This article will cover Best Financial Planners to achieve Financial Security and Long-Term Wealth. Comprehensively managing investments, retirement accounts, tax responsibilities, and risk levels requires a qualified professional, and the right choice is important.

I will highlight top firms recognizing the value of custom strategies and client focal points to ensure that your money works smarter, and your goals, monetarily speaking, are met.

What is Financial Planners?

A financial planner assists individuals and companies in the preparation and maintenance of their financial records so that specific financial objectives may be attained. Clients seek the planner’s expertise in areas including budget preparation, savings, investment, and retirement, as well as in tax, and risk assessments and protective strategies.

After evaluating the client’s financial position and ascertaining their objectives in the short and long terms, the planner draws up a financial plan aimed at wealth accumulation, debt reduction, and the achievement of financial stability and framed goals.

Most importantly, by provision of advisory services which he/she may also take directly, and evaluation of the client’s financial state from time to time, the planner helps the client in the execution of their objectives in a way that is mistake-free and cost efficient, engendering in them financial self-reliance and freedom.

Benefits Of Financial Planners

Personalized Financial Strategy: Each client receives a financial plan tailored to their income, expenses, goals, and attitude toward risk.

Expert Investment Guidance: Help choose investments that provides maximum return and minimum risk.

Retirement Planning: Helps you determine the amount you should set aside today to maintain your desired standard of living after you retire.

Tax Optimization: Implement techniques that minimize your taxable income and maximize deductions and exemptions.

Debt Management: Helps you control and reduce your debts in a structured way.

Risk Management & Insurance Planning: Helps you determine what insurance you should have to protect yourself from risks.

Goal Tracking & Accountability: Helps you track your goals and keeps you plan of your life changes.

Financial Confidence: Helps you make the right decision and prevents you from costly mistakes which gives you peace of mind.

Best Financial Planners Points

- Parsons Capital Management – Expert financial guidance to grow and protect your wealth.

- Creative Planning – Comprehensive financial planning and investment management solutions.

- Fisher Investments – Personalized investment strategies for long-term financial growth.

- Edelman Financial Engines – Tailored financial plans to achieve your life and retirement goals.

- Facet Wealth – Affordable, customized financial planning with dedicated advisors.

- Mercer Advisors – Holistic wealth management for individuals, families, and businesses.

- Plancorp – Strategic financial planning and investment management services.

- Abacus Wealth Partners – Personalized wealth strategies for lasting financial security.

- The Planning Center – Expert advice on investments, retirement, and risk management.

- Yeske Buie – Comprehensive financial planning for wealth preservation and growth.

10 Best Financial Planners

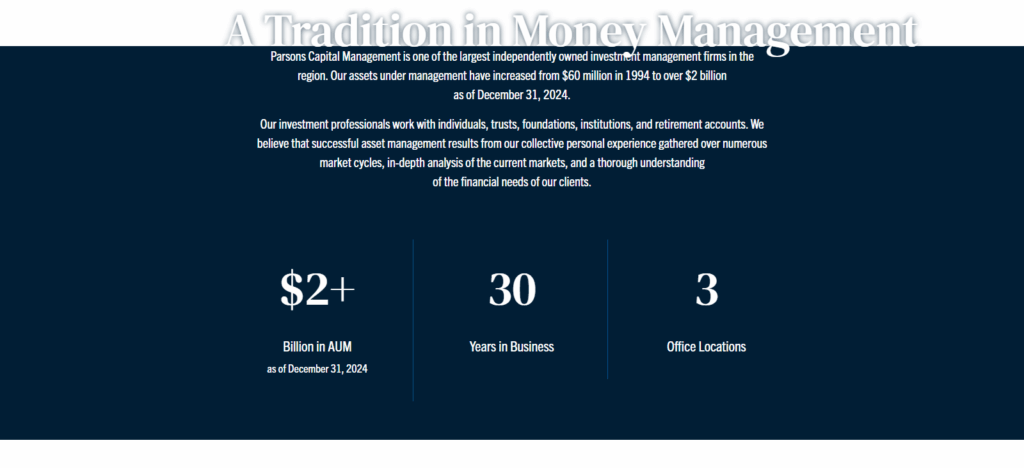

1. Parsons Capital Management

Parsons Capital Management is among the best financial planners because of its personalized wealth management strategies. Unlike advisory firms with more general approaches, Parsons invests the time to understand every client’s financial objectives, risk appetite, and personal situations.

Their planners are able to achieve the goals of maximum financial growth with minimum financial risk due to the combination of innovative planning and extensive market knowledge.

Unmatched transparency, progress evaluations, and comprehensive financial planning that encompasses investments, retirement, tax, and estate planning is what differentiates Parsons Capital Management. Their client-oriented, flexible philosophy is the reason for Parsons Capital Management’s reputation for reliability.

| Feature | Details |

|---|---|

| Company Name | Parsons Capital Management |

| Services Offered | Investment management, retirement planning, tax strategies, estate planning, risk management |

| KYC Requirements | Minimal documentation for account setup; focuses on core financial details |

| Client Approach | Personalized, goal-focused, long-term wealth strategies |

| Unique Point | Combines market expertise with tailored, transparent financial planning |

| Target Clients | Individuals and families seeking customized wealth management |

| Communication | Regular progress reviews, proactive guidance, and transparent reporting |

2. Creative Planning

Creative Planning is highly regarded because of its all-embracing and customer-centered approach to wealth management.

The firm places exceptional focus on integrated wealth management, which includes investments, retirement finances, tax and risk assessment, and all other financial planning that is customized to specific client goals.

Perhaps what really differentiates Creative Planning is how it incorporates top-tier technology with real-time advisory services to ensure that clients obtain up-to-the-minute information and guides regarding their finances.

The firm places exceptional focus on retirement and enduring wealth with transparent and continuous client-admin interaction. It is this thorough and meticulous financial planning that fosters long-lasting and reliable Creative Planning.

| Feature | Details |

|---|---|

| Company Name | Creative Planning |

| Services Offered | Investment management, retirement planning, tax strategies, risk management, estate planning |

| KYC Requirements | Minimal documentation required; core financial and identification details only |

| Client Approach | Comprehensive, personalized financial strategies tailored to individual goals |

| Unique Point | Combines advanced technology with personalized advisory for real-time insights |

| Target Clients | Individuals, families, and businesses seeking holistic wealth management |

| Communication | Regular updates, proactive guidance, and transparent reporting |

3. Fisher Investments

Fisher Investments emphasizes a research-driven approach along with an effective financial planner reputation for its individualized strategy development that matches a client’s objectives and unique variables like personal risk appetite and lifecycle phase.

The firm’s proactive communication and student-driven approach focus on achieving long-term objectives like retirement wealth accumulation. Attention shifts with dynamic adjustments to portfolios to capitalize on global advancements.

Clear analytics support dynamic strategy shifts to risk mitigation to global advancement. Transparency enhances trust that cumulative wealth will have a secure accumulation phase.

A disciplined approach like the personal attention afforded to a retirement planner promises a Fisher Investments client a secure accumulation phase.

| Feature | Details |

|---|---|

| Company Name | Fisher Investments |

| Services Offered | Personalized investment strategies, retirement planning, portfolio management, risk management |

| KYC Requirements | Minimal documentation; focuses on essential financial and identification details |

| Client Approach | Research-driven, tailored investment plans for long-term growth |

| Unique Point | Proactive portfolio management using continuous market analysis and global opportunities |

| Target Clients | Individuals and families seeking customized, long-term investment strategies |

| Communication | Regular reviews, transparent reporting, and personalized advisor support |

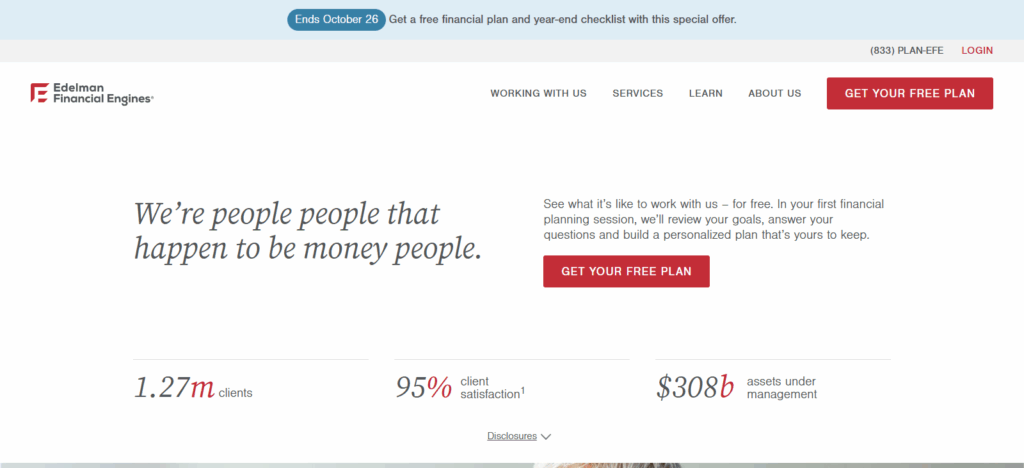

4. Edelman Financial Engines

Edelman Financial Engines continues to receive acclaim and prestige as one of the top financial planners because of the unique combination of technology and one-on-one financial advice.

The firm’s planned comprehensive integration of investment management, retirement planning, tax planning, and risk management along the spectrum of one’s financial goals is truly commendable. What is most remarkable about Edelman Financial Engines is the ability of the clients to see and understand their financial future, of advanced financial modeling and accompanying devoted advisors.

The combination of monitoring, focused strategies along the continuum of client’s financial goals and financial vision opens the door for clients to enjoy peace of mind and makes them a preferred firm for wealth management.

| Feature | Details |

|---|---|

| Company Name | Edelman Financial Engines |

| Services Offered | Investment management, retirement planning, tax optimization, risk management, estate planning |

| KYC Requirements | Minimal documentation; core financial and identification details only |

| Client Approach | Combines technology with personalized advice for tailored financial plans |

| Unique Point | Advanced financial modeling tools with dedicated advisors for goal-focused strategies |

| Target Clients | Individuals and families seeking comprehensive, long-term financial planning |

| Communication | Regular plan reviews, proactive guidance, and transparent reporting |

5. Facet Wealth

Facet Wealth stands out when it comes to financial planners. This is due to its affordable, flat-fee fully personalized financial planning. Unlike conventional advisory firms, Facet Wealth gives each client access to a registered CFP® professional who personally tailors a plan for each client that encompasses their investments, retirement, tax obligations, and insurance.

What makes them different is their commitment to accessibility and transparency. Clients are guaranteed to receive qualified advice without the burden of additional charges or fees. Added to this are their technologically advanced planning tools and personalized advisory services which give clients the opportunity to manage their finances confidently, calmly, and constructively.

| Feature | Details |

|---|---|

| Company Name | Facet Wealth |

| Services Offered | Financial planning, investment management, retirement planning, tax strategies, insurance planning |

| KYC Requirements | Minimal documentation; only essential financial and identification details |

| Client Approach | Dedicated CFP® professional for fully personalized financial strategies |

| Unique Point | Affordable, flat-fee structure with one-on-one advisor support |

| Target Clients | Individuals seeking accessible, customized financial planning |

| Communication | Regular check-ins, proactive guidance, and transparent updates |

6. Mercer Advisors

Holistic wealth management has earned Mercer Advisors awards as a top financial planner. Investment management, retirement planning, tax strategy, estate planning, and risk management are just a few of the many individual services they offer. Mercer Advisors tailors each of these services to the client’s objectives.

The team approach is what really distinguishes Mercer Advisors. Members of diverse financial services sectors coordinate the formation of integrated financial strategies. Clients are also managed personally, and the communication and planning are predictably long-term. Clients know they are partnered with a wealth management firm that has their best interests in mind because of that level of expertise and focus.

| Feature | Details |

|---|---|

| Company Name | Mercer Advisors |

| Services Offered | Investment management, retirement planning, tax strategy, estate planning, risk management |

| KYC Requirements | Minimal documentation; core financial and identification details only |

| Client Approach | Holistic, collaborative team model for integrated financial strategies |

| Unique Point | Multi-disciplinary approach combining specialists for comprehensive wealth management |

| Target Clients | Individuals, families, and business owners seeking long-term financial planning |

| Communication | Regular plan reviews, proactive advice, and transparent reporting |

7. Plancorp

Plancorp is considered one of the best financial planners because of its highly individualized and strategic approach to managing wealth.

The firm focuses on designed individualized financial plans which encompass one’s goals and life investments and even extend to retirement, taxation, and estate planning. What distinguishes Plancorp is the importance of long-term, detailed planning as well as active, helping hands which give clients the understanding to manage complicated financial matters confidently.

Their advisors value open, ongoing dialogue, and flexibility in plans to address different situations in the market. This holistic, client-first mentality promotes enduring prosperity, and peace of mind.

| Feature | Details |

|---|---|

| Company Name | Plancorp |

| Services Offered | Investment management, retirement planning, tax optimization, estate planning, risk management |

| KYC Requirements | Minimal documentation; essential financial and identification details only |

| Client Approach | Highly individualized and strategic wealth management tailored to client goals |

| Unique Point | Proactive guidance with adaptive strategies to navigate complex financial decisions |

| Target Clients | Individuals and families seeking long-term, comprehensive financial planning |

| Communication | Regular updates, personalized reviews, and transparent reporting |

8. Abacus Wealth Partners

Abacus Wealth Partners is viewed as one of the finest financial planners primarily due to its custom-fit and highly client-centered approach to wealth management. The firm regards wealth management as relational.

Each client’s unique goals and circumstances drive the construction of a bespoke plan comprising components of investments, retirement, taxation, risk management, and more. Abacus Wealth Partners regards trust as a hybrid product of transparency and fiduciary responsibility. The interests of the clients should always prevail.

The financial acuity of the staff is complemented by a highly powerful software used to monitor plan shifts and life alterations as well as external conditions, thereby guaranteeing relevant shifts.

All these lived experiences create lasting financial resilience and confidence. The firm embraces a holistic and dynamic methodology. This promotes the attainment of financial security in a very confident and lasting manner.

| Feature | Details |

|---|---|

| Company Name | Abacus Wealth Partners |

| Services Offered | Investment management, retirement planning, tax strategies, estate planning, risk management |

| KYC Requirements | Minimal documentation; only essential financial and identification details |

| Client Approach | Personalized, long-term wealth strategies focused on client goals |

| Unique Point | Emphasis on fiduciary responsibility and building lasting client relationships |

| Target Clients | Individuals and families seeking tailored, transparent financial planning |

| Communication | Proactive guidance, regular reviews, and transparent reporting |

9. The Planning Center

Because of its client-centered and holistic approach to wealth management, The Planning Center is considered one of the best financial planners. The firm focuses on creating individualized financial plans that consider investments, retirement, taxes, risk management, and strategies for each client within the framework of their specific goals and life situation.

The proactive guidance and constant client education that allows them to understand and shape their financial future is what distinguishes The Planning Center.

The financial confidence of clients is maintained and their gradual and sustainable growth is achieved due to the emphasis on transparency, long-term planning, regular reviews of the strategies, and constant risk management and strategies of the firm.

| Feature | Details |

|---|---|

| Company Name | The Planning Center |

| Services Offered | Investment management, retirement planning, tax strategies, risk management, estate planning |

| KYC Requirements | Minimal documentation; only essential financial and identification details |

| Client Approach | Holistic, client-centered financial planning tailored to individual goals |

| Unique Point | Emphasis on proactive guidance and client education for informed financial decisions |

| Target Clients | Individuals and families seeking comprehensive, long-term wealth management |

| Communication | Regular reviews, transparent reporting, and ongoing advisor support |

10. Yeske Buie

Yeske Buie is one of the best financial planners because of its client-centered attitude which takes service beyond conventional wealth management.

The firm creates detailed financial plans which incorporate investments, retirement, tax planning and risk management services around each client’s personal goals and life situation.

What distinguishes Yeske Buie is the primary focus on the ‘why’ of their clients’ financial decisions. Yeske Buie clients appreciate the financial clarity, consistent attention, and tailored solutions which guide them to confident, prosperous, and secure financial wellbeing.

| Feature | Details |

|---|---|

| Company Name | Yeske Buie |

| Services Offered | Investment management, retirement planning, tax planning, estate planning, risk management |

| KYC Requirements | Minimal documentation; only essential financial and identification details |

| Client Approach | Comprehensive, client-focused financial planning tailored to individual goals |

| Unique Point | Emphasis on behavioral finance to guide informed, confident financial decisions |

| Target Clients | Individuals and families seeking long-term financial security and growth |

| Communication | Regular plan reviews, proactive guidance, and transparent reporting |

Conclusion

In conclusion, selecting the right financial planner is fundamental to achieving long-term financial success and financial well being. Leading firms such as Parsons Capital Management, Creative Planning, Fisher Investments, Edelman Financial Engines, Facet Wealth, Mercer Advisors, Plancorp, Abacus Wealth Partners, The Planning Center, and Yeske Buie excel in personalized approach, expertise, and comprehensive wealth management integration.

What distinguishes them is the appreciation of client goals, strategic focus, advocacy, transparency, and long-term relational support. Collaboration with such responsible financial planners guarantees the right course of action, strategic growth, and mental calm that come with a planned and enhanced financial future.

FAQ

Look for credentials (like CFP®), experience, client-focused services, transparency, a fiduciary responsibility, and a personalized approach that aligns with your goals.

They offer investment management, retirement and estate planning, tax strategies, risk management, debt management, and ongoing financial guidance tailored to each client’s needs.

Costs vary—some charge a flat fee, hourly rate, or a percentage of assets under management. The best planners offer transparent pricing without hidden fees.

Yes, top financial planners create tailored retirement strategies, ensuring clients save, invest, and manage income to maintain their lifestyle after retirement.