In this article, I will talk about the How To Stake Bridging Aggregator Governance Tokens. Staking these tokens lets users earn rewards as well as participate in cross-chain platform governance. Participating in the blockchain ecosystem’s DeFi evolution requires understanding the process, benefits, and risks of staking.

What is Governance Tokens?

A governance token is a type of crypto asset enabling its possessor or a holder to effectively participate in the decision-making processes of a certain blockchain project or a decentralized organization.

Users may vote on specific proposals like protocol changes, funding, and other revisions of the set rules.

Through governance tokens, community members influence the growth trajectory, policies and the future of the platform which enhances the decentralization and self-management. This shift in decision-making authority leads to user empowerment instead of dependence on a centralized authority.

How To Stake Bridging Aggregator Governance Tokens

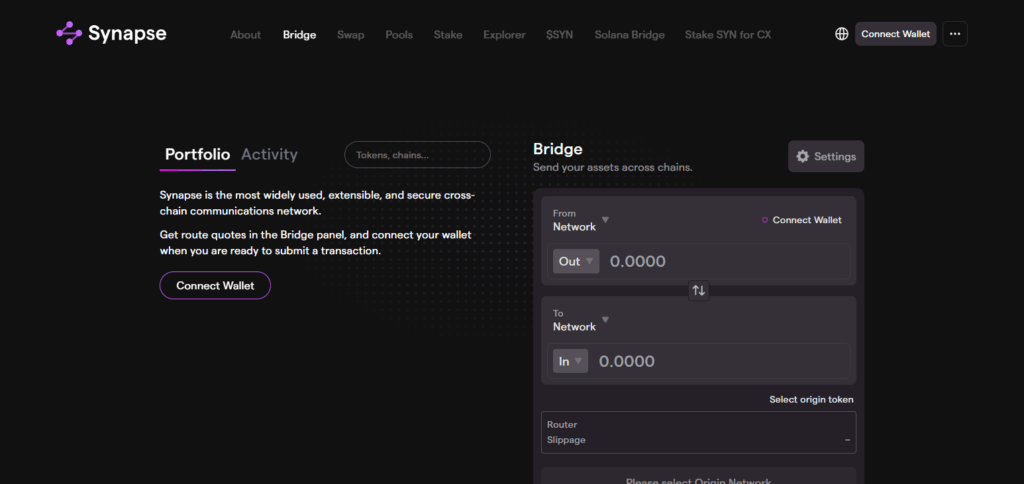

By staking bridging aggregator governance tokens, there is an opportunity to earn rewards while taking part in protocol governance. Consider the following example using Synapse Protocol ($SYN):

Step-by-Step Guide to Staking SYN Governance Tokens

Acquiring SYN Tokens

- Purchase $SYN from exchanges such as Binance, Coinbase, or Uniswap.

- Another option is providing liquidity in Synapse pools to earn SYN tokens.

Connect Your Wallet

- Use a web3 wallet such as MetaMask or WalletConnect.

- Access the Synapse staking page.

Stake Your SYN Tokens

- Select governance staking mode.

- Approve transaction and confirm the stake in your wallet.

Governance Participation

- Allows users to vote on protocol decisions.

- Voting scope includes proposals like fees, security, and bridge integration.

Reward Earnings

- Payment can be in the form of SYN, stablecoins, or other tokens.

- Rewards some platforms offer may be auto compounded for greater returns.

Monitoring and Managing Risks

- Ensure proper auditing of the platform to prevent smart contract hazards.

- Take into consideration token volatility that impacts APY returns.

Other Place Where To Stake Bridging Aggregator Governance Tokens

Symbiosis

Symbiosis is a distinctive tool for managing staking bridging aggregator governance tokens, which helps the users to take part in cross-chain liquidity management. It effectively merges many different blockchains which enables the token holders to stake and make decisions to improve bridging productivity.

Symbiosis utilizes both governance and staking rewards to enable users to actively foster secure and scalable asset transfers and control the direction of the platform. This enables asymbiosis to qualify as a center of efficient decentralized finance interoperability.

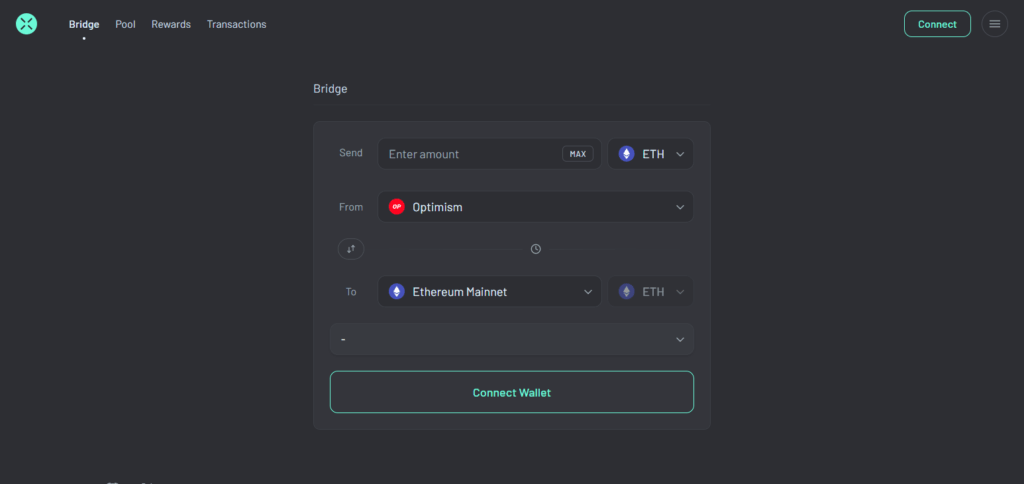

Across Protocol

Across Protocol is an innovative platform that specializes in the configurable staking bridging aggregator governance tokens for cross-chain asset transfers. Unlike other providers, Across emphasizes security and low-cost bridging. This enables token holders to stake while partially controlling the protocol upgrades and governance.

Users actively participate in the Staking Governance Mechanisms, serving as stewards to oversee active governance that enables enhancements to be efficiently integrated across blockchains. This makes the protocol an indispensable multifunctional instrument for interacting with decentralized finance that is smooth and reliable.

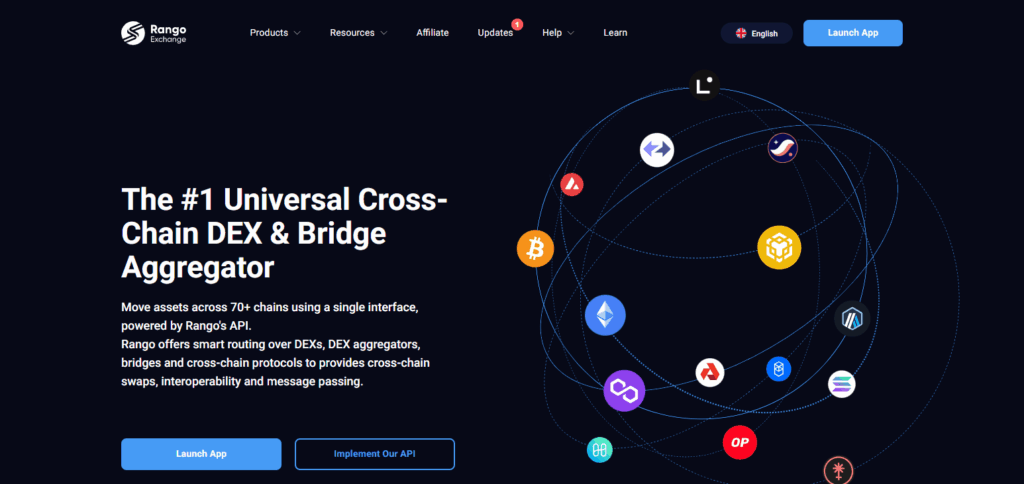

Rango Exchange

Rango Exchange is a blockchain agnostic decentralized exchange (DEX) and a bridge aggregator which enables users to stake their governance tokens and participate in the platform’s evolution. Users can participate in key decisions like protocol level changes, fee model changes, and active governance voting via the $RANGO token.

This promotes community ownership of the ecosystem and aligns user interests with the growth of the platform. Moreover, active participants are retained because of the provided staking incentive structures. With over 70 blockchains and 100+ DEXs and bridges integrated, Rango further enhances its utility, marking it as an important player in the space of decentralized finance.

Wormhole

Wormhole is a bridging aggregator of great power; it enables users to stake governance tokens and participate within its decentralized ecosystem. Its specific advantage is the secure and efficient linking of multiple blockchains for seamless cross-network asset transfers.

Governance token holders influence important protocol decisions while earning rewards, thus promoting community control and network security.

Such hybrid governance in conjunction with staking is optimal for users who wish to support cross-interoperability while deploying capital in decentralized finance.

Why Stake Bridging Aggregator Governance Tokens?

Take Part in Voting: Participating in the staking process entitles you to vote and consequently impacts the governance, fee structures, and overall development focus of the protocol.

Make Money: Most platforms encourage staking by paying users with tokens or collecting fees from users who engage in bridging.

Assist with Network Security: Stakeholders’ interests influence the security of cross-chain bridges which needed to be secured.

Aid in Decreasing Control of Authorities: Governing the community reduces the control authorities have over the platform.

Strengthen Cross-Chain Workability: Taking part facilitates improvement in the speed, reliability, and costs of bridging services.

Tips to Maximize Your Staking Rewards

Select the Correct Platform: Choose bridging aggregators with an excellent reputation, strong security, and good reward rates.

Keep Your Tokens Staked: To increase the value of your rewards, keeps stakes over long periods to avoid payout cycles.

Stay Updated: Keep up with protocol development updates and voicing participation in governance votes that might impact rewards or staking.

Spread Your Tokens: Stake different protocols with different tokens to get rid of risk while reducing new opportunies.

Optimize Profit: Cut down on withdrawals and transaction fees to protect the profit margin gained, be cautious to maintain profit.

Enable Automatic-Compounding: If possible, enable it to trade rewards propmtly to gain more than previously.

Common Risks and Considerations

Smart Contract Exploits

Bugs or exploits in the staking or bridge contracts may result in loss of funds.

Volatility of the Market

The prices of tokens may decrease giving you less value for your staked assets and rewards.

Set Lock-up Opportunities

Certain platforms will have a ‘Lock’ requirement for a certain number of tokens for fixed periods of time which restricts both liquidity and flexibility.

Risks within Governance Structures

Impact of the community’s poor judgment or malicious proposals can have harmful effects on the platform.

Network Fee Congestion

High blockchain fees or other forms of congestion can influence the rate at which transactions are processed.

Over-reliance on the Platform’s Decentralization

Dependence on a limited number of validators or nodes diminishes the benefits that come with decentralization.

Pros & Cons

| Pros | Cons |

|---|---|

| Earn passive income through rewards | Risk of smart contract bugs or hacks |

| Influence platform governance | Token price volatility can reduce value |

| Support decentralized cross-chain bridges | Potential lock-up periods limit access |

| Promote network security and stability | Governance decisions may sometimes be risky |

| Encourage platform growth and innovation | Transaction fees can reduce net rewards |

Conclusion

To sum everything up, staking and bridging aggregator governance tokens is a great way to earn rewards while shaping cross-chain platforms.

Choosing trustworthy protocols, comprehending the risks, and participating in governance helo maximize benefits as well as contribute to the security of the decentralized ecosystem.

For those interested in passively earning or actively participating in decision-making, staking provides an opportunity to deepen interoperability and strengthen the DeFi world.