In this post, Ill discuss the How to Stake Chainlink Tokens. Staking LINK lets you earn rewards while lending security to the Chainlink network.

Whether you are brand-new to crypto or have traded before, this step-by-step guide will show you the easiest and safest way to stake your coins, helping you boost your earnings and support the Chainlink community at the same time.

What Is Chainlink Tokens?

Chainlink tokens, or LINK, power the Chainlink network, a decentralized oracle that links smart contracts to real-world data. Users pay node operators with LINK whenever they need accurate data, so contracts execute as planned.

By staking their tokens, holders boost network security and earn extra rewards. Because of these roles, LINK is key for DeFi apps and other projects that rely on honest, outside information.

How to Stake Chainlink Tokens

Example: Staking 50 LINK via Chainlink Staking v0.2

Step-by-Step Guide

Visit the Official Staking Site

Head to staking.chain.link and double-check the URL so you don’t walk into a phishing site.

Connect Your Wallet

Hit Connect Wallet and pick MetaMask or any supported Web3 wallet. Give the prompt the thumbs-up.

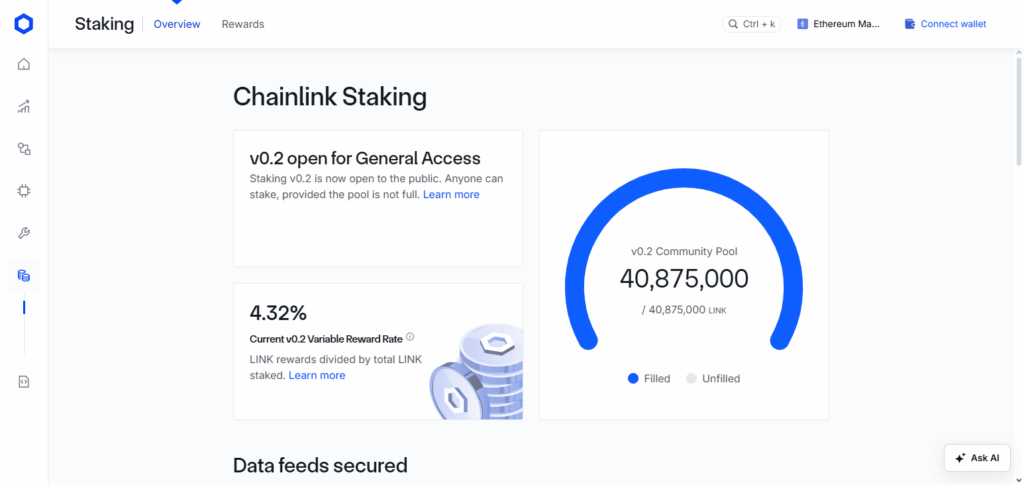

Check Pool Availability

Look to see that the staking pool still has room. The v0.2 cap is set at 45 million LINK.

Enter Staking Amount

Type in 50 LINK and tap Stake, but make sure you also have a little ETH on hand for gas.

Confirm the Transaction

MetaMask will pop up with the transaction details. Scan the gas fee, then hit confirm if it looks okay.

Start Earning Rewards

Once the block includes your transaction, your LINK is locked and working for you, and rewards will start rolling in.

Track and Manage

Jump into the dashboard any time to check how much you’ve earned or to unstake when the lock-up period is over.

Benefits Of Stake Chainlink Tokens

Earn Passive Income

You collect rewards in LINK just for helping secure the network.

Support Network Security

Your stake makes the Chainlink oracle system safer and more reliable.

Increase Token Utility

Staking gives LINK a use beyond simply sitting in a wallet.

Participate in Governance

Some models let you vote on proposals that shape the network’s future.

Potential for Token Appreciation

Long-term staking can boost holding time, possibly driving price higher.

Contribute to DeFi Growth

Staked nodes feed accurate data to smart contracts, powering more DeFi projects.

Prerequisites for Staking Chainlink Tokens

LINK Tokens: First, you need a stash of Chainlink (LINK) tokens to stake.

Compatible Wallet: A wallet that works with the Chainlink network, like MetaMask or Ledger, holds your LINK and signs transactions.

Staking Platform Access: Pick a trusted staking site or node that lets you stake Chainlink.

Basic Blockchain Knowledge: You should know how to open your wallet, approve deals, and talk to staking contracts.

Sufficient Gas Fees: Keep a little ETH-or whatever token the network needs-on hand to cover the fees every time you stake.

Internet Connection: A good, steady internet link helps you watch and manage your staking activity without hiccups.

Tips for Safe and Effective Staking

Pick Trusted Platforms

Only use well-known staking services or Chainlink’s official site that other users have vouched for.

Secure Your Wallet

Guard your wallet’s private keys and, whenever you can, store them in a hardware device that stays offline.

Verify URLs

Before entering any site, carefully check the web address to dodge phishing tricks.

Keep Software Updated

Make it a habit to update your wallet app and related tools so you get the latest security fixes.

Know Lock-up Periods

Read the rules on how long your tokens will be locked and what fees come with early exits.

Spread Your Stakes

Don’t put every LINK into one provider; spreading it cuts the chance of losing everything at once.

Check Often

Look at your rewards and account status regularly so you spot any strange activity right away.

Potential Rewards and Risks of Staking LINK

Potential Rewards of Staking LINK

- You earn passive income when rewards arrive, and they appear in fresh LINK tokens.

- By staking, you help secure the Chainlink network and cheer its long-term growth.

- Should Chainlink gain more fans, the token’s price might rise along with your stake.

- You step right into Chainlinks decentralized oracle world and join other active nodes.

Risks of Staking LINK

- Unstaking too early or a network issue could slash your tokens, and thats always scary.

- Even lots of LINK staked can lose value overnight if the crypto market jumps around.

- Picking a shady wallet or stake pool can end badly, so trust-only proven services.

- During the lock-up time, you cant sell or move your tokens, which ties up your funds.

Conclusion

In short, staking Chainlink tokens lets you earn passive income while strengthening the network. Just pick a reliable platform, link your wallet, and lock up your LINK safely, and you join the expanding Chainlink community.

Although price swings and timed contracts pose risks, smart, careful steps can keep those dangers in check. Start staking now, boost your crypto portfolio, and help push decentralized finance forward.