The top cryptocurrency wallets for sanctions-safe transfers will be covered in this post, with an emphasis on systems that put regulatory compliance, AML controls, and safe transaction monitoring first.

Selecting the appropriate cryptocurrency wallet is crucial for organizations and companies looking for risk-free, compliant cross-border digital asset transactions as international sanctions enforcement becomes more stringent.

What Are Sanctions-Safe Crypto Transfers?

Digital asset transactions carried out in complete conformity with international sanctions legislation and regulatory frameworks are known as sanctions-safe crypto transfers.

These transfers make sure that wallets, organizations, or jurisdictions on international sanctions lists—such as OFAC, the EU, the UN, or UK authorities—are not used to send, receive, or transit cryptocurrency.

Sanctions-safe transfers use robust AML/KYC controls, blockchain analytics, and real-time transaction screening to detect and stop high-risk or illegal conduct before it is carried out.

Sanctions-safe cryptocurrency transfers are crucial for institutions and regulated companies to reduce legal, financial, and reputational risk while permitting legal cross-border movement of digital assets.

Key Features of the Best Crypto Wallets for Sanctions-Safe Transfers

Up-To-Date Sanctions Review: Wallets should filter the outbound transactions and the parties in the effected under the current global sanctions to stop any transaction that may have been prohibited.

Blended Cryptosystems Engineering: The integrated analytical system of the crypto wallet will analyze the transaction and will raise an alert if any suspicious behavior has been detected from the trails and system.

Set AML/KYC Controls: Anti-money Laundering (AML) and Know Your Customer (KYC) standards should be strictly maintained, and user identities should be confirmed to keep pace with the existing regulation.

Policies Management on Transaction Approvals: Various policies on transaction processing may be implemented, and organizations may establish internal tiers of control that are to be employed prior to such transactions being executed.

Audit Logs & Reporting: Logs documenting every action taken in the system should be kept, along with documents that confirm compliance, in order to facilitate internal audits and respond to regulatory inquiries.

Safeguard Custody Engineering: Safe systems, whether in the form of custodial systems, MPC or other systems, or Hardware Wallets, will ensure that the kept-keys system will protect the assets from being lost or abused.

Multi- File System: A wallet that accommodates a variety of other blockchain systems will allow the transfer of secured digital assets across a range of other systems.

Compliance to Tiered Access Control of Roles System: The flexibility of design will help the organization in segregating users to enforce compliance with the system.

Automating of Compliance: The manual processing of alerting, blocking, and other compliance activities will help to fully utilize the compliance system.

Documentation That Is Ready For An Audit: Documenting and exporting evidence and compliance reports connectors makes regulators and auditors happy.

Key Point & Best Crypto Wallets for Sanctions-Safe Transfers List

| Platform | Key Point |

|---|---|

| Gemini Custody | Regulated, SOC 2–certified institutional custody with strong compliance controls and insurance-backed cold storage. |

| Kraken Custody | Secure, bankruptcy-remote custody service designed for institutions seeking segregated accounts and high transparency. |

| Matrixport Custody | Enterprise-grade digital asset custody with integrated trading, lending, and structured product access. |

| Zengo Business | MPC-based, keyless wallet solution focused on eliminating private key risk for businesses and DAOs. |

| Qredo | Decentralized MPC custody network enabling secure cross-chain transfers and policy-based transaction approvals. |

| Coinbase Custody | Trusted institutional custodian offering insured cold storage, regulatory compliance, and deep liquidity access. |

| Anchorage Digital | Federally chartered crypto bank providing qualified custody with on-chain governance and staking support. |

| Ledger Enterprise | Hardware-backed custody platform combining secure HSM technology with customizable enterprise governance controls. |

| BitGo | Industry-leading multi-signature custody with insurance coverage and advanced wallet policy management. |

| Copper ClearLoop | Off-exchange settlement solution reducing counterparty risk while enabling instant trading liquidity. |

1. Gemini Custody

With strong security, compliance controls, and segregated cold storage, Gemini Custody is a regulated institutional custodian supported by the New York Department of Financial Services.

It is intended for organizations that require strict regulatory control, open reporting, and the protection of insured assets.

Gemini Custody’s compliance infrastructure reduces exposure to sanctioned entities by assisting businesses in meeting international AML/KYC regulations in the context of the best cryptocurrency wallets for sanctions-safe transfers.

Institutions can feel secure about asset security thanks to its insurance coverage for digital assets and frequent audits. Additionally, Gemini seamlessly interacts with treasury management systems, trading desks, and staking services.

Gemini Custody Features, Pros & Cons

Features

- Custodial services and regulation.

- High-value institutional cold storage.

- Sanction-compliant custody.

- Insured custody.

- Custody with audit trail reporting features.

Pros

- custody regulation lowers the risk of legal issues.

- His custody deeply stored.

- Custody with integrated marriage compliance.

- Insured custody lowers the risk of losing funds.

- Reporting features ease the audit and compliance process.

Cons

- Weak custody services are more expensive.

- This is not perfect for decentralization and blockchain governance.

- New DeFi funds and custody options are scarce.

- Insufficient investment flexibility.

- Insufficient investment flexibility.

2. Kraken Custody

Kraken Custody is dedicated to providing sophisticated clients safe, separate, custodial, digital assets custody that is bankruptcy remote, and tailored to sophisticated clientele. It is strengthened by internal controls, transparent and independent audits for proof of reserve.

Kraken Custody is considered one of the best crypto wallets for sanctions safe transfers. Kraken’s compliance team actively monitors sanctioned addresses and sanctioned related blockchain activity to protect institutions from legal exposure.

Kraken Custody is able to accommodate a variety of tokens, flexible per missioning, and custom account configurations to support hedge funds, asset managers, and digital asset storage foundations.

Kraken Custody Features, Pros & Cons

Features

- Custody structure remote from bankruptcy.

- Transparency with reserves and proof.

- Active/lender AML/KYC compliance.

- API for banks matched institutionally.

- Custody segregated per account.

Pros

- Transparency with reserves strengthens trust.

- Less sanctions risk with integrated AML/KYC.

- Isolated custody lowers operational risk.

- Compliant processes are automated with API.

- Reasonable pricing for the banks.

Cons

- Lack of user experience sophistication compared to the competitors.

- Staking and governance are not available.

- Adoption of new token standards happens slowly.

- Support for non-institutional users is inadequate.

- Integrated risk monitoring dashboards are lacking.

3. Matrixport Custody

Matrixport Custody combines the safeguarding of digital assets with integrated financial services including lending, trading, and structured products. This fusion of services attracts institutional clientele who prefer one-stop ecosystems.

Custodial services include operational transparency, and all three levels of compliance security. Within the best wallets for crypto, and safer transfers, Matrixport focuses on reducing risk and monitoring compliance for transfers, and transactions, to restricted and sanctioned countries.

Their platform features both hot and cold digital asset storage, along with customizable permissions and institutional audit compliance reporting. To enhance asset management for businesses, Matrixport combines financial services with digital asset custody.

Matrixport Custody Features, Pros & Cons

Features

- Trading and custody services with lending.

- Compliance integration.

- Controls for custom policies.

- Support for multiple assets.

- Analytics and reporting.

Pros

- Operational friction is decreased with a unified platform.

- Embedded workflow for compliance and sanctions.

- A balance of custom policies for risk and control.

- Diversification is enhanced with a wide range of assets.

- Advanced analytics improve transfer risk insights.

Cons

- Higher complexity of the platform for newbies.

- Compliance framework may not be as extensive as niche vendors.

- Partial decentralization and limited self-custody are drawbacks.

- Potentially elevated fees for cross-service use.

- Not ideal for users wanting dominant control over the wallet.

4. Zengo Business

Zengo Business offers a non-custodial keyless wallet solution that employs multiparty computation (MPC) to remove single private keys, making key management easier.

This wallet is targeted to businesses, DAOs, and other enterprises that need to sign transactions securely without the key storage risk.

Regarding the best crypto wallets with architecture that protects against sanctions, Zengo supports compliance tools that integrate with blockchain analytics and sanction screening pre-transaction execution.

Zengo Business simplifies compliance with enterprise UX, role-based access controls, and multi-approve workflows to reduce regulatory and operational risk when organizations asset safely.

Zengo Business Features, Pros & Cons

Features

- Technology for keyless wallets based on MPC.

- Governance with multiple approvals.

- Integrated compliance scoping.

- Mobile and web UX is user friendly.

- Access based on roles.

Pros

- No single point of key failure with MPC.

- Enforcement of internal approvals is simple for teams.

- May avoid compliance with sanctions based on the screening for transfers.

- Adoption for enterprises is simplified with a user friendly interface.

- Access restrictions are based on the structure of the team.

Cons

- Integrates with a third-party vendor for sanctions analytics.

- Not fully custodial (depends on policy enforcement)

- Storage has a limited number of cold options.

- Less than custodians legacy features institutional advanced.

- Large institutional settlement volumes not handled natively.

5. Qredo

Qredo is a decentralized custody network that combines the use of MPC and Layer 2 technologies to distribute signing, achieve low-latency cross-chain transfers, and secure digital assets.

For institutional adoption, Qredo provides targeted policy control and governance to meet large and complex organization needs, and best crypto wallets for architecture that protects against sanctions, Qredo offers compliance and regulatory analytics to help organizations avoid sanctioned address transactions.

With the unique offering of a fully decentralized Protocol, Qredo provides instant settlements with efficient liquidity provisioning across multiple blockchain while also maintaining the security and governance audit trails for institutions Risk and Governance teams.

Qredo Features, Pros & Cons

Features

- Decentralized MPC network

- Support for cross-chain transfers

- Settlement on-chain

- Workflows of policy-based approval

- Tools integrated compliance

Pros

- Decentralized custody reduces the risk of single points.

- Support for cross-chain compliance simplifies multi-asset.

- Policy workflows help to enforce rules around sanctions.

- Faster settlement on-chain and more transparency.

- The risk of single points is reduced with decentralized custody.

Cons

- Institutional teams new for onboarding are complex.

- For optimal performance, participation in the network is required.

- For sanctions analytics, it may need separate compliance tools.

- Less insurance than custodians centralized the simple needs.

- Not ideal for single-chain needs custody simple and.

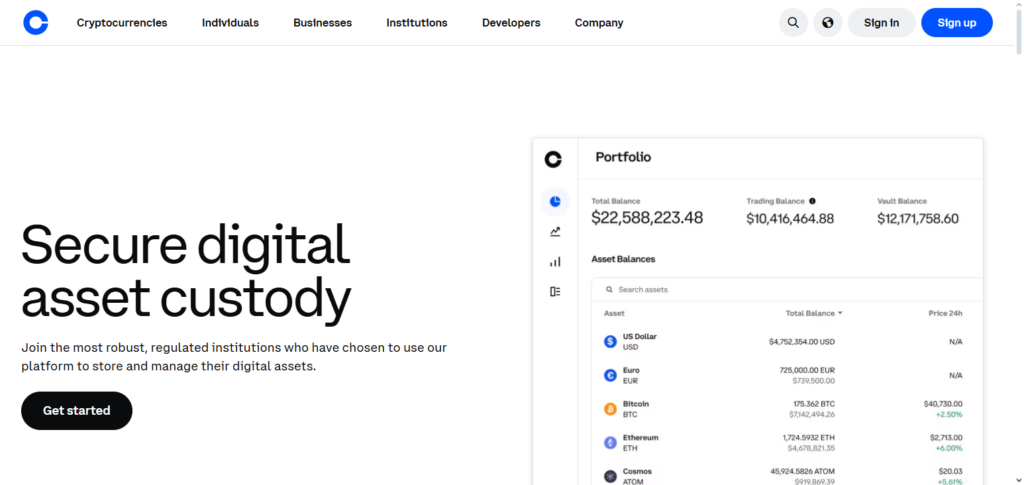

6. Coinbase Custody

Because of their scale as a U.S.-regulated crypto corporation, Coinbase Custody is able to provide insured cold storage and full regulatory compliance, along with attendant institutional support across a wide spectrum of digital assets.

Their service is tailored to the needs of asset managers and fund-related companies requiring dependable custody services anchored on regulatory compliance. Considering the best crypto wallets for sanctions-safe transfers,

Coinbase Custody takes full advantage of blockchain monitoring and AML/KYC to track and reduce the risk of dealing with unauthorized clients. Their clients can use automated compliance through sys integrated reporting and custody systems while securing crypto custody and transfer services.

Qredo Features, Pros & Cons

Features

- Decentralized MPC network

- Support for cross-chain transfers

- Settlement on the chain

- Policy-based approval on workflows

- Compliance tools that are integrated

Pros

- Decentralized custody eliminates the risk of a single point of failure.

- Support for cross chains facilitates multi-asset compliance.

- Policy-based workflows are useful for enforcing sanctions policies.

- Settlement on the chain is faster and more transparent.

- For institutions, the governance controls are more robust.

Cons

- Complexity of onboarding for brand new institutional teams.

- For optimal performance, reliance on network participation is a must.

- For comprehensive sanctions analytics, additional tools may be necessary.

- Less coverage for insurance when compared to centralized custodians.

- When simple single-chain custody is a need, it is not the optimal choice.

7. Anchorage Digital

Anchorage Digital is a digital asset bank with a federal charter that offers custody banking services and the ability to stake, sign, and transact securely on-chain. Their services operate across crypto ecosystems and provide several advanced security options, including hardware isolation and multi-factor authentication.

Considering best crypto wallets for sanctions-safe transfers, Anchorage Digital can help institutions avert undesirable exposure through blockchain compliance and analytics because of their Digital Asset Bank charter.

Customers gain a unique combination of traditional banking regulatory control and modern cryptographic security, and for many institutions, the bank charter enhances trust. Anchorage’s platform supports seamless integration with trading partners and staking protocols while prioritizing regulatory adherence.

Anchorage Digital Features, Pros & Cons

Features

- Digital banks with federal charters

- Custody solutions

- Staking & governance on-chain

- Monitoring & screening compliance

- APIs for institutions

Pros

- Regulatory trust with a bank charter.

- Keeps compliance with on-chain activities.

- Robust safe transfer compliance for US sanctions.

- Integration with enterprises via APIs.

- Staking is available while keeping custody safe.

Cons

- Fewer locations available for service than worldwide competitors.

- Greater minimums for institutional account openings.

- User experience is more difficult than consumer wallets.

- Small teams have less self-custody.

- Complicated fee structures.

8. Ledger Enterprise

Ledger Enterprise turns the security of Ledger’s hardware foundation into scalable custody solutions for businesses and financial institutions by integrating hardware Security Modules (HSMs) with Enterprise Governance control.

Ledger Enterprise provides organizations with the ability to define fine-grained access control policies, multilevel approvals, and tamper-proof storage of cryptographic keys in different environments. Ledger Enterprise, among the best crypto wallets for sanctions-safe transfers, is able to merge with legal compliance software in order to screen and sanction-check transactions and their counterparties prior to executing them.

This feature minimizes legal exposure. Ledger Enterprise’s model integrity keeps the proprietary cryptographic keys safe and isolated from the outside. Audit trails and access control by roles help institutional risk and compliance teams protect the assets they manage.

Ledger Enterprise Features, Pros & Cons

Features

- Security on HSM/keys

- Enterprise policy controls

- Custody options on-premise

- Role-based controls on governance

- Audits that are exportable

Pros

- The risk of theft of keys is reduced with hardware protection.

- Suitable governance flexibility.

- Will integrate sanctions screening.

- Enterprises have full custody.

- Excellent support for multiple signature processes.

Cons

- Requires integration with compliance tooling externally.

- Higher cost for enterprise deployment.

- Not cloud-native — hardware logistics required.

- Limited liquidity or settlement integrations.

- Manual compliance workflows may be needed.

9. BitGo

BitGo is a widely recognized multi-signature custody service provider that gives institutional clients safe custody, policy-based wallets, and insurable wallets. He provides safe custody and policy-based wallets to institutional clients. He has a broad operational control and asset coverage.

Among the best crypto wallets for sanctions-safe transfers, BitGo also has built-in compliance of wallet policies and also provides optional blockchain analysis to determine if there is a potential relationship with parents that have been sanctioned.

With wallet policy customization, multi-user access control, and a strong custody framework, BitGo serves asset managers, trading companies, and service providers who require high confidence and risk control in providing custody. Settlements and staking are also included in these enterprise solutions.

BitGo Features, Pros & Cons

Features

- Multi-signature custody

- Policy-based wallet controls

- Optional insurance

- Compliance & sanctions screening

- Settlement & staking tools

Pros

- Proven multi-sig security model with risk controls.

- Policies help enforce sanctions-safe workflows.

- Optional insurance mitigates asset loss exposure.

- Supports institutional settlement tools.

- Provides integrated compliance features.

Cons

- Insurance may not cover all risks.

- Onboarding can be slow for smaller entities.

- Fewer native analytics versus specialist platforms.

- Not fully decentralized custody.

- Transactions might require more approvals, slowing speed.

10. Copper ClearLoop

ClearLoop by Copper is a post-trade off-exchange settlement network that aims to mitigate counterparty risk by allowing direct on-chain settlements among crypto market participants.

ClearLoop integrates custody control with instant liquidity execution while reducing dependence on third-party facilitators.

For institutions considering best crypto wallets for transfers that are safe from sanctions, ClearLoop’s system can work with compliance filters and blockchain analytics to avoid sanctioned wallets.

By securing settlements and minimizing the time to settle, ClearLoop enables the movement of assets while managing risk. Copper ClearLoop is designed for trading firms and institutions that need speed, lower settlement risk, and visibility into compliance.

Copper ClearLoop Features, Pros & Cons

Features

- Off-exchange settlement network

- Instant on-chain settlement

- Counterparty risk reduction

- Compliance integrations

- Liquidity provider connections

Pros

- Reduces settlement risk with direct on-chain clearing.

- Integrates compliance filters for sanctions-safe transfers.

- Faster settlement than traditional custodial chains.

- Connects institutional liquidity points.

- Improves operational efficiency.

Cons

- Depends on partner networks for deeper sanctions analytics.

- Not a standalone custody wallet.

- Needs connection with an institutional framework.

- Tight access for smaller companies might be possible.

- Still budding in the adoption of institutional markets.

Comparison of Sanctions-Safe Crypto Wallets

| Wallet / Platform | Regulatory Compliance | Sanctions Screening | Custody Type | Security Model | Best For |

|---|---|---|---|---|---|

| Gemini Custody | ✔️ Licensed, regulated | ✔️ Built-in monitoring | Custodial | Cold storage + compliance controls | Institutions requiring full compliance & reporting |

| Kraken Custody | ✔️ AML/KYC + proof of reserves | ✔️ Compliance tools | Custodial | Segregated accounts | Transparent institutional storage |

| Matrixport Custody | ✔️ Compliance suite | ✔️ Screening + analytics | Custodial / Hybrid | Policy controls | All-in-one institutional services |

| Zengo Business | ⚠️ Depends on integrations | ⚠️ Integrated compliance optional | Non-custodial MPC | MPC keyless wallet | Teams & DAOs seeking secure keyless custody |

| Qredo | ⚠️ Protocol compliance | ⚠️ Can integrate screening | Decentralized MPC | On-chain settlement | Cross-chain, decentralized organizations |

| Coinbase Custody | ✔️ Strong regulatory | ✔️ Robust monitoring | Custodial | Insured cold custody | Large institutional clients |

| Anchorage Digital | ✔️ Federal charter | ✔️ Active sanctions checks | Custodial / Qualified | Staking + governance support | Regulated institutional banking |

| Ledger Enterprise | ⚠️ External compliance | ⚠️ Integration required | On-premise hardware | HSM + multi-sig | Enterprises with in-house governance |

| BitGo | ✔️ AML/KYC + screening | ✔️ Built-in monitoring | Custodial / Multi-sig | Multi-sig wallet | Mid-large institutions needing flexible custody |

| Copper ClearLoop | ⚠️ Partner compliance | ⚠️ Integrated settlement filters | Settlement network | On-chain clearing | Institutions needing instant settlement |

Conclusion

For institutions, businesses, and high-value cryptocurrency users, selecting the finest cryptocurrency wallets for sanctions-safe transactions is now a legal and practical requirement.

Platforms such as Gemini Custody, Coinbase Custody, Anchorage Digital, BitGo, and Ledger Enterprise show how blockchain monitoring, advanced security architectures, and regulatory compliance combine to lower exposure to sanctions.

By using MPC, off-exchange settlement, and decentralized custody models, cutting-edge solutions like Qredo, Zengo Business, Matrixport Custody, Kraken Custody, and Copper ClearLoop provide flexibility.

In the end, the ideal wallet combines robust governance, real-time compliance screening, and safe transaction execution, allowing businesses to securely transfer digital assets while adhering to international regulations and sanctions.

FAQ

Sanctions-safe crypto transfers are transactions that comply with international sanctions laws by preventing interactions with blacklisted wallets, entities, or jurisdictions using blockchain monitoring and compliance controls.

They help institutions avoid legal penalties, regulatory action, and reputational damage by ensuring all digital asset transfers meet AML, KYC, and global sanctions requirements.

Key features include real-time blockchain analytics, sanctions screening, policy-based approvals, audit trails, secure custody, and integration with compliance tools.

Custodial wallets often provide stronger built-in compliance and monitoring, while advanced non-custodial solutions can achieve compliance through integrated analytics and governance controls.

Yes, MPC-based wallets enhance security and can integrate sanctions screening and approval workflows before transactions are signed.