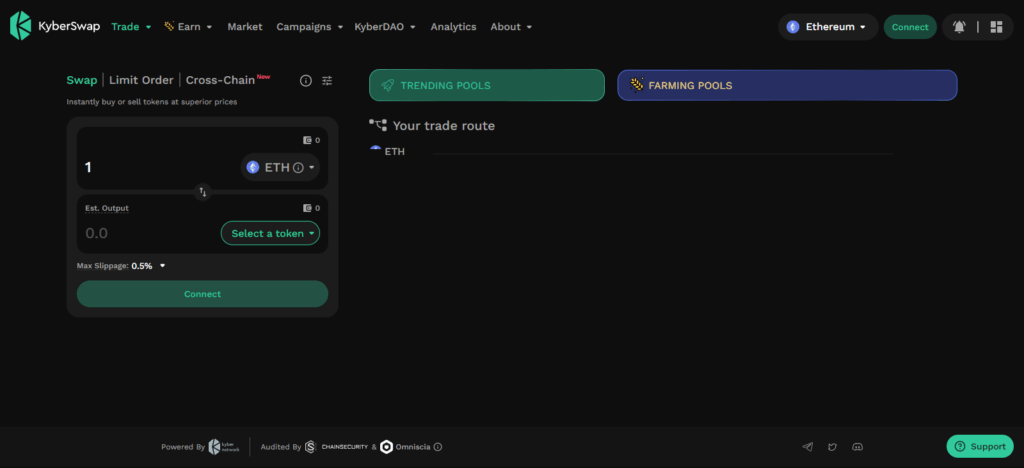

7. KyberSwap

KyberSwap is probably one of the finest crypto swap exchanges because it pairs on-chain liquidity aggregation with real-time token swaps.

This ensures every customer receives the liquidity most favorable the user and decentralized exchanges.

Tiered liquidity routing evaluates the most appropriate liquidity switch to use for a given trade while actively minimizing slippage. Even large orders will experience slippage loss. KyberSwap does not control your tokens.

KyberSwap is non-custodial. KyberSwap is even more advanced because it permits analytics and yield-generating opportunities.

Minimizing your loss is a core principle of KyberSwap. Its uncompromising devotion to safety, elasticity, and simplicity makes it an effective crypto swap for any user.

| Feature | Details |

|---|---|

| Exchange Type | Decentralized Exchange (DEX) Aggregator |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Avalanche, Fantom |

| KYC Requirement | Minimal/No KYC required for swapping tokens |

| Liquidity Source | On-chain liquidity pools and aggregated DEX liquidity |

| Transaction Fees | Low network fees; no extra platform charges |

| Unique Feature | Dynamic routing ensures best rates across multiple liquidity sources |

| Security | Non-custodial, audited smart contracts |

| Best For | Traders seeking fast, efficient swaps with multi-chain support |

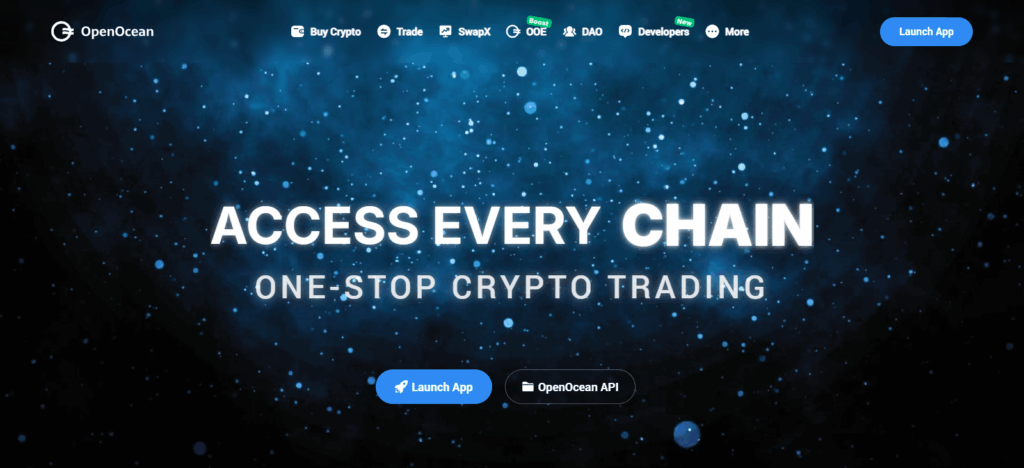

8. OpenOcean

OpenOcean is called the best crypto swap exchange for a reason. As a fully integrated multi-chain DEX (decentralized exchange) aggregator, it links liquidity to and from DEXs and CEXs. This is the most effective way to get the best pricing on swaps.

OpenOcean’s innovative smart routing technology partitions individual orders and executes across several endpoints to maximally slash slippage and enhance the overall speed of execution.

OpenOcean’s near-unrestricted versatility is evident in the range of blockchains and tokens it supports through cross-chain swaps, as well as the varying crypto investment portfolios. Advanced trading interfaces, integrated DeFi, and quality analytics improve user assessment and decision-making on OpeneOcean.

The user experience, combined with effective security practices, ensures an optimal, satisfactory swapping experience. OpenOcean is fast, inexpensive, and dependable, and ensures all trades are executed seamlessly.

| Feature | Details |

|---|---|

| Exchange Type | Multi-Chain DEX Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Solana, Avalanche, Fantom, and more |

| KYC Requirement | Minimal/No KYC required for swapping tokens |

| Liquidity Source | Aggregates liquidity from multiple DEXs and CEXs |

| Transaction Fees | Low network fees; no extra platform fees |

| Unique Feature | Cross-chain swaps with smart routing for optimal prices |

| Security | Non-custodial, audited smart contracts |

| Best For | Traders seeking multi-chain swaps with best rates and low slippage |

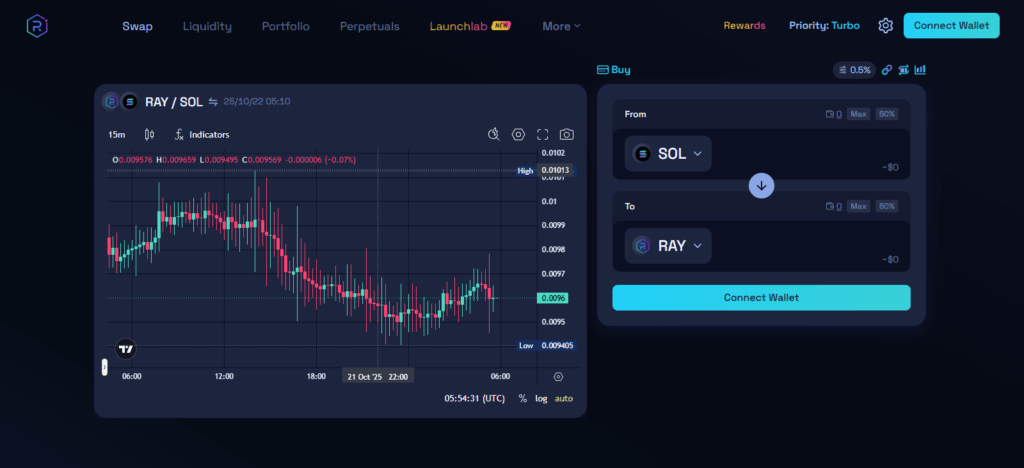

9. Raydium

Raydium ranks among the fastest and most efficient crypto swap exchanges. This is because it is a Solana-based decentralized exchange that leverages the blockchain’s low costs and rapid confirmation times.

Its on-chain liquidity pools ensure ample liquidity for efficient token swaps with low slippage. Its integration with Serum’s order book enables users to simultaneously utilize the liquidity of the decentralized exchange and order book.

Furthermore, users can opt for yield farming, staking, and NFT integration, thus giving users various ways to earn. Considering the ease of use, strong security, and multi DeFi functions, users can appreciate the seamless and high liquidity swapping on the Solana blockchain ecosystem.

| Feature | Details |

|---|---|

| Exchange Type | Solana-based Decentralized Exchange (DEX) |

| Supported Chains | Solana |

| KYC Requirement | Minimal/No KYC required for swapping tokens |

| Liquidity Source | On-chain liquidity pools integrated with Serum order book |

| Transaction Fees | Low Solana network fees; no extra platform fees |

| Unique Feature | Combines DEX liquidity with Serum order book for optimal swap execution |

| Security | Non-custodial, audited smart contracts |

| Best For | Traders seeking fast, low-cost swaps within the Solana ecosystem |

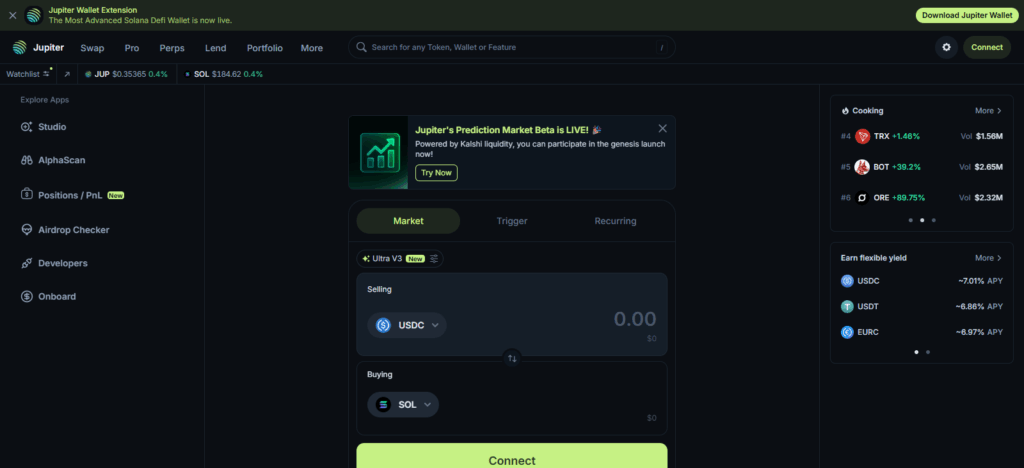

10. Jupiter

Jupiter is praised as one of the top crypto swap exchanges because it is a Solana-based DEX aggregator that crosses Solana-based DEXs to find the best price and lowest slippage for users.

It’s smart routes automatically divide transactions across various liquidity sources and can execute large trades efficiently. Jupiter supports virtually all Solana tokens and enables fast, inexpensive cross-platform swaps within the Solana ecosystem.

With its simple interface, robust security, and trade optimization, Jupiter offers users of all experience levels a seamless, efficient, and dependable service.

| Feature | Details |

|---|---|

| Exchange Type | Solana-based DEX Aggregator |

| Supported Chains | Solana |

| KYC Requirement | Minimal/No KYC required for swapping tokens |

| Liquidity Source | Aggregates liquidity from multiple Solana-based DEXs |

| Transaction Fees | Low Solana network fees; no extra platform fees |

| Unique Feature | Smart routing finds the best prices across Solana DEXs for low slippage |

| Security | Non-custodial, audited smart contracts |

| Best For | Traders seeking optimized swaps and best rates within the Solana ecosystem |

Pros & Cons

Pros

- Quick Transactions– There’s no need to wait for an order to match; you can swap your crypto instantly.

- Easy to Use– Simple interfaces make it easier for newbies to swap coins.

- Minimal Charges– Compared to other centralized exchanges, swap exchanges charge lower fees, particularly for small trades.

- More Decentralization– More exchanges are non-custodial. That means you are in control of your crypto.

- Cross-Chain Asset Swaps– Some exchanges allow you to swap assets on different blockchains.

- Liquidity– Some liquidity aggregators will source liquidity from multiple exchanges to offer you the best rates.

- User Privacy — There’s little need for personal details, which is a big plus for privacy.

Cons

- Limited Coin Options– Not all swap exchanges offer all cryptos.

- Large Trades and Slippage– If executed via an exchange, large trades might spike in value and decrease liquidity for the swap.

- Smart Contract– Unprotected smart contracts, which are common, can be a potential loss in an exchange.

- Only Crypto-to-Crypto– Most exchanges do not provide services for crypto-to-fiat transactions.

- Perspective– Some of the advanced functionalities are complex for first-time users.

- Blockchains Fees– Each swap on the exchange will incur fees that are set by the respective blockchains.7. Less Regulation – Lack of regulation can increase certain risks when it comes to decentralized swaps.

Conclusion

To sum up, crypto swap exchanges have changed the way users exchange digital assets because the platforms allow users to do so quickly, cheaply, and easily, with little to no friction in the processes involved in token swapping.

Top exchanges such as 1inch, THORChain, PancakeSwap, Curve Finance, SushiSwap, Matcha, KyberSwap, OpenOcean, Raydium, and Jupiter offer diverse functionality including liquidity aggregation, the ability to perform cross-chain swaps, low fees, and sophisticated DeFi tool intergrations.

Apart from the efficiency and low friction processes, users must also take into account the exposure to risks such as slippage, smart contract, and limited tokens. The right crypto swap exchange is all about your trading use case, your security tolerance, and the blockchain ecosystem you want to work in.

FAQ

Not all cryptocurrencies are supported on every swap exchange. Check each platform for available tokens and liquidity pools before trading.

Yes, most swap exchanges charge transaction or liquidity provider fees. Fees vary by platform and blockchain network conditions.

Many decentralized swap exchanges are non-custodial and do not require accounts. Users only need a compatible crypto wallet.

Some platforms like THORChain and OpenOcean support cross-chain swaps, allowing users to exchange tokens across multiple blockchain networks.

Consider security, liquidity, fees, supported tokens, user interface, cross-chain support, and community reputation when selecting a platform.