This article addresses automated portfolio rebalancing crypto tools and reviews the services that allow investors to maintain the ideal allocation of their assets with the least amount of manual work possible.

These tools enable automated crypto portfolio management and customization based on the user’s preferences, saving users time and energy and helping them to manage the effect of volatility on their portfolios. These tools allow easy exchange integration, real-time rebalancing, and customizable strategy implementation.

What is Automated Portfolio Rebalancing?

Automated Portfolio Rebalancing refers to an automated financial technique which strategically keeps an investment portfolio aligned with specific asset allocation goals It replaces the need for active human supervision to bring the portfolio back to a target allocation.

Keeping in mind an individual’s investment strategy, target allocation consists of various fractions of stocks, bonds, crypto etc. Automated systems minimize human errors and invest according to an individual’s risk tolerance and goals.

Automated rebalancing mitigates emotional decision making in investing. It saves time and effort to stay disciplined with an investment approach. Automated rebalancing promotes portfolio risk management and target goal alignment.

Benefits Of Crypto Tools for Automated Portfolio Rebalancing

Time and Efficiency: Since automated tools oversee and track market conditions as well as asset performance, the need for manual adjustments and tracking is eliminated. Time consuming manual portfolio rebalancing is not necessary, thus, investors are able to optimize their portfolios with relative ease.

Consistency of Strategy: By employing crypto tools, investors are able to systemize their strategies since portfolio adjustments are automated based on predetermined and set instructions. This greatly mitigates the chances of irrational and emotional portfolio adjustments, ensuring consistency, no matter how volatile and turbulent the market is.

Mitigating Risks: Automated rebalancing mitigates the reallocation of portfolio assets and thus, keeps the portfolio aligned with the determined risk profile and exposure. This is especially important in turbulent market conditions where losses are likely to be sustained.

Accessibility: These tools for automated crypto portfolio rebalancing are inexpensive in comparison to the fees of a financial advisor, thus making them available to investors of all asset sizes. Diversified investment portfolios of all levels can be managed without incurring huge fees.

Scalability: As time goes on and your portfolio expands, it can get more and more difficult to manage without assistance. Automated systems simply and effortlessly manage any size portfolio making them a great option for investors who want to expand into multiple cryptocurrencies and different asset classes.

Less Human Mistakes: For the simple reason that there will be no missed trades, no miscalculations, and no manual intervention, automation removes all the human mistakes that would happen during manual rebalancing. Everything will be executed as per the clients’ instructions without any deviations.

Round the Clock Rebalancing: Since the crypto market operates 24/7, the time for rebalancing your portfolio can elapse and major losses might be incurred. Automated portfolio rebalancing ensures that you will not be caught off guard, as the rebalancing takes place constantly and seamlessly without active supervision.

Customized Rebalancing: Individual investors can define their own rebalancing parameters, such as when to initiate a rebalance and the threshold of deviation from the target allocation that will trigger an adjustment. This gives investors the ability to customize portfolio management to their individual needs.

Key Point & Best Crypto Tools for Automated Portfolio Rebalancing List

| Crypto Tool | Key Features | Best For |

|---|---|---|

| Shrimpy | – Automated portfolio rebalancing- Social trading features- Integration with multiple exchanges | Beginners & Social Traders |

| 3Commas | – Advanced trading bots- SmartTrade for manual trades- Portfolio rebalancing tools | Active Traders & Bot Users |

| CoinStats | – Multi-exchange portfolio tracking- Wallet integration- Performance analytics | Portfolio Tracking & Performance Analysis |

| Kubera | – Track both crypto & traditional assets- Wealth management dashboard- Budgeting features | Users Managing Both Crypto & Traditional Assets |

| Quadency | – Automated trading bots- Portfolio rebalancing- Strategy marketplace | Algo Traders & Automation Enthusiasts |

| Altrady | – Multi-exchange trading- Real-time price tracking- Portfolio management tools | Traders Seeking Multi-Exchange Integration |

| Zerion | – DeFi asset management- Direct access to DeFi protocols- Portfolio analytics | DeFi Investors |

| Zapper | – DeFi asset tracking- Portfolio optimization tools- Investment tracking across DeFi platforms | DeFi Users & Yield Farmers |

| CoinTracking | – Detailed tax reports- Advanced portfolio tracking- Performance analytics | Tax Reporting & Portfolio Analytics |

1. Shrimpy

Shrimpy is among the most effective automated portfolio rebalancing tools in the market owing to its user-friendly design and sophisticated automation capabilities.

The platform enables the creation of customized rebalancing automation strategies across multiple exchanges, rebalancing the user’s portfolio to their pre-defined levels. Another of Shrimpy’s most notable features is the ability to copy top traders strategies which is helpful for any user, independently of their level of experience.

The extensive back-testing powered by integration to most major exchanges allows the user to safely optimize their portfolio, perform low manual optimizations on profile volatility, and enhance their portfolio’s volatility efficiency and consistency.

| Feature | Details |

|---|---|

| Tool Name | Shrimpy |

| Primary Function | Automated portfolio rebalancing and management across multiple exchanges |

| Supported Exchanges | Binance, Coinbase Pro, Kraken, KuCoin, Bitfinex, and many others |

| KYC Requirement | Minimal KYC (Mostly for connecting with exchanges; some exchanges may require full verification) |

| Automation Features | Customizable rebalancing, social trading, automatic portfolio adjustments based on set rules |

| Security | Uses API keys for secure exchange integrations, with two-factor authentication (2FA) available |

| User Interface | Intuitive and user-friendly dashboard for portfolio tracking and management |

| Free & Paid Plans | Offers both free and paid subscription plans, with additional features for premium users |

| Unique Feature | Social trading features allow users to copy top traders’ strategies for automatic portfolio management |

| Supported Wallets | Integrates with various wallets, including hardware and software wallets for portfolio tracking |

| Fees | Subscription-based pricing for premium features, with no trading fees involved in the tool itself |

2. 3Commas

3Commas is arguably the best tool for automated portfolio rebalancing and crypto portfolio automation. Creation of custom trading bots for automated management and rebalancing of crypto portfolios at several exchanges is a robust automation and customizable feature.

3Commas’ SmartTrade also provides the flexibility for users to make real-time manual adjustments, and the platform also provides backtesting tools to optimize the user’s strategy.

3Commas is unique in that it integrates with over 20 major crypto exchanges, which increases user control and flexibility. More importantly, 3Commas protects user portfolios during unpredictable and volatile crypto market swings with sophisticated risk management tools.

| Feature | Details |

|---|---|

| Tool Name | 3Commas |

| Primary Function | Automated trading bots, portfolio rebalancing, and smart trading features |

| Supported Exchanges | Binance, Coinbase Pro, Kraken, Bitfinex, KuCoin, and more |

| KYC Requirement | Minimal KYC (primarily for connecting with exchanges; some exchanges may require full verification) |

| Automation Features | SmartTrade, automated portfolio rebalancing, customizable trading bots |

| Security | API key-based integrations, 2FA for added security, encryption of sensitive data |

| User Interface | Advanced but user-friendly interface, with dashboards for strategy management and performance tracking |

| Free & Paid Plans | Offers both free and paid subscription tiers, with more advanced features in premium plans |

| Unique Feature | Advanced bot strategies with backtesting capabilities and manual SmartTrade options for flexibility |

| Supported Wallets | Compatible with various wallets for portfolio integration and asset management |

| Fees | Subscription-based pricing for premium features, no trading fees in the tool itself |

3. CoinStats

CoinStats is one of the best tools for crypto automated portfolio rebalancing due to its portfolio tracking and management features.

It integrates with more than 20 major exchanges and wallets, enabling customers to view their crypto portfolio as a whole. With one of a kind automated rebalancing tool, customers can maintain their target asset allocation as it adjusts portfolios automatically when the market changes in real time.

The easy to use interface and customizable alerts positively contribute to the automation sentiment by keeping investors updated with little to no involvement needed on their part. Also, the performance analytics and tax reporting features offer customers more insights on their portfolio.

| Feature | Details |

|---|---|

| Tool Name | CoinStats |

| Primary Function | Automated portfolio tracking, management, and rebalancing across multiple exchanges and wallets |

| Supported Exchanges | Binance, Coinbase, Kraken, Gemini, KuCoin, and other major exchanges |

| KYC Requirement | Minimal KYC (Only required for exchange integrations or transactions through the platform) |

| Automation Features | Automated rebalancing, portfolio tracking, price alerts, and performance analytics |

| Security | 2FA, secure API integrations, encrypted user data |

| User Interface | User-friendly, with easy navigation for tracking portfolio performance and adjusting allocations |

| Free & Paid Plans | Offers both free and premium plans, with additional features like advanced analytics and tax reporting |

| Unique Feature | Comprehensive portfolio management across multiple wallets and DeFi platforms, including asset tracking |

| Supported Wallets | Integration with software, hardware, and exchange wallets for centralized portfolio management |

| Fees | Free plan available, premium plans with more advanced features for subscription fees |

4. Kubera

Kubera stands out as one of the best tools for automated portfolio rebalancing, particularly for those wishing to oversee both crypto as well as traditional assets from the same interface.

Its greatest value proposition is one of integration as it offers the complete sweep of all assets in one interface, comprising of stocks, crypto, real estate, and much more. Automation for rebalancing crypto wallets in crypto wallets and crypto exchanges is particularly value-added.

It locks the portfolio for net worth target and offers sophisticated tracking tools to provide flexible preset limits on the asset allocation, making it truly remarkable for portfolio rebalancing.

| Feature | Details |

|---|---|

| Tool Name | Kubera |

| Primary Function | Portfolio tracking and management for both crypto and traditional assets, with automated rebalancing |

| Supported Exchanges | Binance, Coinbase, Kraken, Bitstamp, and many others (crypto and traditional asset tracking) |

| KYC Requirement | Minimal KYC (Mainly for connecting and managing crypto exchanges, but no extensive verification needed) |

| Automation Features | Automated portfolio tracking, customizable rebalancing rules for crypto and traditional assets |

| Security | High security with encryption and secure integrations, including support for 2FA |

| User Interface | Clean, modern dashboard for managing both crypto and traditional investments in one place |

| Free & Paid Plans | Paid subscription model with all-inclusive features for portfolio management and rebalancing |

| Unique Feature | Multi-asset portfolio tracking (crypto + traditional assets), making it ideal for comprehensive wealth management |

| Supported Wallets | Integrates with major crypto exchanges and wallets, supporting a wide range of assets |

| Fees | Subscription-based pricing; no transaction fees for crypto trades, but fees for advanced features |

5. Quadency

Quadency offers automated portfolio rebalancing, transferable to any level of trader proficiency. Quadency’s easy-to-use design, coupled with highly automated trading bots, provides automated rebalancing across crypto exchanges.

After Quadency, those in crypto portfolio management with the most experience will trade with bots. Quadency provides fully integrated trading strategy back-testing, which allows the trader to run a simulated trading environment.

Quadency also allows real-time analytics of a trader’s portfolio, providing a complete framework to manage a portfolio. The combination of automated trading, analytical depth, and strategy back-testing provides the automated trader the ability to manage their portfolio most efficiently in crypto assets.

| Feature | Details |

|---|---|

| Tool Name | Quadency |

| Primary Function | Automated portfolio rebalancing, trading bots, and strategy management across multiple exchanges |

| Supported Exchanges | Binance, Coinbase Pro, Kraken, KuCoin, Bitfinex, and other major exchanges |

| KYC Requirement | Minimal KYC (Mainly for connecting with exchanges; full verification may be required by exchanges) |

| Automation Features | Customizable rebalancing, automated trading bots, backtesting strategies, and portfolio tracking |

| Security | API key-based integrations with 2FA and encryption for secure asset management |

| User Interface | Intuitive and advanced interface with customizable features for experienced and novice users |

| Free & Paid Plans | Offers both free and premium plans, with additional features like advanced bots and backtesting tools |

| Unique Feature | Backtesting feature for refining strategies, making it ideal for users looking to optimize automated rebalancing |

| Supported Wallets | Integration with various wallets and exchanges for seamless asset management |

| Fees | Subscription-based pricing for premium features, no trading fees through the platform |

6. Altrady

For automated portfolio rebalancing, Altrady is one of the best tools out there, especially for traders looking for a complete package with multi-exchange integration. Altrady is unique since it integrates a number of exchanges and offers active real-time portfolio management.

The automated rebalancing functionality is a priceless resource because it enables users to continuously re-optimize the portfolio as per the users investment strategy, and the user can simply “set it and forget it”.

To automate the other aspects of portfolio management, users can take advantage of the advanced charting, P&L tracking, alerts, and other monitoring features. The combination of automated rebalancing and the ability to customize portfolio management is what makes Altrady best in its class.

| Feature | Details |

|---|---|

| Tool Name | Altrady |

| Primary Function | Multi-exchange trading, portfolio management, and automated rebalancing for crypto assets |

| Supported Exchanges | Binance, Coinbase Pro, Kraken, Bitfinex, KuCoin, and other major exchanges |

| KYC Requirement | Minimal KYC (Mainly for exchange integrations; full verification required by exchanges) |

| Automation Features | Automated portfolio rebalancing, real-time price tracking, and trade execution across multiple exchanges |

| Security | Secure API key-based integrations, two-factor authentication (2FA), and encryption |

| User Interface | Clean and easy-to-navigate dashboard with advanced charting tools for better decision-making |

| Free & Paid Plans | Offers both free and premium plans, with advanced features in the paid subscription |

| Unique Feature | Real-time market data integration across exchanges, helping users track portfolio performance and optimize rebalancing |

| Supported Wallets | Integration with various wallets and exchanges for centralized portfolio management |

| Fees | Subscription-based pricing for premium features; no trading fees for using the platform |

7. Zerion

As a pioneer in decentralized finance (DeFi), Zerion’s automated crypto portfolio rebalancing tools stand out for incorporating fully managed rebalancing DeFi assets across different protocols and liquidity pools to effortlessly configure and manage rebalancing and tracking DeFi liquid pool owner and portfolio dashboards.

Through Zerion’s direct integrations with Ethereum and other blockchains, users bypass intermediary DeFi automation rebalancing tools and execute rebalancing automation directly at the blockchain layer.

For DeFi investors, the ability to customize rebalancing directly with Zerion’s built-in performance dashboards and portfolio rebalancing analytics scoped for market changes aligns directly to optimizing risk and being a pivotal asset.

| Feature | Details |

|---|---|

| Tool Name | Zerion |

| Primary Function | DeFi portfolio management and automated rebalancing for decentralized assets |

| Supported Exchanges | Integrates with Ethereum, Polygon, and other major DeFi protocols |

| KYC Requirement | Minimal KYC (No KYC required for portfolio tracking and DeFi asset management) |

| Automation Features | Automated portfolio rebalancing, transaction optimization, and rebalancing across DeFi platforms |

| Security | Secure wallet integration, encrypted data, and decentralized management |

| User Interface | User-friendly interface designed for managing DeFi assets and investments |

| Free & Paid Plans | Offers both free and premium plans, with additional features such as advanced analytics and DeFi integrations |

| Unique Feature | Focused on DeFi asset management, with direct access to liquidity pools and automated yield farming |

| Supported Wallets | Integrates with Ethereum-based wallets like MetaMask, WalletConnect, and others |

| Fees | Free plan available, with premium features available for a subscription fee |

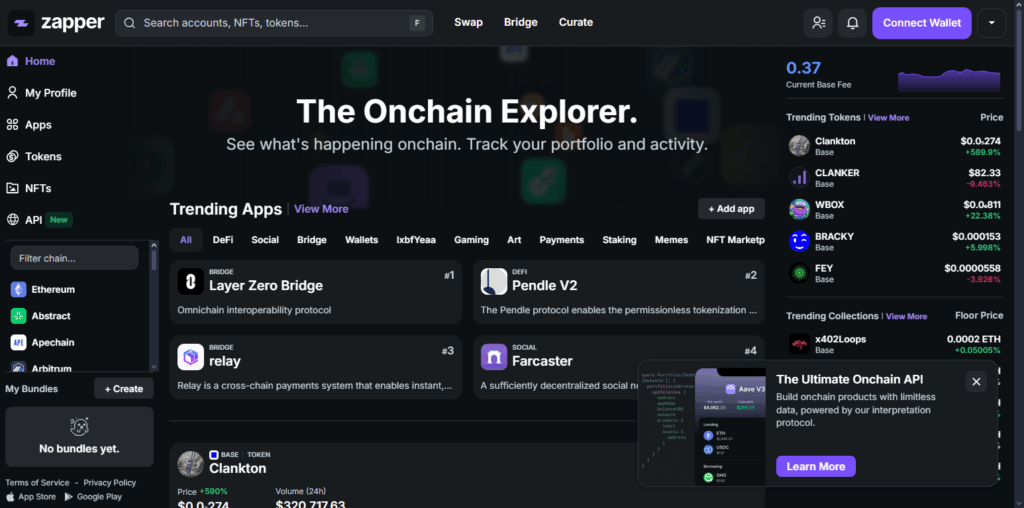

8. Zapper

Zapper is a multifunctional nifty crypto automated portfolio rebalancer especially for those involved in decentralized finance (DeFi). It is unique for having a single dashboard that consolidates all investments in DeFi, which allows users to track and manage their assets effortlessly across multiple interfaces.

In addition to automated portfolio rebalancing, Zapper permits continuous optimization of user portfolios to their preferred target distribution, significantly minimizing the user’s work. Zapper’s advanced yield farming, liquidity pooling, and other core DeFi protocol integrations make it very useful.

Zapper’s ingenuity lies in their user interface coupled with the automation that really empowers a user to save on their time while maximizing portfolio returns during market fluctuations.

| Feature | Details |

|---|---|

| Tool Name | Zapper |

| Primary Function | DeFi portfolio management, asset tracking, and automated rebalancing across decentralized platforms |

| Supported Exchanges | Integrates with Ethereum, Polygon, and other major DeFi protocols |

| KYC Requirement | Minimal KYC (No KYC required for using the platform; only needed for certain transactions) |

| Automation Features | Automated portfolio rebalancing, yield farming optimizations, and integration with liquidity pools |

| Security | Secure wallet integrations with encrypted transactions and decentralized management |

| User Interface | Intuitive interface tailored for DeFi asset management, allowing easy tracking and rebalancing |

| Free & Paid Plans | Offers both free and premium features, including advanced DeFi integrations and analytics |

| Unique Feature | Specializes in DeFi portfolio management, with features for optimizing returns through automated yield farming and liquidity pool management |

| Supported Wallets | Integrates with Ethereum-based wallets (MetaMask, WalletConnect) and DeFi platforms |

| Fees | Free for basic features; premium features require a subscription |

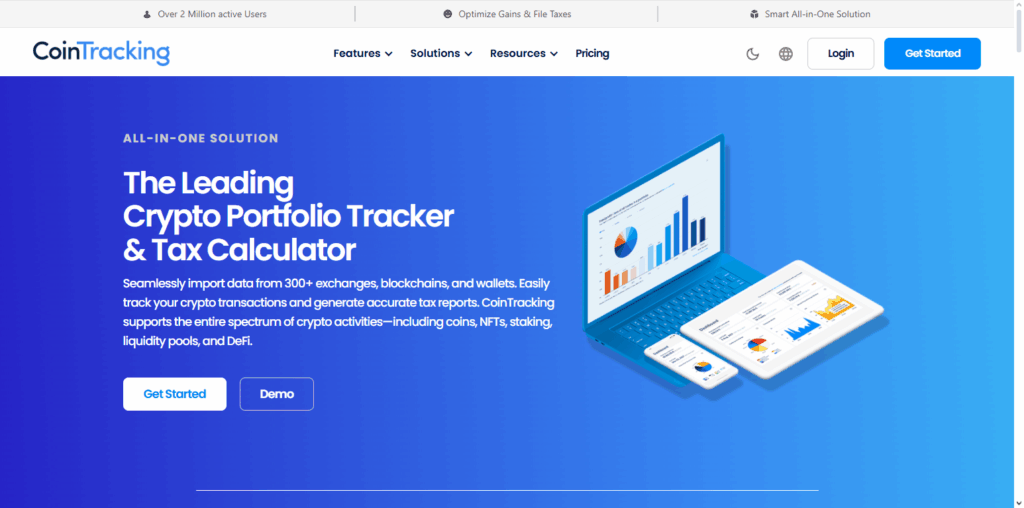

9. CoinTracking

Automated portfolio rebalancing is one of the superb features of CoinTracking, which is built for individual traders as well as tax professionals.

The ability to track portfolios over multiple exchanges, wallets, and even blockchains is the highlight. It automatically syncs transactions over several wallets, constantly updating as asset allocations change.

For automated rebalancing, the user sets parameters for CoinTracking to make adjustments. For tax optimization, portfolio analytics, and other assessment reports, CoinTracking is one of the best.

The all-in-one concept streamlines the user experience to manage profit and tax optimization on a portfolio. It is also one of the best portfolio rebalancing software in the market.

| Feature | Details |

|---|---|

| Tool Name | CoinTracking |

| Primary Function | Portfolio tracking, performance analytics, and automated rebalancing for crypto assets |

| Supported Exchanges | Binance, Coinbase, Kraken, Bitfinex, KuCoin, and other major exchanges |

| KYC Requirement | Minimal KYC (Mainly for exchange integrations; full verification may be required by exchanges) |

| Automation Features | Automated portfolio rebalancing, trade tracking, tax reporting, and portfolio analysis |

| Security | API key-based integration with 2FA and encrypted data storage |

| User Interface | Comprehensive dashboard with detailed reports, portfolio tracking, and easy navigation |

| Free & Paid Plans | Free plan available; premium plans with advanced features such as detailed tax reporting and backtesting |

| Unique Feature | Detailed tax reporting and integration with exchanges for automated trade tracking and portfolio management |

| Supported Wallets | Integration with crypto exchanges, wallets, and blockchains for centralized portfolio management |

| Fees | Free for basic features, premium features available with subscription plans |

Risk & Consider

Market Instability: Automated portfolio management tools react to market changes. Markets can rebound quickly, and automated rebalancing might lock in losses. Constant rebalancing might help a portfolio in some markets, but in highly volatile markets, it can increase trading costs and lower the overall returns.

System Failure: Automated rebalancing tools rely on an API integration system with exchanges and wallets. Exchange downtime, broken APIs, and connectivity loss can result in unbalanced portfolios and missed profit opportunities.

Over-Optimization: Excessive fine-tuning of a rebalancing program results in over-trading the portfolio, high trading costs, and taxes. Minimizing the need for portfolio management on a daily basis is a good automating strategy, but there should be a line drawn to maintain overall portfolio balance and a sustainable automated strategy.

Security Risks: Automating processes connecting your crypto assets to other platforms and APIs might trigger security breaches, including hacking and phishing. Weak security measures can lead to unauthorized access to your assets. Always use two-factor authentication (2FA) and select tools with strong security measures.

Lack of Flexibility: Automation works great for routine processes like rebalancing portfolios, but there might be situations due to market conditions or your investing style where you require an automated system to be more flexible. Standard rebalancing strategies may miss unique situations that require an element of judgement.

Regulatory Uncertainty: Cryptocurrency regulations and requirements around automated tools including tax and security regulations are fluid. You should monitor and manage associated risks as they become more defined to avoid unnecessary tax or legal consequences.

Fees and Costs: Costs and expenses of automated rebalancing or other advanced features in premium accounts of automated portfolio management tools can be expensive. Accumulated transaction costs associated with rebalancing can lead to loss of profits.

Conclusion

To finish up, the most effective automated portfolio rebalancing crypto tools combine convenience, efficiency, and sophisticated capabilities in aiding self-service portfolio management focused on rebalancing specifically with the least manual work involved.

For example, Shrimpy, 3Commas, and CoinStats, among others, deploy automation strategies that sustain ideal asset allocation, thus hedging emotional decision making, and saving time over the continuum.

However, one must consider the market’s inherent volatility, the possible effects of manual or automated strategies, the security of the portfolio, the manual and automated transaction costs, and the automated transaction costs of the tools.

Since the tools could help crypto balanced management portfolio, the tools could help in achieving orderly asset allocation for the overall portfolio.

FAQ

Automated portfolio rebalancing in crypto involves using software tools to automatically adjust your crypto asset allocations according to predefined strategies. This ensures your portfolio stays aligned with your risk tolerance and investment goals without needing manual intervention.

Using automated tools saves time and reduces the emotional aspect of trading. These tools help maintain a balanced portfolio, optimize asset allocation, and mitigate the risks of overexposure to volatile assets. Additionally, they enable more consistent strategy execution and better portfolio diversification.

While automated portfolio tools are generally safe, they come with security risks like any online platform. Always choose tools with robust security features, such as two-factor authentication (2FA) and secure encryption. Additionally, ensure the platform has a solid reputation and offers continuous support.